Summary:

- Eli Lilly and Company stock has seen a 21.8% increase since the article was written, outperforming the S&P 500.

- The company’s strong earnings growth and potential for blockbuster drugs contribute to its continued success.

- The 5-year target price for Eli Lilly has been raised to $1,318, indicating 81.8% upside potential over the next 3-5 years.

jetcityimage

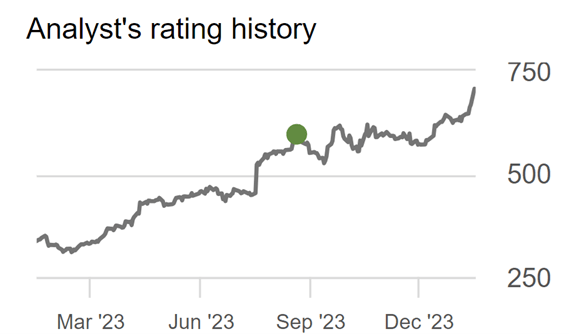

I last wrote about Eli Lilly and Company (NYSE:LLY) back in a September 11, 2023 article. At that time, the stock was trading at $595.56 per share. I gave the stock a buy rating and put out a 5-year target price of $1,020 per share. During my 25 years as a professional money manager and analyst, I have always used 5-year target prices. It helps take a lot of short-term emotion out of the equation. In addition to this, why do analysts come up with 5-year growth rates and 6-month target prices? That makes no sense to me.

At any rate, when I wrote the article, the stock had 74% upside potential over the next five years. This is very good and well above average. I think that it is important to go back and review just how I arrived at that target price and what that same exercise yields today after the company’s blowout earnings on Tuesday.

FROM THE SEPTEMBER 11, ARTICLE

“The consensus, 2024 analyst’s earnings estimate is currently $12.52 per share. This is the starting point. In addition to this, their five-year average annual earnings growth rate is estimated at 25% per year. Given that this mega-cap company has averaged 10% over the last 10 years, this number looks too high to me. I’m using 16% per year based on the potential growth of their three current biggest-selling drugs.

I now extrapolate these earnings numbers out over the next five years and arrive at the potential for $22.67 per share in earnings by 2028. Now we need to come up with a multiple (PE ratio) to multiply those earnings to establish a five-year target price.

A superior growth stock like Lilly is going to command a premium multiple. This is not a slow-growth stock like JNJ or Merck. Lilly has averaged a PE multiple of 40-50 during the last several years. It’s currently trading at a PE multiple of 73X due to its high growth potential.

Therefore, I’m going to use a fairly generous multiple of 45X on those potential 2028 earnings estimates of $22.67. This gets me to a five-year target price of $1,020.

$22.67 X 45=$1,020

When this target price is compared with its current price of $586.46, this represents an upside potential of 74% over the next five years.”

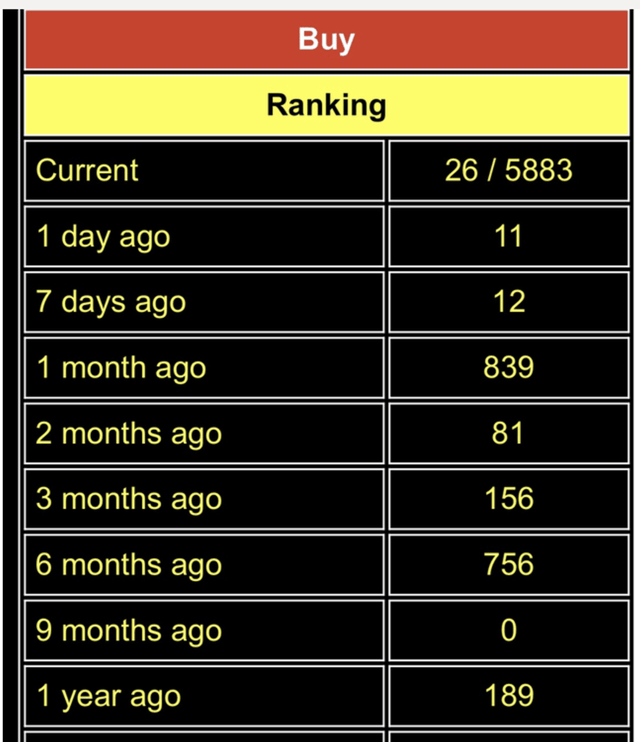

At the time I wrote the article, the stock also had an overall rank of 26, out of 5,883 stocks, ETFs, and Mutual Funds in my proprietary database. That ranking is based on my quant rating system, which is very unique in that it combines an equal dose of VALUATION and MOMENTUM. Most quant systems just focus on momentum. I have found over the years that it is also wise to watch your valuations.

Here is what the ranking looked like in my database back then:

Data from Best Stocks Now Database

I also put my money where my mouth was. Lilly is the biggest position by far in my Premier Growth Portfolio of 19 stocks. This portfolio is up 123.4% since I started it for my subscribers back on January 1, 2019. During that same time, the S&P 500 (SP500) is up 99.25%.

This is one of five portfolios that I offer in my premium service. Believe it or not, our Ultra Growth portfolio has done even much better than that.

Not everyone agreed with my 5-year target price on Lilly at the time. That is okay, though, that is why we call it a market. Here are just some select comments that I received after my article was published.

“This is so laughable I don’t even know where to begin.”

