Summary:

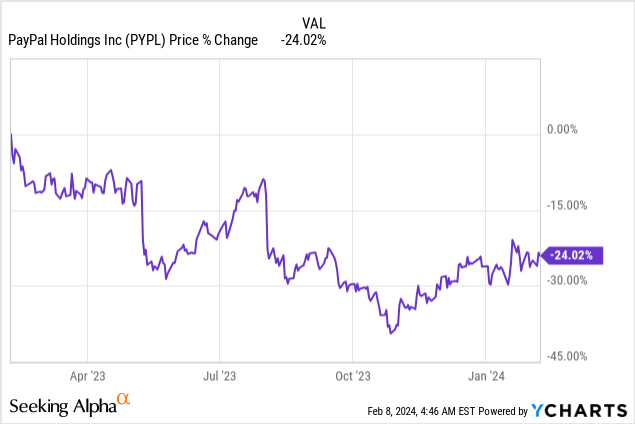

- PayPal’s fourth quarter earnings sheet exceeded expectations, but shares tanked 9% as the Fintech’s earnings guidance disappointed.

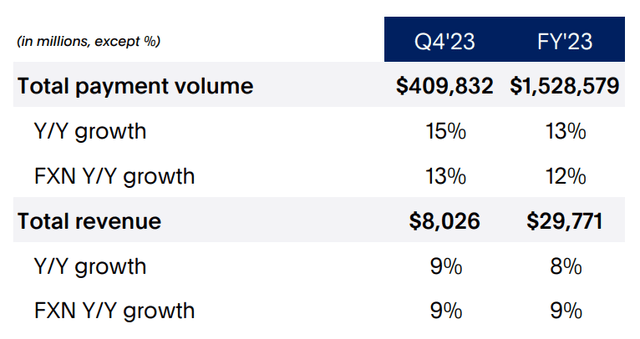

- PayPal’s total payment volume was up 15% while customers continued to use PayPal’s products more often.

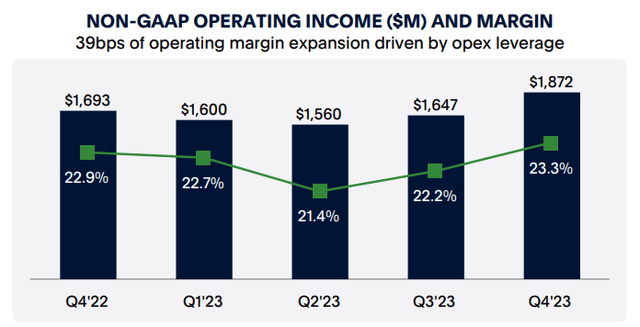

- The Fintech saw a boost to its operating income margin in Q4’23.

- PayPal’s guidance for FY 2024 implies a 100% free cash flow return ratio.

- Shares of PayPal are a bargain and greatly undervalued.

Stephen McCarthy/Sportsfile via Getty Images

PayPal (NASDAQ:PYPL) reported better than expected earnings sheet for the company’s fourth quarter, yet shares dropped 9% on a weak outlook for FY 2024 earnings. However, the Fintech’s Q4’23 results were solid with regard to all major key metrics, including total payment volume growth, operating income margin expansion and free cash flow. Since PayPal’s shares are down about 9% ahead of trading, I believe we are dealing with a buying opportunity here. I am going to be an aggressive buyer today and, in my opinion, the risk profile has been skewed even more to the upside!

Previous rating

I labeled PayPal an Unbeatable 9X P/E Bargain in October chiefly because of the FinTech’s low valuation and high free cash flow (return potential). PayPal expectedly delivered strong free cash flow in Q4’23 and generated operating income margin gains as well. Operating income margin expansion, strong FCF and double-digit total payment volume/TPV growth are three top reasons to buy shares of PayPal as investors are panicking over the Fintech’s earnings guidance.

TPV growth and account acquisition trajectory

PayPal did not especially convince with its performance on the account acquisition front in 2023: PayPal lost accounts throughout 2023, and the company continued to lose customers in Q4. PayPal account base declined 2.5M customers in the fourth-quarter and the Fintech ended the FY 2023 with 426M customers. According to PayPal these account losses related largely to unengaged customers.

While Q4 marked the fourth consecutive quarter of account losses, PayPal’s customers are transacting more, leading to growth in total payment volume. TPV measures the amount of dollars that are processed through the payment system and it is a crucial KPI for PayPal: in the fourth-quarter this crucial figure was up 15% and reached $409.8B. As a result, TPV pulled up PayPal’s revenues by about 9% year over year to $8.0B. Transactions per active account increased 14% Y/Y to 58.7, implying that users that do use the company’s payment services are more engaged than ever.

PayPal

Operating income margin gains and catalyst for continual expansion

One area that I pay special attention to is PayPal’s operating income and margin trend. PayPal has aggressively pushed for cost-savings and operating expense cuts in the last year which mostly came from cutbacks in the sales and marketing category. These cost initiatives are starting to bear fruit and PayPal reported a 1.1 PP margin improvement in the fourth-quarter.

PayPal’s operating income margin in the fourth-quarter was 23.3% and it was the second quarter of consecutive margin expansion. PayPal said at the end of January that it would lay off 9% of its workforce in a bit to further control costs and deliver a catalyst for operating income margin expansion in FY 2024. I believe PayPal has surprise potential here this year, especially if inflation continues to moderate which should be a boost to consumer spending. A boost to consumer spending in a strong economy could fuel both PayPal’s total payment volumes as well as the number of transactions per active PayPal account.

