Summary:

- UBS raises Nvidia Corporation’s earnings estimates and price target, but warns of near-term trouble for growth due to decreased lead times.

- Nvidia’s lead times for GPU orders have decreased from 8-11 months to just 3-4 months, indicating a potential future sequential growth peak.

- While Nvidia’s current growth appears strong, the stock may not be priced for the end of its growth, posing a risk for investors.

SOPA Images/LightRocket via Getty Images

Here’s something interesting. UBS just published a bullish note on Nvidia Corporation (NASDAQ:NVDA), on which it increased both NVDA’s earnings estimates and price target, to $850.

Yet, at the same time, it’s easy to argue that this note ought to raise investors’ alarms. This is so because something within the note points to near-term trouble for NVDA’s growth. And of course, NVDA stock will fare quite poorly if its growth suddenly stops. Let me explain.

Lead Times As Per UBS

As it turns out, while putting out its bullish note, UBS also claimed that over the past few months, Nvidia’s lead times have come in substantially, to just 3-4 months now.

Now, what does this mean? It means that someone ordering GPUs for AI compute right now, can expect them to be delivered in 3-4 months.

Late last year, according to other sources, these lead times were much, much larger. As much as 36-52 weeks. That’s 8-11 months.

Having earned $14.5 billion on datacenter hardware in the third quarter of fiscal 2024, Nvidia clearly sold a boatload of its H100 GPUs for artificial intelligence (AI) and high-performance computing (HPC). Omdia says that Nvidia sold nearly half a million A100 and H100 GPUs, and demand for these products is so high that the lead time of H100-based servers is from 36 to 52 weeks.

Thus, in just 3-4 months at most, it seems evident Nvidia’s lead times went from 8-11 months to just 3 months.

What Does This Mean?

Think about how Nvidia satisfies GPU orders:

- On any given quarter, Nvidia has a given production capacity (dictated by its suppliers’ capacity, mostly)

- On any given quarter, Nvidia is shipping against both past (backlog) and new orders for its GPUs.

- Also, on any given (and future) quarters, production capacity isn’t static. Nvidia is pushing its suppliers to be able to produce more and more GPUs.

However, what does it take for lead times to decrease? It’s necessary either for future production capacity increases to be outstripping future orders, or maybe also for Nvidia to be shipping product in excess of the orders being received. Or, given the extreme drop in lead times (from 8-12 months to just 3-4 months in just 3-4 months at most), likely both.

Now, remember that shipments on a given quarter are satisfying both backlog and new orders. If lead times drop to the point where backlog disappears, then shipments would fall to just new orders, which are highly likely to be lower than backlog + new orders.

This, in turn, would mean that in the quarter Nvidia eliminates its lead times (or just gets close to eliminating, since there are always delays), such will appear as a sequential drop in revenues. That is, at that point, growth will be gone.

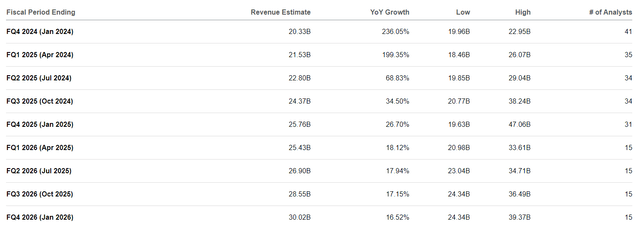

Now, obviously, Nvidia isn’t priced for such an event. Consider the existing consensus:

There’s not a single quarter-on-quarter drop in expected revenues up to the January 2026 quarter — 9 quarters into the future.

Yet, apparently more than half of the lead time was eaten in a single quarter. Meaning, we could be just 2-3 quarters away from such a negative event (end of sequential growth). And therein lies the trouble, as the stock isn’t priced for its growth to end.

This Means Little For Near-Term Growth And Earnings

Notice, however, that this rapid decline in lead times also comes from expanded production capacity. And that while such expanded production capacity hastens the inevitable end to growth, it also greatly increases the current apparent growth, revenues and earnings, since it allows more of the backlog to be shipped in the current and immediate quarter(s)!

That is, while NVDA is plunging headlong into the end of its growth, the very dynamics which take it to this event faster, also make current growth, revenue levels and earnings higher.

It’s still quite possible that NVDA will thus have another monster revenue and EPS beat when it reports Q4 FY2024 on February 21st, as well as strong guidance for Q1 FY2025. And only when it reports Q1 FY2025 and guides for Q2 FY2025, will the risk from these observations really start being felt. And that’s nearly 4 months away.

Still, often the market starts discounting problems before they arrive. And here, the problem does seem to be arriving.

This Doesn’t Mean The End Of AI Growth

Another important thing to take notice, is that NVDA’s quarterly revenues (and earnings) peaking don’t mean that AI capacity will stop growing. It won’t. All the GPUs Nvidia will keep on shipping will continue to add to an installed GPU base, even if the number of shipped GPUs stagnates or falls qoq (quarter-on-quarter, sequentially).

Moreover, Nvidia’s many competitors (AMD, META, GOOG, etc.) will also be adding to that base, through their own chip sales and orders.

Thus, AI capacity (for training, inference) continuing to grow is quite different from NVDA continuing to grow.

Conclusion

Nvidia lead times decreasing is genuine bad news for Nvidia in the “medium” term (2-3 quarters out). Nvidia right now is shipping both against backlog and new orders. Once lead times decrease to close to zero, Nvidia will be shipping only against new orders, which will tend to represent a lower revenue level when compared to shipping to backlog+new orders.

Nvidia’s exhaustion of its backlog seems set to happen 2-3 quarters into the future, given that according to UBS, Nvidia turned a 8-11 month backlog into a 3-4 month backlog in just 3-4 months.

Nvidia’s consensus doesn’t include any end to the QOQ growth even looking 9 quarters out, hence this event materializing would be quite negative for Nvidia stock.

At the same time, though, increases in Nvidia’s capacity to deliver GPUs, which will also be helping in reducing the backlog, mean that in the short-term (1-2 quarters), Nvidia might well continue to beat and raise estimates.

Still, with Nvidia having ascended to the 3rd largest market cap in the US markets based on discounting ceaseless growth into the future, caution is certainly warranted as there’s clear risk this ceaseless (sequential) growth will cease in the near future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Idea Generator is my deep-value subscription service. It’s based on a unique philosophy (predicting the predictable) and seeks opportunities wherever they might be found, by taking into account both valuation (deeply undervalued situations) and a favorable thesis.

Idea Generator has beaten the S&P 500 by around 46% since inception (in May 2015). There is a no-risk, free, 14-day trial available for those wanting to check out the service.