Summary:

- Roku, Inc. is expected to report strong Q4 2023 numbers, with solid growth rates in active accounts and streaming hours.

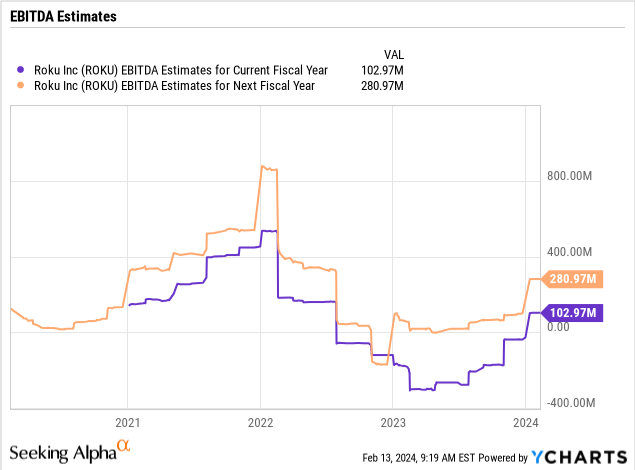

- The video streaming platform has consistently beaten sales estimates and is projected to have strong adjusted EBITDA numbers in 2024.

- Roku stock trades at an EV of ~3x ’24 sales targets.

SOPA Images/LightRocket via Getty Images

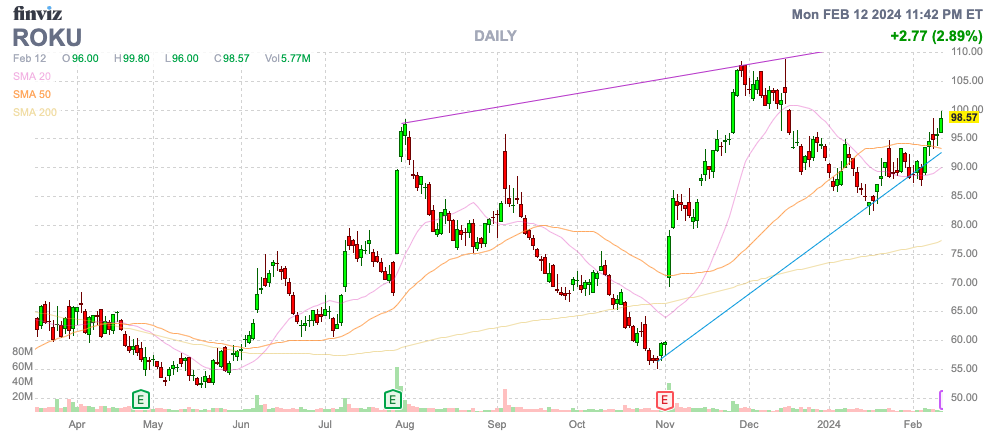

Despite constant signs of a turnaround during 2023, Roku, Inc. (NASDAQ:ROKU) continually hit roadblocks throughout the year. The video streaming service is set to report Q4 ’23 numbers prior to the open on Thursday with another solid quarter forecast. My investment thesis remains Bullish on the stock trading below $100 still despite the big beats this year and attractive valuation.

Source: Finviz

20% Growth Rates

All throughout 2023, our thesis focused on how Roku grew Active Accounts and Streaming Hours metrics in the 20% range. These usage metrics will ultimately drive the growth rates over time with average revenue per user (“ARPU”) growth over time providing an extra kicker to growth rates.

These strong usage metrics led to Platform revenue growing 18% to $787 million. The Devices revenue has been a mixed bag lately, with Q3 growth up 33% to $125 million, but these revenues now come with a negative gross margin.

