Summary:

- Nvidia Corporation is set to report earnings with analyst estimates expecting $4.56 in normalized EPS and $4.19 in GAAP EPS.

- The company has a history of beating earnings and revenue estimates, with a high likelihood of beating expectations again.

- Nvidia’s stock has been performing exceptionally well, with a strong profile of earnings responses and large price moves surrounding earnings announcements.

Tom Williams/CQ-Roll Call, Inc. via Getty Images

Nvidia Corporation (NYSE:NVDA) reports earnings on 2/21/2024 during or after market hours. Consensus analyst estimates are for $4.56 in normalized EPS and $4.19 in GAAP EPS. Analysts expect revenue to come in at $20.33 billion. The stock has been roaring to the point that it is all everyone is talking about. It is driving the S&P 500 (SP500) with very little help, and the option chains exhibit call skew, which is usually the other way around, especially with tech stocks.

This article will discuss analyst expectations and my EPS forecast and put the upcoming earnings event in a historical perspective. Over the last 90 days, there have been 390 EPS revisions (definitely not an underfollowed stock), and they were all upwards. Yesterday, when the market was smashed on CPI, Nvidia barely budged (down 0.17%). Today, in the pre-market, it was up 1.69%. This feels unstoppable.

Companies usually exceed analyst expectations(~75% of the time). I haven’t checked the data, but I’d wager that this is even more true for companies that have just surged to become the 3rd largest company in the world. You are rarely catapulted there by missing earnings a bunch of times in a row.

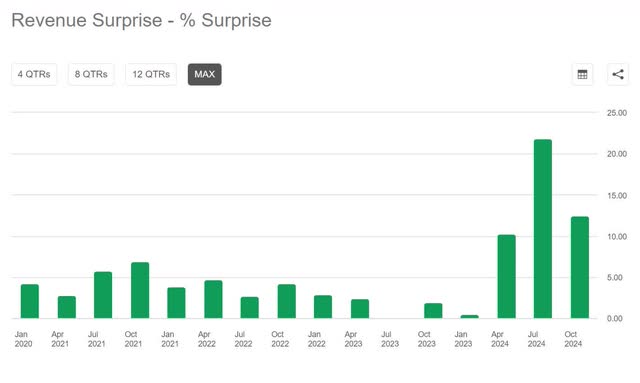

It is challenging for the company to surprise with additional sales, and surprises are more likely to be negative. Indeed, Nvidia beat 14/16 of the last EPS estimates. With growth, companies’ revenue performance is much more critical. Negative or EPS being missed is easily forgiven if a company is investing heavily in future growth AND that growth is showing up. That’s the case with Nvidia, as well. It beat revenue on 16 of the last 16 earnings estimates. I must add that it tends to be more challenging for companies to beat revenue consistently. Generally, management has less leeway to shift revenue between quarters.

earnings surprises NVDA (SeekingAlpha)

On average, Nvidia beats earnings by 9.05% in EPS. When it beats, the average beat is 11.69%. When it misses, it misses by only 9.4%. The company beats revenue by an average of 5.46%.

Based on historical data, the odds are high that the company will beat earnings again. I’d put it at 85%+ for revenue, the most critical metric. I’m experimenting with a model to get my estimates based on analyst estimates, company historical earnings data, general earnings data, buybacks, and other inputs. Then, I adjust my model for anything that warrants it. In this case, I didn’t see a need to do so. I’m still experimenting with this approach. Take my numbers with a grain of salt, but they point to Nvidia most likely beating on earnings and revenue.

| FQ4 2023 | EPS estimate per share $ | Revenue estimate ($ billions) |

| Wall Street Analysts | $4.19 | $20.33 |

| Bram de Haas | $4.4 | $22.3 |

It is hard to argue; the stock hasn’t priced that in already, though, given its incredible strength.

