Summary:

- To generate significant cash flows, American Tower needs to squeeze more money out of its Tower Assets, but the trend shows that the opposite is happening.

- Also, mobile data growth remains a key factor driving the need for digital infrastructure, but the amount being spent by customers, in this case wireless carriers, should also be considered.

- From both these two perspectives, it is not worthwhile to invest.

- However, both cost control and debt reduction are positives at times of uncertainty.

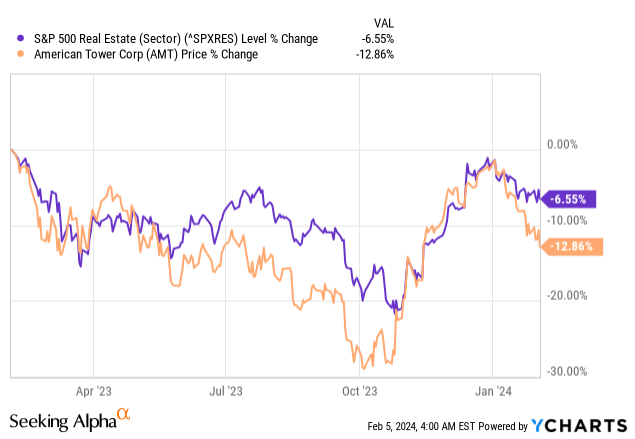

- Thus, I have a hold position for AMT which pays above 3.5% dividend yields, but, as a rate-sensitive stock, it can suffer from volatility in case Mr. Powell sounds too hawkish.

Bill Oxford

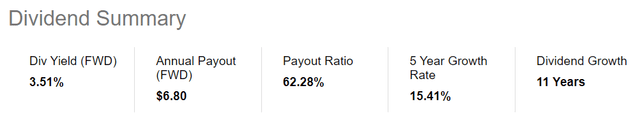

REITs or Real Estate Investment Trusts have historically been resilient in navigating periods of uncertainty as they tend to generate steady cash flows. Also, according to some researchers, it is the S&P real estate sector that has proved to be the real winner compared to other market averages since October last year with American Tower (NYSE:AMT) closely following as shown in the orange chart below.

Given such a backdrop, one could be tempted to invest in this specialized REIT which pays dividend yields of above 3.5% and also provides exposure to the digital transformation trend now being given further impetus by AI. However, this thesis thinks otherwise and for this purpose, I will focus on the stock’s sensitivity to interest rates. It is also important to assess how its customers, or telcos providing wireless services are spending.

First, I check whether AMT can continue to generate a sustained level of cash.

Squeezing less Money out of its Tower Assets

For cash to be generated from operations sustainably, revenues should maintain their growth trajectory in the first place. Now, this is indeed been historically the case with AMT whose revenue has been growing steadily throughout the years with double digits (or 14.9%) recorded for fiscal year 2022. However, analysts have a consensus estimate of only 3.6% for fiscal 2023 which constitutes a significant drop.

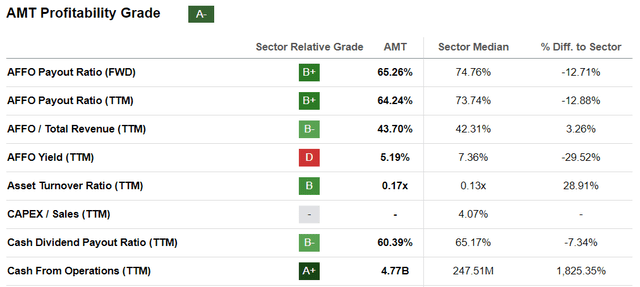

On the other hand, the company boasts superior profitability scores relative to the median for the real estate sector, especially for cash generated from operations. However, there is one important sustainability-determining metric that is missing and this is the capex-to-sales ratio which is a measure of the capital spent for every dollar of sales generated.

