Summary:

- The Dogs of the Dow is a simplistic investment strategy that picks the 10 stocks from the Dow with the highest dividend yield each year.

- It’s a flawed methodology, and I’ll show that the list includes great buys and stocks to avoid like the plague.

- I focus on Verizon and 3M in this article.

ugurhan

Written by Sam Kovacs

Introduction

I always thought the Dogs of the Dow, to be an overly simplistic investment strategy which missed more than it captured. Simply picking the 10 stocks from the Dow with the highest dividend yield each year seems to be a bit of a stretch.

It is an extremely crude implementation of the “value” factor, which should be distinguished from value investing.

Value investing and the value factor both aim to capitalize on undervalued stocks, but they approach this goal differently.

Value investing is a strategy focused on finding stocks trading for less than their intrinsic value, based on a comprehensive analysis of the company’s fundamentals, such as earnings, dividends, and financial health. It’s a method popularized by investors like Warren Buffett and Benjamin Graham, emphasizing long-term investment in undervalued companies with strong fundamentals, requiring patience and thorough research.

On the other hand, the value factor is a concept from factor investing, identifying stocks that are cheap relative to their fundamentals based on quantitative metrics like price-to-earnings or price-to-book ratios (or in this case, dividend yield).

This approach relies on statistical evidence suggesting that, over time, such stocks tend to outperform more expensive ones. It’s a more systematic and quantitative method, without the deep dive into company-specific fundamentals that characterizes value investing.

Seeking Alpha’s quant value scores are an example of factor scores.

The rationale behind the Dogs of the Dow strategy is that the companies in the Dow Jones Industrial Average are large, established, and financially stable.

Therefore, if their stock prices have fallen to the point where their dividend yields are among the highest in the index, it could indicate that the stocks are undervalued.

Buying these stocks gives investors the opportunity to benefit from both the dividends and the potential capital gains if the stocks’ prices rebound.

Below is the current list of “dogs of the dow”

- 3M (NYSE:MMM)

- Dow (DOW)

- Walgreens (WBA)

- Chevron (CVX)

- IBM (IBM)

- Cisco (CSCO)

- Coca-Cola (KO)

- Johnson & Johnson (JNJ)

- Goldman Sachs (GS)

- Verizon (NYSE:VZ)

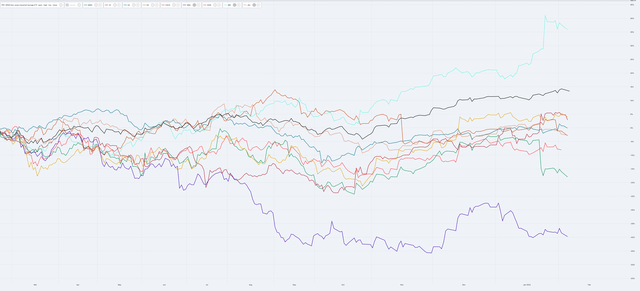

Of course, to become the highest yielding stocks, not all of these have had the best performance relative to the rest of the market as shown in this chart below.

DIA vs Dogs (Dividend Freedom Tribe)

The only exception is IBM which has outperformed the Dow Jones (DIA) in the past 12 months.

As you can see, the fact that stocks like IBM which is up a lot and WBA which is down a lot can both be on the list, shows that while the dogs of the dow is a crude attempt at a value factor (and an even cruder at a quality factor) it ignores the momentum factor, which plays against it.

But that is beyond the scope of this article.

Today I want to talk about two of these stocks, which are among the highest yielding of this list.

One of them is, I believe, a very strong buy, while the other remains a stock that I’m continuing to avoid.

Verizon

Verizon was on my list of 5 top stocks for 2024, which I published on January 4th.

The stock is up 5% since then, but it’s not all rosy for our position.

You see, while we stayed away from Verizon in between 2019 and 2022, when the stock price hit $50 in April 2022, we hit buy.

Because we never buy in multiple increments, we managed to get our average cost down to $41, by adding shares at $44, $35 and $39.

So we’re essentially flat + the dividends. The stock currently yields 6.4% and trades at $41.5.

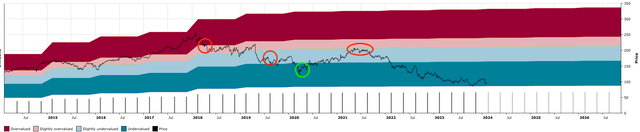

VZ DFT Chart (Dividend Freedom Tribe)

Investing on the way down can expose you to a lot of pain.

You need to be convinced you’ve got a good idea, and you need to be able to hold on.

There is an alternative, which also has trade-offs which is to wait for a stock to bottom, then buy the recovery.

For example. Instead of buying VZ at $39 on the way down, I could have bought it at $39 on the way up.

That way I’m putting momentum on my side.

I believe that VZ has turned the corner now, and the recovery is underway.

