Summary:

- Drug manufacturers are facing a massive patent cliff, with over $200 billion in annual revenue at risk through 2030, meaning innovation is critical to prop up sales, and today’s company focuses on that.

- Thermo Fisher Scientific Inc. just reported strong Q4 earnings, with adjusted EPS exceeding expectations and a margin increase from the previous year.

- Thermo Fisher Scientific’s growth strategy focuses on high-impact innovation, trusted partner status, and an unparalleled commercial engine.

ADragan

Introduction

I just wrote an article on one of my favorite healthcare stocks, drug manufacturer AbbVie (ABBV). Like many of its peers, the stock has been through elevated uncertainty regarding the loss of a major patent.

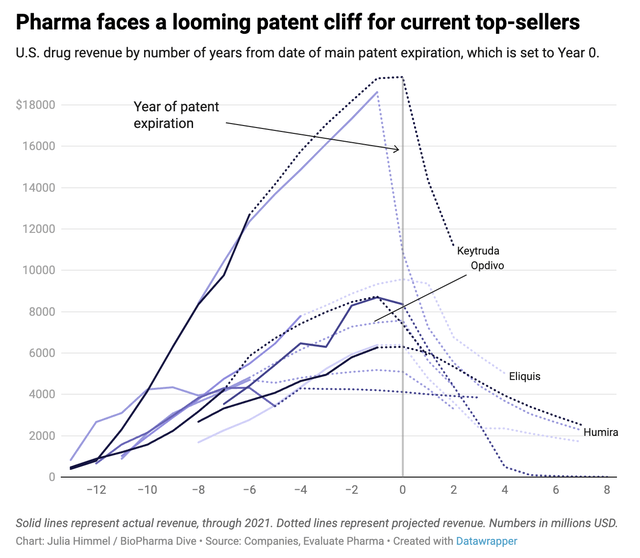

As we can see below, patent losses tend to have a massive impact on sales, which makes sense, as producers of biosimilar alternatives are often ready to jump in as soon as it is legally possible.

According to BioPharma Dive, where I got the chart above, drug manufacturers are facing a massive patent cliff.

Today, big drugmakers are facing an even larger “patent cliff,” with more than $200 billion in annual revenue at risk through 2030. But this time around, many of the brand name drugs losing market exclusivity are biologic products, manufactured from living cells, rather than the chemical pills that previously dominated the ranks of pharma top-sellers.

This means that big pharma companies should accelerate innovation by acquiring smaller companies with promising pipelines and accelerate in-house innovation.

Either way, it means the key is innovation, which brings me to Thermo Fisher Scientific Inc. (NYSE:TMO).

My most recent article on the company was written on October 31, when I went with the title “My Family Is Buying A Lot More Thermo Fisher Stock.”

Since then, shares are up 24%, beating the already impressive 17% return of the S&P 500 (SP500) by roughly 700 basis points.

The only reason why TMO is not in my personal portfolio is that I already own its peer, Danaher (DHR), which is highly correlated to TMO due to similar operations in the healthcare supply chain.

On January 30, Danaher reported fantastic earnings (covered in this article), which included a very upbeat outlook, as the company expects favorable market conditions to return in the second half of 2024.

In this article, we’ll discuss TMO’s just-released Q4 earnings, which also paint a very promising picture.

So, let’s get right to it!

There’s (A Lot Of) Growth On The Horizon

In the fourth quarter, earnings results surpassed expectations, with adjusted EPS of $5.67, exceeding the prior guidance by $0.05.

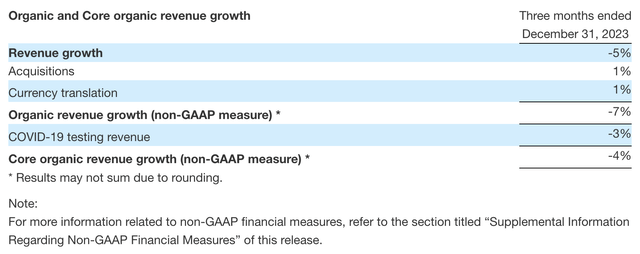

However, the reported revenue witnessed a 5% YoY decrease in Q4, primarily attributed to a 7% decline in organic revenue, partially offset by a 1% contribution from acquisitions and a 1% tailwind from foreign exchange.