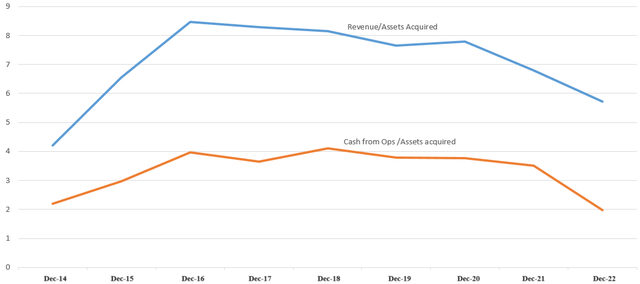

To make up for this discrepancy, I dug into the cash flow statement to extract the Net Sale/Acquisition of asset metric which is negative thereby showing that more assets have been acquired than disposed of. Here, I am talking about the cell towers it acquires before leasing them to telcos. For this matter, 92% of its revenues came from tower assets compared to only 8% from data centers during the third quarter of fiscal 2023 (Q3). Dividing the cash flow from operations by this metric, I obtained the Cash Flow from Ops/Asset Acquired ratio, and plotted the values from 2014 to 2022 as shown by the orange chart below.

Charts were built using data from (seekingalpha.com)

This shows that from a peak of around $4 of cash generated for each dollar spent on assets in 2018, only $2 was obtained in 2022, with the downturn starting in 2021 indicating that there has been a pronounced deterioration in the cash earned from cell towers on a relative basis.

The same downtrend is shown by the Revenues to Assets Acquired ratio in the blue chart above, showing that the return from investment has gone down. Now, investing more money while seeing lower returns can only result in higher debt of $46.8 billion, especially given the REIT’s commitment to maintaining dividend payments at the $3 billion level.

Divesting as Telcos Spend Less

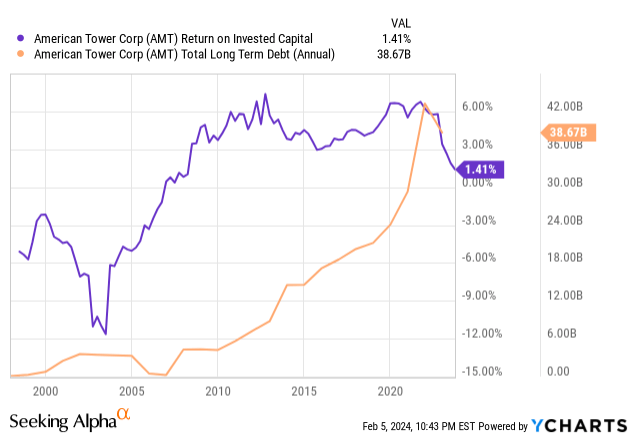

Looking into the rear mirror, there was again a deterioration in returns in 2003 as per the chart below, but both debt and interest rates were much lower then than currently. Thus, it is not surprising that AMT is performing capital recycling or selling underperforming assets to reduce leverage.

ycharts.com

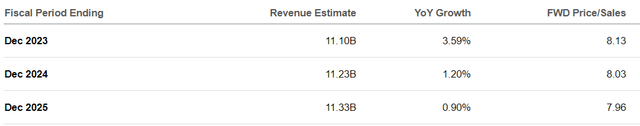

In line with the above strategy and focusing on organic growth, it has divested its fiber business in Mexico, and tower business in Poland, followed by the sale of its 100% equity interests in ATC India amounting to $2.5 billion to Data Infrastructure Trust, an affiliate of Brookfield Asset Management (BAM). Also, that country could account for about 11% of the company’s overall property sales of $2.79 billion at the end of Q3. Now, since the deal could be closed in H2-2024, this means that about $254 million (2,7900 x 0.11) of sales have to be subtracted from the topline of fiscal 2024 when only 1.2% of topline growth is anticipated by analysts as shown below.

Revenue Estimates (seekingalpha.com)

Looking further into the reason for divestment away from India where mobile data usage is exploding shows that things can prove more complicated when competition is factored in together with customers’ spending power. Here, the problem is that AMT’s largest customer, Vodafone Idea which is facing financial constraints failed to honor some leasing payments resulting in AMT’s bearing impairment charges, all in an environment of strong competition from Indus Towers and Summit Digitel, two big owners of cell towers.