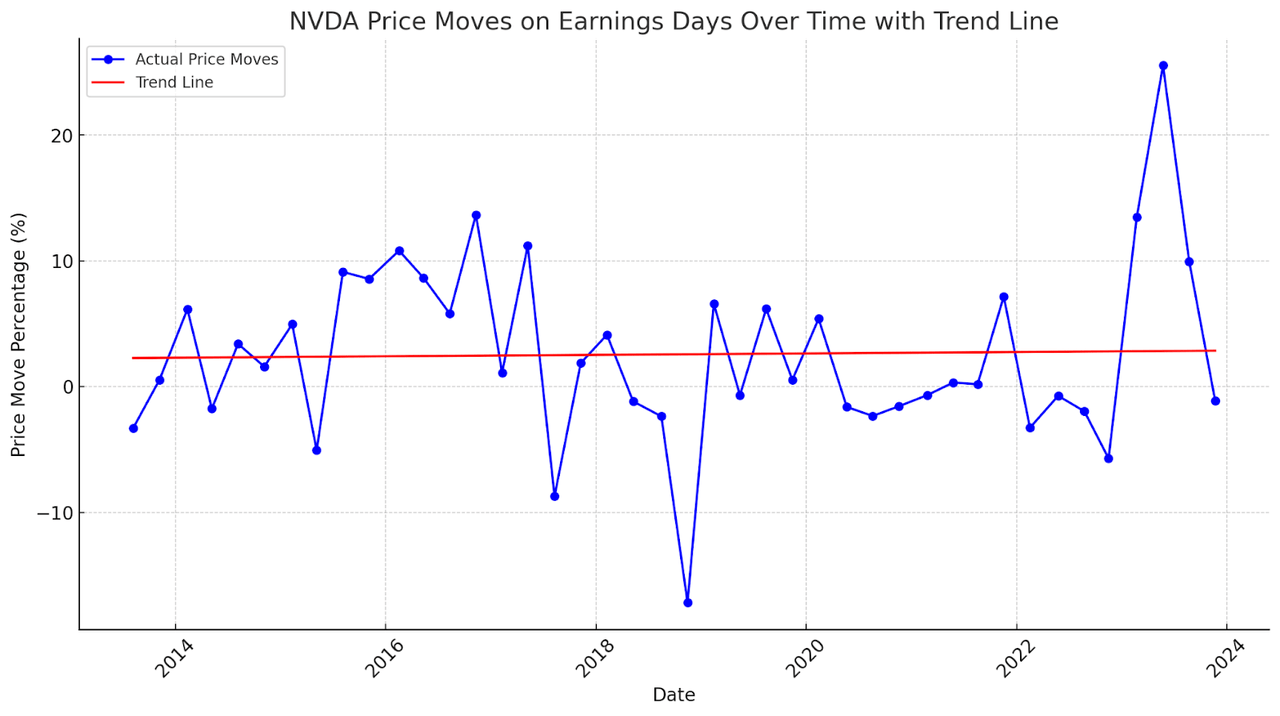

What matters is how Nvidia stock will do on earnings. I’m looking back at the data of a stock I know has been performing exceptionally well.

The profile of its earnings responses will look more favorable than the average stock. This doesn’t necessarily hold in the future because expectations have increased over time. Between the Nvidia price on the close of the day before an earnings event and the opening of the day after earnings events, the price moves look like this:

NVDA earnings price moves over time (author)

