Summary:

- META is a blue-chip stock that is poised for a strong 2024 to follow up an outstanding 2023 performance.

- The Bat Signal (introduced below) indicates a “risk-on” environment based on market technicals and META is a good way to play the current market regime given the enhanced macroeconomic risk.

- Potential for outperformance if management is able to ramp profitability of messenger apps and Reels at a faster pace.

JOSH EDELSON/AFP via Getty Images

Despite META having already experienced a tremendous run-up in share price and some market participants and analysts beginning to question if the run is sustainable (see WSJ article from earlier this week: Big Tech Stocks Find Little Room for Error After Monster Run) I believe that the run is not over and that META has a strong fundamental outlook in 2024 and is well positioned in the current market regime to continue to deliver strong performance.

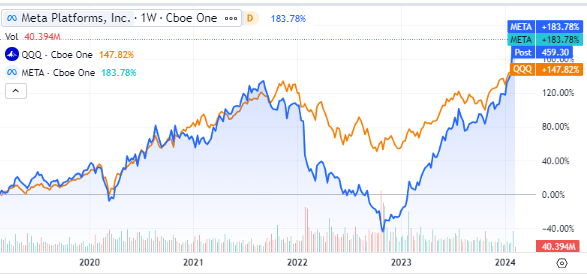

After an absolutely stellar 2023 (and a correspondingly poor 2022), META share price performance has caught up to the broader NASDAQ index.

Seeking Alpha

Interesting, forward valuation levels remain relatively tame compared to the historical average as the stock has matured into a cash flow juggernaut. Given the favorable outlook for ad spend, the amazing strength of the stock chart and my macro outlook, I believe that META is due to continue its outperformance in the near term based on external factors. Furthermore, after years of mismanagement, META has finally developed competencies to complement its core offering which are accretive to growth and profitability (despite the flailing metaverse investment).

META Forward P/E Ratio (CapIQ)

In the following section I will discuss the Bat Signal, some of the high level theory behind the indicators, the broader “portfolio strategy” and why I believe that based on the current reading and market regime that META is a strong buy.

The Bat Signal

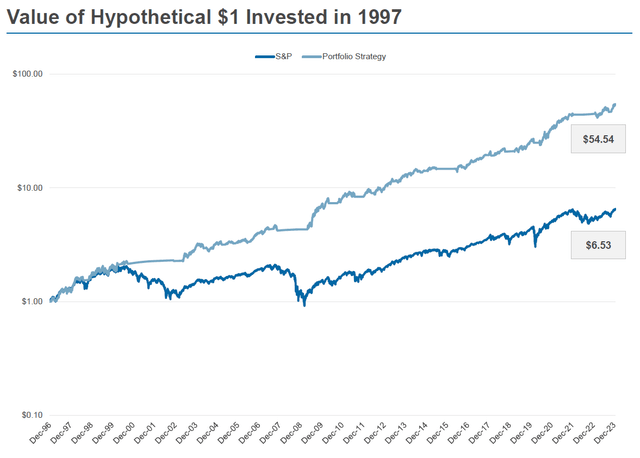

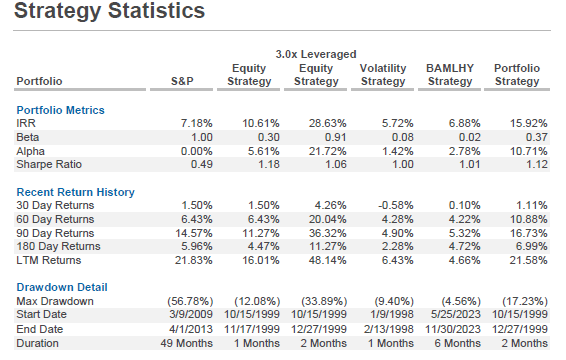

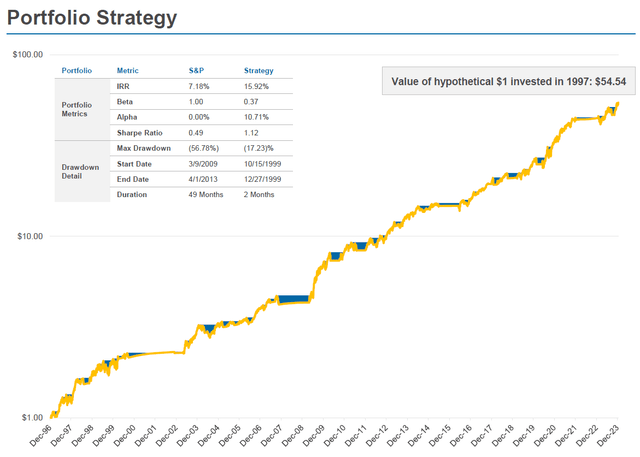

In this article I am going to introduce my newest creation – a trading signal tool which will help investors allocate their portfolios based on the current market regime, a tool which back tested to 1996 has produced over 10.7% alpha annually and has produced a total return of 54.5x compared to 6.5x for the S&P 500. This tool is called The Bat Signal.

