Summary:

- Box offers a compelling risk/reward at current levels, with improving margins and new product catalysts.

- The company dominates the enterprise content management market with advanced security and collaboration solutions.

- Box has multiple drivers for growth, including AI integration, enhanced collaboration tools, and industry-specific solutions.

Andriy Onufriyenko/Moment via Getty Images

Box (NYSE:BOX) offers a compelling risk/reward at current levels in my view. The leading Content Cloud player trails peers on growth but deserves a better multiple given improving margins, new product catalysts, and secular tailwinds for secure collaboration. After years of inconsistent execution, Box may finally be poised to accelerate growth while maintaining profitability.

Investment Thesis

Box is significantly undervalued. The company dominates the vast, $74 billion enterprise content management market with advanced security, compliance, and collaboration solutions tailor-made for complex business needs. Box leverages this market leadership into attractive SaaS economics, including 74% gross margins and over 30% free cash flow margins.

After a transitional year of billing contractions, Box has multiple drivers that I think can reaccelerate organic growth back above 10%, whether from new product innovations like Box AI or further penetration of large enterprise customers. Yet, shares languish around just ~3.6x sales or ~18x FWD earnings – an unwarranted discount in my opinion for such a sticky, profitable software vendor.

I believe Box deserves at least a 6x sales multiple, in line with other high gross margin software companies. This implies significant upside for investors buying an established market leader at a trough valuation. Box offers long-term investors a compelling mix of dominant market positioning, sound financials, and significant underappreciation in the market.

Product Offering and Competitive Positioning

As the leading pure-play enterprise content management platform, Box enjoys a dominant competitive position in a massive $74 billion market opportunity. The key features cementing Box’s leadership in the space include enterprise-grade security and compliance, e-signature and workflow automation capabilities, real-time collaboration features, and broad ecosystem integrations.

Unlike rivals Dropbox and OpenText which respectively have consumer roots or legacy on-premise technology, Box remains laser-focused on complex enterprise needs. Box is the only vendor solely optimized for securing and managing business content in the cloud, in my view. This pure-play focus allows Box to offer differentiated compliance certifications and tailor its capabilities specifically for sophisticated enterprise use cases. Additionally, Box’s cloud-native architecture positions it well to scale and serve massive clients relative to smaller niche competitors lacking similar scalability. As evidence of its market leadership, Box already counts 69% of the Fortune 500 as customers.

New Growth Levers

After a transitional 2023, I see multiple avenues for Box to reaccelerate growth in 2024 and beyond.

Most importantly, Box AI and the new consumption-based pricing model can unlock value in customers’ rising unstructured data based on early feedback. Box will need to ensure even deeper AI Integration, for example through closer integrations with leading models like OpenAI, to deliver more advanced functionality that attracts AI-driven content management customers.

Enhanced collaboration tools with point solutions like Box Canvas and tighter integrations with Microsoft Teams or Office 365 could also solidify Box as a centralized hub for collaborative content creation.

Beyond AI and collaboration, Box has room for growth by addressing Industry-Specific Solutions. Whether through partnerships or in-house development, tailoring offerings to specific industries like healthcare, finance, or legal could open up new addressable markets while also solving niche pain points.

Sharpening its vertical solutions would complement Box’s heritage serving horizontal content management needs across sectors. This dual-pronged approach could appeal to both specialized use cases and foundational enterprise-wide deployment.

I also see increased overall TAM penetration, enhanced partnerships, and expanding the international footprint powering further expansion. Box has invested substantially in product and go-to-market recently, setting the stage for a rebound in my view.

With its market leadership and embedded customer content reach, Box is strongly positioned to capitalize on these growth levers to reignite top-line acceleration beyond the recent modest results.

Billings Contraction

Admittedly, Box’s growth has been lackluster recently. In Q3 announced in December 2023, billings declined 2% year-over-year. The retention rate has also fallen to 102% indicating limited upsell and some downgrades. However, I believe billings faced tough year-ago comparisons and overall macro pressures. Underlying customer metrics remain healthy in my perspective, with a record number of $100K+ clients and best-in-class 3% churn rates. As software budgets recover, I’d expect existing customer expansion and new customer wins to drive accelerated growth for Box.

Recent Financial Performance

Over the past year, Box’s growth has decelerated due to macro headwinds. Revenue increased 6% y/y in the most recent quarter, but billings declined 2% amid foreign exchange pressures. Margins have held up better, with Box generating 30%+ free cash flow margins over the trailing twelve months. However, top-line weakness led management to moderate the fiscal 2025 growth outlook to just 5-8%.