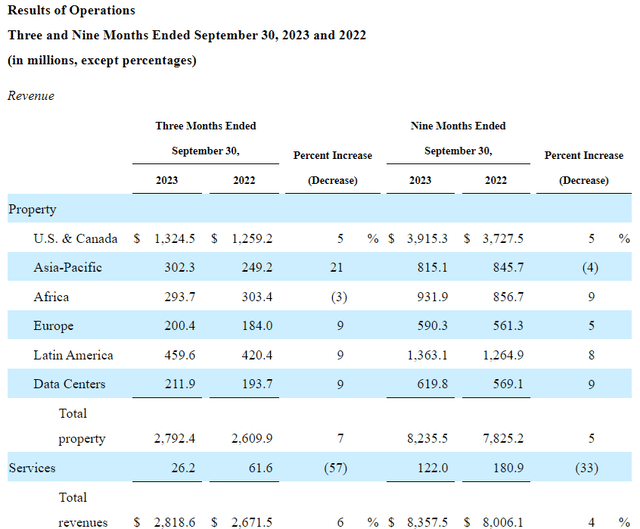

Looking West, while the U.S. and Canadian markets which accounted for 47% of AMT’s revenues in Q3 (as calculated from the SEC filing below) do not suffer from the same problems as the Indian market, it shows one cannot take for granted that towerCos can just rely on data usage to keep on growing rapidly through the addition of more tenants and equipment on their towers.

SEC filings – Q3 (seekingalpha.com)

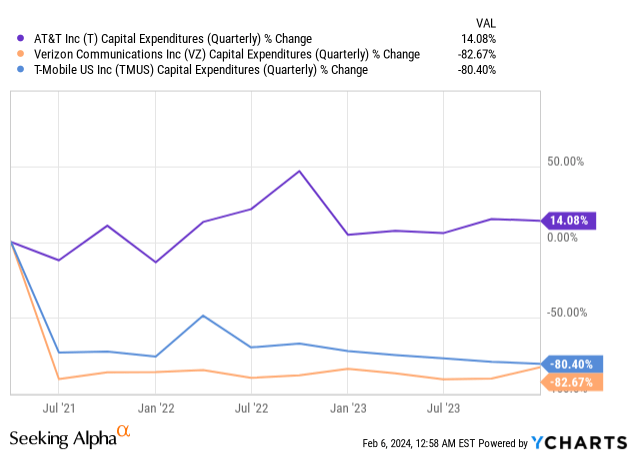

In this respect, even if mobile data usage growth of 20% to 30% range is expected in the U.S., it will ultimately depend on what wireless operators spend in terms of capital. Thus, after investing heavily to acquire spectrum frequencies, place radio antennae atop cell towers since 2018, and upgrade their networks from 4G to 5G, the net capital spending has seen a net downtrend since 2021 considering what the three nationwide MNOs (mobile network operators) spend as charted below.

Looking forward, AMT’s CEO talking during a conference on December 4, expects carrier Capex to decrease to $35 billion annually from around $42 billion. Still, analysts from Wells Fargo (WFC) were even more pessimistic in September 2023 as per an article in Lightreading, and instead forecast a trough in carrier spending to about $27 million, in 2024.

Therefore, amid such a backdrop, it is not advisable to invest, but there is worse.

AMT’s Rate Sensitivity and Exposure to AI

Coming back to the introductory chart, a large part of REITs’ upside was after the Federal Reserve opted to leave interest rates unchanged as of September last year. Subsequently, the U.S. Central Bank again adopted a neutral stance in the October FOMC meeting, while at the same time, except for some monthly variations, the inflation rate has been on a downtrend since mid-2022. Thus, with progress seen in the fight against inflation, many market participants started pricing rate cuts with up to 75% expecting rate cuts in March 2024 earlier this year.

Now with its above-3.5% dividend yield as pictured below, AMT remains a rate-sensitive stock.

