Summary:

- The Market has been somewhat short-sighted, with Alphabet Inc./Google already discretely integrating its next-gen AI capabilities into its top-line drivers, with 2024 likely to bring forth excellent results.

- It continues to maintain its dominance in the global search engine market, with Bing still lagging way behind, naturally contributing to the excellent growth observed in Google Search revenues.

- Combined with the growing FY2023 Free Cash Flow generation and robust balance sheet, we believe that Google remains a highly profitable growth tech stock suitable for most discerning investors’ portfolios.

- As a result of these developments, we believe that Google is currently trading at discounted FWD P/E valuations, with it being the cheapest of all Magnificent Seven stocks.

- Interested investors may still dollar cost average at this pullback.

PeopleImages/iStock via Getty Images

We previously covered Alphabet Inc. aka Google (NASDAQ:GOOG, NASDAQ:GOOGL) in October 2023, discussing how the stock had been prematurely sold off due to the market’s concerns about Google Cloud’s decelerating growth rate and the perceived lag behind Microsoft Corporation’s (MSFT) first-mover advantage in the AI race.

We continue to rate GOOG as a Buy attributed to the company’s excellent profitable growth, with the deep correction observed in its stock prices offering growth-oriented investors an improved margin of safety.

In this article, we shall discuss why we believe that the market has been somewhat short-sighted, with GOOG already discretely integrating its next-gen AI capabilities into its top-line drivers, with 2024 likely to bring forth excellent results.

Combined with the stock’s depressed valuations and the market’s overreaction, interested investors may still dollar cost average accordingly.

The GOOG Investment Thesis Has Been Overly Discounted Against The Magnificent Seven

For now, Google reported a double beat FQ4’23 in its Q4 earnings call. It produced revenues of $86.31B (+12.5% QoQ/ +13.5% YoY) and GAAP EPS of $1.64 (+5.8% QoQ/ +56% YoY).

Many of Google’s tailwinds are attributed to the sustained dominance in the global search market at 91.47% by January 2024 (-0.15 points MoM/ -1.43 YoY), with Bing still lagging behind at 3.43% (+0.06 points MoM/ +0.4 YoY).

This optimistic trend has directly contributed to the excellent performance reported by GOOG’s top line driver, namely Google Search, with revenues of $48.02B (+9% QoQ/ +12.7% YoY) in FQ4’32 and $175.03B in FY2023 (+7.7% YoY).

Despite the Market’s undeserved misgivings about the ad business, YouTube ads have also performed exceedingly well with $9.2B in revenues (+15.7% QoQ/ +15.5% YoY), as YouTube continues to command the leading streaming market share at 8.5% (-0.5 points MoM/ -0.2 YoY) by December 2023.

With YouTube, Netflix, Inc. (NFLX), and ByteDance’s (BDNCE) TikTok spearheading the transition from linear TVs to online streaming, we believe that the market has been overly punitive after the recent GOOG earnings call, with the stock plunging by -8.7% at its worst.

On the one hand, GOOG’s Cloud segment has sustained its profitable growth trend since FQ1’23, with sales of $9.19B (+9.2% QoQ/ +25.7% YoY) and expanding profit margins of 9.3% (+6.2 points QoQ/ +15.8 YoY) by FQ4’23.

This is on top of the Cloud segment’s expanding revenue backlog at $74.1B (+14.1% QoQ/ +15.2% YoY), implying the growing demand for its cloud computing and generative AI SaaS offerings.

On the other hand, it is apparent that despite being an AI-first company, GOOG has yet to successfully monetize its generative AI/ cloud offerings, when compared to MSFT Cloud’s impressive operating profit margins of 48.1% (-0.3 points QoQ/ +6.8 YoY) and Amazon.com, Inc. (AMZN) AWS at 29.6% (-0.6 points QoQ/ +5.3 YoY).

While GOOG has recently launched Gemini, with Gemini Ultra coming soon, it remains to be seen how the newly launched AI platform may compete with Open AI’s GPT-4 (Turbo), pending independent reviews.

The only silver lining may be Open AI’s recent debacle, which may trigger developers and big-name companies to diversify their generative AI SaaS provider accordingly.

However, with the GOOG management still testing the limits of Gemini Ultra while only planning to license the platform to developers/ enterprise customers, we believe that readers/ analysts may want to focus on how AI has already been discretely integrated across its existing offerings.

The list includes the Search Generative Experience in the U.S., Bard chatbot globally, expanded content creation suite of tools, photo/ video analysis, and optimized advertising solutions/ insights, amongst others, directly intended to boost the performance of its top-line driver, the Google Search segment.

The strategic combination of direct and indirect channels has allowed GOOG to also “nearly triple the number of its co-sell Google Cloud deals from 2022 to 2023.”

As a result, we believe that while GOOG’s singular AI offerings may be slower to ramp, the management’s integrated approach may eventually provide much bigger monetization opportunities across its high growth segments, particularly Google Services, which has reported excellent sales of $272.54B in FY2023 (+7.5% YoY).