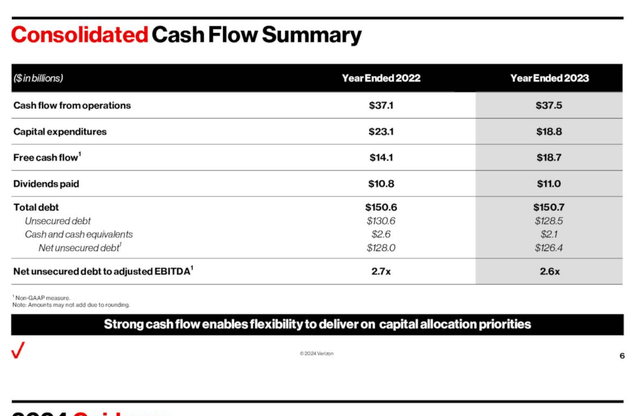

VZ increased revenue by 3% in 2023, and generated $18.7bn in free cashflow, which means the dividend is well covered, representing only 59% of FCF.

The cashflow position should further improve in 2024, with CAPEX coming in $1bn lower than in 2023, which should allow the company to further delever. They are now at a 2.6x debt/EBITA, down from 2.7x last year.

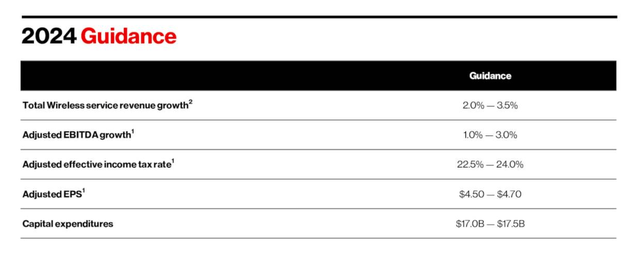

The 2024 outlook is looking good.

We could see the payout ratio further decline in 2024, which is encouraging.

VZ’s price decline was an anomaly, it is now among the 8% of stocks in the US with the best momentum, and should continue to have a strong year.

Now is still a fantastic time to load up.

3M

Our track record with 3M (MMM) has been “not bad” to say the least.

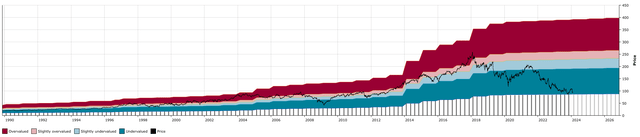

MMM DFT Chart (Dividend Freedom Tribe)

You can search our past coverage on Seeking Alpha, as this leaves a documented paper trail, which we are happy with.

You’ll notice that in 2018 we said we couldn’t buy 3M because it was overvalued, in 2019 we said we expected it to decline more, in May 2020 we bought the stock, and finally in May 2021 we decided to sell the stock at $200.

I circled these events in green and red on the DFT chart above.

Since then, we decided to not purchase the stock and stay away.

In November 2022, we considered entering again, but ultimately decided for the stock to go lower. When it did go lower, we decided that the negatives hanging over the stock (lawsuits and bad optics) made it not worth the risk.

Anyways, 3M recently reported earnings, and the market didn’t like what it saw. The stock now trades at $92, and yields 6.3%.

Yield hungry investors are looking at the stock and thinking “maybe this is the bottom, maybe this is buying when blood is in the streets”.

And I get the feeling. Remember though, as we’ve seen with Verizon, one would be better off buying, when they start cleaning the blood off the streets, than when blood is first poured on the streets. Sorry for the gore mental imagery.

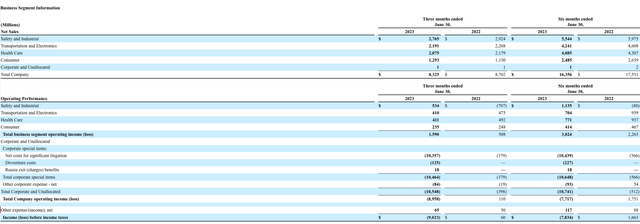

Anyways, the earnings call was very interesting as it gave us lots of little “nuggets of information”.

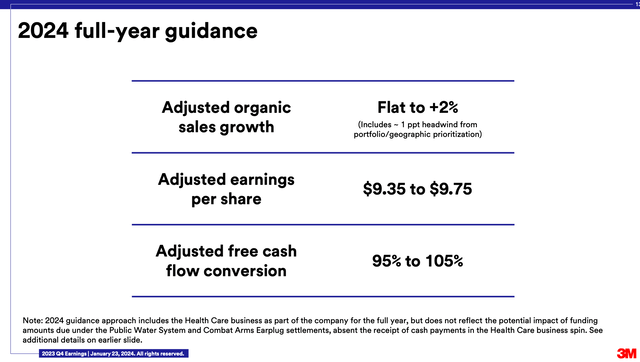

To start with, they provided their 2024 guidance of $9.55 in earnings at the midpoint.

They also announced they are spinning off their healthcare unit to finance the ongoing lawsuits.

Let’s just get the information straight on these lawsuits. There are two main lawsuits, one concerning their Combat Arms Earplugs, and one concerning PFAS water contamination.

In June 3M agreed to a significant settlement to resolve lawsuits related to its Combat Arms Earplugs.

The lawsuits claimed that the earplugs, used by U.S. military service members, were defective and led to hearing loss and tinnitus.

