Summary:

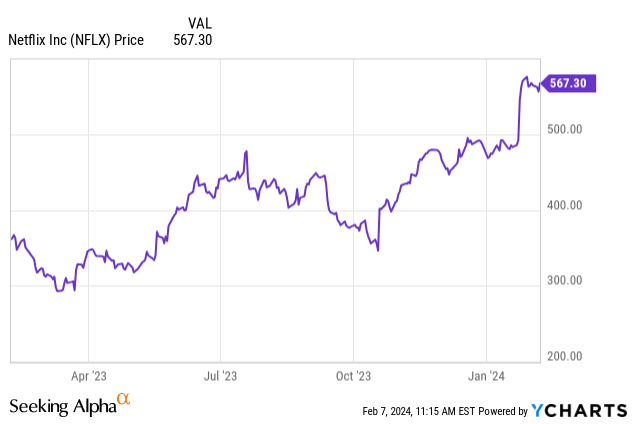

- Netflix’s stock has been performing well in 2024, with shares surging over 20% year to date.

- The company has strong subscriber growth and a promising content slate for 2024.

- Netflix has new monetization opportunities, including advertising and paid sharing features, which could drive revenue growth.

- The company trades at a very reasonable 0.8x PEG ratio against FY24 earnings estimates.

Giuliano Benzin

While most of the stock market has been stuck in a sideways pattern for the majority of 2024 so far, the sentiment for Netflix (NASDAQ:NFLX) is decidedly bullish. The leading streaming company has continued to showcase strong subscriber adds in the wake of price increases, while a strong content slate for 2024 is set to continue appeasing the subscriber base.

Year to date, shares of Netflix have already surged more than 20%: but in my view, there’s still plenty of upside ahead.

New catalysts add on to an already-strong bull case for Netflix

I last wrote a bullish note on Netflix in November, when the stock was trading closer to the $460s. Since then, I’ve enjoyed double-digit gains, but I’m maintaining my position and I remain quite bullish on Netflix’s prospects in 2024.

One of the key tailwinds that Netflix has behind it is a swath of new monetization opportunities. Netflix’s pricing power is already discussed at length – as we review the most recent quarterly results in the next section, we’ll see that the company continues to see healthy subscriber adds despite price increases across all of its plans.

Ads continue to be a nascent revenue opportunity for Netflix. In its recent Q4 shareholder letter, the company wrote as follows on the expansion of its advertising opportunity:

Scaling our ads business represents an opportunity to tap into significant new revenue and profit pools over the medium to longer term. In Q4‘23, like the quarter before, our ads membership increased by nearly 70% quarter over quarter, supported by improvements in our offering (e.g., downloads) and the phasing out of our Basic plan for new and rejoining members in our ads markets. The ads plan now accounts for 40% of all Netflix sign-ups in our ads markets and we’re looking to retire our Basic plan in some of our ads countries, starting with Canada and the UK in Q2 and taking it from there. On the advertiser side, we continue to improve the targeting and measurement we offer our customers.”

New ways to monetize paid sharing features, after Netflix cracked down on password sharing, is another meaningful growth opportunity. On Standard plans, Netflix users can now add up to one shared user at an extra $8/month – bringing in a whole population of paid users that used to stream the service for free. I view Netflix’s crackdown on password sharing as very similar to the music industry’s transition from piracy to streaming. If given a low-cost, easy option to pay for content, many people will opt to pay rather than to flout the rules.

One last recent initiative to call out is Netflix’s new foreign exchange hedging program, which it kicked off in the most recent Q3. FX has been a constant source of revenue downside over the past few quarters, with FX costing Netflix one point of growth in Q4 and an expected three points of growth in Q1 (the latter due primarily to a sharp fall in the Argentine peso relative to the dollar). While hedging certainly isn’t free, having more stable revenue growth and operating margins quarter-over-quarter will be a benefit.

And as a reminder for investors who are newer to Netflix, here is my long-term bull case for the stock:

- The company is enjoying the benefits of price increases at a time when many competitors are raising prices. Netflix’s financials (which we’ll discuss in the next section) have shown that subscribers have virtually shaken off any reaction to the recent price increases. After all, when most competing streaming services are raising prices, the alternatives aren’t as appealing. And with the company noting success in paid family sharing, the company has the opportunity to increase spend per household as well, versus its prior unlimited password-sharing model.