Furthermore, GOOG’s overall operating profit margins of 27.4% (+1 points YoY) have moderately benefited from the drastic layoffs, with the company reporting 182.5K employees by December 2023 (inline QoQ/ -4% YoY).

If not for the $4.16B worth of one-time charges related to the global downsizing/ amortization, we may have seen the company report up to 28.7% in FY2023 profit margins as well (+2.3 points YoY).

Combined with the growing FY2023 Free Cash Flow generation at $69.49B (+15.8% YoY) with margins of 22.6% (+1.4 points YoY) and robust ending net cash of $99.04B (-8.3% QoQ/ -1.8% YoY) in the balance sheet, we believe that GOOG remains a highly profitable growth tech stock suitable for most discerning investors’ portfolios.

So, Is GOOG Stock A Buy, Sell, or Hold?

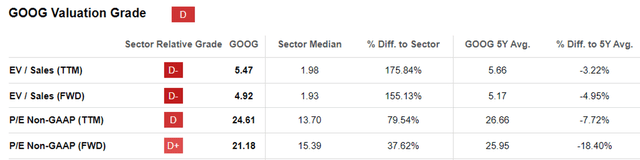

GOOG Valuations

As a result of these developments, we believe that GOOG is currently trading at a discounted FWD P/E valuation of 21.18x, compared to its 1Y mean of 20.98x, 3Y pre-pandemic mean of 25.03x, and its direct competitor, MSFT at 34.89x.

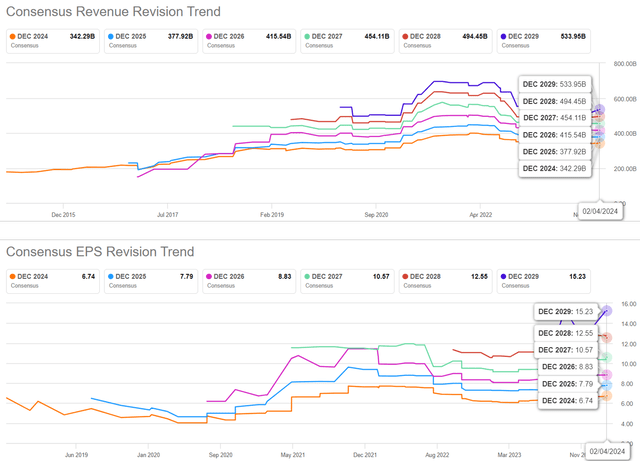

The Consensus Forward Estimates

At the same time, the consensus forward estimates remain promising, with GOOG still expected to generate excellent top/ bottom line growth at a CAGR of +10.6%/ +15% through FY2026.

This is compared to the previous estimates of +9.3%/ +11.6%, albeit decelerating against the previous growth rate of +19.1%/ +19% between FY2016 and FY2023, respectively.

Then again, readers must also note that GOOG’s projected growth rate is still comparable to MSFT’s at +14.6%/ +16.7% over the same time period, implying that the former may still be punished for the perceived delay in Google Cloud/ AI monetization, as discussed above.

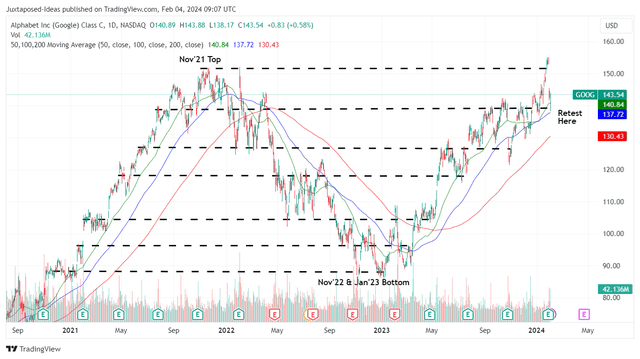

GOOG 3Y Stock Price

However, we maintain our bullish stance surrounding GOOG’s prospects, attributed to the excellent upside potential of +31.3% to our long-term price target of $187, thanks to the recent pullback. This is based on the consensus FY2026 adj EPS estimates of $8.83 and its FWD P/E valuations of 21.18x.

At the same time, GOOG remains the cheapest stock amongst the Magnificent Seven, with its peers trading at notable premiums, including Tesla, Inc. (TSLA) at FWD P/E valuations of 58.57x, MSFT at 35.18x, Apple Inc. (AAPL) at 28.24x, Amazon.com, Inc. (AMZN) at 40.17x, Meta Platforms, Inc. (META) at 24.12x, and NVIDIA Corporation (NVDA) at 53.82x.

This is on top of GOOG’s excellent shareholder returns thus far, with the management already retiring 345M of shares/ 2.7% of its float over the past twelve months and the equivalent of 1.3B/ 10.3% since FY2019, respectively.

Combined with its robust profitability and healthy balance sheet, we maintain our Buy rating on the Alphabet Inc./Google stock, with the recent pullback offering interested readers the opportunistic chance to dollar cost average.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, MSFT, AMZN, NVDA, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.