Summary:

- Teva Pharmaceutical has experienced a significant downturn in the last decade but has recently shown signs of recovery.

- The company has stabilized its operating income of around $3 billion for the past five years, but its large debt load is holding back shareholder value.

- Teva’s revenue growth in 2023, driven by drugs like Austedo and Ajovy, indicates a potential turnaround, but the company still faces challenges with debt and interest payments.

Comezora/Moment via Getty Images

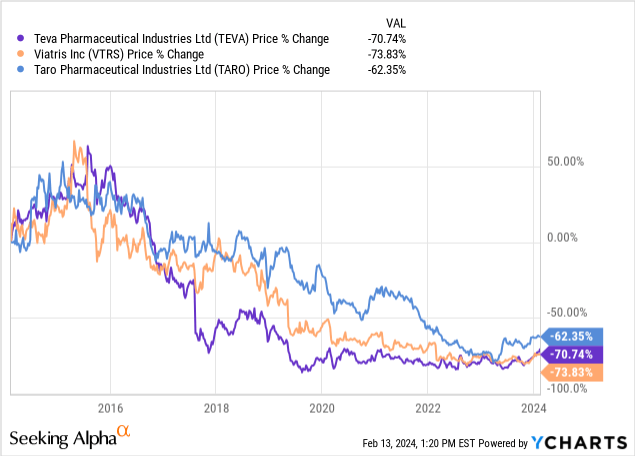

I was recently reviewing Teva Pharmaceutical (NYSE:TEVA) to see if they have turned any sort of corner. They, along with most generic drug makers, have struggled for basically the last decade. Here is a look at a Teva and a few of their competitors like Viatris (VTRS) and Taro (TARO) over the last decade:

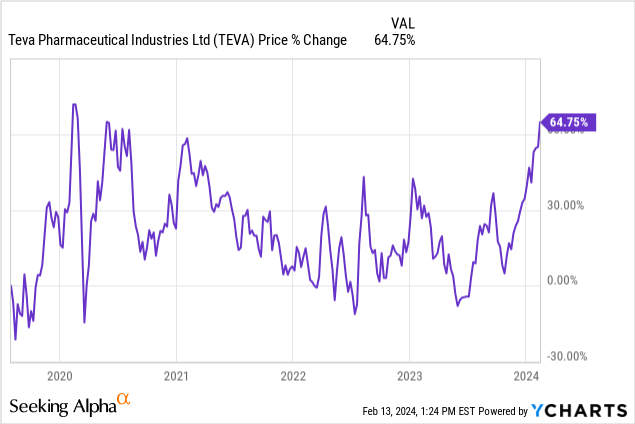

As you can see, the entire industry experienced quite the downturn for several years starting around 2016. Teva had basically hit their lows near the end of 2019 and has since treaded water until the last few months when they have recovered considerably.

So the question becomes- was this rally for Teva over the last few months grounded in fundamentals or were they just going higher with most of the market? To answer this question, I think we should first look at what brought Teva lower over the last decade in the first place.

