Summary:

- PayPal’s Q4 earnings beat estimates, but the company’s guidance for 2024 was worse than expected, causing shares to trade down.

- Despite the negative guidance, PYPL’s undemanding valuation and high shareholder yield make it a potentially solid long-term investment.

- The company’s operational performance in Q4 was solid, with growth in transactions, payment volumes, and earnings per share.

Justin Sullivan

Article Thesis

PayPal Holdings, Inc. (NASDAQ:PYPL) reported its most recent quarterly earnings results on Wednesday afternoon. While results beat estimates on both lines, the market seemed to agree that the more important thing from the report was the fact that the company’s guidance for the current year was considerably worse than expected. Shares traded down sharply, but in the long run, they could still be a solid investment, largely due to an undemanding valuation and a high shareholder yield.

Past Coverage

I have covered PayPal Holdings in the past, most recently in May 2023, or around nine months ago. Then, shares traded at $70, and following my article, in which I gave PayPal a “Buy” rating, shares rose to as much as $75 over the following weeks, before heading lower again when PayPal reported weaker-than-expected results three months later.

With several quarters having passed since my last article on PayPal, I want to cover the company again in order to update my thesis with what has changed since then.

What Happened?

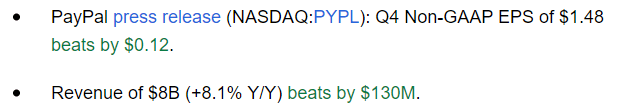

PayPal Holdings, Inc. reported its fourth-quarter earnings results on Wednesday afternoon, following the market’s close. In the following screencap from Seeking Alpha we can see what the company’s headline results looked like:

PYPL results (Seeking Alpha)

We see that the company beat estimates on both lines, which is a positive fact for sure. While revenue growth hasn’t been outstanding, it has been very solid, at a high single digits rate, and revenues came in around 2% higher than expected. The company also beat profit estimates easily, while earnings per share did increase by a pretty nice 19% compared to the previous year’s quarter. While that growth was not on par with what some other tech companies such as Microsoft (MSFT) or Meta Platforms (META) have reported, the company’s results for the fourth quarter looked good.

The market did focus on something else, however: The market is mostly forward-looking, so comments about the future can be more important (and result in a more meaningful share price reaction) compared to the results that the company has generated in the past — even in the very recent past.

Unfortunately, PayPal’s comments about the current year, 2024, were not very positive. The company guides for adjusted earnings per share to be flat compared to 2023, at around $5.10, which isn’t great — the analyst community and most investors were looking for substantial growth, as the consensus earnings per share estimate stood at $5.53, or around 8% higher than PayPal’s guidance, prior to the earnings release.

When a company guides well below expectations, that naturally results in a negative reaction by the market, which is why PayPal’s shares are currently down 8% in after-hours trading. One can argue whether this is overdone, but the guidance was a negative surprise for sure. It is important, however, to consider that PayPal’s management might be sandbagging guidance. History could be a guide here: At the beginning of last year, PayPal was guiding for adjusted earnings per share of $4.87, but the company earned $5.10, or 5% more than what it guided for at the beginning of the year. It is at least possible that PayPal is conservative with its guidance once again, as some companies prefer to increase the guidance throughout the year, even if it means that the initial guidance will be rather underwhelming. Of course, there is no guarantee that we will see the company beat its initial guidance handsomely this year as well.

PYPL’s Recent Performance

Looking at the most recent quarter, there were many things to like in the report, I believe, although not everything was great. Let’s start with something negative:

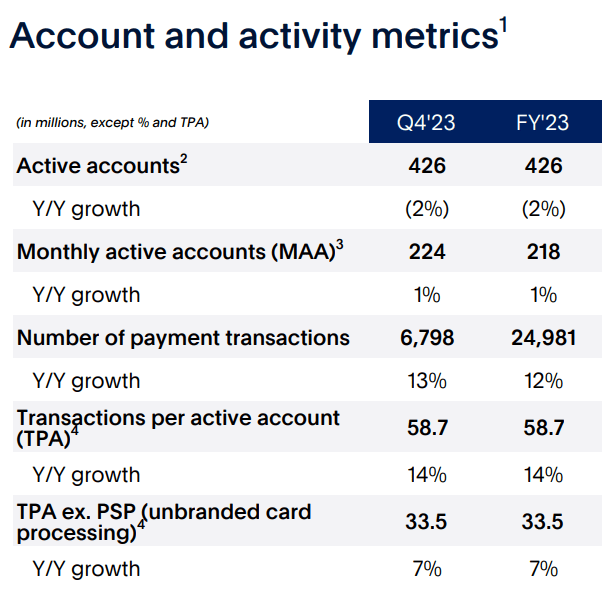

PayPal’s accounts (PayPal presentation)

The company’s number of active accounts (defined as accounts that have done at least one transaction at any point over the last twelve months) declined slightly compared to the previous year’s quarter. The same held true for the remainder of 2023 as well, as the full-year number also was lower compared to the full-year number for 2022. A 2% decline isn’t drastic, but nevertheless a negative factor.

