Summary:

- Altria Group is a profitable company with in-line earnings and a projected 1-4% YoY growth in EPS for 2024.

- MO has authorized a new $1 billion share buyback program and is expected to increase its dividend in Q3.

- Despite concerns about the tobacco industry and health risks, MO presents a value opportunity for long-term investors seeking dividend income.

PM Images

Altria Group (NYSE:MO) has been a battleground for far too long, and nothing it does has excited Mr. Market. The perpetual bear thesis continues to surround MO, and quite honestly, I have heard the same bear case for more than a decade. One of the largest negatives for MO is its underlying product mix, as tobacco use has been linked to health risks. Some investors are unwilling to invest in MO due to this, while others are under the impression that, eventually, MO won’t have a consumer base. Just like I did with Meta Platforms (META) when the sky was falling, I separate opinions and emotions from the facts. MO is running an extremely profitable business, and they just reported in-line EPS for Q4 and guided for a 1-4% YoY growth in EPS for their 2024 fiscal year. In addition to earnings growth, MO authorized a new $1 billion share buyback program, and we can expect another dividend increase around Q3. Shares of MO look as if they have been consolidating at the $40 level, and based on the 2024 guidance, I feel MO is one of the best-valued companies in the market. MO isn’t going to grab headlines like a tech company, but it’s undeniable that MO is still producing strong cash flow and returning billions to shareholders through buybacks and dividends. I am tuning out the noise and going by the numbers, and I still think MO presents an opportunity for long-term investors looking for value and dividend income.

Seeking Alpha

Following up on my previous article about Altria Group

On November 15th, 2023, I wrote an article on MO (can be read here), and I discussed why MO was still attractive to me. MO isn’t a high-growth company by any means, but under $45, MO generates a dividend yield of at least 8.71% while trading at less than 9 times earnings. Now that we have more economic data, Q4 2023 earnings, and 2024 guidance I wanted to follow up on my previous article as I am more bullish on MO. I think MO is one of the best value plays in the market, and I am more than happy to sit back and reinvest the large dividends while I wait for shares to appreciate. Shares of MO look to be consolidating around the $40 level, and it’s hard to see much more downside given their recent 2024 guidance.

Seeking Alpha

Risks to my investment thesis regarding Altria Group

I want to start off by discussing the risks to my investment thesis. While I am bullish on MO, there are risks to consider. MO has been in a downward channel, and there is an opportunity cost to consider when investing. Technology continues to generate strong earnings, and the potential for artificial intelligence continues to grow. There is a strong possibility that investors could generate a larger return by simply investing in the S&P 500 and gaining access to all the companies paving the way in artificial intelligence rather than allocating capital toward MO. No matter where you invest capital, there is always an opportunity cost because there is always somewhere else you could allocate capital toward. By investing in MO, you could underperform the market, or potentially miss out on appreciation that could exceed market returns by investing in individual equities within big tech.

For decades, health concerns have been correlated to tobacco products, and the number of places you can smoke in public have continued to decline. The tobacco industry is subject to federal, state, and local laws. There is a risk that new litigation is brought forward under the current laws or that new regulations will spur additional litigation against MO and others in the tobacco industry. MO also faces risks from shifts in crops, which could impact reduced supply and availability of domestic tobacco if it becomes more economically feasible for farmers to harvest other crops. MO also faces pressure from changing trends across society, which could lead to reduced tobacco use. There are several reasons to avoid investing in MO, as the tobacco industry could face increased pressure as the year’s progress, and there could be other opportunities to generate dividend income. Please do your own research, and just because I am bullish on MO and others may be, that doesn’t mean it will be a good investment for you, as there are several risks to my investment thesis.

Why I am bullish on Altria Group and the value proposition

Regardless of whether I am making an initial investment or dollar cost averaging into a position, I continue to monitor the financials. When you allocate capital toward an investment, you become a company owner no matter if you purchase 1 share or 1,000,000 shares. When it comes to MO, I choose to tune out opinions and base my decisions on the numbers. MO finished 2023 with $3.69 billion in cash and an additional $10.01 billion in equity investments in securities. MO has $25.11 billion in long-term debt on the balance sheet, with $1.12 billion due over the next 12 months. The balance sheet is relatively strong in my opinion, as they have a very manageable amount of debt with a significant amount of on-hand liquidity.