The Long Decline

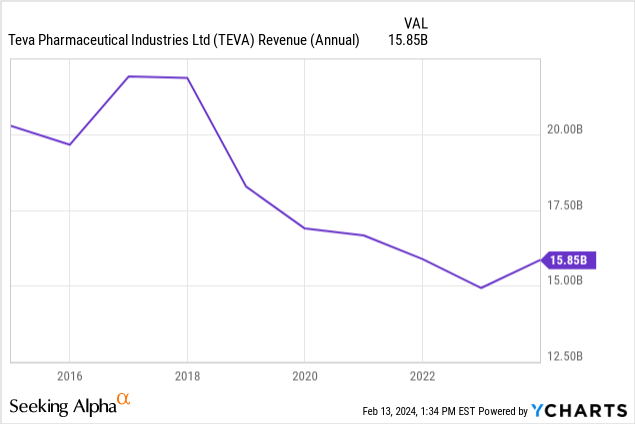

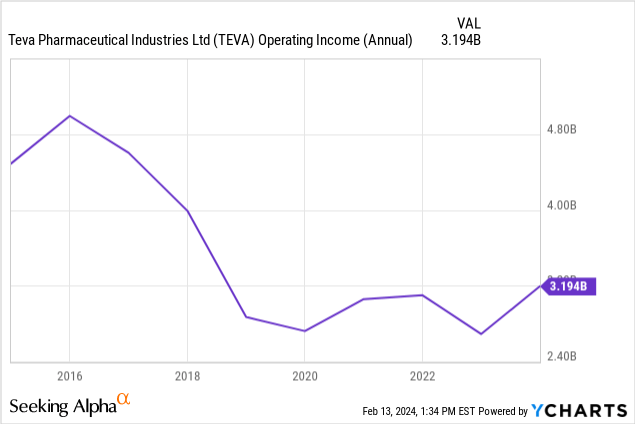

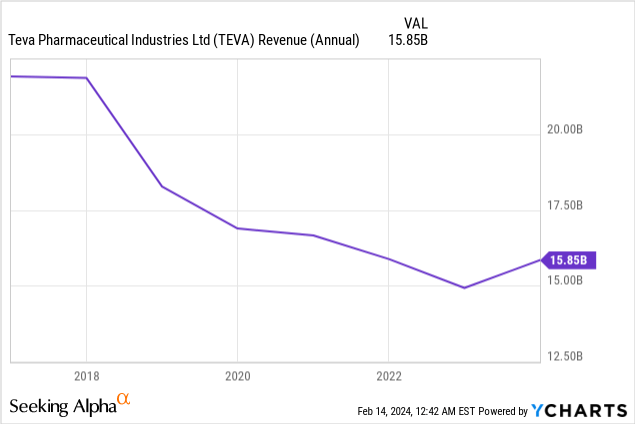

One thing I noticed while looking over Teva is that they have been losing revenues for many years. This affected both the top and bottom lines at first, but after a few years, revenue declines slowed and operating income basically held steady. I take this as a sign that management originally did their job poorly and did not prepare well for losses in the industry, nor with their large acquisition in 2016, which I’ll get to more. However, I think they eventually righted the ship and found ways to cut necessary costs as revenue declines hit the entire industry.

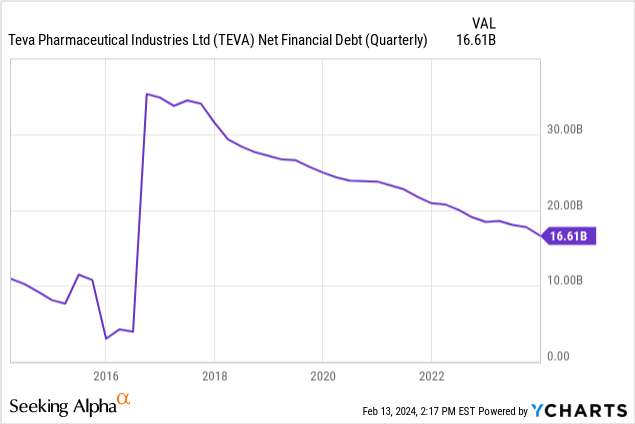

Operating income dipped below $3B in 2018 and 2019, but Teva managed to get it back above $3B for a couple years until it dipped and rebounded again. In short, they have stabilized around $3B in operating income for around 5 years now. That sounds pretty great for a company under a $15B market cap, but debt of course is the real thing holding back Teva from unlocking more value for shareholders. When including Teva’s debt load and cash, they have an enterprise value of about $32B. Most of the debt load was picked up when they acquired Allergan’s Generic business for $40.5B back in 2016.

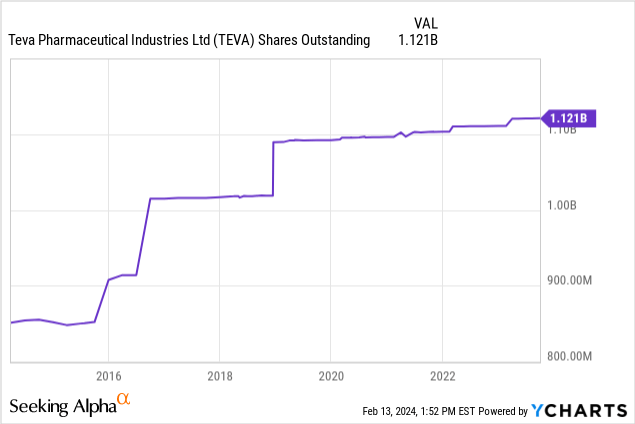

This debt load has been strangling the business ever since those revenue declines started. Teva last paid a dividend in 2017 and have been net issuers of shares every year despite the shares trading at very low P/E multiples and people clamoring that they have been a strong buy for years. To me, it always speaks volumes when the board can’t even justify buying back any meaningful amount of shares, despite the supposedly, rock-bottom prices:

The reason management could not justify a dividend or buybacks was that it had that huge debt number they had to deal with first. The good news is that Teva has done major work getting this debt down ever since they made that acquisition from Allergan:

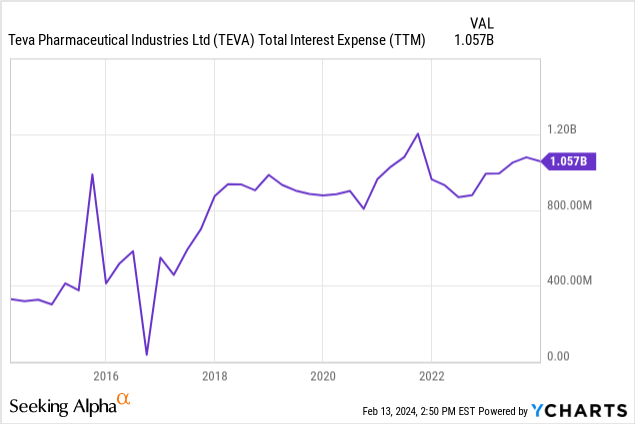

The bad news is that it has not resulted in lower interest payments for Teva. Back when they issues the debt for the acquisition, they did so with much better credit and accordingly a much lower cost of capital. They have been downgraded multiple times over the years (debt rating of BBB+ by Fitch in 2015 versus their BB- rating by Fitch that was affirmed last year) by rating companies due to their large debt load, decreasing revenues, and tougher generics environment. For those unfamiliar with Fitch’s rating scale, this is 5 steps down and knocked them firmly from investment grade debt down to junk grade.

Because of this and because of rising interest rates, last year Teva issued new, longer-term debt ranging from 7.375% up to 8.125% in order to pay off debt coming due within the next few years ranging from 2.8% up to 7.125%. Here is the chart showing just how much their interest expenses have risen even while paying off so much debt:

Is a Turnaround Almost Here?

One big reason for hope is that Teva’s revenues were finally up in 2023 as compared to 2022. Management started a ‘Pivot to Growth’ strategy in 2023 and it has been showing signs of making a difference in the topline. Two of the drugs most responsible for their growth in 2023 are Austedo and Ajovy. Uzedy also started growing in 2023, but it was just approved in April 2023, so it is from a very small base. Here is another graph of Teva’s revenues over the last few years, just to show how important this time could be as an inflection point:

Back to the drugs that are at least partially responsible for this turnaround. Austedo XR is Teva’s drug to treat both tardive dyskinesia and Huntington’s disease chorea. Its sales grew by 27% over the last year, from ~$940M in 2022 up to $1.2B in 2023. Management has also already guided for $1.5B in 2024 for Austedo sales, which if they can hit their target again in 2024, would be good for another 20% increase in sales.

Ajovy is a drug that is used as a preventative treatment for migraines. It is an injectable and they deliver it with an auto injector that can be used at home or administered by a health professional. This to me shows that its upside is probably more limited than the largest blockbuster pills as injectables typically won’t have as high of an adoption rate. It also must show the quality of their product though, because despite that hurdle, they have grown sales really well the last few years. It must provide relief from the debilitating condition that migraines are for many. They increased sales from $377M in 2022 up to $435M in 2023, which was good for a 16% increase. Teva is guiding for $500M in sales for Ajovy in 2024.

Lastly Uzedy is a much smaller piece of the pie currently, but could be great for them for many years to come. Uzedy is an injectable used to treat schizophrenia and they have guided for it to hit $80M in 2024. Who knows how much market share it will eventually garner, but they point out that the market is very large currently at ~$4B and growing at 6%. Even a 1-2% market share would help Teva out greatly in the coming years and anything more than that is gravy.

With the help of all these drugs and an upfront payment of $500M from Sanofi in Q4 2023, Teva hit total revenues of $15.8B in 2023 and has guided for a range of revenue between $15.7B to $16.3B for 2024. To compare apples to apples, I think it’s important to remove that $500M upfront payment from Sanofi I mentioned out of the 2023 numbers. This means for growth to more reasonably be compared from $15.3B in 2023 to the range of $15.7B to 16.3B given for 2024. Organic growth wasn’t quite as great as it appeared in 2023, but it also means the growth would be quite solid for 2024, if they can hit their targets.

