Summary:

- McDonald’s Corporation Q4 revenue grew 8% but fell short of analyst expectations.

- Global same-store sales growth decelerated, signaling a slowdown from previous quarters.

- McDonald’s is expecting comparable-store sales to normalize in 2024, with a focus on affordability for low-income consumers.

Brandon Bell/Getty Images News

Back in July, I placed a “Hold” rating on McDonald’s Corporation (NYSE:MCD) stock, noting that despite recent solid growth, that its valuation looked high. Since then, the stock is down about -4% versus a 12% increase in the S&P 500 (SP500). With McDonald’s recently reporting fourth quarter earnings, let’s catch up with the name.

Q4 Earnings

For the quarter, MCD grew its revenue 8%, or 6% in constant currencies, to $6.1 billion. That came in just below analyst expectations for sales of $6.37 billion.

Sales at company-owned restaurants climbed 12% to $2.74 billion, while revenue from franchise restaurants rose 6% to $3.87 billion.

Global same-store sales rose 3.4%. U.S. comparable sales rose 4.3%, helped by menu price increases. International operated market same-store sales rose 4.4%, led by U.K., Germany and Canada. International development licensed markets saw comparable restaurant sales rise 0.7%. The company said all regions rose in these markets except in the Middle East, which has been impacted by war.

Notably, its global same-store sales growth was a meaningful deceleration from both the growth it had seen earlier in 2023 and the growth it had seen since coming out of the pandemic. Same-store sales growth peaked in 2023 during Q1, when MCD registered 12.6% comps both in the U.S. and globally. It was also a big decrease from the 8.8% global and 8.1% U.S. same-store sales growth it saw in Q3.

Operating margins came in at 43.7%. That compared to 43.6% a year ago.

Adjusted EPS came in at $2.95. That topped the consensus by 12 cents.

Looking ahead, MCD is expecting to see comparable-store normalize in 2024 to a more historical average of between 3-4% both in the U.S. and internationally. Part of this appears to be lower-income customers pressing back on price increases.

On its Q4 earnings call, CEO Christopher Kempczinski said:

“I think consistent with what we talked about on the prior call, where you see the pressure with the U.S. consumer is that low-income consumer. So call it $45,000 and under. That consumer is pressured. From an industry standpoint, we actually saw that cohort decrease in the most recent quarter, particularly I think as eating at home has become more affordable. There’s been much less pricing that’s been taken more recently on packaged food. So you’re seeing that eating at home is becoming more affordable that I think is putting some pressure from an IEO standpoint on that low-income consumer. If you think about middle income, high income, we’re not seeing any real change in behavior with those. We continue to gain share with those groups. But the battleground is certainly with that low-income consumer. And I think what you’re going to see as you head into 2024 is probably more attention to what I would describe as affordability. So think about that as being absolute price point being probably more important for that consumer in a lower absolute price point to get them into the restaurants than maybe a value message, which is a 2 for $6 or something like that. Those probably are going to resonate a little bit less in ’24, particularly we think in the front half with the consumer there may be something that’s lower absolute price points.”

At the same time, MCD is expecting commodity inflation to be in the low single-digit range, with wage inflation in the mid-to-higher single-digit range. As I noted in an earlier article on Shake Shack Inc. (SHAK), beef prices have been very elevated and have continued to go up, so it is impressive the company is only expecting low-single digit commodity price inflation. Meanwhile, the minimum wage has been going up across many states, but California fast-food workers, in particular, will get a big raise later this year to $20 an hour.

Ultimately, consumers pushing back on price at a time with wage and potentially food commodity pressure isn’t a great spot. MCD, however, is continuing to invest in more intuitive technology, which should help mitigate wage pressure over the long run, as well as drive sales. The company is also looking to drive its loyalty programs around the world, which should lead to more app ordering and a more efficient process.

MCD is also looking to innovate with its menu to help drive growth. Chicken will be one area it will look to build on, with newer items such as McCrispy and McSpicy performing well. The company is also rolling out its Best Burger initiative. This includes simple changes such as giving the beef patties more room on the grill and being kept hotter until served, as well as better buns and onions being added before cooking the patties. Canada and Australia were two of the first markets to see the changes and saw an uplift in sales.

MCD will also continue to drive new restaurant growth. It will add more than 1,600 net new locations in 2024. China will be a big focus, with 1,000 new openings. The company also bought Carlyle’s 28% stake in McDonald’s China, bringing its minority ownership up to 48%.

Valuation

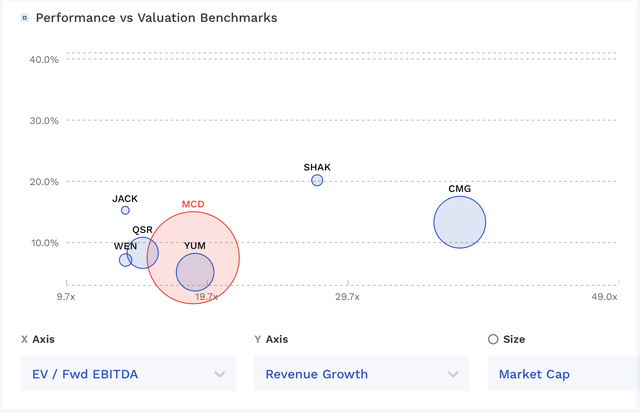

MCD stock currently trades at 17.1 the 2024 consensus EBITDA of $14.75 billion and 16.1x the 2024 consensus of $15.69 billion.

It trades at a forward P/E of 22.7x the 2024 consensus of $12.53 and 20.8x the 2025 consensus of $13.64.

Revenue growth is expected to grow 6.3% this year, and then grow over 5.8% next year.

MCD trades towards the higher end of its quick service restaurant peers’ valuation, but below faster-growing companies such as Chipotle Mexican Grill, Inc. (CMG) and SHAK.

MCD Valuation Vs Peers (FinBox)

Before the pandemic, MCD would trade between 10.5-18.5x EBITDA. That would value the company between $175-350 based on 2025 EBITDA, with a midpoint of $262.50.

Conclusion

McDonald’s has put up very strong results coming out of the pandemic, with the company being able to push prices as inflation costs surged. However, with lower-end consumers pushing back, and price increases expected to return to more normal levels, McDonald’s Corporation should return to more normal growth as well.

At the same time, it does face some potential headwinds with wage and beef cost inflation. In addition, many of its new restaurant location openings are centered on China, where consumers have struggled coming out of the pandemic. This adds some minor additional risk as well.

With more normalized growth should come a more normalized price multiple. And on that end, MCD looks fairly valued at the moment. As such, I rate McDonald’s Corporation stock a “Hold” with a $260-300 target range. I prefer competitor SHAK, which has more unit growth opportunities, and in general, has a higher-income customer base.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.