Summary:

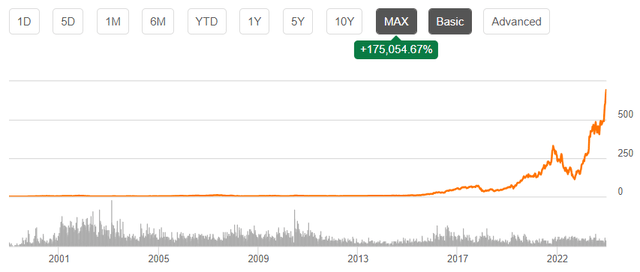

- Nvidia Corporation is a highly successful company with a $1.6 trillion market cap and a stock price that has appreciated by over 175,000% since its IPO.

- The company’s dominance in the GPU field and its integrated computing acceleration ecosystem give it a competitive advantage and wide moat.

- Nvidia’s profitability surpasses that of even the largest and most successful companies, such as Apple and Microsoft.

- My target price for Nvidia Corporation is $820.

Tom Williams/CQ-Roll Call, Inc. via Getty Images

Introduction

From my perspective, NVIDIA Corporation’s (NASDAQ:NVDA) stock often faces perceptions of being substantially overvalued among investors due to its indirect interaction with end consumers, unlike some iconic brands that engage directly with them. However, NVDA boasts an unparalleled ecosystem that is the backbone of the ongoing digital revolution, marked by the rapid adoption of artificial intelligence (“AI”) capabilities. This ecosystem grants NVIDIA a unique strategic positioning, likely safeguarding its market share and sustaining its consistently high profitability, which ranks among the highest across all companies.

I maintain a strong conviction in my valuation assessments of companies with wide moats, as I firmly believe that their growth prospects and superior profitability are safeguarded. According to my valuation model, Nvidia Corporation stock is currently undervalued by 18%, presenting an attractive opportunity for a standout performer like this. Consequently, NVDA merits a “Strong Buy” rating.

Fundamental analysis

Nvidia Corporation is an accelerated computing company that operates through two operating segments: “Computer & Networking” and “Graphics.” Nvidia is one of the largest companies in the world, with a $1.6 trillion market cap at the moment despite being relatively young, incorporated in 1993. The stock price appreciated by more than 175 thousand percent since the company’s IPO in 1999.

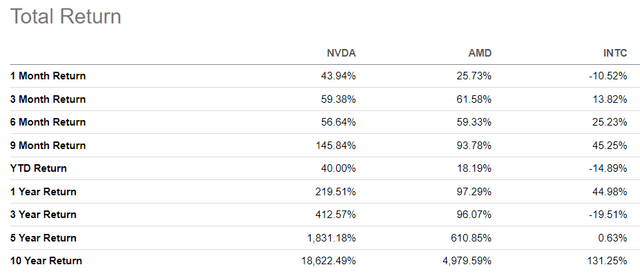

Nvidia is one of the most successful stocks ever, mainly thanks to its invention of the graphic processing unit (“GPU”) in 1999. The GPU serves as the central component for computing acceleration, positioning Nvidia as a beneficiary of some of the most influential technological trends of the past three decades. From the explosion of PC gaming in the late 1990s to the rise of cryptocurrency mining, and presently, as a crucial element driving the adoption of artificial intelligence (“AI”) capabilities, Nvidia has been at the forefront of these advancements. According to investing.com, Nvidia had a massive 82% GPU market share at the end of 2022, far bigger than its closest rivals, Intel Corporation (INTC) and Advanced Micro Devices, Inc. (AMD). Therefore, it is not surprising that NVDA’s stock has outperformed its closest competitors in recent years.

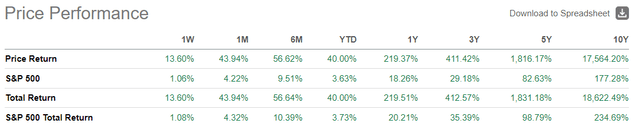

Given the below stocks’ return dynamic over the last year, it looks like NVDA is perceived by the market as the biggest AI winner in the semiconductor industry. This looks fair, considering the company’s massive expertise and market share in the GPU field.