Altria Group

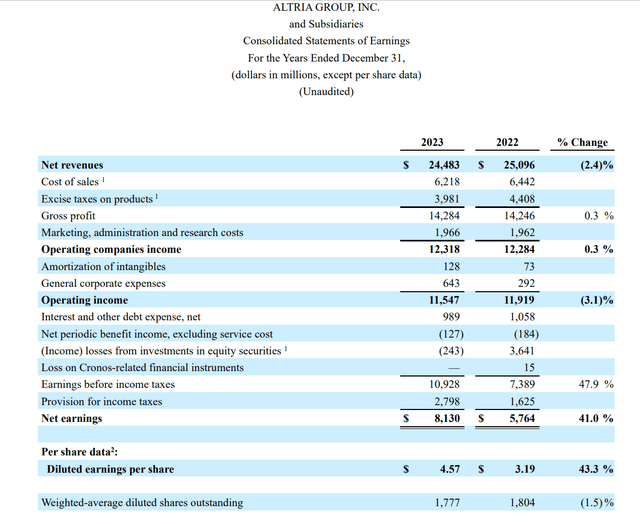

The next thing I look at is the business operations. In 2023 MO generated $24.48 billion in revenue. After the cost of revenue and all FDA and state settlement fees are included, MO produced $14.28 billion in gross profit. MO’s topline revenue decreased by -2.4% YoY, but their gross profit increased by 0.3% as they operated at a 58.34% gross profit margin. Outside of the cost of revenue MO spends $1.97 billion running the other aspects of their business. After amortization and general corporate expenses are factored in, MO generates $11.55 billion in operating income, which is an operating margin of 47.16%. Unlike 2022, MO didn’t take a $3.6 billion charge from losses in equity investments, and its profitability in 2023 looked much different. On a YoY basis, MO’s earnings before income taxes came in at $10.93 billion, which was a 47.9% YoY increase, and their bottom-line net income was $8.13 billion a 41% YoY increase. MO also repurchased 1.5% of the common shares outstanding, which helped their diluted EPS increase 43.4% YoY to $4.57 per share.

Altria Group

I am bullish on MO because when I strip away the noise, the underlying business is healthy, operates at a 33.21% profit margin, and generates billions in profits. MO guided adjusted diluted EPS in the range of $5 – $5.15 in 2024, which is a 1-4% increase from the $4.95 in diluted EPS they generated in 2023. MO currently has 1.78 billion diluted shares outstanding as of the close of the 2023 fiscal year, and if they only produce $5 in adjusted diluted EPS in 2024, their diluted earnings would be $8.89 billion. The dividend is currently $3.92, which would amount to $6.97 billion in earnings paid to the shareholders through the dividend. This would leave $1.92 billion in diluted earnings remaining, and if MO utilized the entire $1 billion authorization for buybacks, they would still have $920 million in diluted earnings remaining. This leaves more than enough room for MO to increase the dividend and pay down a portion of the long-term debt that will mature. As the Fed cuts rates, some of this debt could also be refinanced, so the entire $1.12 billion may not be repaid in 2024.

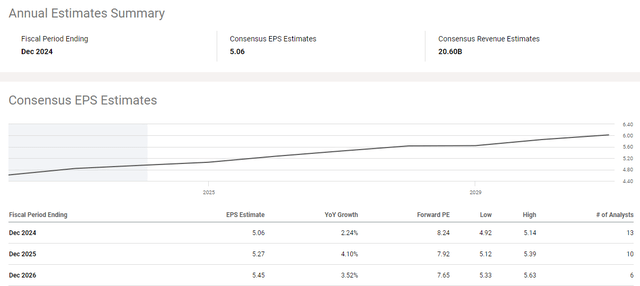

The consensus EPS estimate for 2024 is $5.06, which is in the middle of MO’s guidance. MO is trading at 8.24 times 2024 earnings and 7.92 times 2025 earnings. I fully understand that tobacco isn’t exciting, but paying less than 9 times forward earnings for a company producing this profitability level seems like a true value opportunity to me. MO also has an interesting catalyst on the horizon that could change forward guidance. There has been a lot of movement of legalizing marijuana, and if this occurs, MO is one of the best-positioned companies to benefit. I am not factoring anything in, but on the chances that legalization becomes a reality, it could create a newfound bullish thesis for shares of MO that allows it to trade at a higher valuation.

Seeking Alpha

Altria continues to reward shareholders by returning capital to shareholders

In 2023, MO paid $6.8 billion in dividends while providing investors with a 4.3% dividend increase. This was the 58th dividend increase over a period of 54 years for this Dividend King. MO also repurchased 22.7 million shares, completing its buyback authorization. MO’s capital allocation goal is to provide investors with a mid-single digit annualized dividend increase through 2028, as they expect to grow EPS by mid-single digits annually. For income investors, this is very bullish because the dividend increases going forward will outpace the rate of inflation, and the dividend yield is substantially larger than what risk-free assets are currently paying.

MO has historically increased the dividend in August prior to the Q3 dividend. If MO continues to grow the dividend by 4.3%, the current dividend of $3.92 would increase to $4.09 in 2024, $4.27 in 2025, $4.45 in 2026, $4.64 in 2027, and $4.84 in 2028. Over the next 5-years, investors would gain an additional $0.92 per share or 23.47% in their annualized dividend payments. Today, shares trade for $41.36, and over the next 5-years based on a 4.3% annualized dividend increase, MO would pay out $26.21 per share, which is 63.37% of its current share price in dividends before factoring compounding on reinvestments.

Altria Group

Conclusion

As the Fed starts to cut rates, I think we’re going to see an increased focus on income-producing equities as over $6 trillion is sitting idle in money market accounts. I am very bullish on MO as it currently yields 9.4% and trades at less than 9 times 2024 earnings. Despite the unpopular business segment MO operates in, profitability matters at some point, and the valuation will be too low to ignore. I think that time is rapidly approaching as MO has billions of cash on hand, operates at a 33.27% profit margin, generated $8.13 billion in net income for their 2023 fiscal year, and raised adjusted EPS guidance by 1-4% YoY. This is a company that is still growing its EPS, growing their dividend after 54 years, and buying back shares. I would be shocked if MO falls further after consolidating around the $40 level, especially after its latest guidance. MO is a clear winner for income investors as the dividend is projected to keep growing at a mid-single-digit rate.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.