Summary:

- Tesla, Inc. margins have declined due to price reductions and increased costs, causing concern among investors.

- The automotive industry is evolving to favor higher margins for companies like Tesla, which has strong competitive advantages.

- CEO Elon Musk is the driving force behind Tesla’s success, yet his pivotal role also presents significant risks, especially if he were to leave the company.

Xiaolu Chu

Context

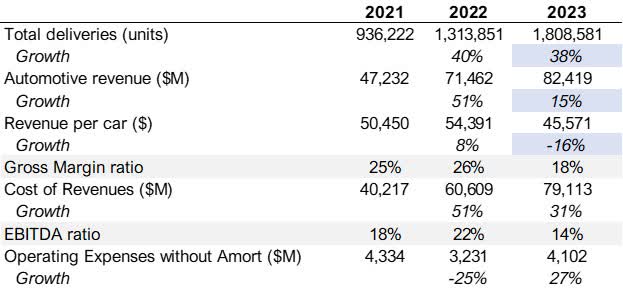

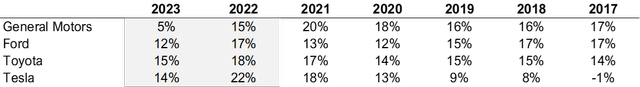

The Tesla, Inc. (NASDAQ:TSLA) fiscal 2023 report was disappointing, showing weaker margins and low revenue projections for 2024. The company’s EBITDA margin dropped to 14% from 22% in 2022, as shown in Figure 1. This decline in margins is attributed to a 15% price reduction, while costs have increased significantly—cost of revenue grew by 31% compared to a 38% increase in deliveries, so it is normal, and operating expenses, excluding amortization, rose by 27%.

As a result, Tesla’s stock price dropped by 12%, affected by these results and a subdued growth outlook for 2024. Investors who view Tesla as a pioneering tech company expect high returns, reflected in its current P/FCF ratio, 137. The main concern is whether the reduced margins are a short-term issue or a long-term challenge. A permanent decrease in margins would suggest Tesla is succumbing to the broader challenges of the automotive industry, potentially leading to lower investor returns and positioning Tesla as just another car manufacturer. However, if the margin decline is temporary, there’s potential for margins to improve, supporting Tesla’s valuation as a disruptive tech company.

In my article, I’ll discuss why I believe the margin decrease is temporary and what that means for Tesla’s valuation. I also evaluate the real risks that can drag the stock.

Figure 1: Author based in Tesla financials: https://seekingalpha.com/filings/pdf/17213144

I believe the dip in Tesla’s margins is temporary, not permanent, for a few reasons: 1) The automotive industry is evolving in ways that favor higher margins for companies like Tesla; 2) Tesla has strong competitive advantages; 3) The company is tactically lowering prices to benefit from the business cycle.

The automotive industry is evolving

Traditionally, it’s been tough to get into the auto industry because of high barriers. Building a manufacturing facility can cost around $1B. Ford (F), for example, has had to spend $4.5B on warranty repairs. And to be competitive at those slim profit margins, you need a large-scale operation, and for that operation you need a big distribution network like Volkswagen’s 7,700 dealerships. Tesla’s margins, EBITDA ratio, have dropped to levels similar to traditional car companies, as you can see in Figure 2, even though they were rising before 2022 as a tech company.

Figure 2: EBITDA ratio, companies financials

The competition in the industry is fierce, with many global players benefiting from large economies of scale. It’s easy for others to copy what’s working. Overall, the industry isn’t very appealing.

The Auto Industry is changing because cars are relying more on software and microprocessors. This makes cars more like computers, and the industry more like the Computer Industry. The companies that control the car’s operating system and build the hardware infrastructure, powered by AI, will likely dominate and earn high margins. Similar to Apple (AAPL) in computers, Tesla offers a vertically integrated solution. In the future, one or two companies may create complex software to manage everything in the car, from control systems to entertainment and autonomous driving. My estimation is that these companies could dominate the market and make big profits.