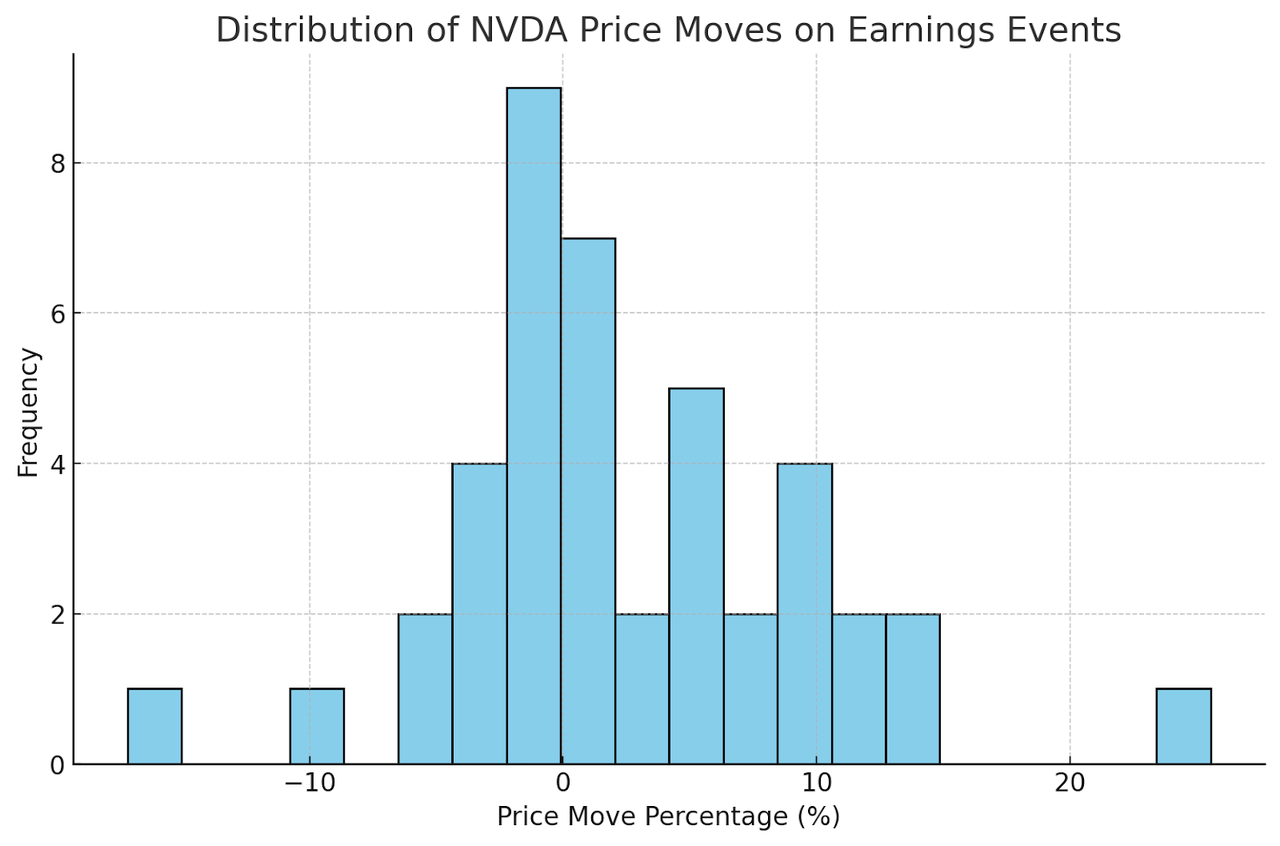

The average price move is 2.57%. This percentage reflects the average relative change in Nvidia’s price surrounding the earnings announcements. This is exceptionally high. It also looked like the share price reactions on earnings were generally large. Superficially, it also appears recent moves were relatively large compared to its history. This jives with the implied volatility being jacked and calls being more expensive than puts. Historical price distributions look like this:

Distribution of NVDA share price reactions (author)

Again remember, this is likely an exceptionally favorable profile because it has been such a terrific performer.

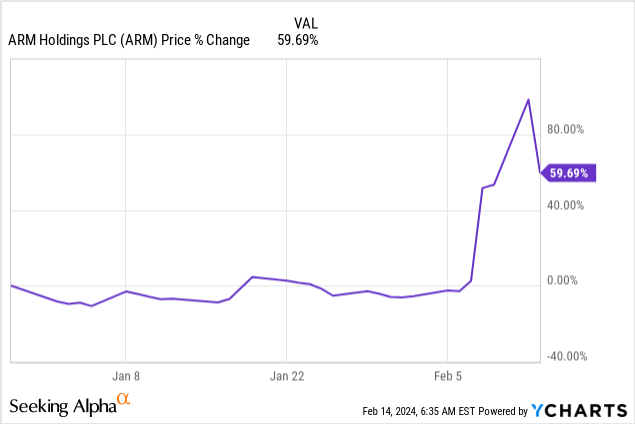

I recently did a similar Arm Holdings (ARM) analysis, where implied volatility was also elevated. The implied volatility was very high there as well. I liked selling a straddle that expired before earnings. But even selling before earnings didn’t go well. After earnings, the straddle was annihilated by extreme upward moves on the earnings event.