PayPal

Solid free cash flow generation

The third reason to buy PayPal relates to my original justification for buying PayPal: the Fintech is doing very well for itself in terms of free cash flow. The company earned $2.5B in free cash flow in Q4 which was inflated by the origination and sale of buy now, pay later receivables in the amount of $1.7B. PayPal struck a deal with private equity company KKR last year that could include loans of up to $44B in order to offload credit risks and focus on its free cash flow. On average, PayPal generated $1.1B in free cash flow every quarter in FY 2023. The adjusted free cash flow and PayPal’s margins for the last five quarters are depicted below.

| PayPal | Q4’22 | Q1’23 | Q2’23 | Q3’23 | Q4’23 | Growth Y/Y |

| Revenues ($M) | $7,383 | $7,040 | $7,287 | $7,418 | $8,026 | 9% |

| Adj. Free Cash Flow ($M) | $1,433 | $1,000 | $869 | $1,911 | $774 | -46% |

| FCF Margin | 19% | 14% | 12% | 26% | 10% |

– 9 PP |

(Source: Author)

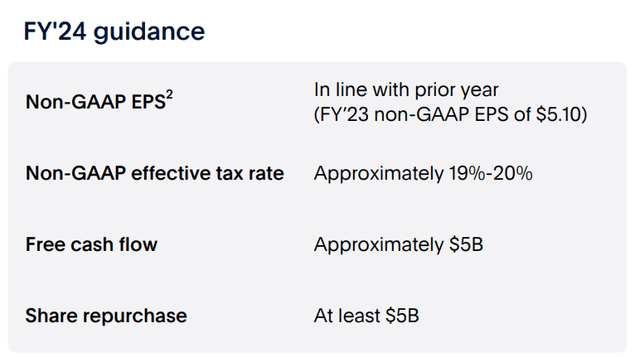

The outlook for FY 2024 is conservative, so what?

The 9% sell-off after earnings was mainly related to PayPal’s guidance to which, in my opinion, investors are overreacting. PayPal’s full-year earnings are expected to come in, on an adjusted basis, at $5.10 per-share which implies no growth year over year (PayPal’s FY 2023 adjusted EPS was also $5.10). While the outlook was disappointing from an earnings growth perspective, PayPal continues to expect a solid $5.0B in free cash flow and the return of 100% of this FCF to shareholders this year. The repurchase volume of $5.0B implies that the Fintech could buy back ~8% of its outstanding shares this year.

PayPal

PayPal is priced at a silly P/E ratio

Given the enormous size of PayPal, the presence of 426M active accounts and an expected $5.0B in free cash flow this year, I believe PayPal’s P/E ratio is bordering on being silly: shares of PayPal are valued at a price-to-earnings ratio of 10X which seems, to me at least, woefully inadequate when put into relation to the significant amount of free cash flow PayPal’s payment network generates on a recurring basis. On average, PayPal generates more than $1.0B per quarter in free cash flow which has a lot of value for investors, in part because PayPal is targeting a 100% free cash flow return percentage for FY 2024.

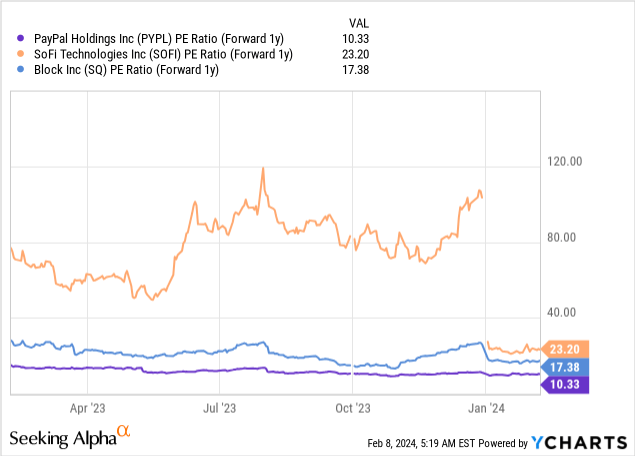

SoFi (SOFI) — which is crushing it right now with regard to customer acquisition — is valued at 23X forward earnings and the higher P/E ratio is due to the fact that the firm is rapidly expanding its customer base and just turned profitable. The P/E ratio for Fintech rival Block (SQ) is 17X. I like Block a lot because of its momentum in the Cash App business and because it is nearing an inflection point in terms of profitability. Both SoFi and Block have stronger EPS growth prospects in the short term as they do better on the customer acquisition front and their core products have momentum.

PayPal, however, is attractive chiefly from a value point of view. My fair value P/E ratio has not changed since my last coverage and I believe PYPL could trade at least at 15X forward earnings given its potential for operating income margin expansion and high, recurring FCF. The implied fair value, based off of FY 2025 earnings is $90 which implies approximately 58% revaluation potential.

Risks with PayPal

The biggest risk factor for PayPal is the trajectory in net new active accounts, in my opinion, which could weigh on PayPal’s ability to drive organic revenue growth. Transactions per user and account growth are two metrics that are worth paying close attention to. What would change my opinion on PayPal is if the company saw a drop-off in its free cash flow or its transactions per active accounts were to decline.

Final thoughts

Despite PayPal whiffing on its earnings outlook for FY 2024, there are three reasons to be optimistic and three reasons why I am going to be an aggressive buyer today: 1) PayPal’s TPV, a key metric for payment processors, is growing at double-digits, 2) The Fintech continued to deliver operating income margin improvements in the fourth-quarter, indicating that the company’s focus on driving cost-savings is bearing fruit, and 3.) PayPal continues to be a free cash flow powerhouse that is set to buy back ~8% of its outstanding shares in FY 2024. PayPal’s value ultimately lies in the fact that the Fintech, despite its enormous free cash flow prowess, is selling for just about 10X forward earnings, implying an earnings yield of 10%. Shares are a bargain and I am loading up the truck today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, SOFI, SQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.