I will take the time in this article to lay out the theory behind this indicator and why I believe it is an indispensable tool to investors looking minimize risk and maximize risk-adjusted return, particularly in a market with as much uncertainty as the current.

The Bat Signal utilizes several strategies which are combined to produce the flagship “Portfolio Strategy” which produces the highest risk-adjusted return while limiting drawdowns. The various strategies include:

- Equity Strategy: which is long only, and alternates between the S&P 500 and T-bills in unfavorable environments.

- 3.0x Leveraged Equity Strategy: Long only, high beta strategy; alternate between Equity Strategy triple leveraged through S&P 500 ETF (UPRO) and T-bills in unfavorable environments

- Volatility Strategy: Long only, low beta strategy; alternate between S&P 500 and T-bills in unfavorable environments, meant to indicate expansionary moments for incremental leverage in the Portfolio Strategy

- BAMHLY Strategy: Long only, low beta strategy tracking the BAMLHY index; alternate to T-bills in unfavorable environments

- Portfolio Strategy: Long only, combined strategies; 1/3 dedicated to 3.0x Leveraged Equity Strategy when Volatility Strategy is long; T-bills in unfavorable environments

Proprietary Analysis (CapIQ)

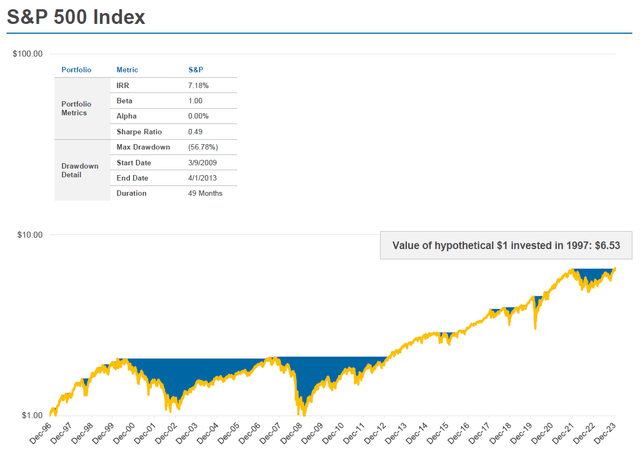

The strength of the Bat Signal portfolio strategy is that it is very adept at avoiding drawdowns as seen in the below charts. Since 1996, the S&P 500 index has sustained multiple large drawdowns (shaded in blue) with a max drawdown of 56.78% in 2009 and ending in 2013 – a 49-month drawdown. Compare this to the Bat Signal which sustained a max drawdown of 17.23% in 1999 which only lasted for 2 months. The ability to avoid large and sustained drawdowns makes the Bat Signal an essential tool for risk management for any investor.

Proprietary Analysis (CapIQ) Proprietary Analysis (CapIQ)

Underpinning all the portfolio strategies is the thesis that when investors speculate, they speculate across all asset classes. The strategies make no determinations based on fundamentals but asses the favorability of the investing environment through market internals. The beauty of this strategy is that it consistently generates alpha without having to take a view on the economic or company-specific fundamentals – it simply quantifies what the market is already telling you about the current trading regime and adjusts the strategy to be congruent with this regime. I believe that this strategy consistently outperforms without being “priced in” due to the fact that such a strategy (which is based on technical indicators and seeks to allocate between broad indices) is fundamentally incongruent with a capital raising strategy that can be easily scaled and thus the inefficiency is able to persist over time. While I don’t think the Bat Signal is the first strategy to ever conceive of using market internals to guide portfolio allocation, hedge funds and mutual funds cannot raise capital on the basis of such a strategy given that it does not neatly fit into an existing strategic framework which large institutional investors would be willing to contribute capital into.