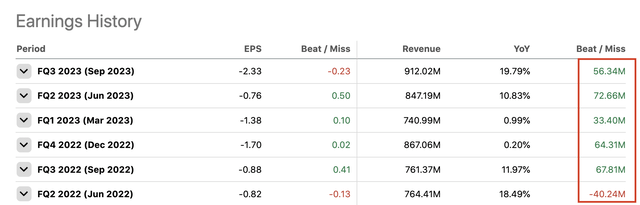

The stock made multiple runs at $100 last year, but Roku never maintained those rallies. Since a large $40 million miss back for the Q2 ’22 quarter, Roku has beaten quarterly sales estimates by at least $33 million, with an average beat above $60 million.

Considering Roku has only guided to Q4 ’23 revenues of $955 million, the recent revenues beats were massive. The consensus estimates for Q4 are only up at $966 million, and the recent normal beat pushes the revenue total above $1 billion.

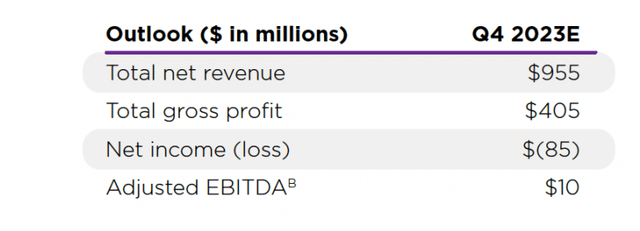

Source: Roku Q3’23 shareholder letter

The consensus estimates are for revenues to only grow by 11% in Q4 followed by 12% growth in 2024. If Roku matched the sequential user growth as going from Q3 ’22 to Q4 ’22, the company would report the following metrics for the December quarter, suggesting Platform revenue should remain strong:

- Active Accounts – 80.2M, up 4.6M in Q4 for 14.6% YoY growth

- Streaming Hours – 28.7B, up 2.0B in Q4 for 20.0% YoY growth.

The ad market was the big issue with the quarterly numbers in 2022 and some industry players have reported mixed numbers for December quarter. Roku moved away from the scatter ad market throughout the last year helping with strong ad revenues.

