Summary:

- The Walt Disney Company’s fiscal Q1 report shows successful cost-cutting efforts, with expenses down and net income up.

- Disney increased its dividend by 50% and reinstated buyback, indicating confidence in future earnings and cash flow.

- Disney+ continues to lose ground to Netflix, with a decrease in subscribers during Q1.

- Content segment is a huge concern as I rate Disney stock a “Hold.”

Chesnot/Getty Images Entertainment

The Walt Disney Company (NYSE:DIS) has just released its Q1 report, as Seeking Alpha has covered here. Despite missing revenue estimates, the stock is up around 8% pre-market as the market appears to be cheering on other announcements from the company.

My most recent coverage of DIS stock was back in August 2023, when I rated the stock a “Hold” while arguing that the stock had more room to go down. The stock did fall further to the upper $70s, but since has gained more than 25% since my August article, including the pre-market price action. While I acknowledge that maybe was a miss on my part, I am still skeptical that the latest results show that The Walt Disney Company is turning around fundamentally. Let’s see why in the latest edition of The Good, The Bad, and The Ugly.

The Good

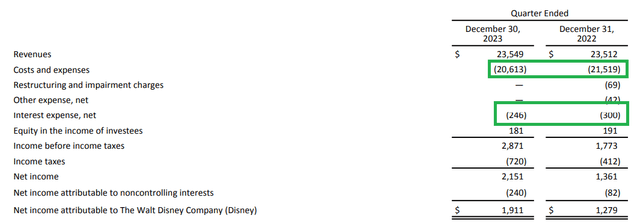

- Disney has been very vocal about its cost-cutting efforts and plans. Q1 results showed a successful follow-through on these plans. Expenses went down 4.21% YoY or an impressive $906 million. Interest expenses went down $54 million or 18% YoY. These cost savings were telling when you consider that Disney posted a $632 million jump in net income YoY while bringing in just $37 million in additional quarterly revenue YoY.

DIS Cost cutting (thewaltdisneycompany.com)

- Disney upped its semi-annual dividend to 45 cents/share, a 50% jump from the previous 30 cents/share. While the new dividend is still almost 50% below the 88 cents/share the company paid before the COVID-induced dividend elimination in 2020, the 50% dividend increase is an encouraging sign that the company expects steady earnings and cash flow in FY 2024.

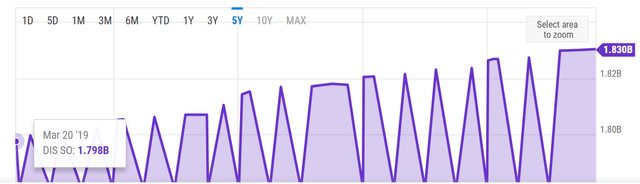

- In addition to dividends, the company is also looking at rewarding shareholders through buybacks with $3 billion authorized for FY 2024 (page 10). At the current pre-market price of ~$105, that authorization is good to retire 28.5 million shares, which would also save the company about $25 million in annual dividend expenses. To the company’s credit, although it did not buy back shares recently, its total shares outstanding has only gone up by 2% over the last five years.

DIS Shares Outstanding (YCharts.com)

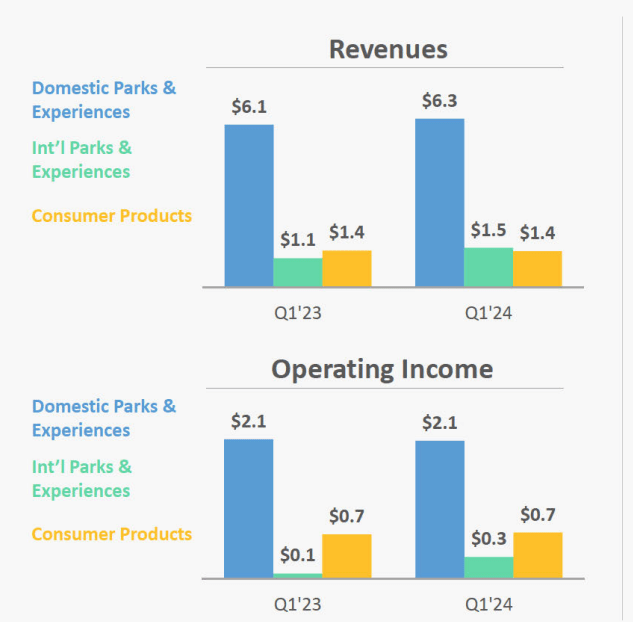

- Revenue and operating income from International Parks and Experiences grew 36% and 200% YoY in Q1, thanks to strong performance in Shanghai Disney Resort and Hong Kong Disneyland Resort. With domestic revenue and operating income more or less stagnating YoY, it is encouraging to see the international wing show strength.