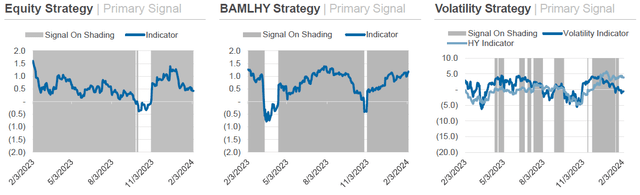

Looking at the daily signals above, the shaded grey areas indicate when the respective strategy is “on” and thus is allocated to risk-on vs. risk-off (T-bills). Given that the Equity and BAMLHY strategies are both on while the Volatility Strategy is off, the Bat Signal is giving a partial risk-on reading. Based on this reading, I think that META fits in nicely as a blue-chip stock with good fundamentals in the current market regime.

In the next section I will discuss my macro view which is cautious, however I believe that META strong fundamental outlook, cost cutting measures and a generally resilient economy (for now) make META a strong addition defensive position to an equity portfolio with potential for upside.

Macro

My view around the recession has not changed and I still believe that a recession is the likely outcome over the next year and not a soft landing however, a resilient economy and vast government deficits have enabled the economy to run “hot” longer than I expected. Moving forward, I will use the Bat Signal as the basis for all of my investment theses however, I would still like to promote caution in the current environment despite the risk-on signal.

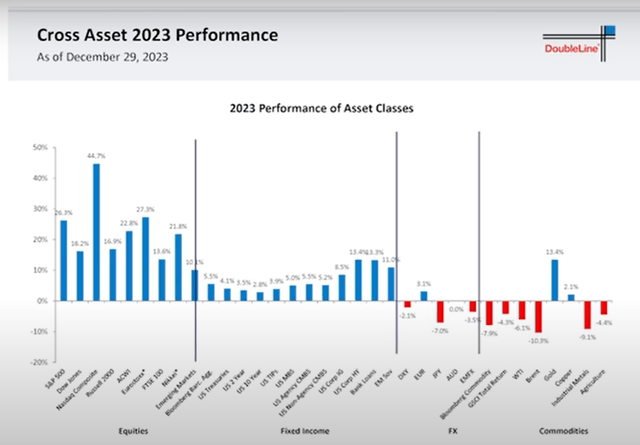

2023 was an outstanding year for equities and corporate debt after a very lackluster 2022 (similar to META’s share price performance). This outperformance was due to a variety of factors including positive liquidity flows due in party to TGA balance being depleted and favorable inflows from the Fed’s Reverse Repo facility, a “hot” economy with low unemployment cooling but still high inflation and reasonably strong economy growth, and expectations for rate cuts in 2024 among other things. I retain a cautious outlook as I believe the market has priced in a highly optimistic outlook and while I don’t think a simultaneous soft landing and rate cutting cycle is an impossible outcome, I believe that the risk is skewed towards the downside. Furthermore, valuations remain expensive and volatility is low as the market moves to a “risk-on” mode and in my opinion there is already some danger in being late to the party.

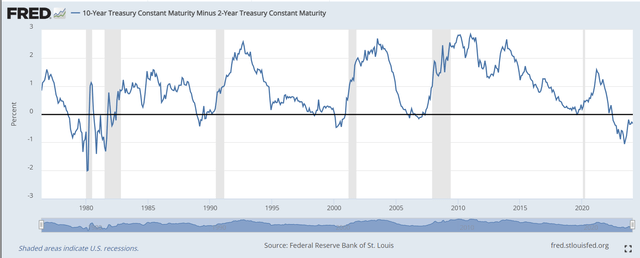

The yield curve remains inverted but has ostensibly begun the process of de-inverting as rates have come down from highs. This process typically happens before a recession starts and remains an unfavorable data point against the soft-landing thesis.

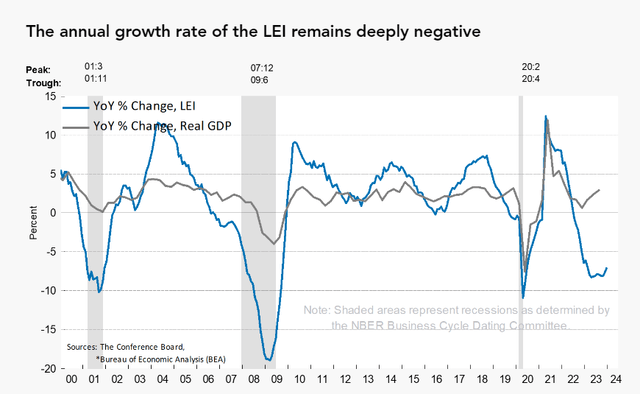

The LEI (Leading Economic Indicators) index remains deeply negative and based on historical data would point to a recession having already begun. However, these indicators appear to be doing less good of a job in the current cycle at predicting recession likely due to the weight of manufacturing indicators in the index. The manufacturing sector has been in a period of prolonged weakness over the past year however, the US economy is more tilted to services than ever and perhaps these indicators have lost some of their predictive power over the economy as a whole.