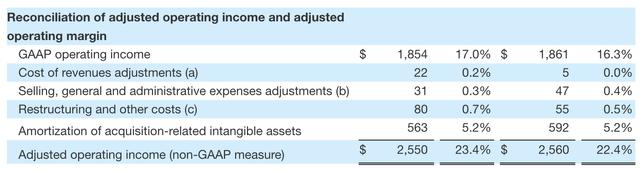

Operationally, the company reported adjusted operating income of $2.55 billion in the fourth quarter, achieving a margin of 23.4%, indicating a 100 basis points increase from Q4 of the previous year.

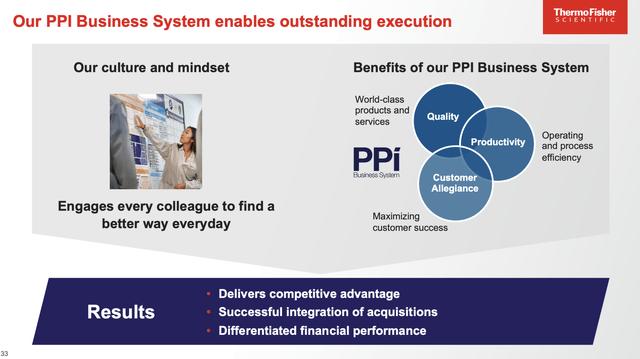

This performance was attributed to strong productivity, effective price realization, and the impact of the PPI Business System.

However, it was partially offset by lower pandemic-related revenue, strategic investments, and foreign exchange effects.

After all, as we can see above, COVID-19 testing revenue was a 3% headwind.

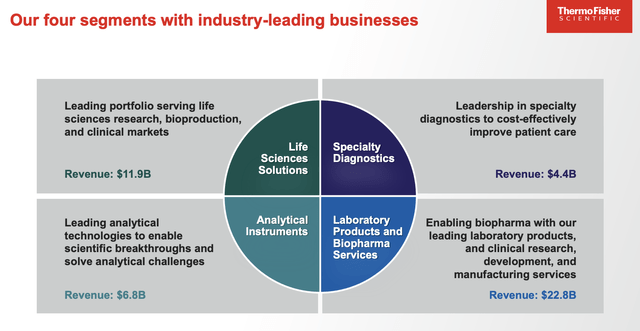

With that in mind, let me throw some more numbers at you as we look into its business segments.

- In the Life Sciences Solutions segment, Q4 reported revenue declined by 19%, primarily due to pandemic-related revenue runoff, resulting in an adjusted operating margin of 36.2%.

- Analytical Instruments reported an 8% increase in Q4 revenue, with an adjusted operating margin of 28.8%.

- Specialty Diagnostics witnessed a 1% decline in reported revenue, but adjusted operating income increased by 27%, leading to a margin of 23.9%.

- In the Laboratory Products and Biopharma Services segment, Q4 reported revenue decreased by 4%, and adjusted operating income declined by 4%, resulting in a margin of 14%.

Looking beyond these dry numbers, the company provided some very important comments on industry developments.

According to Thermo Fisher, in pharma and biotech, there was an anticipated decline in growth, primarily attributed to a 7-point headwind resulting from the aforementioned vaccine and therapy runoff.

However, the impact was mitigated by the company’s trusted partner status, leading to market share gains and a successful transition of COVID-related capacity to other therapies.

Furthermore, in academic and government sectors, growth in Q4 was in the mid-single digits, while the full year saw high single-digit growth, driven by strong performances in electron microscopy, chromatography, and mass spectrometry.

In the industrial and applied sectors, growth was in the low single digits for both Q4 and the full year, with a notable contribution from the electron microscopy business.

However, the diagnostics and healthcare end market witnessed a Q4 revenue decline in the high teens and a 30% drop for the full year.

Despite these challenges, core business growth was strong in immunodiagnostics, microbiology, and transplant diagnostics in 2023.

