Summary:

- Affirm is expected to be structurally unprofitable as loan growth continues, and it cannot simply grow its way to profitability.

- The basic economics of Affirm’s business model are not favorable, with high expenses outweighing income from loans.

- Even with cost-cutting measures and increased transactions, Affirm is unlikely to achieve profitability in the foreseeable future.

Ratana21/iStock via Getty Images

I’ve been short consumer lending company Affirm (NASDAQ:AFRM) off and on for some time. In this article, I want to explain why Affirm will continue to be structurally unprofitable. As loan growth continues, it will become clear that Affirm can’t simply grow its way to profitability. I expect shares of Affirm to fall significantly in value from the current level of more than $40/share.

Affirm’s Business Model and Background

Affirm helps consumers pay for purchases in one of three ways. As you can see from Affirm’s website, consumers have three options to use Affirm to pay:

How Affirm Works (Affirm Website)

Source: Affirm Website

Customers can make four payments two weeks apart (“buy now, play later” or “BNPL”), or choose to make interest payments over 6 or 12 months. In the case of the interest bearing transactions, a large part of the loan principal is amortized with each payment. Merchants also pay a fee to Affirm as a percentage of the amount financed, so Affirm still gets paid something even in the event of the non-interest bearing transaction.

In describing its business, Affirm’s investor relations communications such as its Shareholder Letters tell you a lot about how much the company is growing. It’s clear Affirm is growing and they recently entered an agreement to provide BNPL payments through Amazon (AMZN). It’s important to note that this agreement means Affirm will be working with small Amazon third-party sellers, not with Amazon itself.

Basic Economics Are Not Favorable

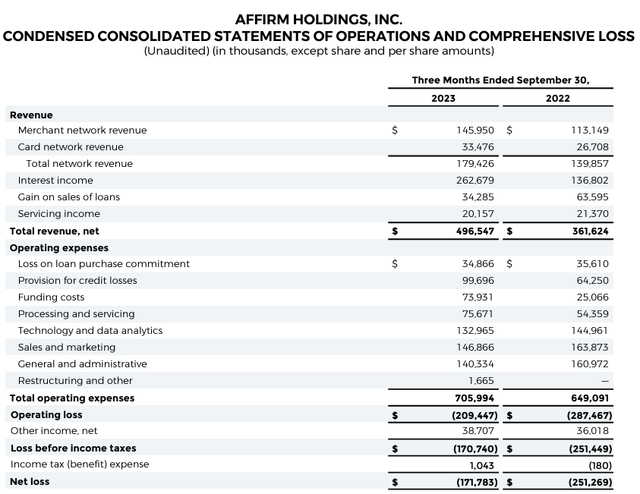

The problem is that shareholders should not only be concerned with projections of how much Affirm grows in the future, they also need to be concerned with what happens when that growth arrives. Rather than the metrics proposed in shareholder communications, I suggest rearranging some basic numbers from Affirm’s income statement to gain insight:

Income Statement (Affirm Shareholder Letter)

Source: Shareholder Letter

For the most recent quarter, we see that the income associated with making the loans themselves, “Interest Income” and “Gain on Sale of Loans” was worth approximately $297 million in income. The financial costs of the loan assets, including loss on purchase commitments, provision for losses, and funding costs, were approximately $208 million. So assuming we could have just owned these assets, Affirm shareholders would have earned approximately $89 million last quarter.

The problem is all that other stuff on this income statement. Technology and data analytics, sales and marketing, and general and administrative expenses totaled approximately $420 million!

I’ve left out a discussion of credit card and servicing revenue, which are both significant, but I don’t think anyone is arguing that they move the needle on the future of this business. Similarly, I’m looking past “other income” which is primarily interest on cash balances. We see plenty of stocks with cash on the balance sheet trade well below the value of that cash when the company’s core business is unprofitable, so I don’t believe the potential interest income on cash balances would contribute much towards the market cap of Affirm if my thesis is correct.

The Future Doesn’t Look That Bright

Affirm has done a very nice job of bringing its costs down, as you can see from the three major expense lines I described above. The problem is that even if last quarter’s cuts were repeated, we’d only see a reduction of $49 million from $420 million to $370 million.

If Affirm doubled the number of transactions and kept the same margins, its earnings on those financial assets would still only be $180 million! Remember, that includes both the merchant contribution and the interest earnings, and it would require a lot of unproven assumptions about the economy, the competition and interest rates in order for all those things to happen.

For these reasons, I don’t see Affirm coming close to profitability, even in the event that it continues cutting costs and growing the number of profitable loans that it makes.

Risks To My Thesis

Everyone is wrong sometimes – even me. To that end, it’s worth noting that Affirm might reach profitability in a way I didn’t anticipate, such as exceeding growth and margin goals, shrinking expenses faster than I anticipated, or with some other change in the competitive landscape.

Shorting stocks can be risky. The best way to deal with those risks is to cut losses when you realize the thesis is wrong, and keep the size of each position small. That being said, I still value shorting stocks because they continue to earn money in a portfolio through market downturns, which gives me “new” capital to reinvest at attractive rates of return.

Conclusion

Affirm seems like a company that offers value to its consumer and merchant customers. But my conclusion is that the company is structurally unprofitable and that growth won’t lead to profitability in the foreseeable future.

Thanks for reading.

Best of luck to all – including the shareholders!

Analyst’s Disclosure: I/we have a beneficial short position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.