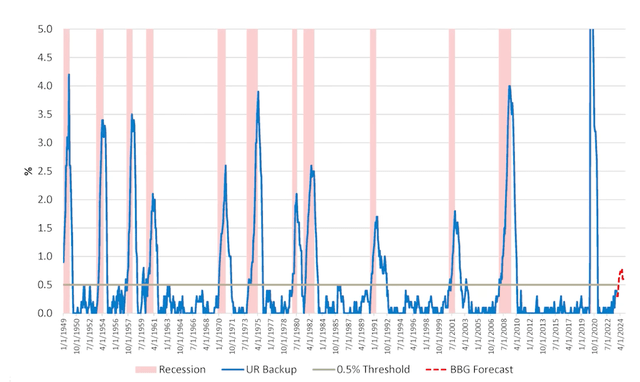

While the January jobs number was quite strong it was accompanied by a warning signal – layoffs were the second highest for the month of January going back to 2009. Looking at the top chart, you can see that once the unemployment rate “Backup” (i.e. employment levels below full employment) goes above 0.5% it typically leads to a cascade of layoffs and a recession. According to the Bloomberg forecast (red dashed line), we are expected to hit this 0.5% threshold in 2024 and I expect that layoffs will become a trend in 2024.

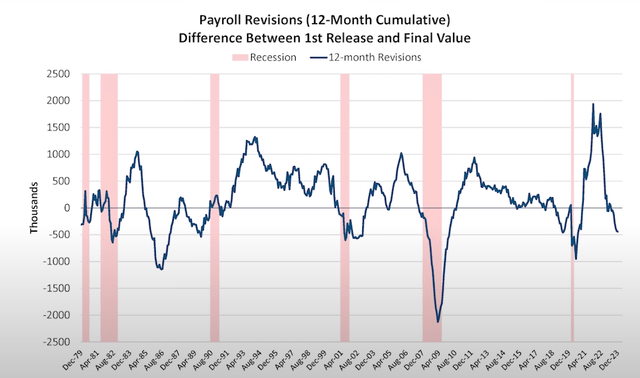

Payroll revisions continue to be negative in large part – another troubling indicator (although certainly not a guarantee of a recession based on the historical data).

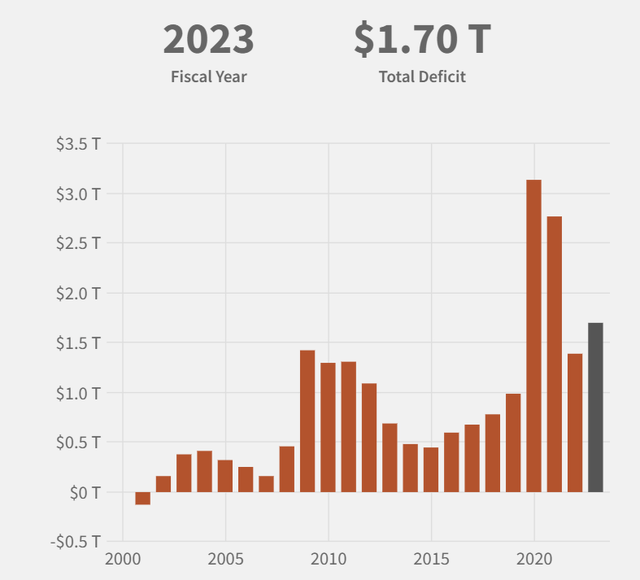

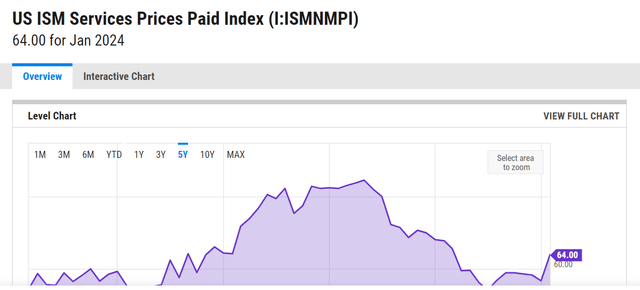

The federal government continues to run large deficits despite low unemployment and high inflation and I believe that this spending will help put a floor on inflation and will likely make it challenging for the federal reserve to consistently hit their inflation targets while also increasing the risk of double-dip inflation. The ISM services prices paid index for the month of January came in above expectations at 64 and while still well below 2021 levels is a substantial deviation from the downward trend seen over the last 12 months. Data points like these are why the Fed is being so cautious in signaling rate cuts as the risk of policy error is higher as some forward-looking indicators of inflation are troubling.