Now, when rates are cut this means that government bonds and other risk-free investments will pay lower yields, which automatically favors dividend-paying REITs as alternatives for income-seeking investors. This is the reason AMT and other REITs went up, but their performance has plateaued before seeing a decline in January. This was due to the Fed’s Chairman sounding somewhat hawkish during the December 12-13 FOMC meeting when he said that “it is far too early to declare victory” on inflation. In the January meeting a few days back, he reiterated this sentiment by saying that “inflation is still too high, ongoing progress in bringing it down is not assured, and the path forward is uncertain”.

As a result, only 40% of economists now believe that there will be rate cuts in March, which means that in case the Fed does not turn dovish in about six weeks during the next FOMC meeting, market conditions could prove volatile for REITs in general, but, the outcome could even be worse for AMT.

In this case, as part of capital recycling, the company is disposing of assets which is good for the balance sheet and its objective to achieve a leverage ratio of 5%. However, if it wants to acquire assets to boost growth, AMT may disburse more money than it plans due to higher borrowing costs in case interest rates remain higher for longer. Therefore, in the eventuality of an acquisition that impacts its leverage, the stock will suffer.

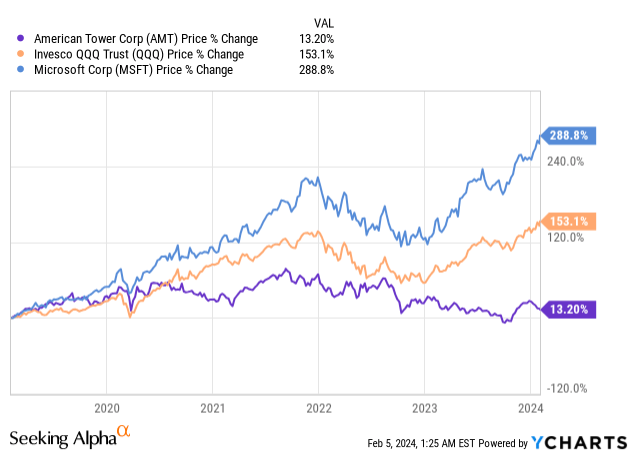

In this respect, gone are the days when AMT’s share price was somewhat correlated with the tech-heavy Invesco QQQ Trust ETF (NASDAQ:QQQ) or cloud hyperscaler Microsoft (NASDAQ:MSFT) as shown in the chart below. This was more precisely after December 2021 when it acquired CoreSite to take advantage of opportunities in edge computing (or processing of data away from metro areas) as I had elaborated in a thesis in July 2022.

Even with the additional sales opportunities, I had a Neutral position as the stock was already richly valued at that time, and, it is the same today with the company rated D- in terms of valuations. Along the same lines, following the $2.5 billion asset sales, the price-to-FFO will not come down as it only includes cash generated from operations. On the other hand, the stock could come down from the $190 level to the $175-$180 support level due to its rate sensitiveness in case Mr. Powell does not change his hawkish stance.

Still, I do not have a Sell rating as during times of uncertainty, cost control measures also matter. To this end, the mid-point of the capital expenditure of $1.7 billion for 2023 is less than the year before and dividend payments also have not increased (as they are being kept flat year-over-year). Furthermore, AMT’s trailing interest coverage ratio of 2.65% is well above the median for the sector and progress is being made on leverage. For this matter, considering that $2.5 billion (tower sales in India) makes up 5.3% of the total debt of $46.8 billion displayed by the balance sheet at the end of Q3, the debt/total capital ratio should come down to about 75.3% from 80.65% currently which is another positive.

Finally, with its data center business seeing a 9% YoY growth in Q3, AMT could see more AI-led colocation revenues, especially in the North American market this year, while not forgetting edge computing opportunities as more people consume intelligent applications through the luxury of their mobile phones. In this case, for those wishing to position themselves on the stock, it is better to wait for updated guidance especially as to the growth strategy when financial results for the fourth quarter are announced around February 27.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.