Summary:

- In a few weeks, I will provide a keynote speech at The MoneyShow in Las Vegas and conduct research on the casino sector.

- This article compares two gaming REITs, Gaming and Leisure Properties and VICI Properties in terms of their portfolios, tenants, debt metrics, and financial performance.

- So, who’s rolling the dice with me?

Larysa Vdovychenko/Moment via Getty Images

In a few weeks, I plan to fly to Las Vegas to give a keynote speech at The MoneyShow.

This is my first keynote (at the MoneyShow) since Covid-19, and I’m extremely excited to get back into the speaking groove again.

In addition, I’m thrilled to see many of my Seeking Alpha friends as well as Steve Forbes and Charles Payne.

While in “Sin City,” I plan to conduct a “boots on the ground” series, which means I’ll be playing a few hands of blackjack.

Don’t worry, I know the difference between gambling and investing, which simply means I’m researching the casino sector.

As you may recall, in December I received some positive feedback on my article comparing Realty Income (O) and Agree Realty (ADC).

So, today I thought that I would follow that up with another piece comparing the only two pure-play gaming REITs: Gaming and Leisure Properties, Inc. (NASDAQ:GLPI) and VICI Properties Inc. (NYSE:VICI).

Both of these real estate investment trusts, or REITs, are internally managed and invest in experiential properties with a portfolio of premier gaming assets that feature luxury hotels, restaurants and bars, as well as an assortment of other entertainment venues.

Both REITs lease their properties to leading operators in the gaming and hospitality industries such as Caesars Entertainment (CZR) and PENN Entertainment (PENN).

So, without further ado, and as a warmup for my trip to Vegas, let’s see where the chips fall…

Gaming and Leisure Properties – GLPI

Following its spinoff from Penn National Gaming in 2013, Gaming and Leisure Properties became the first REIT with an exclusive focus on gaming properties.

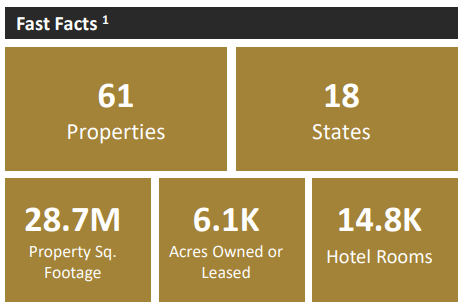

The gaming REIT now has a market cap of approximately $12.0 billion and a 28.7 million SF portfolio comprised of 61 geographically diversified gaming properties featuring approximately 14,800 hotel rooms across 18 states.

GLPI – IR

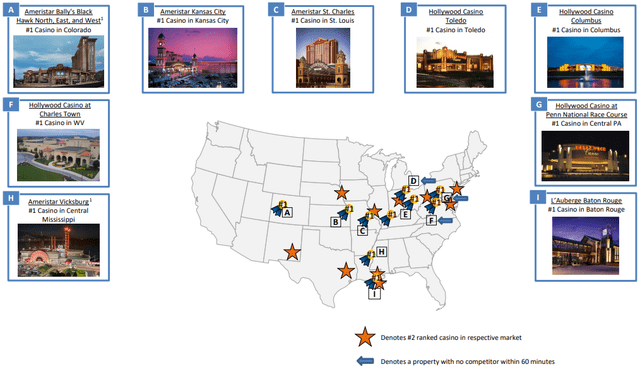

Gaming and Leisure’s portfolio has high-quality gaming properties including several that are ranked #1 in their respective markets. Some examples of their market-leading properties include:

- Ameristar Bally’s Black Hawk (#1 Casino in Colorado)

- Ameristar Vicksburg (#1 Casino in Central Mississippi)

- Hollywood Casino at Penn National Race Course (#1 Casino in Central PA), and

- L’Auberge Baton Rouge (#1 Casino in Baton Rouge).

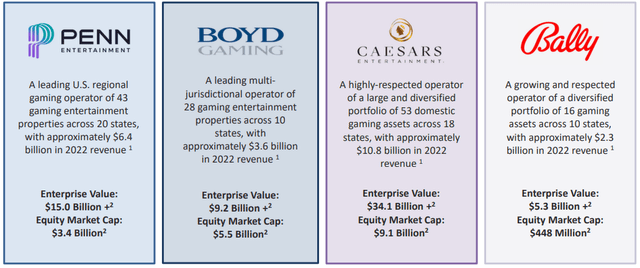

Since its formation, GLPI has operated at 100% occupancy and currently receives approximately 88% of its rent from top gaming operators including Penn Entertainment, Boyd Gaming (BYD), Caesars Entertainment, and Bally’s (BALY).