Tesla has strong competitive advantages

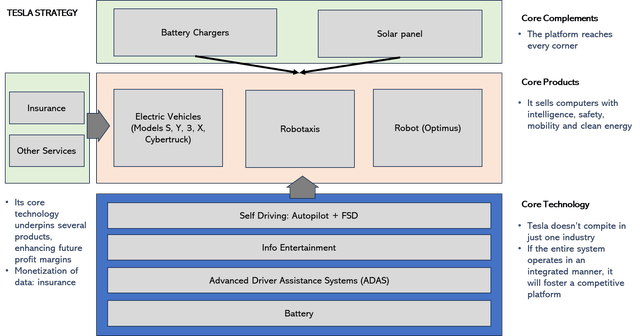

As I have said before, the big question about Tesla is whether it’s a regular car company or a tech company. It’s pretty clear for me that Tesla is a tech company. Specifically, it’s a platform company that competes in many different industries. Regular car companies can’t really keep up with Tesla because its business model is unique—it’s more complex and focused on AI technology. Let’s break it down (Figure 3).

Tesla essentially markets intelligent, safe, mobile computers powered by clean energy. The technology developed for its vehicles is also applied to robots and any other machines it manufactures, embodying economies of scale in research and development that promise to bolster future profit margins. Furthermore, Tesla capitalizes on the data collected from its products to enhance safety, increase Full Self-Driving (FSD) sales, and offer insurance, thereby with the capacity to boost its profitability.

Tesla strives to minimize the total cost of car ownership. By integrating solar panels to cut energy expenses and employing Powerwall batteries, Tesla not only reduces costs but also has the potential to create extra income for its customers. This reduction in overall expenses can make customers less sensitive to price.

Tesla distinguishes itself from Apple by actively leveraging its technology to offer products and services to other car companies. Recently, Tesla has been extending its Full Self-Driving (“FSD”) software and battery charging infrastructure to other automakers. This inclusive approach, exemplified by its extensive charging network accessible to any car model, not only expands Tesla’s market reach but also enables it to secure additional government funding, and this can drive greater profits.

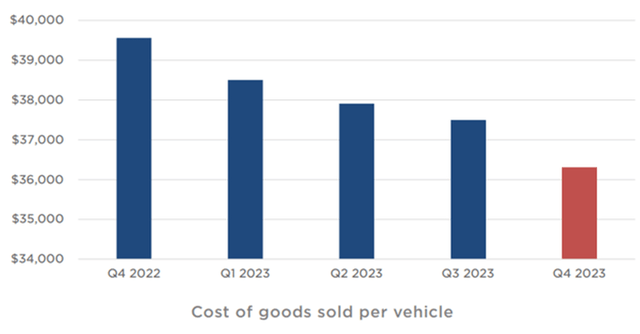

Tesla functions as a multifaceted ecosystem, indicating that it goes beyond the conventional definition of a car company. CEO Elon Musk highlighted in the latest earnings call that Tesla is an AI robotics company. With a wide range of technological offerings, Tesla’s competition extends beyond just the automotive sector. By competing across multiple industries simultaneously, Tesla’s intricate system is strategically crafted to utilize different components to enhance profit margins. This emphasizes my bet of long-term margin expansion, as evidenced in Figure 4.

Figure 4: Tesla 2023Q4 Earnings Presentation

Lowering prices to benefit from the business cycle

The automotive industry is currently navigating a downturn in its cycle, primarily driven by the Federal Reserve’s decision to raise interest rates, that hits specially to discretionary consumer. In this challenging environment, Tesla faced a critical decision: should it have maintained its current pricing strategy, risking a decrease in sales volume growth, or should it have reduced prices to potentially grow sales volume?

Opting to keep prices steady may have resulted in fewer cars sold, hindering Tesla’s ability to scale operations and maintain a competitive edge in the market. This challenge is not only against traditional automakers like Ford and General Motors (GM) but also against electric vehicle (“EV”) newcomers such as BYD Company (OTCPK:BYDDF). Tesla is well aware of the cyclical nature of the automotive industry. Given the generally low margins across its competition, Tesla, which has enjoyed higher margins as illustrated in Figure 2 prior to 2023, is in a position to capitalize on market share during these difficult times.