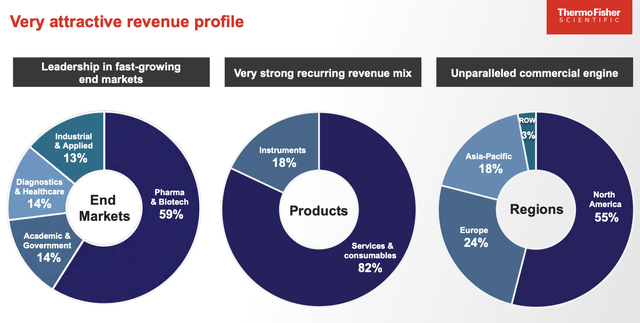

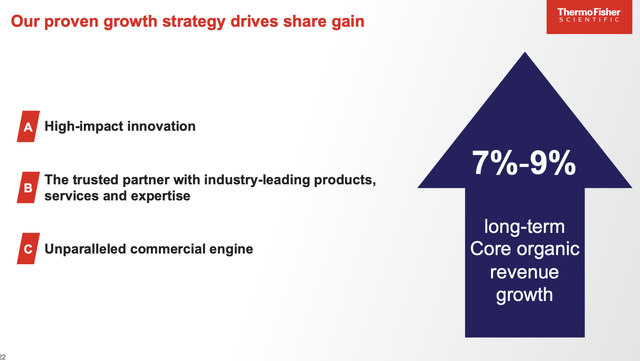

Speaking of some of its tailwinds, TMO’s growth strategy revolves around three key pillars, which are expected to provide it with at least 7% long-term annual core revenue growth:

- High-impact innovation.

- Trusted partner status.

- An unparalleled commercial engine.

Notably, the company showed a successful year of high-impact innovation, launching groundbreaking products in various sectors.

In chromatography and mass spectrometry, the company introduced the Thermo Scientific Orbitrap Astral Mass Spectrometer, driving advancements in precision medicine.

The electron microscopy business saw the launch of the Thermo Scientific Metrios 6 STEM, while Specialty Diagnostics unveiled the first FDA-cleared assays for preeclampsia risk assessment.

The Life Sciences Solution introduced the Gibco CTS Detachable Dynabeads platform, accelerating cell therapy manufacturing.

The fourth quarter continued this momentum with releases like the Thermo Scientific Meridian EX System and the Aquanex Ultrapure Water Purification System.

Adding to that, from an M&A point-of-view, the acquisition of CorEvitas in Q3 strengthened the clinical research business, and the company announced its intent to acquire Olink in Q4, aiming to enhance proteomic solutions.

Capital was also returned to shareholders through stock buybacks and dividends, amounting to $3.5 billion in 2023.

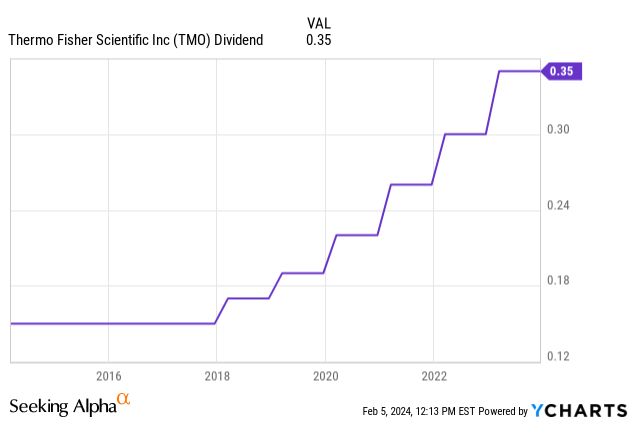

TMO currently pays $0.35 per share per quarter in dividends. This translates to a yield of just 0.25%. Needless to say, the 16.7% hike on February 22, 2023, didn’t have a major impact on investors – except on long-term investors who have been with the company for many years.

Furthermore, the fact that it has a 6.5% payout ratio shows that it has other priorities than paying a juicy dividend.

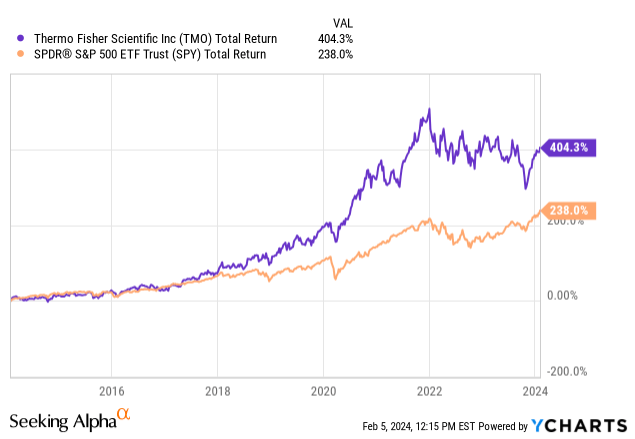

However, that’s OK, as TMO has been an incredible source of wealth, returning more than 400% over the past ten years, outperforming the S&P 500 as represented by SPDR® S&P 500 ETF Trust (SPY) by a wide margin.

