Summary:

- Pfizer reported better than expected Q4 earnings, with solid organic top line growth in FY 2023, despite a drop in COVID-19 product revenues.

- The drop-off in COVID-19 product sales has caused negative sentiment overhang for Pfizer’s shares and the yield to soar above 6%.

- Pfizer has a strong financial outlook for FY 2024 and has potential catalysts for growth, including the integration of Seagen and cost savings initiatives.

- With a P/E ratio of less than 10X, income investors can add a top income play with restructuring upside to their portfolios.

Michael M. Santiago

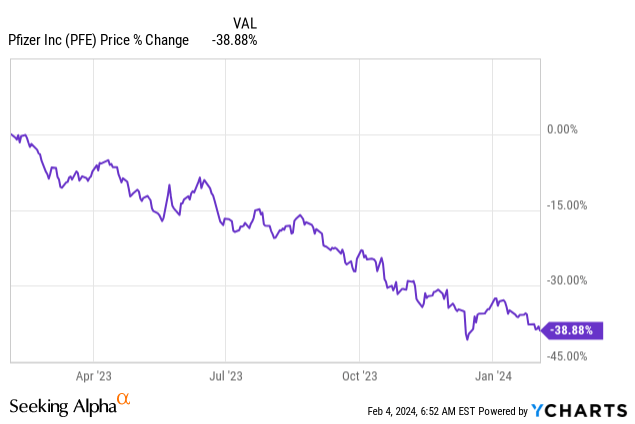

Pfizer (NYSE:PFE) submitted a better than expected earnings card for the fourth fiscal quarter last week. Despite a drop-off in COVID-19 related product revenues, Pfizer has been able to deliver solid organic top line growth in the fourth quarter as well as FY 2023. The pharmaceutical giant also confirmed its financial outlook and guided for Y/Y revenue upside in FY 2024. In my opinion, the drop-off in Corminaty and Paxlovid sales has created overly negative sentiment overhang for Pfizer’s shares which has caused the firm’s dividend yield to soar above 6% lately. Pfizer will likely continue to grow its dividend and is targeting $4.0B in cost-savings by the end of the year. With a P/E ratio of less than 10X, the more than 6% yield is a steal!

Previous rating

I recommended shares of Pfizer in October when the pharmaceutical company cut its earnings and revenue forecast for FY 2023 due to falling sales for its COVID-19 products: A Contrarian Buy Near 1-Year Lows. Shares of Pfizer have since decreased about 17%, so investors are still bearish on the pharmaceutical company, which I don’t believe is justified. COVID-19 product sales are down, but the company is restructuring and focusing on the future… which is also where investors’ focus should be. The outlook for FY 2024 is not bad at all and with the P/E ratio down to just 10X, investors are not overpaying for the 6% dividend either.