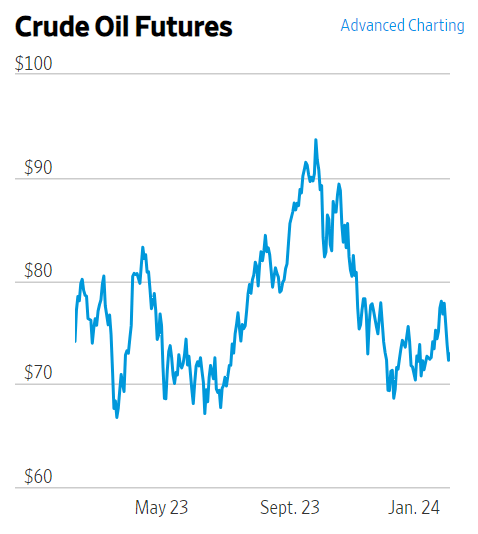

WSJ

The weakness of crude prices over the last several months is also dubious as global demand appears to be weakening. If this downward trend continues it would suggest a cautious outlook on the economy and markets in 2024.

In the next section I will discuss META’s outstanding business fundamentals and why it is well positioned to succeed in the current macro environment and market regime.

Zooming in on META

After posting a strong Q4, META share price surged over 20% (and has since given back some of the gains). The Company has focused on boosting efficiency and profitability in 2023 and with headcount down 22% YoY, has still managed to grow revenue by 25% and operating income for the Family of Apps segment by 97%.

Given the tough comps with 2023, there is likely to be some deceleration in revenue growth in 2023. Typically, in periods of decelerating revenue growth META has not performed as well as in periods of accelerating revenue growth. However, given favorable the market backdrop as well as META’s enhanced profitability and strong growth levers I believe META is still well positioned for 2024.

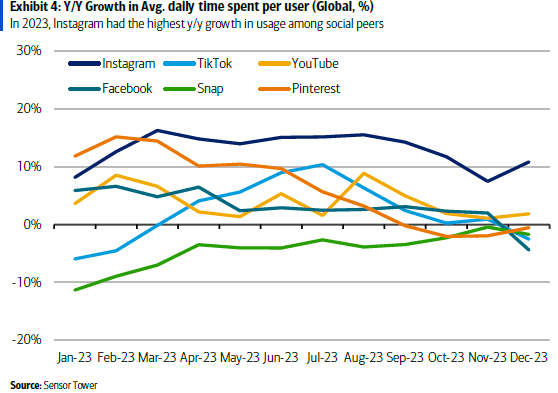

There are several key aspects of the bull thesis for META, among these being industry leading growth, ARPU and daily usage at Instagram. As Reels integration combined with AI enhanced algorithms drive growth, data from Senor Tower suggest that Instagram time spend per user grew 6% YoY in the US and 11% YoY internationally. Instagram is now capturing 62 minutes of daily average user time compared to 50 minutes two years ago.

Sensor Tower

Furthermore, Reels monetization cycle is still early. On the Company’s third quarter earnings call, management noted that Reels is now net neutral to overall company ad revenue (earlier than expected) and will be a modest tailwind to revenue growth in 2024. The format is improving targeting and favorable placement in newsfeed and is seemingly capturing increasing user traction on FB and IG.

In addition, new AI / ML features (including generative AI) will help drive creative enhancement, campaign optimization, enhanced ad measurement and back-end cost saving for advertisers via adoption of Advantage+ products. These enhancements are virtuous as stronger content generation drives higher engagement which in turn drives higher content output. The Company is also expected to roll out an updated LLM in 2024 which according to press reports will be as powerful as GPT 4.0.

