Summary:

- Improved sales expectations for Skyrizi and Rinvoq and acquisitions in oncology and neuroscience add confidence AbbVie can continue growing.

- I now see EPS growing at 8.2% per year through 2030, faster than most of its peers.

- The stock is a Buy and look ready to break above its 2-year trading range.

SeventyFour/iStock via Getty Images

The Pipeline Is Filling

The main story about AbbVie (NYSE:ABBV) the past few years has been the loss of exclusivity of its immunology drug Humira. This has been AbbVie’s top selling drug since the spinoff from Abbott Laboratories (ABT) in 2012, making up over 60% of the company’s total sales at one point. AbbVie saw this coming from a long way off and took steps to diversify its product line. These include the 2020 acquisition of Allergan as well as development of next generation immunology drugs Skyrizi and Rinvoq. Still, investors remained concerned about the long-term health of AbbVie’s pipeline and the company’s capability to deliver sales and earnings growth as steadily as it did during the dominance of Humira. These worries have caused the stock to trade in a range of $133 – $175 for the last two years.

Seeking Alpha

I last covered AbbVie in September 2023, rating it a Hold. In that article, I went over the prospects for Skyrizi and Rinvoq, as well as developments in AbbVie’s other therapeutic focus areas outside of Immunology: Oncology, Neuroscience, and Aesthetics. I showed there was a pathway for growth through 2030, but it was slower than prior years with uncertainty at the end of the period. Since then, the stock had a total return of 15.8%, so a Buy might have been more appropriate. With the stock now at the top of its 2-year range, the main question is if it can break out to new highs.

AbbVie’s 4Q and FY 2023 earnings showed an expected sales and earnings decline, but the main takeaway was from the long-term guidance and pipeline update. The company strongly increased its growth expectations for Skyrizi, Rinvoq, and migraine drugs Ubrelvy and Qulipta. They also discussed the next generation of drugs in the pipeline beyond these current growers, and the impact of two major acquisitions announced within a week of each other at the start of December.

With these developments, the first line of the “Nothing Is Everything” Skyrizi jingle applies to the long-term path for AbbVie: Things are getting clearer. Let’s look at the details in the top 3 therapeutic areas and an update to the financial model from the last article. With this higher growth, AbbVie stock can break out of the 2-year range and earn a Buy rating.

Immunology

Before we even get to the new developments, the first bit of good news is that Humira sales are not declining as quickly as originally expected. Sales of the drug were $14.4 billion in 2023 and are projected to be $9.6 billion in 2024. This is $0.6 and $1.2 billion higher, respectively, than the forecast in my previous article. The company was not ready to provide a long-term tail revenue projection on the earnings call as biosimilars were still coming on the market in some countries. Still, I added $1 billion per year to Humira sales in my model due to this strength.

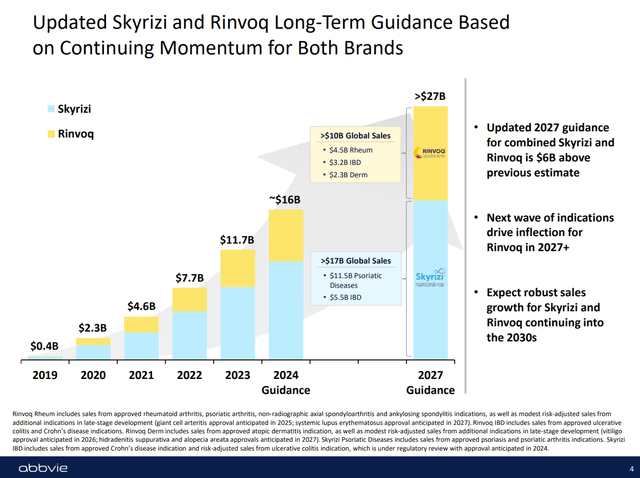

The biggest development in dollar terms from the latest update is that AbbVie now expects Skyrizi and Rinvoq sales to total $27 billion in 2027, up $6 billion from previously. Further, they noted that they “expect robust sales growth for Skyrizi and Rinvoq continuing into the 2030s”. The drugs are taking share in psoriasis and other skin conditions, as well as inflammatory bowel disease.