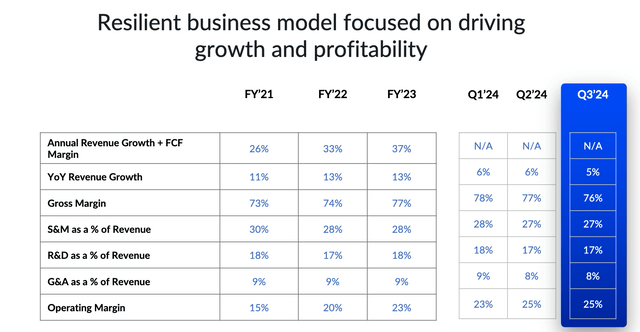

Investor Presentation

Key trends to monitor are Box’s net retention rate, which has slipped below 105%, and operating margins as growth slows. However, metrics like 3% churn and 51% of revenue from Suites indicate solid customer traction so far. The question is whether new products can drive reacceleration.

Overall Financial Profile

Despite slower near-term growth, Box generates substantial cash flow thanks to its high-margin SaaS business model. Over 74% gross margins allow Box to drive 30% free cash flow margins, with guidance pointing to an increase next year. The balance sheet is also solid, with ~$440M of cash against only $370M of LT debt. On the capital returns side, Box has $84M of share repurchase authorization remaining.

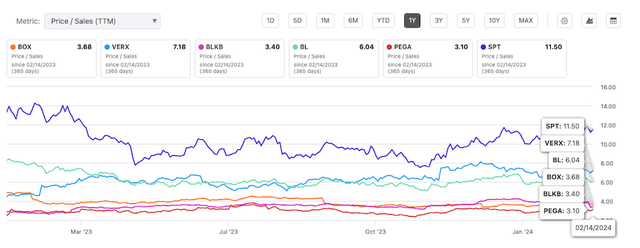

Valuation

Box currently trades around just 3.6x TTM sales. This seems extremely inexpensive given Box’s profitability, 102%+ net retention rate, and high margin profile. SaaS peers fetch at least 6-7x sales these days, even if not yet profitable. 3.6x seems too low for Box’s recurring revenue profile with high margins. A valuation convergence towards industry peers would lead to significant returns for investors.

Comparables (Seeking Alpha)

Upside Catalysts

Potential catalysts for Box include:

- Better than expected uptake of Box AI driving bigger deal sizes

- Improving net retention rates in 2024 from cross-selling

- Additional margin expansion and cash generation

- Accretive acquisitions to augment product portfolio

- Speculation of a potential buyout given low valuation

Downside Risks

Risks to the thesis:

- Prolonged weakness in software budgets

- Continued low-single-digit growth trends

- Failure to execute on AI and new product launches

- Share losses to competitors- Shareholder activism distracts management

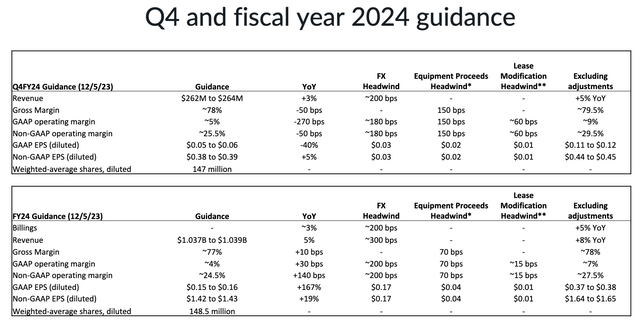

Upcoming Earnings Expectations

Box reports Q4 FY2024 earnings on March 5th. Investors should focus on early traction for Box AI adoption from the Enterprise Plus installed base. Consumption-based pricing could start becoming material. Continued operating margin expansion over the 30% level would demonstrate Box’s inherent profitability, even with modest growth.

Company Guidance (Investor Presentation)

However, the biggest swing factor remains FY25 revenue guidance. My base case is for Box to guide conservatively again near 5-7% growth. But an acceleration into high single digits would signify management’s confidence in growth rebound taking hold. The risk is a further haircut to the outlook if macro strains persist.

Conclusion

In conclusion, Box has struggled on the growth front recently, but I believe the stock deserves more credit for its secure market position in content management, sound underlying financials, and solid growth prospects. The current ~3.6x sales multiple essentially prices the Box for zero growth even though there’s a significant probability of high-single digit to low-double digit topline expansion ahead – providing substantial upside for patient, long-term investors. Given the emerging product catalysts and reasonable valuation, I rate Box stock a Buy at $26/share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.