COVID-19 product revenue drop-off may be fully priced into Pfizer’s shares

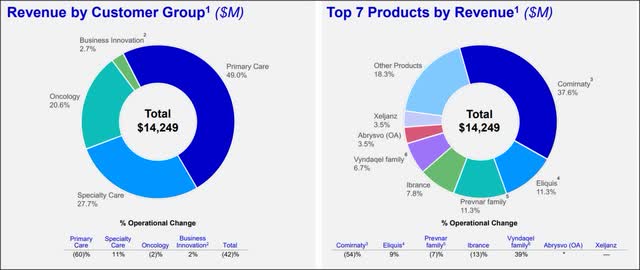

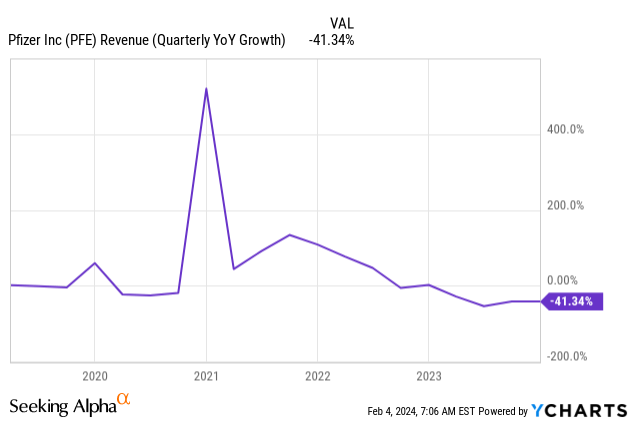

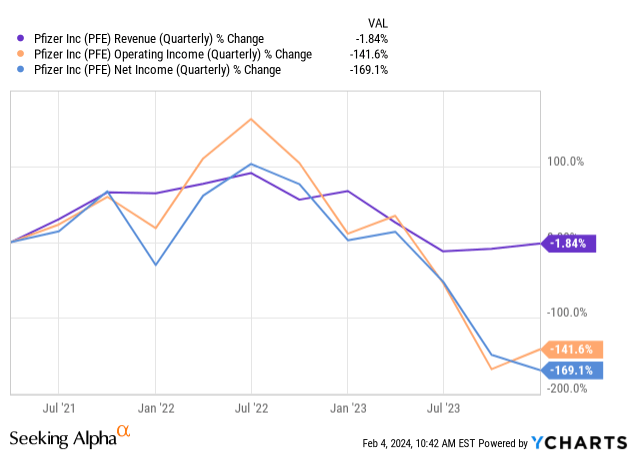

Pfizer reported fourth quarter revenues of $14.2B, showing a drop-off of 42% compared to the year-earlier period. The revenue figure missed expectations of $14.4B which likely explains the market’s muted response after earnings. However, excluding COVID-19 product sales, Pfizer’s Q4’23 revenues actually increased 8% on an organic basis. The picture looks similar on a full-year basis: Pfizer’s consolidated revenues fell 41% year over year, but increased 7% organically compared to FY 2022. In other words, the organic revenue growth picture is not nearly as dire as Pfizer’s valuation reflects.

Corminaty, Pfizer’s COVID-19 vaccine was responsible for a 38% revenue share in the fourth quarter and the vaccine product saw a more than half (54%) decline in revenue compared to the year-earlier period. Obviously, this is not great for the company or its investors, but it seems to me that the market has more than priced deteriorating revenue prospects for COVID-19 products into Pfizer’s shares at this time.

Pfizer’s revenue growth peaked during the pandemic and growth, on a non-adjusted basis, is normalizing. Given this backdrop, Pfizer’s top line outlook for FY 2024 is surprisingly strong and with Seagen getting integrated into Pfizer this year, I believe investors’ focus could further shift towards the company’s ability to generate organic revenue growth in FY 2024.

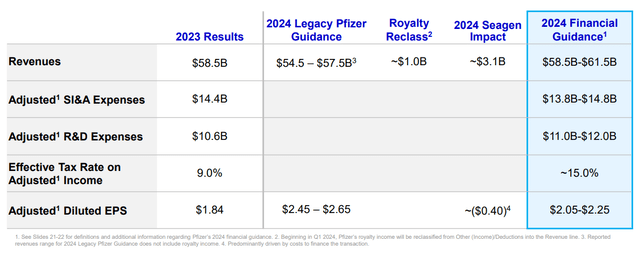

Pfizer said that, despite slumping sales related to its pandemic-era COVID-19 products, it expects between $58.5B and $61.5B in revenues with about $3.1B related to the recent acquisition of Seagen.

Seagen is a biotechnology company that develops anti-body therapies to treat cancer. The acquisition of this oncology company was part of a deliberate effort to reposition Pfizer’s product portfolio and shift away from its blockbuster Corminaty COVID-19 vaccine and the COVID-19 Paxlovid pill. The outlook includes about $8.0B in FY 2024 revenues related to COVID-19 products which accounts for only about a 13% top line share, at the mid-point of guidance.

What I don’t like about Pfizer is that the company’s net income has taken a big hit and the company may have to do more to cut down expenses (it has guided to capture cost-savings in the amount of $4.0B by year-end). Pfizer saw a 93% drop in net income compared to FY 2022, year over year.

Where could upside potential for Pfizer come from?

