Summary:

- Tesla’s Q4 results indicate that its era of fast sales growth is over. An analysis of the European market explains why sales growth is slowing and where things are likely headed.

- Tesla’s emerging problem in Europe is arguably its decision to manufacture in Germany, which is an increasingly expensive place to do business, while its German & Asian competitors are flocking to Hungary.

- Tesla is likely to continue losing EV market share in Europe, as its competitors are positioning themselves to produce EVs at a lower cost.

- I expect its shares to be range-bound between $100/share and $300/share for the foreseeable future, therefore, $150/share or below should be considered a good entry point.

Xiaolu Chu

Investment thesis: Having established itself as a dominant, profitable EV producer, Tesla (NASDAQ:TSLA) recently moved on to the next phase in its competition with emerging EV producers, namely an increasingly brutal fight for market share. With the backing of solid profit margins, it can afford to undercut competitors, especially in the Developed World, most of which are still struggling to produce & sell EVs at a profit. Europe might emerge as an exception, where Tesla bet on producing its cars in Germany, while much of its German & Chinese competition is building up capacity in Hungary where there is a clear comparative advantage in labor, energy, and government taxation costs. Lower production costs mean those companies that are investing heavily in EV production capacity in Hungary and other Eastern EU states, are increasingly in a position to engage in price discounting to counter anything that Tesla may try to do. Tesla is losing ground to its competition in Europe within the EV market this decade and it may continue to do so going forward. Using the European market as a case study, we can conclude that Tesla’s future outlook in terms of sales looks set to be one of moderate growth, which does not support current P/E valuations. As such, I see Tesla stock trading in the $100/share to $300/share range for the foreseeable future.

Tesla’s Q4 results:

For the fourth quarter of 2023, Tesla saw an increase in revenues of 3%, to $25.17 billion. It is nowhere near the growth levels one might expect from a company that currently has a forward P/E ratio of about 60, in other words, about two and a half times higher than the S&P index. The net income attributable to shareholders increased by 115%, to $7.93 billion, which does partially justify continuing to have Tesla stock trading at a P/E ratio that is priced for growth. It should also be noted that profit margins were healthy, with net earnings at 31.5% of revenues. It is an enviable level of profitability, even as many car companies are still trying to figure out how to profitable sell EVs.

Growth in vehicle deliveries was significant, with a 13% increase in deliveries in Q4, 2023, compared with Q4, 2022. The reason why it did not translate into a corresponding increase in revenues is in large part due to a decline in the average price of Tesla cars sold. One factor was Tesla’s policy of discounting its cars to start fighting for market share.

How Tesla compares to peers in terms of EV market share in Europe:

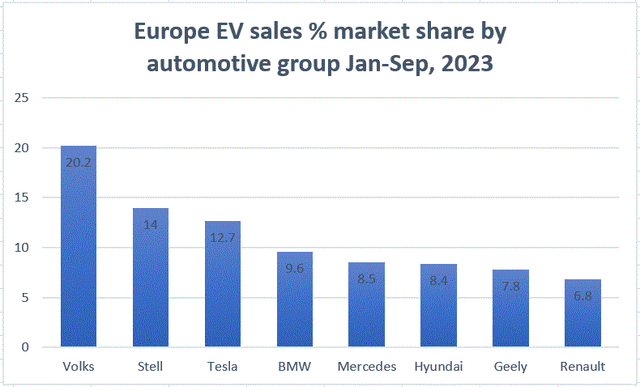

Tesla is currently far from being the most dominant EV maker & seller in Europe.

It is notably beating European luxury carmakers like Mercedes (OTCPK:MBGYY) & BMW (OTCPK:BMWYY), both of which I expected to do a lot better in the EV sector, given that they are already catering to the same income demographic that tends to buy EVs. Both of those companies are in the process of taking part in what is shaping up to become a marriage made in Hungary, between European carmakers and Asian EV battery producers, which they hope to help them conquer the European EV market.

Tesla’s potential production cost disadvantage in Europe, as competitors flock to more cost-effective places.

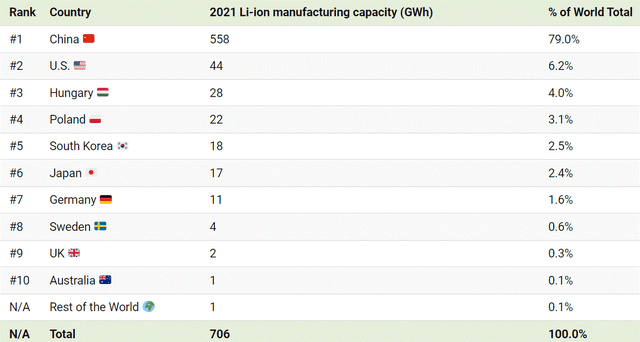

Hungary is emerging as a world leader in EV battery production, thanks to Asian investments and it is also seeing massive inflows of investments in EV assembly plants.

