Summary:

- Our quarterly review of Visa and Mastercard is here.

- The two payment empires beat expectations once again, as investors continue to underestimate their vast growth opportunities.

- Both Visa and Mastercard trade at attractive valuations considering their long double-digit earnings growth trajectory.

- Mastercard went on a tear following earnings, but a deeper look shows that its outperformance is not enough to justify the premium over Visa.

- I reiterate both as a Buy, but find Visa more attractive.

Justin Sullivan

It’s time for our quarterly checkup on two of my favorite companies, Visa (NYSE:V) and Mastercard (NYSE:MA). As usual, both payment empires beat their respective revenue and EPS estimates, as they continue to showcase better-than-expected growth and consistent margin expansion.

All that’s left to determine is, once again, which one is the better investment following their calendar Q4’23 results.

Revisiting Why We Preferred Visa

I started covering Visa and Mastercard back in April of last year, claiming that both are impeccable businesses, with strong secular tailwinds and still a long runway for continued high-single-digit to low-double-digit growth.

Although some perceive them as old, saturated businesses, I found the opposite to be true, as both Visa and Mastercard consistently introduce new innovative solutions in adjacent fields to their core payment processing operations.

While I found the two payment giants to be attractive investments, I claimed concentrated investors should pick one horse in this race, as there’s no added value in holding both, considering their businesses are similar, and therefore their risks, tailwinds, and headwinds, are practically identical.

Building on this decision, I determined that Visa was my horse in this race, as I found the higher valuation for Mastercard wasn’t justified by only a slightly better growth trajectory, taking into account the importance of the network effects in the business, and the fact that Visa is significantly more profitable.

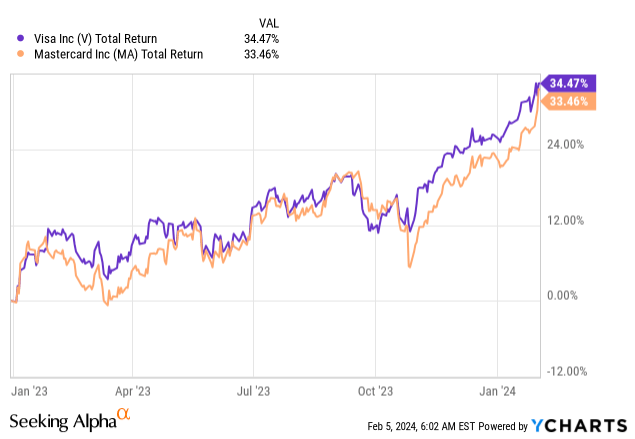

Looking at their returns since the beginning of last year, we see they performed pretty much in line with each other, with Mastercard gaining significant ground following their recent earnings. Had we checked before Visa’s earnings announcement on January 25th, we would have seen a more significant outperformance of 4%.

Dissecting Mastercard’s Post-Earnings Outperformance

Diving deeper into our investment thesis in Visa over Mastercard, we said that we found Mastercard’s higher valuation unjustified by what we found to be only slightly better growth prospects. Specifically, over the majority of the time, Mastercard is only growing faster than Visa because it has a lower base, rather than outgrowing in absolute dollars.

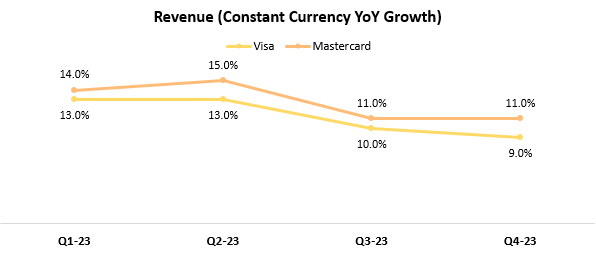

Speaking about growth, there are several metrics to consider when comparing those two. Of note, Visa’s fiscal calendar is one quarter ahead of Mastercard’s, and all graphs shown are based on the calendar quarter for the purpose of comparability.

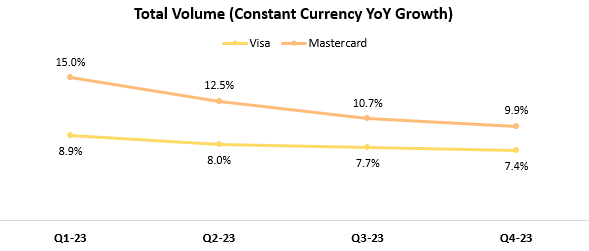

Created by the author based on data from Visa and Mastercard financial reports.

Let’s begin with the total volumes, which is the aggregated dollar amount of purchases made on the networks and cash disbursements (checks, returns, etc.). We can see that Mastercard significantly outperformed Visa during the year, with the gap narrowing in the last calendar quarter.

For context, Visa’s total volume amounted to $3.9 trillion, compared to Mastercard’s $2.3 trillion. Visa’s total volume increased by $275 billion compared to the prior year period, whereas Mastercard added $219 billion.

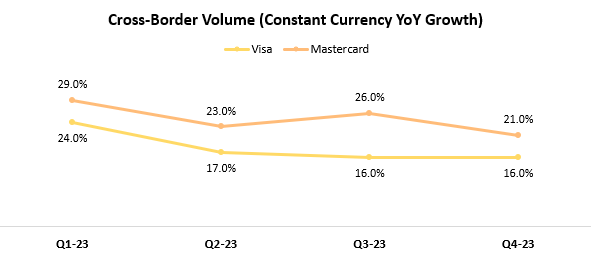

Created by the author based on data from Visa and Mastercard financial reports.