“Time to short Lilly big time.”

“Bought Puts on LLY yesterday at 597, so that tells you what I think.”

Once again, the stock was trading at $595.56 at the time. It closed at $725.38 after Wednesday’s close. It is now up 21.80% since I wrote the article. The S&P 500 is up 11.3% during that same time.

Seeking Alpha

The stock has delivered that much sought after, but elusive alpha since the article was written. Can that alpha continue, and it is still on track to reach my 5-year target price of $1,020?

How did Wednesday’s earnings report impact that target price and can this stock become a Trillion Dollar Baby? We will do the same valuation exercise and see where it lands now.

Lilly has a lot going for it right now with their breast cancer drug Verzenio and their diabetes drug Jardiance. But nothing compares with their blockbuster diabetes drug Mounjaro, which was approved late last year for weight loss with the re-branded name of Zepbound.

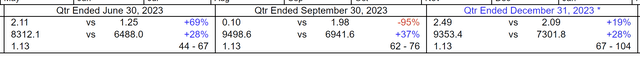

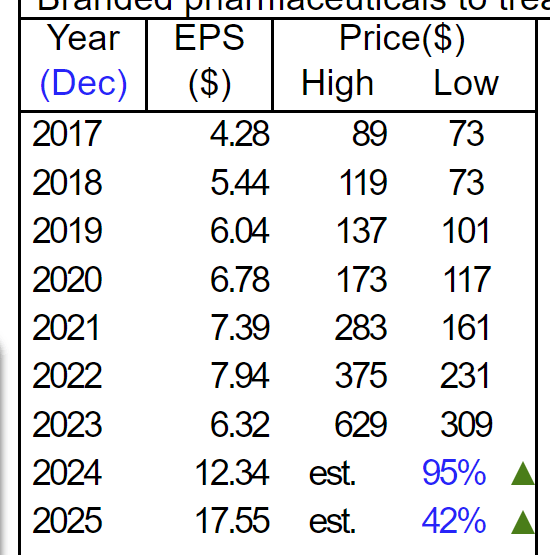

Look at Lilly’s past earnings growth and projected earnings growth in the table below. No wonder that the stock continues to hit new all-time highs. Go ahead and compare this growth with other laggard stocks in the sector like Johnson+Johnson (JNJ), Pfizer (PFE), and Merck (MRK). Stocks follow earnings! Without earnings growth where are you going to get capital appreciation? Lilly currently has earnings growth in spades.

MarketSmith.co

Does anyone remember CANSLIM by William J. O’Neill? The “A” CANSLIM represented annual earnings growth. Also, look at Lilly’s recent quarterly earnings. This was the “C” in CANSLIM. Lilly’s earnings are just beginning to accelerate. I much prefer to own a stock that has accelerating earnings (Nvidia (NVDA) would be a good example) vs. decelerating earnings. Tesla (TSLA) would be a good example.

Now, what CANSLIM was missing for me was a “V” for valuation. Give me a “V”!

Here is what my current valuation exercise looks like.

This time around, I am raising my 5-year growth rate from 16% to 20% per year. This is because Lilly has a massive hit on its hands. They can hardly keep up with the demand for their weight-loss drug. What is the total market for a weight loss drug that works? Enormous!

Current 5-year earnings projections

2024-$12.41

2025-$17.74

2026-$21.29

2027-$25.55

2028-$30.66

My earnings estimate for 2028 now goes up from $22.67 to $30.66. I am lowering my multiple from 45X to 43X. My five-year target price goes up from $1,020 to $1,226. I go from a Buy to a Strong Buy, and I raise my 5-year target price from $1,020 to $1,318. This gives Eli Lilly and Company stock 81.8% upside potential over the next 3-5 years. This is well above average.

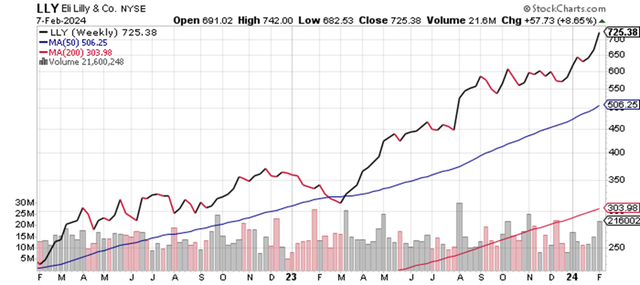

Here is a current chart of the stock. This continues to be a powerful chart that continues to hit new all-time highs. I expect this to continue.

What is not to like about Lilly? It is now ranked #2 overall in my proprietary database that my subscribers get access to.

Data from Best Stocks Now Database

Lilly is currently our second largest position, just behind Nvidia. I called NVDA the best stock in the market now in an article that I wrote back on August 29th of last year. The stock is up another 43.7% since then while the S&P 500 is up 11.1%. Not that is a lot of alpha!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LLY, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Stocks Now Premium gives you access to Bill Gunderson, professional money manager & analyst with 23 years of experience.

You get Bill’s daily “live” buys and sells in his four portfolios: Emerging Growth, Ultra-Growth, Premier Growth, and Dividend & Growth. These portfolios have done very well since their 1/1/2019 inception.

JOIN NOW to get daily “live” buys and sells, weekly in-depth market-timing newsletter, access to Bill’s proprietary database with daily rankings on over 6,000 securities, and a daily live radio show!