With new investments such as CATL in the pipeline, Hungary will probably maintain its role as Europe’s largest EV battery producer for the foreseeable future, and with that, it will also play a significant role as an EV manufacturing hub. None of this happened accidentally. Hungary offers significant advantages, especially for manufacturing enterprises.

-

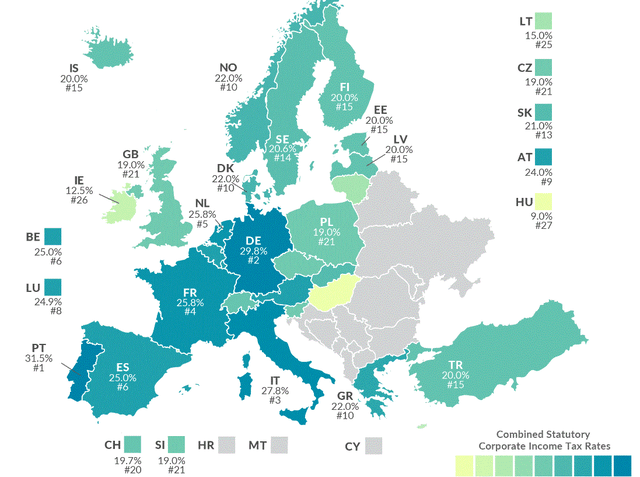

Corporate taxes.

Hungary’s current corporate tax rate is the lowest in the EU, while Germany’s is the second-highest in Europe.

It is difficult to quantify just how great of an impact corporate tax rates will have on producing and selling an EV. We should keep in mind that those lower corporate tax rates work their way through the entire supply chain that supports the final assembly of EVs.

-

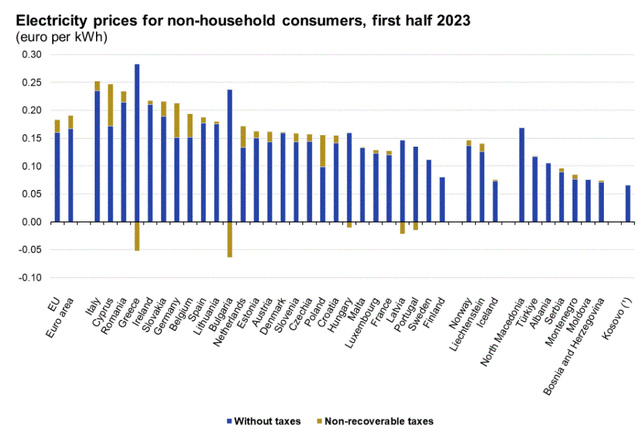

Energy costs.

Hungary is one of the lower-cost places in terms of energy prices, while Germany is among the highest in the non-household segment of the economy.

The difference in electricity costs for non-household consumers may not be great, but it is yet another cost advantage that German car manufacturers, as well as now BYD (OTCPK:BYDDF) are looking to take advantage of. These costs also work throughout the supply chain.

-

Labor costs.

When most people think of outsourcing, within the European context from Western Europe toward the Eastern part of the EU, labor costs tend to come to mind instantly. There is no significant advantage that Hungary has over its immediate neighbors, such as Slovakia or Romania in this regard. Average gross wages in Hungary are about 3 times lower than they are in Germany. That is a significant difference. It is hard to accurately quantify what all these savings mean for Germany’s automakers, in particular when it comes to producing EVs at a cost advantage relative to Tesla. A decade-old estimate from Mercedes (OTCPK:MBGAF) suggests that at least back then the savings per vehicle produced in Hungary were as high as 30% of total production costs. Much has changed since then, including a narrowing in the wage gap. On the other hand, energy prices increased more dramatically in Germany over the past few years.

German EV manufacturers to produce models that directly compete with Tesla models in Hungary. BYD joins the trend.

-

BMW’s Hungary EV & new generation battery plant.

BMW is set to produce some of the models that compete with Tesla’s Model Y at its new plant in Hungary by the end of next year. A successor to the BMW iX3 is one of the models that BMW plans to produce there. The successor version of the model will feature BMW’s in-house battery, which is supposed to provide 30% faster charging, as well as up to 30% more range. Its current range of 240 miles could thus get a significant boost that will take it above 300 miles. It remains to be seen whether or not the price will also be lowered. It currently sells at just under $90,000 for the base model, versus Tesla’s model Y which sells at a starting price of $46,000. BMW has a long way to go to close that price gap, but it is possible that with the cost savings related to producing its cars in Hungary, it will be able to significantly lower the price, even as it improves on performance.