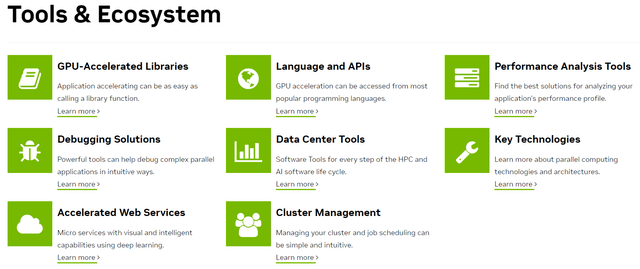

When discussing Nvidia, it’s imperative to recognize that GPUs encompass more than just hardware; they represent an entire computing acceleration ecosystem. Nvidia transcends being solely a hardware company, evolving into a comprehensive ecosystem where hardware seamlessly integrates with software, libraries, and applications. This integrated approach offers a substantial competitive advantage, as companies entering such sophisticated ecosystems face soaring switching costs. To grasp the magnitude of these switching costs, consider the challenge of transitioning from your iPhone to any Android smartphone after investing just a couple of thousand dollars in the phone, watch, AirPods, and subscriptions like iCloud and Apple Music. Now, magnify that difficulty to the realm of IT ecosystems, where companies have invested millions, if not hundreds of millions, to enhance their computing capabilities. This substantial investment underscores Nvidia’s wide moat, positioning it to maintain its dominant stance in the accelerated computing niche.

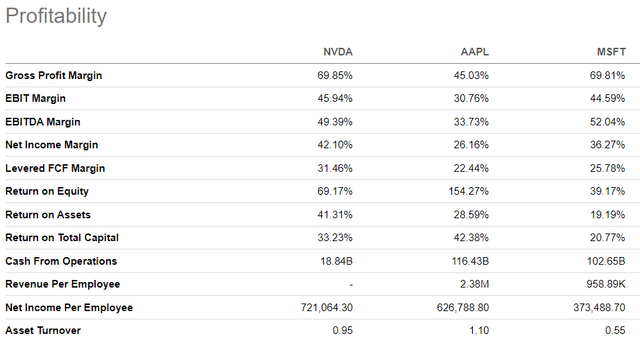

Due to high customer switching costs, ecosystems usually tend to generate superior profitability. Considering Nvidia’s far dominant position in the accelerated computing industry, I think that comparing the company’s profitability to rivals might not be representative enough. Instead, I want to test Nvidia’s profitability compared to the best of the best, the world’s largest companies. Apart from Apple Inc. (AAPL), the second most famous ecosystem for me is Microsoft Corporation (MSFT). Despite the much smaller scale, which we can see below in the “Cash from Operations” line, Nvidia is more profitable than the two monsters across several key metrics.

It looks like Nvidia’s strategic positioning is intact, which is crucial to understand because the company serves apparently the hottest IT industry of the current time. IDC forecasts that enterprises’ investments in generative AI solutions will compound at a massive 86% CAGR over the next five years. While there is a high level of uncertainty about whether enterprises can monetize generative AI capabilities successfully, it is 100% obvious that they will need massive computing capacity expansion, which will be impossible without Nvidia accelerators. This situation reminds me of a famous quote which is attributed to Mark Twain:

During the gold rush, it was a good time to be in the pick and shovel business

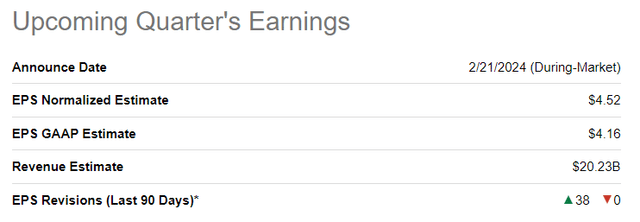

Reflecting on Nvidia’s success, it becomes evident that the company has mastered the art of selling shovels during various “gold rushes,” be it the boom in PC gaming, bitcoin mining, or AI. That is the reason why I am optimistic about the next quarter’s earnings release, which is planned on February 21.

Wall Street analysts seem to align with me, as there were 38 upward EPS revisions over the last 90 days, a massive bullish sign meaning substantial optimism. Revenue is expected to more than triple on a YoY basis, and NVDA’s earnings surprise history is almost flawless, which further fuels my optimism.

Valuation analysis

As already discussed above, NVDA stock demonstrates immense growth momentum across different timeframes, outperforming peers and the broader stock market.