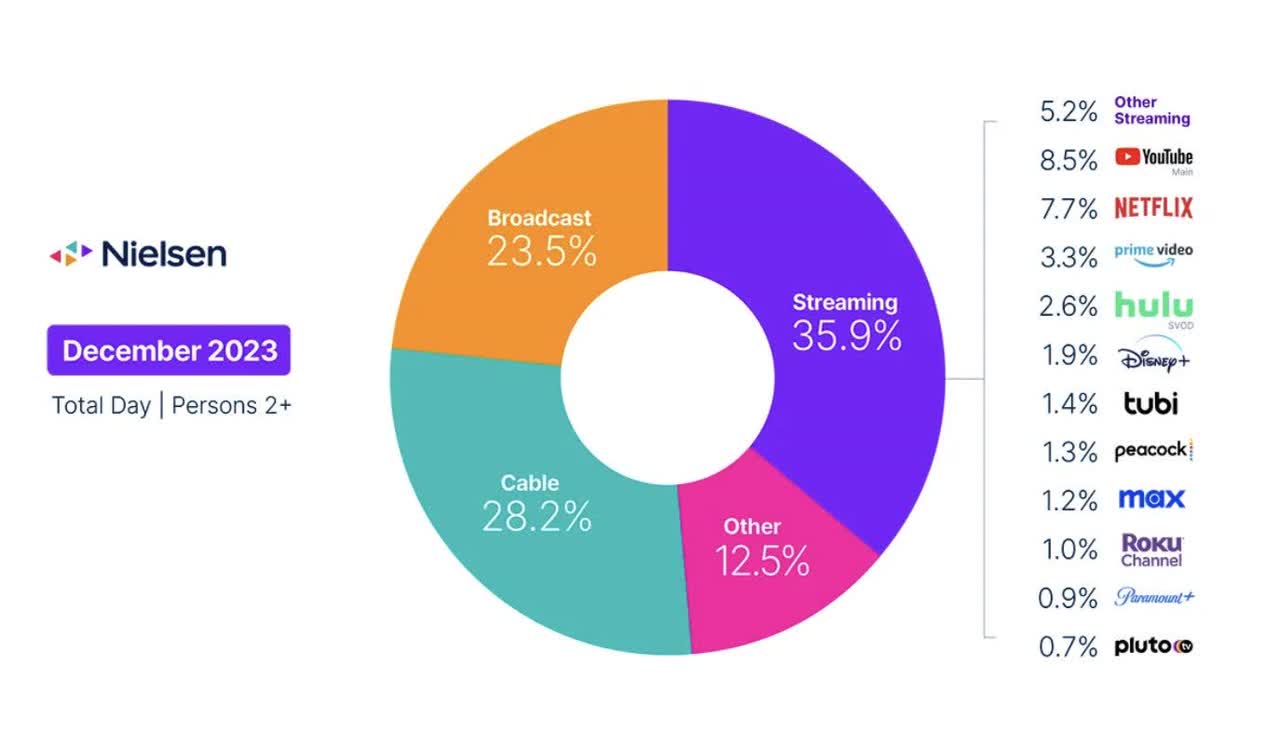

The Roku Channel remains a surprise success with 1.0% of the TV market per Nielsen ratings proving more ability to tap into the upfront ad guarantees. The company reported hours watched were up more than 50% YoY in Q3 alone.

The channel remains a top-10 streaming app and hit nearly ~3% of all streaming in December 2023 to surpass Paramount+ (PARA) and Apple TV (AAPL) and nearly matching the reach of Max (WBD).

Discounted Price

The stock only trades at ~4x sales, but Roku has a net cash balance of over $2 billion. With a market cap of only $14.0 billion, the stock has a minimal enterprise value of $12.0 billion.

Naturally, Roku was vastly cheaper when the stock traded far below $100 in 2023, but Roku isn’t anywhere close to expensive here. Nearly 65% of the U.S. TV market still needs to transition to streaming providing substantial growth in the years ahead for one of the leading streaming platforms.

ARK Invest projected substantial upside for the stock via digital video ad revenue growth. The company is now EBITDA-positive and plans to be very profitable in 2024, making the Bull Case of $605 for 2026 more possible now.

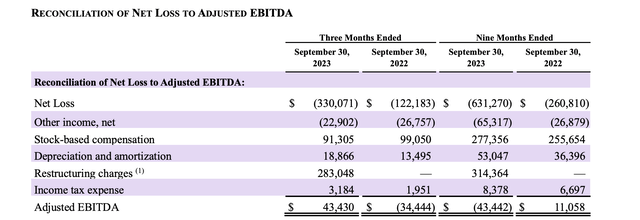

As with other growth companies, the majority of any GAAP loss is due to stock-based compensation and restructuring charges in the case of the large Q3 ’23 loss. Roku has other costs for Depreciation that impact the adjusted EBITDA metric, but the company is another corporation actually hit by adjusting the EBITDA metric by excluding actual interest income.

Source: Roku Q3’23 shareholder letter

Roku guided to a minimal adjusted EBITDA of $10 million. The company would still report an adjusted EBITDA loss of over $30 million with interest income in the range of $85 million.

The company has promised plans for adjusted EBITDA, or adjusted profits, during all of 2024. Considering the large EBITDA loss of $69 million in Q1 ’23, Roku should be on pace for some large profits this year, turning the large cash balance into an asset.

The streaming video company should start throwing off some large EBITDA numbers starting this year. The market will soon realize these numbers approach actual adjusted profits.

Takeaway

The key investor takeaway is that Roku, Inc. investors should expect another big beat in the upcoming Q4. Management has constantly provided conservative guidance for the last year, and Roku is likely to guide to strong adjusted EBITDA numbers for 2024. The stock has been a great deal on dips, but Roku isn’t anywhere close to being expensive here, closer to $95.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.