-

Mercedes & Audi have a long-established presence in Hungary that is now being retooled for EV production.

Mercedes & Audi have a well-established presence in Hungary. Mercedes decided to use a flex plant model, where it can easily switch between producing EVs or conventional cars. The electric EQB SUV with a range of 240 miles, starts at $53,900 and is being manufactured in Hungary. It is price-competitive compared with Tesla’s Model Y, but it lacks a bit of range, which seems to be at the heart of the lack of success that Mercedes is seeing in the EV market. Volkswagen’s (OTCPK:VLKAF) Audi Q4 and other Volkswagen group EV models have electric motors built in Hungary, which helps it save money on labor, taxes, and energy costs.

-

Tesla’s main global competitor looks to compete in Europe.

BYD seems to have the same idea as German EV makers, given that it recently announced plans to build its first EV assembly plant in Hungary. It could be argued that it might be a way to simply try to maximize profits for BYD and all other companies that are converging on the one country that seems to have had a longer-term vision of catering to the EV industry. The profit motive may be the primary driver of EV producers and battery manufacturers converging to the place where they can be arguably the most cost-effective in Europe. If or when the battle for EV market share in Europe intensifies, Tesla’s main competitors seem to be well-positioned to compete. Tesla’s decision to assemble its cars in Germany on the other hand may have lessened its ability to do in Europe what it has done for most of the past decade, namely outcompete its Western market competitors, even as it became a highly profitable company.

Investment implications.

-

The reasoning behind the upgrade from sell to hold.

I bought Tesla stock last year at just over $120/share and sold once it reached $195, as I pointed out in an article at the beginning of 2023. My current upgrade to a hold from a sell back then is by no means a reflection of a change in my overall view in terms of performance expectations. The only difference is that back in February 2023 Tesla stock was on an upswing, so an opportunity arose to take profits, while now it is on a downswing, thus I am looking for the price to be right once again to get back in. In other words, it is now once again a stock of interest that I am watching, thus the upgrade.

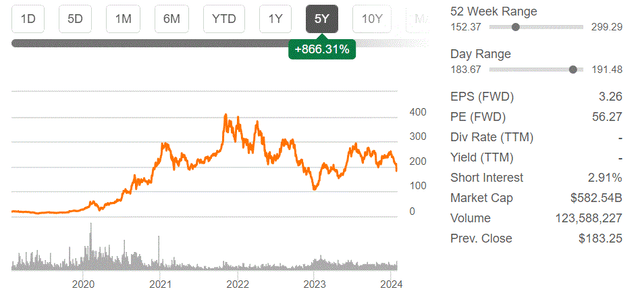

Tesla stock price & other metrics (Seeking Alpha)

I missed out last year as it went as high as over $290/share, however as I write this, Tesla stock trades just slightly below my exit price point, therefore holding would not have earned me any extra gains on the trade as of right now. I am currently looking to start buying Tesla stock again if it drops below $150 or so, which is when the P/E ratio will start to resemble reasonable fundamentals of the company as I perceive them. As we can see, even after the recent decline in its stock price, Tesla stock is still trading at about twice the P/E valuation of the overall market.

-

Tesla’s higher P/E relative to peers may be partially justified.

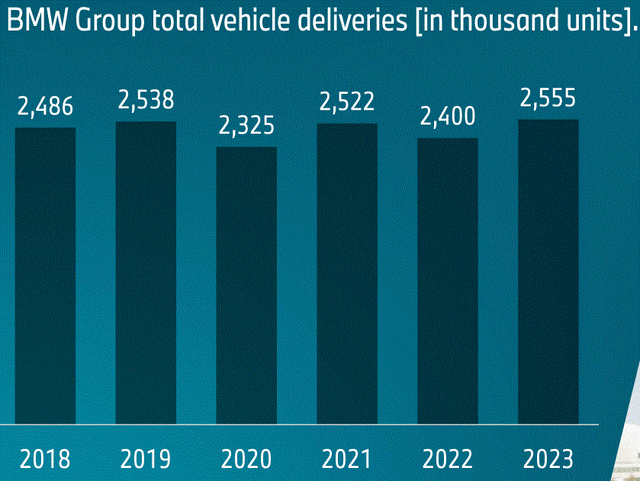

One of the bear cases that can be made for Tesla is the massive discrepancy between its P/E and that of its automotive industry peers. For instance, BMW, which I foresee as becoming a major competitor in Europe for EV market share, especially within the luxury segment, has a forward P/E of only about 5.