Other Future Growth Opportunities

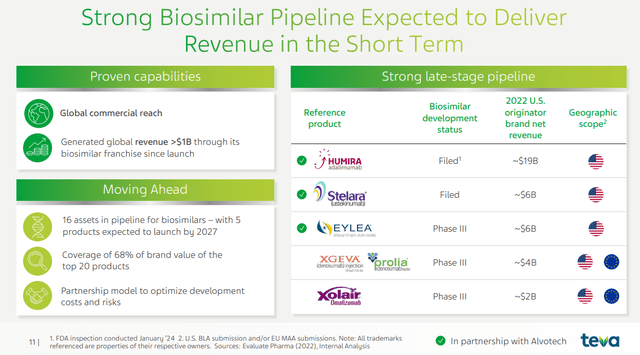

Outside of the drugs that are still showing good growth, they have a portfolio of biosimilars coming up, some of which are in the regulatory approval/filing process with the FDA and others that are still running trials. Here is a list of their largest upcoming biosimilars:

Biosimilar Pipeline (Teva Investor Relations)

Humira and Stelara both lost exclusivity in 2023. However, it will take a little longer until Teva can start competing to pick up market share of both with their biosimilars, assuming they receive approval. For Humira, management stated on their latest earnings call that they are awaiting inspection by the FDA of their partner’s (Alvotech) facility in Ireland. They need that inspection approved by the FDA in order to move forward. They have said they hope for that to happen in 2024 and for revenues to start this year, but that if it takes a while and still gets approved, then they do expect revenues to start in 2025 and beyond.

Stelara, they have a more clear timeline if it does get approved. Teva management stated on their earnings call that they expect a decision on FDA approval and a launch (if approved) in Feb 2025. While Stelara isn’t as big of a pie to try to pull from, there aren’t nearly as many competitors going after it as there are for Humira, so we’ll have to see which ends up being the larger opportunity.

I want to caution investors to remember that while those numbers next to Humira and Stelara are very large numbers, there will be a lot of competition. Not only will many want a piece of the pie, but the pie will likely get a lot smaller as biosimilars compete with each other on pricing. Furthermore, there is a chance that only a few win big, especially with Humira. If there are too many competitors moving in on Humira, it could be that only a few get recognized by payers. With Teva hitting the market with their biosimilar somewhat late, I worry that they won’t even be on the main list approved by payers.

Back to Debt

The real story to me is still the debt for the next several years. Sure revenue growth is great and will surely make it easier to maintain or grow net income, but until Teva can get back to investment grade debt ratings, I think their share price could stall. Despite moving a large amount of debt out further in 2023, they still have around $3.5B in debt coming due in either 2024 or 2025. The interest rate on this debt ranges from the ultra low 1% up to 7%, so it is very likely that if some of it can’t be paid off and has to be refinanced it will come at higher interest rates.

In fact there are still some low interest rates (1.6%-5%) coming due all the way through 2027, so I think it could still be quite some time until Teva finally starts refinancing at lower rates on the whole. While I expect Teva to keep making a dent in the debt over the next few years, it is a little disheartening to know that the overall interest paid may keep going up for a little while. With federal interest rates likely to finally lower in 2024 and their debt getting to a small enough total number, perhaps Teva can finally start seeing lower overall interest payments to go along with their lower total debt numbers.

Conclusion

There are promising signs for Teva with several drugs (namely Austedo and Ajovy) leading to revenue gains in 2023, which marked a true inflection point from a revenue standpoint. They also have a portfolio of biosimilars of some pretty popular drugs they hope to get approval for in the coming years. The debt has yet to reach an inflection point, but I am hopeful one could be reached in the next couple years with lower interest payments or debt rating upgrades both constituting more inflection points.

I am wary of any revenue growth targets until I see those kept time and time again. Keep a close eye on these numbers as they come in throughout the year to know how well management is executing or if any other macro events weigh on revenues. Revenue growth is great, but I expect the true inflection to come when debt gets low enough that Teva gets back to an investment grade rating (or at least starts heading in that direction) and interest payments start going lower. At that point, I would think management could actually consider returning money to shareholders in the way of buybacks or a dividend as well as having more options to consider for further growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TEVA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.