Additionally, it should be noted that the company collected 100% of its rents during the covid pandemic.

While VICI and GLPI both have high tenant concentration, wide tenant diversity in the gaming space is practically impossible to achieve as there are only so many state-licensed gaming operators that VICI and GLPI can lease their properties to.

While I always prefer a well-diversified tenant base, it is not always possible in all sectors, particularly those which require tenants to be specially licensed to operate specialized properties, for example in the cannabis and gaming industries.

However, I’m not too concerned with either gaming REIT’s tenant concentration for the following reasons:

- Gaming facilities and their related amenities tend to be trophy properties that cannot easily be replaced.

- Municipal and state regulations make it more difficult to build or relocate a casino property when compared to more traditional types of real estate.

- Both gaming REITs receive the majority of their rent from Caesars & MGM, or PENN, all three of which are nationally recognized and established publicly traded gaming operators.

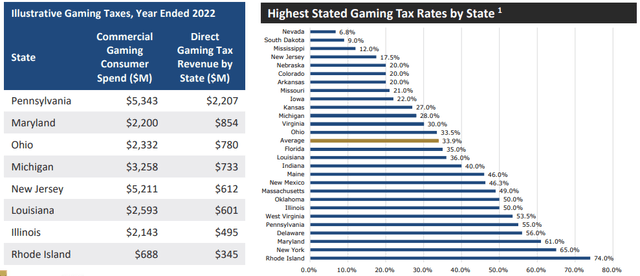

Moreover, state and local governments have an incentive to see gaming properties succeed as many of them rely heavily on tax revenues from the casinos in their state or locality. This dependence on tax revenues adds a layer of protection that most other real estate sectors do not enjoy and, in general, limited license jurisdictions that are protected by the state tend to have higher tax rates.

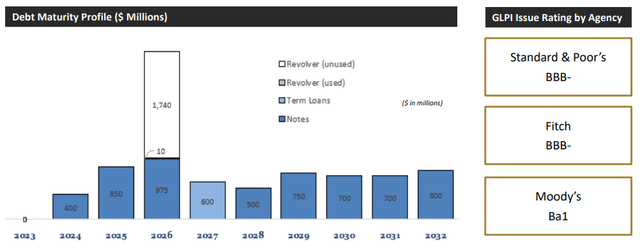

GLPI achieved a cross-over investment grade status in 2018 and currently is rated BBB- by S&P Global, BBB- by Fitch, and Ba1 by Moody’s.

The company has solid debt metrics with an EBITDA to interest expense ratio of 4.32x and a trailing twelve-month (“TTM”) net debt to EBITDA of 4.8x as of the end of 3Q-23. Plus, as of their most recent update, 100% of GLPI’s debt is unsecured.

VICI Properties – VICI

VICI was formed out of Caesars Entertainment’s bankruptcy in 2017 to become the second, and to date, one of only two publicly traded REITs with a primary focus on gaming properties.