BMW stock and other financial metrics (Seeking Alpha)

It also offers a very generous dividend yield of about 8.7%, which in theory should justify a higher P/E. The difference is that BMW is far from being a growth stock. It may increase EV sales in the future, but it will likely come at a cost, with conventional car sales set to decline.

As we can see, yearly sales have been holding flat in the past years. My personal view is that the EU EV transition plan to 2035 will lead to an overall decline in European car sales. BMW might see a net decline in total sales as a result, even though comparatively speaking it might emerge as one of the least-impacted European automakers, as I pointed out in an article in 2022. I do not think that Tesla’s growth prospects justify a P/E ratio that is about 12 times higher than BMW’s, but its growth profile, versus the no growth profile of BMW, does justify a significantly higher P/E valuation.

-

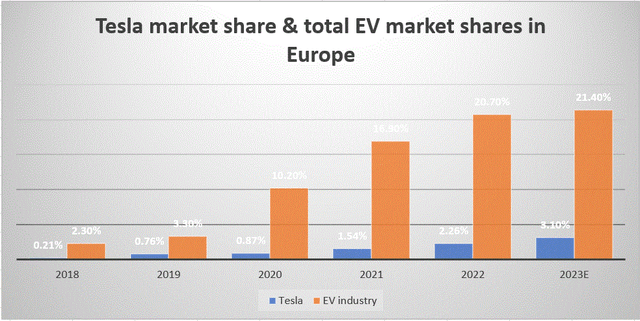

Tesla lost EV market share in Europe this decade.

With my analysis of Tesla’s situation in Europe in mind, my perception of Tesla’s overall fundamentals is that it is maturing into a solid company within the global auto industry, with strong profit margins, as well as the potential for continued moderate long-term sales growth.

Data sources: Good car bad car.net, InsideEVs

As we can see, Tesla continues to capture more of the total automotive market share in Europe, together with the rest of the EV industry. Even as the EV industry slowed significantly in 2023 in terms of increasing its automotive sector market share, Tesla still managed to significantly increase its market share. That may not necessarily be an indication of how things will go this year and beyond, because as I pointed out, most of its competitors are gearing up to compete more intensely. Furthermore, looking at a multi-year performance, for instance, from 2019 until the present, the overall EV industry in Europe outperformed Tesla. Tesla’s share of the European auto market grew about four-fold in the period, while the overall share of the EV industry grew about seven-fold, as the chart shows. In other words, this decade, Tesla is underperforming the overall European EV market in terms of sales growth.

-

The size of the global luxury car market is limited and Tesla already plays a sizable role, therefore it is unclear how much more of it is up for grabs.

It should also be noted that all of Tesla’s current models target the luxury car segment in terms of potential consumers, which is as true in Europe as it is in the US or China. The total global luxury car market is estimated to be $655 billion as of 2023. Tesla is already about 13% of the global luxury car market, based on its total automotive revenues of $82.42 billion in 2023. It is questionable just how much further that market share can be expanded.

Europe’s luxury carmakers are gearing up to fight for market share by keeping manufacturing costs low, as I thoroughly examined in this article. Elsewhere, competition will continue to be fierce as well, especially given that the luxury segment tends to be where the profits are for EV makers. We should not write off the ICE-powered cars from retaining a significant portion of the global luxury car segment, as well as the European car market. Many luxury car enthusiasts continue to prefer it to electric.

The global luxury car market will probably continue to expand, although it might disappoint current expectations of it reaching the trillion-dollar mark by the end of the decade. Tesla’s sales growth may increasingly reflect the growth in the global luxury car market, as well as the growth of the EV segment within the overall luxury car market. I expect EVs to become dominant within the luxury car segment worldwide, perhaps by the end of the decade, whereas as of 2022, they captured about 30% of the luxury car market.

Conclusion:

Within this context, I expect Tesla’s shares to mostly trade between $100/share and $300/share for the foreseeable future. Buyers will flock to it as it approaches $100/share, where its valuation will look increasingly reasonable, and sell as it approaches $300/share, where it will look increasingly out of step in terms of its fundamentals. For reference, with all else held equal, If Tesla stock were to trade at $100/share, its P/E ratio would drop to about 31, just slightly above the S&P 500 P/E ratio currently at just over 26. Based on my view, I see Tesla’s P/E ratio approaching the market’s average P/E as a likely bottom, namely that most investors would choose Tesla over owning the broader market, once P/E ratios converge. It was the same reasoning that led me to buy Tesla stock early last year as it went to $120/share. I just don’t see much downside for this stock once it gets close to the overall market in terms of valuation. Therefore it is worth buying its stock whenever it falls below $150/share in my view, knowing that the downside is limited from that point on and selling once its shares rise above $200/share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.