Risks

The driving force behind Tesla’s achievements is Elon Musk, making him the primary risk factor in investing in Tesla. If Musk were to depart from the company, not only would the engine of the company vanish, but he would likely take key personnel with him, especially the AI team he consistently praises. A pressing issue garnering attention in newspapers presently is the attempt to nullify Elon Musk’s $54 billion pay package. Should he fail to secure a package that aligns with his expectations, it could serve as a catalyst for his departure from the company. Additionally, Musk has expressed the need to maintain control of at least 25% of the company to feel comfortable expanding a significant AI operation.

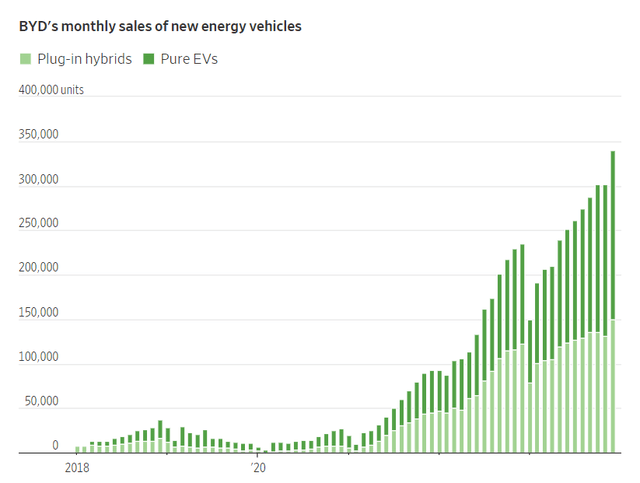

The second significant risk lies in Chinese car companies, exemplified by BYD, China’s electric vehicle manufacturer, which recently surpassed Tesla as the world’s top-selling electric car brand. BYD sold 526,409 fully electric cars compared to Tesla’s 484,507 in 4Q2023. It’s essential to recognize that this industry operates on economies of scale, where volume plays a critical role. Consequently, Tesla is adjusting its pricing strategy as a risk management measure.

Figure 5: The Wall Street Journal

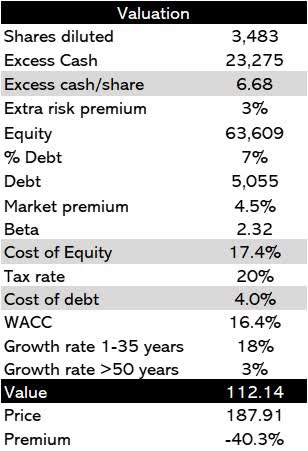

I view Elon Musk’s potential departure as the primary risk, warranting an additional 3% risk premium in my valuation.

Tesla valuation

To value Tesla, I consider the Dominance Company Method I have launched in a former article. As I have developed in this article, Tesla is creating a whole platform that reinforces itself, and I estimate that he will dominate the car industry and, in general, the AI robotics world. So, as many companies that have dominated its industry, Tesla should be able to growth its free cash flow per share at 18% during at least 35 years. In this table I summarize key parameters of the valuation.

Figure 6: Author

I’ve estimated Tesla’s value at $112 per share, which represents a 40% discount compared to the market price. Given the significant risks associated with Elon Musk’s persona affecting Tesla’s management, I recommend against investing in Tesla.

Conclusion

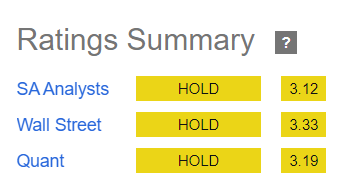

Tesla is down 24% this year, Q4 margins have lowered, and guidance for 2024 has disappointed. Tesla has lost the leader position in electric vehicles against BYD, a Chinese competitor. Tesla has been up and down since its IPO and its leader, Elon Musk has been a controversial character. Ratings are not very favorable (Figure 7)

Figure 7: Seeking Alpha

I believe Tesla is a transformative company with a profound impact on the world, and it will continue to thrive under the leadership of Elon Musk, whom I greatly admire. However, Musk’s vulnerability as a leader suggests that there may be better investment opportunities with similar or superior returns.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.