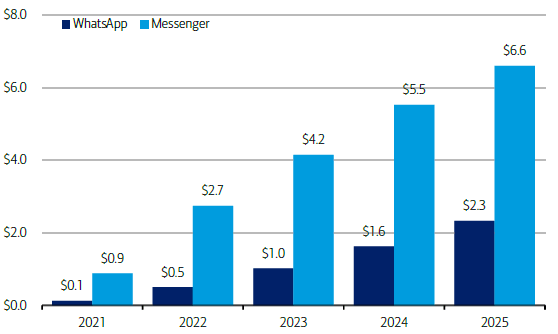

Finally, monetization of META’s 2 billion monthly users on its messaging apps (WhatsApp and Messenger) will be key drivers of revenue growth over the next 3 years. While management has indicated that Click-to-WhatsApp ad revenue is already at a multi-billion dollar run-rate, enhanced features such as paid messaging, AI services, payments, eCommerce, and gaming have the potential to drive ARPU to high single digits (which for a platform with 2 billion users represents a $10 billion+ opportunity).

Company Filings, Wall Street Research

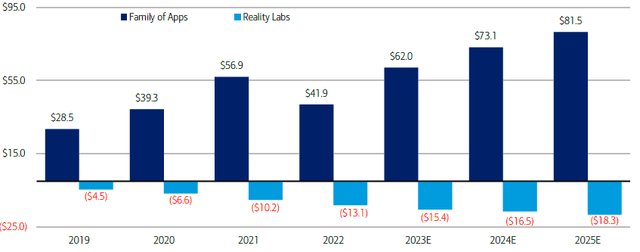

Unfortunately, META’s investment in the metaverse (Reality Labs) has been quite a debacle, with a (-25%) contribution to EPS in 2023. While the company continues to make substantial investment, it is unlikely that Reality Labs will be a positive contributor to EPS any time soon and personally I believe that the Company would likely abandon or scale back these operations substantially if it wouldn’t cause massive embarrassment to management and potentially a black eye to the meteoric success of the stock over the last year.

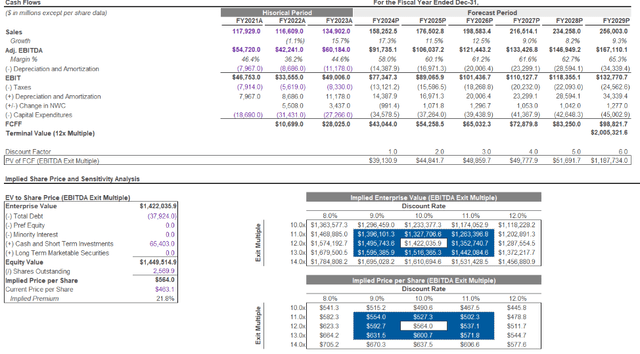

Company Filings, Wall Street Research Proprietary Cash Flow Analysis (CapIQ)

Looking at the research model, analysts are expecting profitability and cash flow to continue to ramp substantially over the next 2 years while sales growth maintains a double-digit percentage pace. While I think this is a reasonably likely outcome, it is somewhat optimistic. However, I do believe that there is some potential for multiple expansion even with revenue growth decelerating in 2024 as the upside potential of monetizing messaging as well as Reels becomes apparent.

In the next section I will discuss some risks to the thesis.

Risks

There are several risks to this thesis, including the potential for a deteriorating macroeconomic environment which I outlined above. Decelerating revenue growth in 2024 over tough 2023 comps have potential to dampen enthusiasm for the stock. Furthermore, as Reels becomes an increasingly important driver of screen time, there is risk of enhanced competition as Reels content is less proprietary to META and less likely to provide a positive network effect. Content creators are able to easily post their content across multiple platforms and over time there might be enhanced competition for top content creators. Reels also has a high capital intensity than the legacy business as videos have higher storage and server costs than images and multiple FPS that need to be analyzed. Finally as displayed at the scathing US senate hearing last week (Meta boss Mark Zuckerberg apologizes to families in fiery US Senate hearing | BBC News), public sentiment towards social media companies and particularly META is quite negative and the likelihood of negative legislation is increasing. The worst of this potential legislation is the repeal of section 230 protections which would likely result in higher monitoring costs for social media companies as they take on liability for third-party content posted on their platforms.

Conclusion

In conclusion, I believe that META is an outstanding business which has weathered a tremendous storm over the past two years culminating in an outstanding 2023 performance. Given the risk-on indication from the Bat Signal, I believe that now is a good time to invest in a blue-chip company with fantastic technicals and potential for strong fundamental performance in 2024. Despite some skepticism from analysts over the continued sustainability of META’s run, I believe that the stock is well positioned to continue its performance despite a somewhat uncertain macro environment. It will be important to keep a close eye on the macroeconomic environment including potential Fed policy changes as well as potential regulatory changes which could negatively impact the business.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.