Under the settlement, 3M will pay $6 billion to nearly 260,000 current and former service members who have suffered hearing loss from using the company’s earplugs. The settlement is structured to be paid out mostly over the next five years.

So let’s call it a $1bn hit per year for 5 years.

The second is related to the contamination of drinking water with PFAS. This agreement involves a significant financial commitment from 3M, totaling up to a net present value of $10.3 billion, payable over 13 years. The settlement is designed to provide funding for public water systems for PFAS treatment technologies without the need for further litigation, including systems that may detect PFAS in the future.

Note that the number we got here from 3M are discounted to a net present value. So let’s just go ahead and call it a $1bn hit per year for 13 years.

So that’s a $2bn hit per year for 5 years on average, then $1bn per year for the next 8 years.

Of course this isn’t going to be as equally distributed as I present it, but it gives an idea of the scale.

$2bn is about the amount of free cashflow that 3M generates in a quarter. So the lawsuits will be taking out 1/4 of FCF for the next 5 years, not great.

This would average over $3.6 per share per year, yet in the earnings call management stated that:

the adjusted earnings per share impact from financing legal settlements could be up to approximately a $0.20 per share headwind based on current market conditions

This suggests the cost of the settlement is weighted more heavily in the future.

Management has hinted that it would use the proceeds from the health care spinoff to finance these payments:

Absent the proceeds from the intended spin-off of the Health Care business, the company has not concluded how it would fund amounts due under the public water supplier and Combat Arms Earplugs legal settlements.

Okay, they might raise the liquidity to finance these things, but what does this mean for 3M’s dividend going forward?

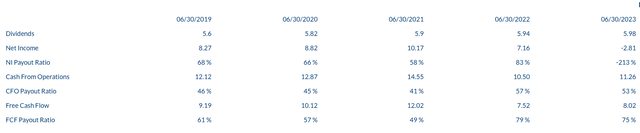

The dividend is currently $6 per share. They forecast $9.55 in earnings which should translate to equal amounts of FCF in 2024.

But they’re going to be spinning off the healthcare unit which contributes to 25% of operating income. Let’s assume that 25% in operating income contributes in a similar fashion to earnings and FCF.

This leaves $7.16 per share to cover the $6 dividend. That’s an 85% payout ratio.

This continues the trend towards worse payout ratios that 3M has experienced during the past years.

85% is manageable, just about.

Last year the dividend was increased by just 0.7%.

This year, the next dividend announcement should come around any time. Will management try and keep the streak of dividend hikes alive, or will they kill it by keeping the dividend flat?

If 3M fail to increase the dividend, I’d see this as a big warning sign. There has been a change in the nature of how management mentions the dividend in earning calls in the past few years, which suggests they’re slowly backing back from their commitment.

Many companies have broken long held dividend streaks in the past 12 months, 3M might be considering doing the same, considering peak pessimism surrounding the stock.

In 2021, this is how management talked about the dividend:

You’ve seen we have increased dividend. It’s 63rd year in a row that dividend is up. It matters to our shareholders. That’s our second priority.

In 2022:

Both dividends and share repurchases remain important pillars of our capital allocation strategy.

In 2023:

we returned $828 million to shareholders via dividends during the quarter.

We’ve slowly gone from very high priority, to a priority along with buybacks, to a mere statement that it’s been paid.

I don’t like this, I’ve seen it happen too often.

The market is pressuring 3M’s price, this is among the highest yield 3M has seen in the past 35 years (I don’t have more data than that, sorry).

MMM 35 Year DFT Chart (Dividend Freedom Tribe)

Why does this matter? George Soros’ theory of reflexivity.

The theory suggests that a depressed stock price can lead to a self-reinforcing negative perception among investors and stakeholders, influencing management decisions.

In other words, not only do fundamentals impact price, price impacts fundamentals.

In such a scenario, even if earnings technically could sustain a dividend, management might opt to cut dividends as a precautionary measure. This is because a persistently low stock price can signal financial distress or a negative outlook to the market, prompting management to conserve cash to bolster the company’s financial position and investor confidence, despite the current earnings picture.

Folks, don’t risk screwing up big time, stay away from 3M.

Conclusion

Just because a stock which has been paying dividends for a long time and is part of the Dow Jones has gone down, does NOT mean that it is a buy.

The Dogs of the Dow strategy lacks discernment, and hopefully you’ve seen here that sometimes stocks go down on relatively unfounded pessimism, and other times they go down because there are fundamental flaws which are changing the outlook of the stock.

If you own shares of 3M, sell now, you’ll likely book a loss which will offset capital gains for the rest of the year, and you’ll get the same yield from VZ, but with much better upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ, GS, IBM, CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to Buy Low, Sell High & Get Paid to wait…

The first thing you want to do is hit the orange “follow” button, so we can let you know when we write more dividend related articles.

But if you want the best experience, join the Dividend Freedom Tribe!

Our model portfolios are ahead of the market, and our community of over 900 members is always discussing latest developments in dividend stocks.

Our model portfolios are ahead of the market, and our community of over 900 members is always discussing latest developments in dividend stocks.