Secondly, cross-border volumes, which in simple terms reflect the dollar amount of transactions made where the payer is from a different country than the receiver. It’s a crucial number for the companies because they charge a higher fee on such transactions.

They don’t provide absolute numbers regarding this metric, but we do know that for Mastercard, cross-border generated $2.3 billion in revenues in Q3’23, or 35% of total revenues, whereas for Visa it was $3.2 billion and 37% of revenues.

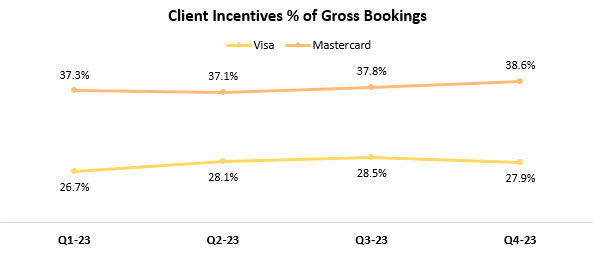

Created by the author based on data from Visa and Mastercard financial reports.

So, we can see Mastercard is gaining volume share. Next, we need to look at client incentives, which is the amount the networks pay to their partners off their gross revenues. The higher the percentage is, the volume becomes less valuable because the network needs to pay more to clients to achieve it.

As we can see, Mastercard is much more “generous” with its incentives, paying out nearly 10 percentage points more than Visa on average.

Created by the author based on data from Visa and Mastercard financial reports.

The higher client incentives explain the discrepancy between Mastercard’s significant outperformance in volumes and the marginal difference in revenue growth.

To me, there’s an apparent strategic difference here, as Mastercard is clearly prioritizing higher volumes. Unlike the usual case of sacrificing the bottom line for top-line growth, here we have a case of sacrificing the top line to gain more clients.

Created by the author based on data from Visa and Mastercard financial reports.

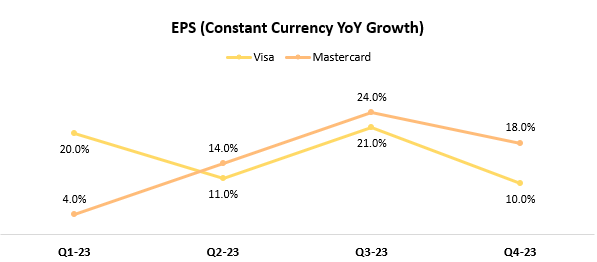

Lastly, we reach EPS. The combination of Visa’s higher profitability, and Mastercard’s higher client incentives lead us to this final metric. In terms of EPS, Visa actually outgrew Mastercard significantly over the 12-month period that ended in December 2023, with 21% growth compared to Mastercard’s 15.6%.

Visa & Mastercard Valuation

Yet again, I think it’s safe to say Mastercard did not outgrow Visa enough to justify a significantly higher valuation. Unlike previous quarters, investors might need to dig a little deeper to understand what’s underlying the higher volumes, but it’s crucial that they do.

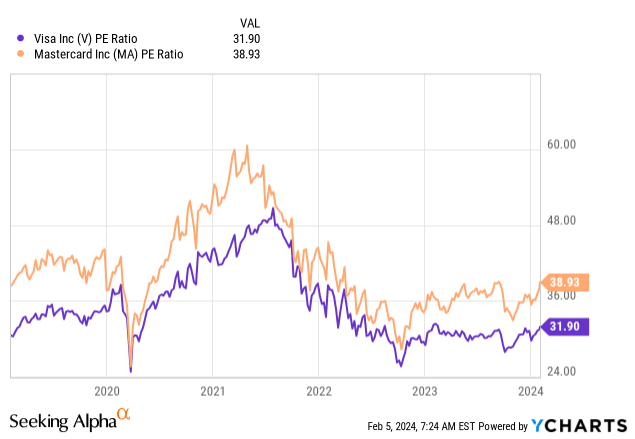

Today, Mastercard is trading around a 38x P/E multiple over 2023 EPS, and a 32x multiple over projected 2024 earnings, which are expected to grow by 17.5%, equaling a PEG ratio of 1.8x.

Visa is trading at a 32x P/E multiple over calendar 2023 EPS, and a 27x multiple over projected calendar 2024 earnings, which are expected to grow by a similar 17.8%, equaling a PEG ratio of 1.5x.

In my view, the market continues to take for granted the fact that because Mastercard is smaller and less profitable, it will inevitably outgrow Visa and see more margin expansion. However, this has not been the case. Looking behind their volume numbers, we see that Visa is able to maintain its significantly larger market share, while growing earnings in line with Mastercard, if not faster.

Based on the following, I find Visa as the more attractive investment yet again.

Conclusion

We’ve grown accustomed to Visa and Mastercard beating expectations and growing earnings at a double-digit pace.

Two of the most powerful, predictable, and resilient companies in the market remain somewhat undervalued historically and compared to lower-quality fintechs.

For investors who wish to pick only one between the two, I remain of the opinion that Visa is more attractive, as it’s significantly undervalued compared to Mastercard with no fundamental justification.

Therefore, I reiterate a Buy rating for both Visa and Mastercard, with Visa being my preferred choice.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.