Pfizer has a number of catalysts that could help drive shares into a new upleg in FY 2024, including:

- Pfizer is moving away from COVID-19 products and the revenue impact is set to get smaller over time (it is 13% based off of Pfizer’s forecast for FY 2024). However, organic sales ex-Corminaty and ex-Paxlovid are growing which paints a healthier revenue picture than investors may realize

- Pfizer is set to integrate Seagen into its business in FY 2024 which will shine the light on the company’s growing oncology product pipeline

- The firm has said it targets $4.0B in cost savings by the end of FY 2024 which should help improve profitability

- Pfizer is set for continual dividend growth. A dividend announcement may reinvigorate interest in Pfizer

- The company may also choose to buy back more shares this year which would make sense considering that they are trading at a cheap price (P/E ratio of less than 10X)

- Pfizer’s breast cancer therapy Vepdegestrant which helps treat metastatic breast cancer and which is co-developed with biotech company Arvinas, just received a fast track from the U.S. Food and Drug Administration. This could allow the pharmaceutical company to bring to market a promising new drug in the near term that helps shift investors’ attention away from legacy products and toward Pfizer’s developing oncology drug pipeline.

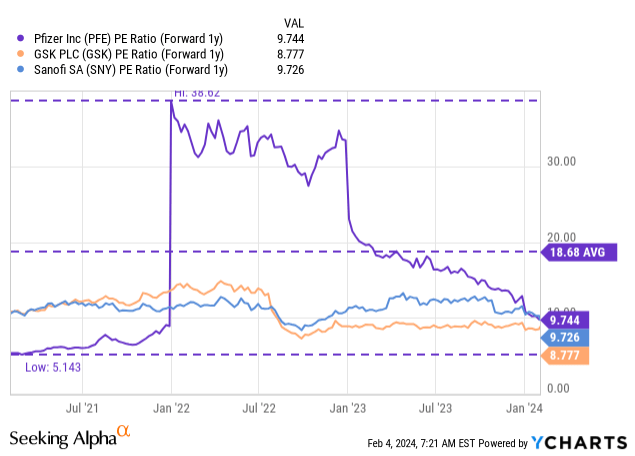

Pfizer’s 6.3% yield is a steal

For me, value territory begins at a 10X P/E ratio or lower and the company in question preferably also pays a dividend yield of 5% or higher. Companies that fall into this category also ideally offer some reasonable prospects for dividend growth. Businesses that I include in this value category next to Pfizer include companies like Altria (MO), British American Tobacco (BTI), Ford (F), AT&T (T) and Verizon (VZ)… all of which offer either high yields or potential for dividend growth, or both.

Pfizer is currently valued at a P/E ratio of 9.7X, slightly below my value stock threshold 10X P/E ratio (which implies a fair value of $28). While Pfizer may not have much upside given an average industry group P/E ratio of 9.4X and my fair value P/E ratio of 10X — the peer group includes GlaxoSmithKline (GSK) and Sanofi (SNY) — Pfizer’s dividend yield as risen to 6.3%, making it an especially attractive choice for dividend investors.

Risks with Pfizer

Pfizer just acquired Seagen and there is a risk with acquisitions that the purchaser overestimates synergy and revenue effects. If Pfizer were to miss its revenue and cost-savings targets for FY 2024 or if its organic revenue growth slowed, shares of Pfizer may be pushed to new lows and I may change my opinion on the pharmaceutical company. I am monitoring Pfizer’s organic sales growth, overall revenue trajectory and COVID-19 product sales.

Final thoughts

I believe Pfizer, despite the decline in COVID-19 product sales and the restructuring context, a decent FY 2023. The pharmaceutical giant saw healthy organic top line growth in the high-single digits, presented a strong FY 2024 revenue outlook and the Seagen acquisition, which was completed in December 2024, could help shift investors’ focus away from Pfizer’s legacy portfolio in FY 2024. The key value provided by Pfizer is its organic revenue growth and a very solid dividend. Given that Pfizer is trading at a less than 10X P/E ratio and provides a well-supported 6.3% yield, I consider PFE to be a value stock!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.