AbbVie

AbbVie will pursue a similar path with these drugs as they did with Humira, adding new indications year after year. The company has submitted the application for Skyrizi in ulcerative colitis and expects approval in 2024. Additional indications for Rinvoq are currently in Phase 3 testing, providing a growth pathway in coming years. These include conditions like alopecia, vitiligo, hidradenitis suppurativa or HS, and lupus.

We are also now starting to see development of the next generation of immunology drugs beyond Skyrizi and Rinvoq. Lutikizumab has showed positive results in Phase 2 testing for HS, and will be advanced to Phase 3. The company also expects lutikizumab to be effective in IBD.

Oncology

AbbVie’s main focus in oncology has been blood cancers. Solid tumor treatments are much further back in the pipeline, mostly in Phase 1. Thie company has shown slow growth in oncology as its top drug, Imbruvica, has been losing share in the US to other BTK inhibitors like AstraZeneca’s (AZN) Calquence. Imbruvica is also one of the initial 10 drugs on the list subject to price negotiation for Medicare coverage. This sales decline is being offset by the newer drug Venclexta, and sales have just begun for Epkinly (epcoritimab) for diffuse large B-cell lymphoma (DLBCL).

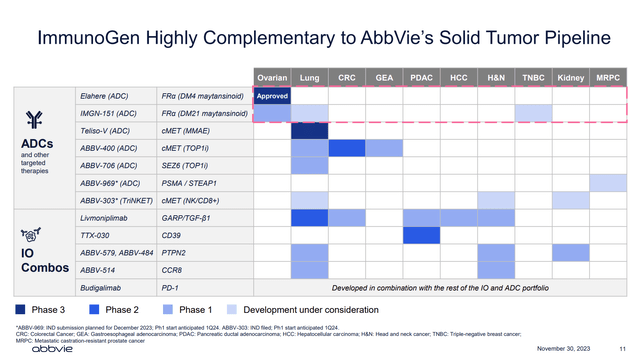

Currently in Phase 3 are navitoclax for myelofibrosis and Taliso-V for non-small cell lung cancer, as well as expanded indications for Venclexta and Epkinly. The biggest oncology development since my last article however, is the acquisition of ImmunoGen (IMGN), announced on November 30. This $10 billion deal will give AbbVie a boost in the solid tumor area, starting with the already-approved Elahere, a second line treatment for certain types of ovarian cancer. Elahere is also in Phase 2 testing for first line treatment and additional types of ovarian cancer. Further back in the pipeline, both companies have been working on antibody-drug conjugates (ADC’s) for solid tumors. The deal will produce R&D synergies for many treatments in this area.

AbbVie

Neuroscience

The top two drugs in this segment were inherited in the Allergan deal, Botox Therapeutic and Vraylar. Botox Therapeutic has a wide variety of uses from migraine to overactive bladder. Vraylar is a depression drug, expected to hit sales of $5 billion at the peak, up from $2.75 billion in 2023. AbbVie’s two CGRP inhibitors for migraine treatment, Ubrelvy and Qulipta, have been growing faster than expected. The company now expects sales to reach $3 billion at their peak, up $1 billion from the last forecast. The pipeline in this segment includes ABBV-951 for Parkinson’s disease (application already submitted) with expected peak sales around $1 billion. The company also has a couple of Alzheimer’s disease treatments in Phase 2.

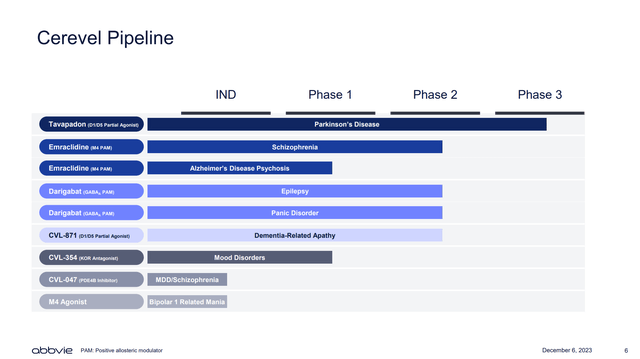

Since the last article, the major development in neuroscience was the acquisition of Cerevel (CERE) for $8.7 billion. Cerevel does not yet have any products on the market, but the pipeline has drugs all across the neuroscience area. Furthest along is Tavapadon for Parkinson’s Disease currently in Phase 3. In Phase 2 are Emraclidine for schizophrenia and Alzheimer’s related psychosis, and Darigabat for epilepsy and panic disorder.