The good news is that one could say that PayPal’s remaining accounts have become more active. This is visible when we look at the number of monthly active accounts, i.e. those doing at least one transaction per month (compared to 1/year for the “active accounts” number). The number of monthly active accounts increased slightly. For a company that makes money on transactions, a user who transacts once per month is more valuable than someone who transacts once per year, all else equal.

When we look at the number of payment transactions, we see an even better result: That number is up 13%, relative to the fourth quarter of 2022. Not only is this a nice growth rate overall, but it is also slightly higher than the average throughout all of 2023, indicating that momentum is on PayPal’s side. In short, we can summarize that the company’s user count has declined slightly, but its remaining users have become significantly more active at the same time, which is great news.

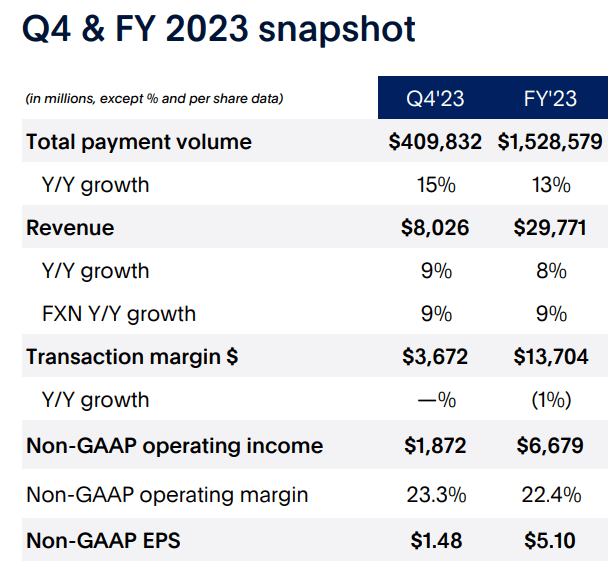

The number of transactions is one important growth driver for the company’s overall payment volume, the other one is the size of the average transaction. As we can see in the following slide, payment volume grew slightly faster than the number of transactions:

PYPL results (PayPal presentation)

This can be explained by a ~2% increase in the average transaction size. While this is slightly below the rate of inflation during the most recent quarter, it’s still good news that this number keeps growing — combined with the more substantial increase in the number of transactions, we got a nice 15% payment volume growth rate. This was up compared to the full-year average as well, indicating that momentum is picking up — this, in turn, could be interpreted as another sign that the company’s guidance for the current year might be conservative.

PayPal’s revenues grew less than its overall payment volume, which isn’t great, but which was no surprise at all — the same has been true for quite some time, thus this was expected by investors and analysts.

Is PayPal A Good Investment?

As we see above, PayPal’s operational performance during the most recent quarter was pretty solid: Transactions and payment volumes grew nicely, revenue growth was not excellent but still reasonably good and better than expected, and earnings per share were up by close to 20%.

There are other things to like as well, such as the company’s good free cash flow generation, its strong balance sheet, and its shareholder returns. Adjusted free cash flow totaled $4.6 billion, which makes for a free cash flow multiple of around 13.5x. That’s not as low as it was when PayPal was trading at ~$50 last October, but a low-teens free cash flow multiple is still far from high for a company delivering appealing business growth.

The company ended the quarter with $17.3 billion of cash, cash equivalents, and investments. The company had a debt of $11.3 billion at the same time, for a net cash position of $6 billion. While not nearly as much compared to what some of the Magnificent 7 have in absolute terms, the net cash position is pretty strong in relative terms — that’s 10% of PayPal’s market capitalization. Apple (AAPL), for reference, had a net cash position of around 2%-3% of its market capitalization at the end of the most recent quarter.

The combination of nice cash flows and a strong balance sheet allows PayPal to be relatively aggressive with buybacks. The company has reduced its diluted share count by 5.2% over the last year, with shares being issued to management and employees already accounted for. That’s more (on a relative basis) than Apple’s famed buybacks.

While PayPal does, I believe, not have a moat that is as great as that of Microsoft, Meta Platforms, etc. it still has a serious moat. Business growth is good, shareholder returns are nice, and the valuation is not demanding, at around 11x this year’s net earnings. The earnings per share guidance for the current year was a major negative surprise, but for those who want to speculate on guidance being conservative (like in 2023), PayPal could be a solid longer-term investment at the after-hours price of $58 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!