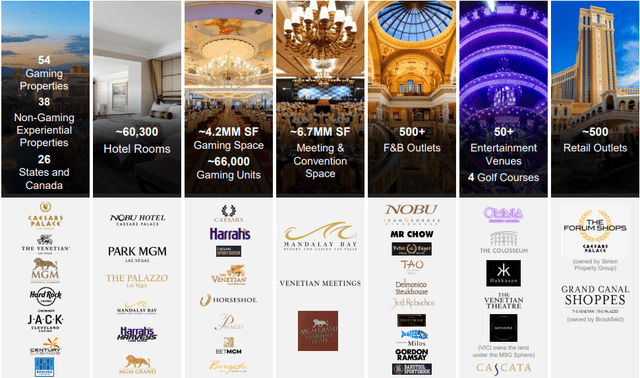

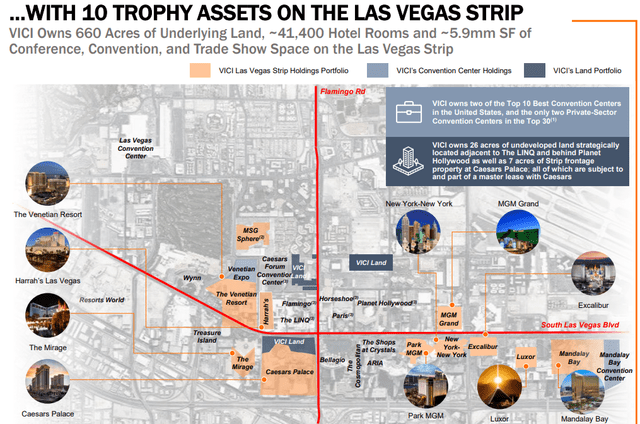

VICI currently has a market cap of approximately $30.8 billion and a 127 million SF portfolio comprised of 54 gaming properties and 39 non-gaming / experiential properties. Additionally, the gaming REIT owns 4 championship golf courses and 33 acres of developable land adjacent to the Las Vegas Strip.

Its gaming assets include several recognizable trophy properties and features over 60,000 hotel rooms, approximately 500 retail outlets, and roughly 500 restaurants, nightclubs, bars and sportsbooks across the U.S. and in Canada.

Its non-gaming experiential properties primarily consist of family entertainment bowling centers that VICI acquired from Bowlero (BOWL) in 2023.

Many of VICI’s most iconic properties are located in Las Vegas and include:

- Caesars Palace

- MGM Grand

- The Venetian Resort

- Harrah’s

- The Mirage

- Luxor

- Mandalay Bay

- New-York-New-York

- Park MGM, and

- Excalibur.

Outside of Las Vegas, the gaming REIT owns several notable casinos including Caesars Atlantic City, Beau Rivage located in Biloxi, Mississippi, and Empire City Casino located in Manhattan NY, just several miles from Times Square.

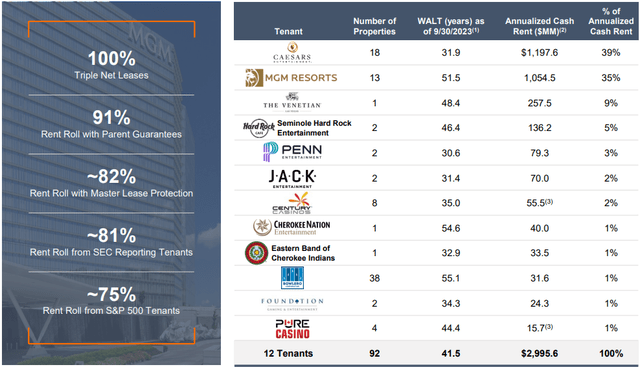

Like Gaming and Leisure Properties, VICI has high tenant concentration with a total of 12 tenants.

The vast majority of VICI’s annualized cash rent comes from its two largest tenants, Caesars and MGM Resorts (MGM), which make up 39% and 35% of VICI’s annual rent, respectively.

When including extension options, both of VICI’s top tenants have extremely long weighted average lease terms (“WALT”), with Caesars having a WALT of 31.9 years and MGM Resorts having a WALT of 51.5 years.

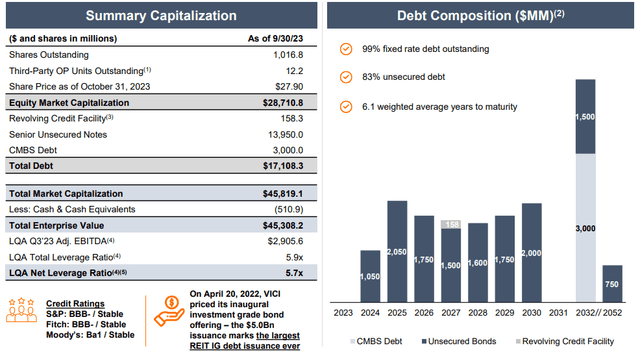

VICI has an investment-grade balance sheet with a BBB- rating from S&P Global.

The gaming REIT has solid debt metrics including a net leverage ratio of 5.7x, a long-term debt to capital ratio of 42.02%, and an EBITDA to interest expense ratio of 4.07x.

Additionally, VICI’s debt is 99% fixed rate, 83% unsecured, and has a weighted average term to maturity of 6.1 years.