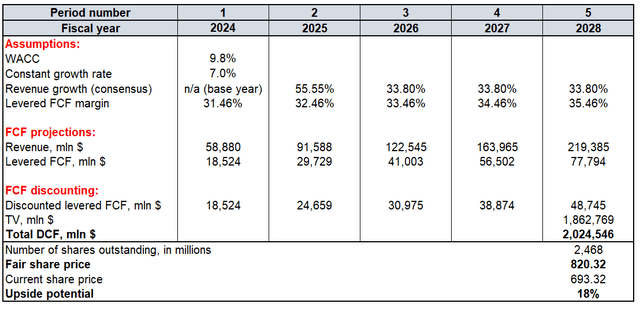

With a $1.6 trillion market cap, NVDA is the U.S. sixth-largest company, far beyond Meta Platforms, Inc. (META), with around a $1.2 trillion market cap. I will run a discounted cash flow (“DCF”) model to test whether such a massive market cap is fair. Future levered free cash flows (“FCF”) will be discounted using a 9.8% WACC. As usual, I have high conviction in consensus revenue estimates for the upcoming two fiscal years due to the large number of Wall Street analysts covering this horizon.

For the years after FY2025, I project a 33.8% revenue CAGR. Due to the company’s dominant positioning in the AI revolution era, I think that a 7% constant growth rate is fair for the terminal value (“TV”) calculation. I use a 31.46% TTM levered FCF for FY 2024 and expect it to expand by 100 basis points annually. There are around 2.47 billion NVDA shares outstanding at the moment.

The DCF model’s outcome is NVDA’s fair share price of $820, indicating an 18% upside potential. This looks like a very attractive valuation for an exceptional company with a wide moat that is poised to capitalize on the ongoing digital revolution.

Mitigating factors

Investing in a stock following a substantial rally, such as the one demonstrated by NVDA in recent months, inherently carries significant risks for several compelling reasons. Firstly, the rally has been driven by multiple upward revisions to long-term earnings outlooks, but it’s crucial to recognize that such a trend cannot be sustained forever. Secondly, after experiencing significant gains, there’s an increased likelihood that investors may begin to realize their capital gains, potentially leading to selling pressure.

Moreover, the valuation model heavily relies on assumptions, and achieving a constant growth rate of 7% is notably ambitious, even for a company like NVDA. This is evident in the DCF calculation, where a substantial portion-90%-of NVDA’s total capitalization estimation is attributed to the terminal value. As such, the model exhibits high sensitivity to the constant growth rate. To illustrate this sensitivity, consider a slight downgrade in the constant growth rate from 7% to 6%, a mere 100 basis points adjustment. As shown in the DCF calculation, this adjustment results in a significant decline in the fair share price to $617 per share, representing an 11% decrease from the current market price and signaling a double-digit downside potential.

The company’s ability to capitalize on the significant technological megatrends of the past three decades is not merely a stroke of luck but a testament to its exceptional visionary leadership. At the helm of Nvidia’s success is its CEO and founder, Jensen Huang, whose remarkable leadership has propelled the company to the forefront of innovation. While having a leader of Mr. Huang’s caliber undoubtedly stands as one of Nvidia’s major strengths, it’s essential to acknowledge that with each passing year, the risk of leadership transition intensifies. When contemplating the departure of an iconic founder from their role, one can’t help but recall the challenging Bill Gates-Steve Ballmer transition at Microsoft, which proved to be a challenging decade for investors. Therefore, if Mr. Huang were to suddenly retire, it could potentially serve as a significant negative catalyst for the stock price.

Conclusion

Nvidia Corporation’s significant surge appears justified, considering the company’s unrivaled position in the rapidly evolving AI revolution. With Nvidia’s unmatched ecosystem, customers face substantial switching costs, enhancing the likelihood of prolonged high profitability. Additionally, the current Nvidia Corporation valuation presents a compelling opportunity, boasting an 18% upside potential.

Investors should remain cognizant of the possibility of a pullback following the stock’s substantial rally. However, such corrections may offer even more favorable buying opportunities. Dollar-cost averaging is recommended to navigate this potential risk while capitalizing on continued rally potential. In conclusion, NVDA stands out as a clear “Strong Buy” in my view, particularly appealing to long-term investors sticking to a buy-and-hold strategy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.