DIS Intl (thewaltdisneycompany.com)

The Bad And The Ugly

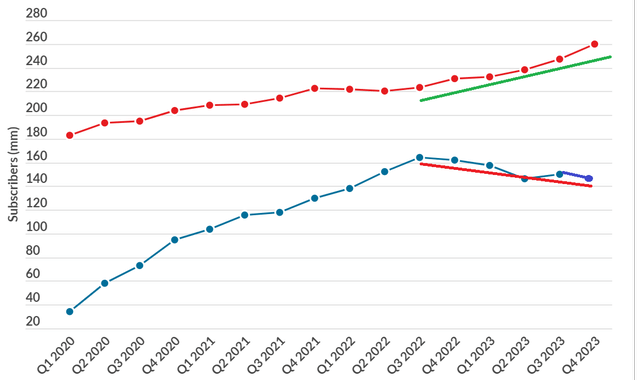

- While Netflix, Inc. (NFLX) recently posted its best subscriber growth since 2020, crossing 260 million subscribers and keeping up its uptrend (refer chart below), Disney+ is continuing its downtrend. At the end of Q1, Disney+ had 149.6 million subscribers, losing further ground to Netflix from the 150.2 million subscribers it (Disney+) had at the end of Q4.

Disney + vs NFLX (businessofapps.com)

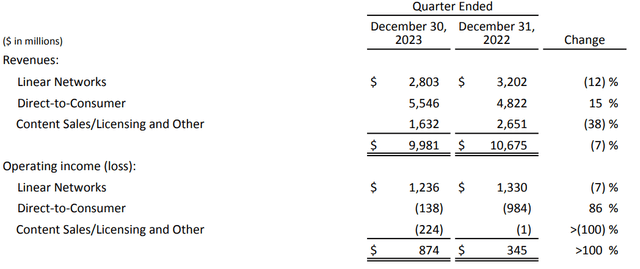

- Quietly tucked on page 14 of 17 pages is the fact that revenue (down 38% YoY) and net income (loss of $224 million) from Content Sales and Licensing came in disastrously lower YoY as well as under guidance. This segment represents Disney’s owned and acquired entertainment content that it streams and markets for theaters, TV, and subscription channels. Whatever happened to the magical content that Disney produced/acquired just one year ago with the likes of Wakanda Forever and Avatar: The Way of Water?

DIS Content (thewaltdisneycompany.com)

- Based on FY 2024’s EPS estimate (page 16) of $4.60, the stock is trading at a forward multiple of nearly 23. I cannot recommend buying the stock at that high a multiple, especially as the market is about to score another record.

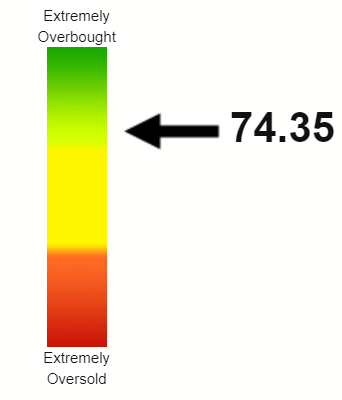

- Finally, Disney’s stock was already in the overbought zone ahead of earnings with a Relative Strength Index [RSI] of nearly 75. If the pre-market price action holds, this is likely to get worse.

DIS RSI (stockrsi.com)

Conclusion

Disney’s Q1 was all about cost-cutting, and kudos to the company for doing that so effectively. In addition, the company is also rewarding shareholders by increasing its dividend and reinstating its buyback program. Still, something doesn’t add up for me. Stagnant overall revenue, the drop in Disney+ subscribers (when competitors are firing away), the disastrous numbers from the content segment, and stagnant domestic park and experiences revenue don’t really scream “growth” to me. In other words, cost-cutting may help a company survive, it won’t make it thrive. Disney still needs to find its own magic back in some shape or form before I believe a turnaround is truly here.

Despite Disney stock going up 25% since my previous “Hold” rating, I retain my “Hold” rating, which basically means “if you have the stock already, hold onto it but if you don’t have a position yet, wait for better entry points.” I don’t believe the 8% jump in Disney shares post fiscal Q1 earnings is justified given the results.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.