Comparison: VICI Vs. GLPI

By the Numbers

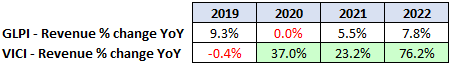

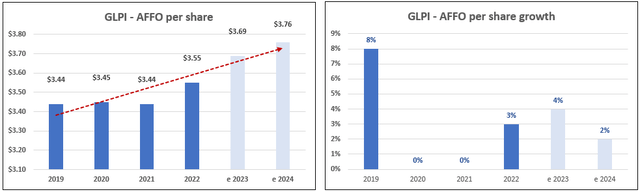

The chart below lists a side-by-side comparison of the gaming REITs total revenues from 2019 to 2022. What jumps out to me is how much revenue growth VICI has achieved in its relatively short existence.

TIKR.com (compiled by iREIT®)

Total Revenues

TIKR.com (numbers in thousands)

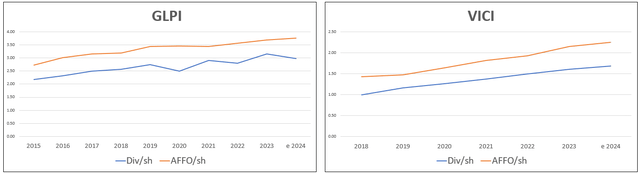

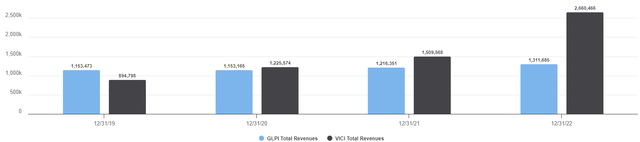

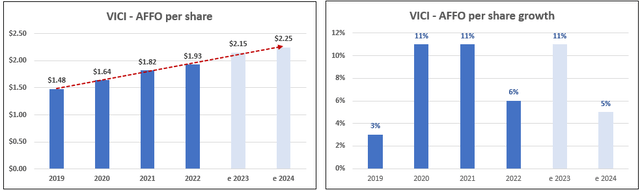

AFFO per share

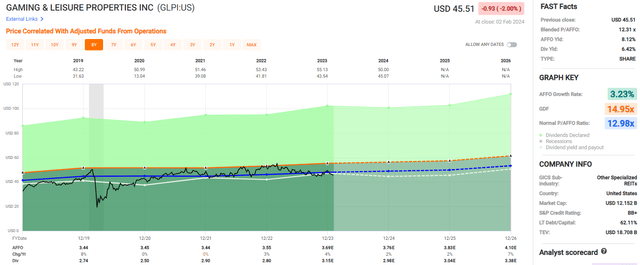

When looking at the bottom line, or adjusted funds from operations (“AFFO”), GLPI has had a blended average AFFO annual growth rate of 3.23% since 2019.

The gaming REIT delivered strong AFFO per share growth in 2019 at 8%, had flat growth in 2020 & 2021, and then increased AFFO per share by 3% in 2022.

For 2023, analysts expect AFFO per share to increase by 4% and then by 2% in 2024.

While GLPI has had fairly consistent AFFO growth over the past several years, its blended average AFFO growth rate of 3.23% is more than doubled by VICI.

FAST Graphs (compiled by iREIT®)

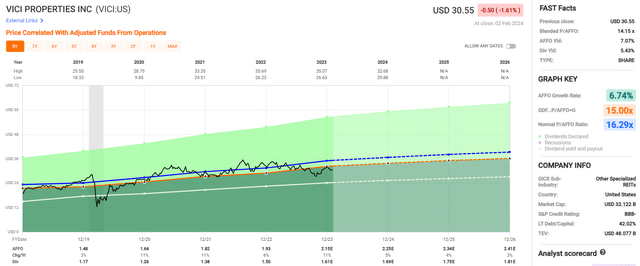

Each year since 2019, VICI has had positive AFFO per share growth and has a blended average AFFO annual growth rate of 6.74%. Once all of the numbers are in for 2023, analysts expect VICI’s AFFO per share to increase by 11% and then increase by 5% in 2024.

In terms of total revenue and AFFO per share, VICI has delivered superior growth since 2019 when compared to GLPI.

FAST Graphs (compiled by iREIT®)

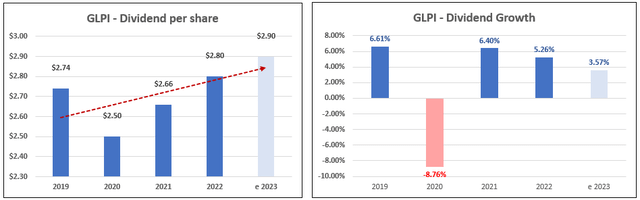

Dividend Growth

In the chart below, I’ve removed the special dividends paid in 2021 and 2023 to normalize GLPI’s dividend history.