Since 2003, TMO shares have returned 16.2% per year!

Going forward, I expect outperformance to continue.

What’s Next? And What Does It Mean For The Valuation?

Looking ahead, the company provided guidance for 2024, indicating a revenue range of $42.1 to $43.3 billion and an adjusted EPS range of $20.95 to $22.00.

The guidance assumes core organic revenue growth between -1% and +1%, with expectations that the market will decline in the low single digits.

The company also anticipates a headwind of $1.3 to $1.4 billion in 2024 due to the normalization of pandemic-related revenue.

Despite this, the company used the earnings call to express confidence in its growth strategy and the PPI Business System to navigate challenges, aiming for adjusted operating income margins between 22.3% and 22.8%.

Furthermore, the company made the case that quarterly phasing suggests improving organic revenue growth and increasing margins throughout the year, which is in line with comments from Danaher.

Analysts agree with this as well.

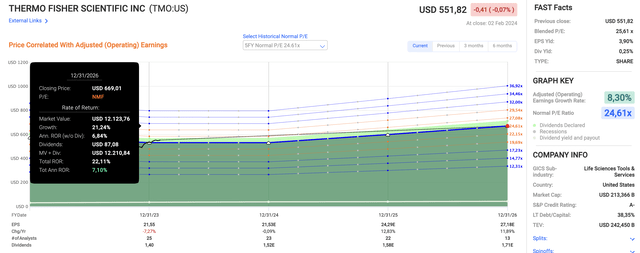

Using the data in the chart below:

- This year, analysts expect the company to keep unchanged EPS.

- 2025 is expected to see 12.8% EPS growth, potentially followed by 11.9% growth in 2026.

- Unfortunately, after its most recent stock price surge, TMO is currently trading at a blended P/E ratio of 25.6x, which is a bit above its five-year normalized multiple of 24.6x, which I believe fits its current growth profile.

- Combining a 24.6x target multiple with expected EPS growth and its subdued dividend, we get an annual return outlook of 7.1% through 2026.

Although 7.1% isn’t bad, at these prices, I prefer to wait for a correction before I buy more for the family accounts that own TMO.

By a correction, I mean a decline of 6% to 10%, which would pave the road for a potential 10% annual total return, using the same numbers I used above – except for a lower starting stock price.

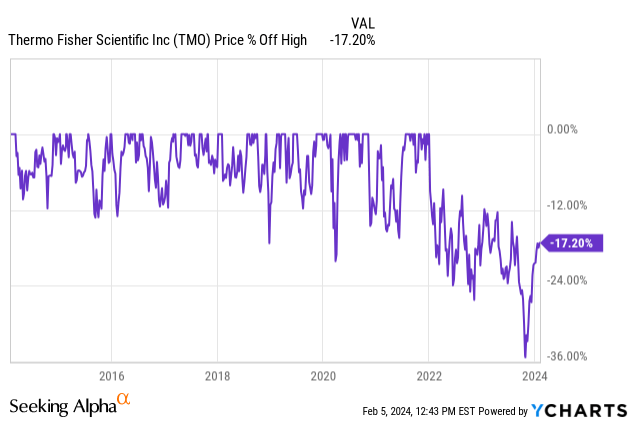

While waiting for a better stock price comes with risks, TMO, which is still trading 17% below its all-time high, tends to go through 10% corrections on a regular basis (as we can see in the chart below).

Major risks to the thesis are long-term elevated rates, which hurt demand for expensive medical equipment, and/or an event that caused a steep market sell-off.

When it comes to cyclical demand risks, I’m not worried, as TMO operates in a very defensive sector.

Takeaway

In the dynamic landscape of healthcare stocks, Thermo Fisher stands out as a beacon of resilience and innovation.

Despite challenges like pandemic-related revenue decline, TMO reported strong 4Q23 results, proving its adaptability.

The company’s three-pillar growth strategy—high-impact innovation, trusted partner status, and an unparalleled commercial engine—has fueled its success.

While the stock’s current valuation poses a wait-and-watch scenario, Thermo Fisher Scientific Inc.’s track record of consistent returns and its proactive approach to industry shifts make it a compelling long-term play.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.