- An end to the content arms race? In 2023, Disney (arguably Netflix’s most serious competitor, when considering the market share of Disney+ and Hulu combined, announced that it would reduce its content volume to focus on quantity. We’re likely moving toward a near-term future in which the major streaming giants will stop trying to outspend each other on content and focus instead on core franchises.

- Record operating profits- Due to a combination of strong membership growth, more efficient headcount levels, and more disciplined content spending as outlined above, Netflix is generating record operating profits.

- Alternative engagement strategies- The company is building off its pop-up Netflix Bites cafe experiences to create more physical/offline destinations for Netflix fans, which it is branding as “Netflix House”. Over time, the company could build up more of an experienced business as Disney has.

Strong Q4 results; padded 2024 content slate

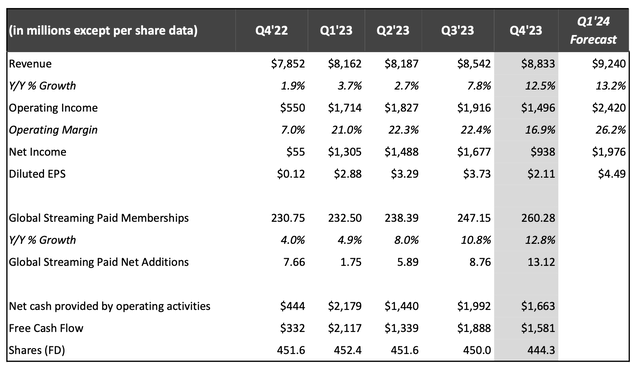

Netflix exited FY23 with an incredibly strong top-line performance. Take a look at the Q4 earnings summary, released in mid-January, below:

Netflix Q4 results (Netflix Q4 shareholder letter)

The first thing to note is that revenue growth accelerated to 12.5% y/y to $8.83 billion, smashing Wall Street’s expectations of $8.71 billion (+10.9% y/y) by a two-point margin. This is also the company’s third straight quarter of acceleration and the first return to double-digit growth after largely low single-digit growth for most of FY23. Meanwhile, it achieved 13.1 million net-new subscriber adds: its best showing all year, and in spite of higher plan prices. Strength was broad-based across regions, with the company adding 1.75 million net-new subscribers in the U.S. and Canada, its highest-ARPU region; and 3.95 million users in Europe, its next-highest ARPU market.

But Netflix isn’t done yet: it’s guiding to 13.2% y/y revenue growth in Q1, which includes an expected 3 points of unfavorable FX impact (which could change, as guidance was based on January 1 rates). Again, once the FX hedge program matures, we should see more stabilization between as-reported and FX-neutral growth rates (though it will also rob Netflix of FX benefits if the dollar goes the other way; i.e., weakens versus global currencies).

The expectation of mid-teens growth is supported by a strong content slate coming up in 2024. Among fan-favorite Netflix shows getting new seasons in 2024 are: Bridgerton, The Diplomat, and Squid Game. The company is also expecting strong viewership for its exclusive live-action remake of Avatar: The Last Airbender, as well as a new TV show produced by the showrunners of Game of Thrones.

And in answer to competitors’ efforts to bundle their sports offerings, Netflix is launching its own live sports offering: WWE wrestling. Speaking on the Q4 earnings call, co-CEO Ted Sarandos noted:

But I’m going to say instead that we are thrilled to bring this WWE Live programming to our members around the world. WWE Raw is sports entertainment, which is right in the sweet spot of our sports business, which is the drama of sport. Think of this as 52 weeks of live programming every week, every year. It feeds our desire to expand our live event programming. But most importantly, fans love it.

For decades, the WWE has grown this multigenerational fan base that we believe we could serve and we can grow. We believe that WWE has been historically under distributed outside of North America. And this isa global deal. So we can help them and they can help us build that fandom around the world. And not to – I should add that this should also add some fuel to our new and growing ad business. We’re very excited about this deal.”

From a margin standpoint, note that Netflix more than doubled its operating margins y/y to 16.9%, from 7.0% in the year-ago quarter. Note that Wall Street consensus is currently expecting $15.98 in pro forma EPS this year, representing 43% y/y earnings growth driven in large part by price increases and operating margin gains.

Key takeaways

With a strong content slate (and the addition of a live sports offering) in 2024, strong subscriber adds in the wake of price increases, and additional routes to monetization, there are plenty of reasons to stay bullish on Netflix. It’s worth noting that its current ~$567 share price represents a very reasonable 35x P/E and 0.8x PEG ratio based on current consensus estimates.

Stay long here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.