Gaming and Leisure increase its dividend each year since 2019 with the exception of 2020, when the quarterly dividend was cut from $0.70 to $0.60 per share.

Dividend increases resumed in 2021, and since 2019 GLPI has had an average dividend growth rate of approximately 2.62% when removing the special dividends.

FAST Graphs (compiled by iREIT®)

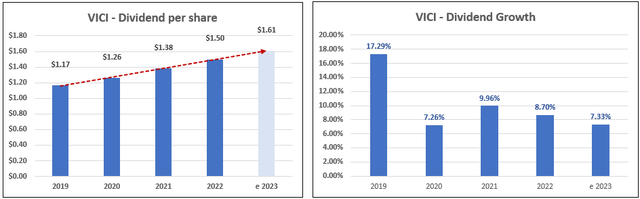

Like revenues and AFFO per share, VICI has delivered superior results in terms of its dividend growth.

Each year since 2019, the gaming REIT has increased its dividend by over 7% and has an average annual dividend growth rate of 10.11% over the past 5 years.

FAST Graphs (compiled by iREIT®)

Dividend AFFO Payout Ratio

Both GLPI and VICI have adequate dividend coverage with a 2023 AFFO payout ratio of 85.37% and 74.88% respectively.

While both gaming REITs have a respectable AFFO payout ratio, I would consider VICI’s dividend safer as its AFFO payout ratio of 74.88% is much more conservative than that of GLPI.

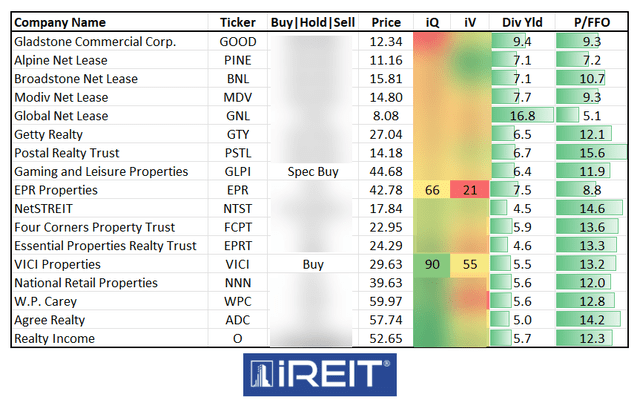

GLPI pays a 6.42% dividend yield and trades at a P/AFFO of 12.31x, compared to its average AFFO multiple of 12.98x. Analysts expect AFFO per share to increase by 2% in both 2024 & 2025 and then increase by 7% in 2026.

We rate Gaming & Leisure Properties a Spec Buy.

VICI pays a 5.43% dividend yield and is currently trading at a P/AFFO of 14.15x, compared to its average AFFO multiple of 16.29x.

Analysts expect AFFO per share to increase by 5% in 2024, and then increase by 4% and 3% in the years 2025 and 2026 respectively.

We rate VICI Properties a Buy.

In Conclusion

I believe my article in December comparing Realty Income and Agree Realty ended with something like “why not just own them both.”

In this case, however, I think there is a clear winner here.

VICI was formed years after GLPI, yet its market capitalization is almost three times that of GLPI (~$30 billion vs ~$12 billion).

VICI has delivered superior revenue growth, AFFO per share growth, and dividend growth in its short existence and I believe it’s on track to continue this trend.

VICI trades at a higher absolute AFFO multiple of 14.15x, compared to GLPI’s AFFO multiple of 12.31x, but VICI is trading at a larger discount relative to its average AFFO multiple.

Both companies have similar balance sheet metrics and business models, but I believe VICI is the better investment at this point given its superior growth, safer dividend, and a deeper discount relative to its average AFFO multiple.

One last thing…

A few things to remember before heading to Las Vegas…

- Always remember not to put all of your eggs in one basket.

- Scared money never wins.

I look forward to your comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VICI, O, ADC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For A FREE 2-Week Trial

Join iREIT® on Alpha today… for more in-depth research on REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, Builders, and Asset Managers. You’ll get more articles throughout the week, and access to our Ratings Tracker with buy/sell recommendations on all the stocks we cover. Plus unlimited access to our multi-year Archive of articles.

Here are more of the features available to you. And there’s nothing to lose with our FREE 2-week trial. Just click this link.

And this offer includes a FREE copy of my new book, REITs for Dummies!