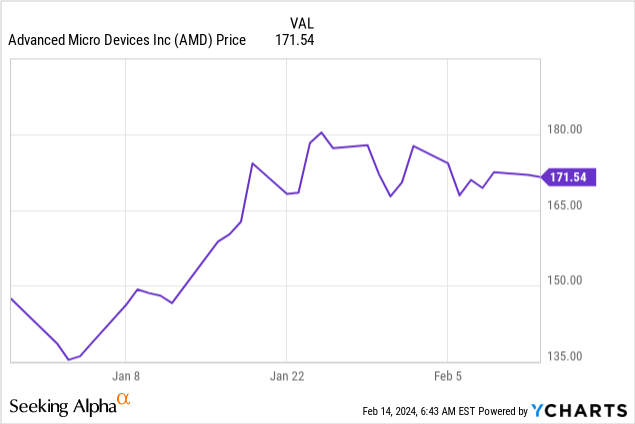

I didn’t analyze the earnings of Nvidia’s close competitor; Advanced Micro Devices (AMD), but AMD recently reported EPS exactly in line and a revenue beat. The company guided for the next quarter and tried to temper analyst expectations through that, resulting in a ~6% selloff. The selloff wasn’t too bad, but it seems to have killed AMD’s momentum for now:

With earnings events, it is interesting to look at the options chain. If nothing else, to see what kind of moves are being priced in.

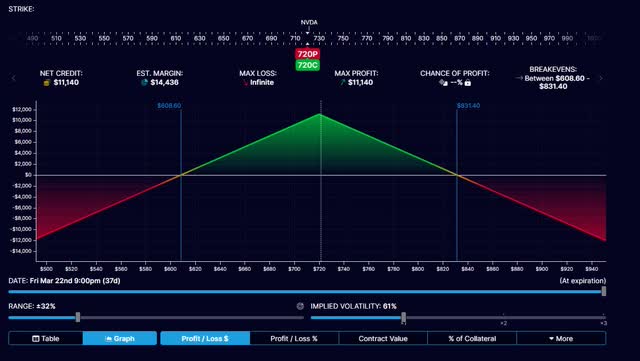

As of March 22, 2024, Nvidia’s $720 call is $56. A put at the same expiry and strike is “only” $52. If you would buy this straddle, Nvidia needs to go above $831.40 or below $608.60 before you break even. That’s roughly a 15% move up or down. Exceeding that meaningfully isn’t easy. Arm Holdings had “only” a ~$60 billion market cap before its earnings, and it wasn’t as widely followed. There were only a few Seeking Alpha articles before mine, and it only IPO’ed last year.

NVDA straddle payoff profile (OptionStrat)

So far, after doing these kinds of analyses, I’ve generally favored selling the straddle over buying the straddle. In this case, it appears to me that purchasing the straddle is currently the best approach. However, that’s with 37 days left to expiration. Nvidia has a lot of momentum upwards, which tends to revert violently. I can see it go on a terrific run or drop significantly. Volatility will likely remain very high because of the earnings coming up and the meme-stock vibes surrounding this stock. It could be an excellent option to hold the straddle towards earnings but sell out just before.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign up here for a 14-day free trial of my weekly premium trade & investment ideas. Discover the best things I can find in this market. Unique and hard-to-find ideas, selected based on the presence of edge, outstanding risk/reward and being uncorrelated or being less correlated to the S&P 500.