AbbVie

Financial Model

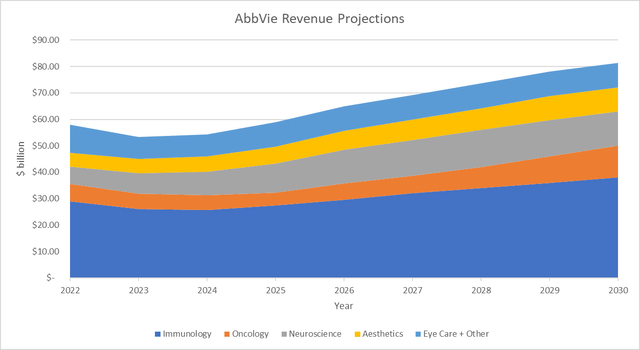

Putting it all together, AbbVie is guiding to $54.2 billion of sales in 2024, up slightly from the trough year of 2023. Looking forward, as discussed above, I have greatly expanded my forecast for immunology segment sales. I now expect them to hit $32 billion in 2027, up from $25 billion in the last estimate. Further, instead of sales flattening after 2027, they continue to grow through 2030, reaching $38 billion in that year. My oncology sales projection has not changed much from the last article, but the ImmunoGen deal provides added confidence in delivery. The forecast for neuroscience is up slightly due to improved forecasts for the migraine drugs and also supported by the Cerevel deal. This takes overall sales to $81.3 billion in 2030, about a 7% CAGR from 2024 levels. This is a considerable improvement from the 3% CAGR in my last article, yet it could still be a bit conservative compared to the company’s target of “high single digit” growth.

Author Spreadsheet

Added interest expense from the debt needed to finance the ImmunoGen and Cerevel acquisitions lowers the estimated net margin percentage compared to the previous article. Still, I expect it to improve slightly year-to-year for the rest of the decade as this debt gets paid off.

The company has stated they do not expect share count to change in 2024, but in later years I project they will be able to buy back about 1% of outstanding shares each year. The overall effect of the margin improvement and share count reduction is to take EPS from $11.15 this year to $17.93 in 2030, a CAGR of 8.2%. This is much stronger than the 4.5% EPS growth I estimated in my last article.

With the faster EPS growth, I am also showing greater dividend growth, keeping the payout ratio constant around 50%. I now estimate the dividend reaching $9.00 per year in 2030, compared to $7.88 in my last article. This is a dividend growth CAGR of 6.4%.

Author Spreadsheet

Valuation

Updating my peer comparison from last article, we see that AbbVie has the highest EPS growth of the peer companies I selected at that time. Just for fun, I added in Eli Lilly (LLY) with its GLP-1 weight loss drugs that have caused market commentators like Jim Cramer to anoint it as Tesla’s (TSLA) replacement in the Magnificent 7 (MAGS). We see that indeed, Lilly has much faster growth than any of the other companies. Using the PEG ratio to normalize P/E for expected growth rate, however, AbbVie comes out as the best value of the group. This is a considerable improvement from last time, when AbbVie was more expensive than Gilead (GILD) or Merck (MRK) on that basis. The improvement in AbbVie’s growth rate is what drove this ranking change.

Author Spreadsheet

Conclusion

AbbVie has done a lot since my last analysis to boost confidence that it can replace the powerhouse of Humira that drove its growth in the first decade as an independent company. Skyrizi and Rinvoq sales prospects have improved considerably, and growth is now expected into the next decade. Major acquisitions in oncology and neuroscience have also bolstered the pipeline and added balance.

With these changes, AbbVie now looks able to deliver high single digit sales growth for the foreseeable future, an improvement from the mid-single digit rate in my last analysis. This is better than most of its large cap peers. The dividend growth rate will also improve from my prior estimate. If the share price grows in line with earnings, I now expect AbbVie to deliver a total return of 9.9% per year the rest of the decade, an improvement from 8% in my last article.

AbbVie stock never reached the $132.50 buy price target I set in September, reaching $138 at the end of November just before the two big acquisitions were announced. Since then, the stock has taken off and not looked back. Now that the pathway for growth is clearer, AbbVie is now a Buy and could soon break above the range it has traded in for the last two years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.