Summary:

- Microsoft Corporation saw substantial growth last quarter, with an 18% increase in revenue year-over-year.

- The company is betting big on Cloud and AI to drive future growth.

- I question whether this will provide the sustained growth needed to justify Microsoft’s current valuation.

LIONEL BONAVENTURE/AFP via Getty Images

This article was coproduced with Chuck Walston.

Despite its enormous market cap, Microsoft Corporation’s (NASDAQ:MSFT) cloud and artificial intelligence (“AI”) businesses are still driving substantial growth. Last quarter, MSFT reported an 18% increase in revenue year-over-year.

The company’s productivity and business processes segment grew 13%, intelligent cloud revenue increased by 20%, and personal computing was up 19%. Net income surged by 33% to $21.9 billion in Q2.

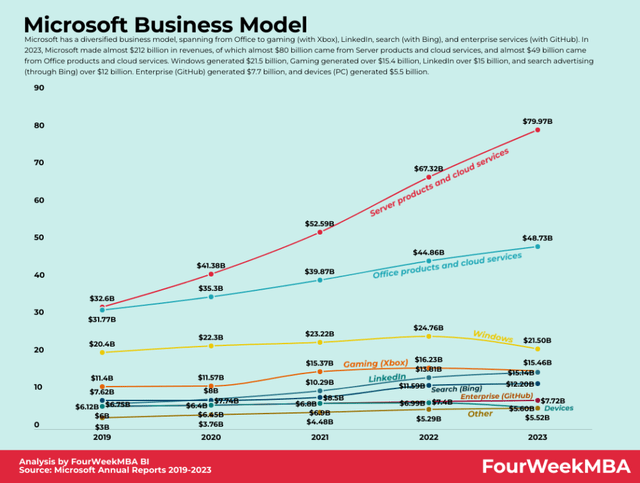

Last year, Azure grew at a 30% rate. Meanwhile, Office 365 is a near-monopoly that generates an enduring stream of recurring revenue, and the company’s push into gaming is also driving growth.

Since ChatGPT was released late in 2022, shares of Microsoft are up 67%, versus 27% for the S&P 500 (SP500), driven by investor focus on AI.

What investors must unravel is whether the behemoth that is MSFT provides the sustained growth needed to justify the stock’s current valuation.

The Activision Blizzard Deal

Over the years, much of Microsoft’s growth has been driven by acquisitions, and Activision ranks as the company’s largest deal to date.

Late last year, Microsoft completed its $68.7 billion acquisition of the video gaming king. To meet regulators’ demands, MSFT transferred the cloud streaming rights for Activision games over the next 15 years to Ubisoft (OTCPK:UBSFY, OTCPK:UBSFF).

Ubisoft has exclusive cloud-streaming rights to all Activision games, and the license is in perpetuity; however, after 15 years, any new games from Activision won’t fall under the agreement.

MSFT also has a decade-long agreement to keep Activision’s Call of Duty games on Sony’s (SONY) PlayStation consoles.

The addition of Activision will add a host of top-notch gaming franchises, and will more than double Microsoft’s gaming business to just over $24 billion.

Last quarter, Xbox revenues increased 61%, with a 55% boost from the Activision acquisition. Activision brings gaming to around 10% of Microsoft’s revenue, an increase from 7% prior to the deal.

Perhaps of greater importance is that it will shift gamers to a cloud-based experience, offering access to games through phones and TV’s, eliminating the need for costly gaming consoles.

The company added 10,000 workers to its roster with the acquisition, and following the deal’s closure Microsoft laid off 1,900 redundant video gaming employees.

Gaming should provide continued growth, with Technavio estimating that the gaming market will record a CAGR of 12% from 2021 through 2025.

Azure

Azure’s Cloud revenue grew 30% year-over-year. Compare that to the 26% growth in AWS and 16% growth in Google Cloud during the same time frame. Additionally, Microsoft estimates AI services drove 6% of the growth, double the demand in the prior quarter.

During the last earnings call, MSFT stated the company has 53,000 Azure AI customers, with over a third coming to Azure in the past 12 months. This helped to push revenue for the Intelligent Cloud segment up 20% to $25.9 billion.

Every segment is experiencing strong growth, but Cloud is the linchpin for the growth needed to drive the stock higher over the long haul. In part, that is because the segment’s robust growth has moved it past the other two segments.

Four years ago, each segment contributed about the same amount of revenue. Fast-forward to last quarter, and Cloud now generates 43% of total revenues. Furthermore, Cloud generates gross margins of 72%.

The golden goose for Microsoft is taking Azure and supercharging it with AI. We think for every $100 of [Azure] cloud spend, Microsoft can monetize an incremental $35 to $48 from AI.

Wedbush analyst Dan Ives.

MarketAndMarkets forecasts a CAGR of 15.1% for the global cloud computing market from 2023 through 2028.

Artificial Intelligence

Microsoft has made it manifest that the company will incorporate artificial intelligence (“AI”) into almost all of its products. The firm’s $13 billion investment in OpenAI’s for-profit arm, a 49% stake in the latter company, is testimony to the commitment MSFT has in AI.

However, the European Union is scrutinizing Microsoft’s partnership with OpenAI, the developer of ChatGPT. Questions center on whether the investment is in reality a merger between the two firms.

Described by some as “game changing,” Microsoft’s Copilot, based on OPENAI’s GPT-4, was rolled out late last year for the Microsoft 365 Office suite, upgrading PowerPoint, Word, Excel and Outlook.

Microsoft bills Copilot as a means to harness generative AI to enhance worker productivity on several levels. The Copilot service uses generative artificial intelligence to aid workers in doing research, making reports and other tasks.

Here’s what CEO Satya Nadella had to say about Copilot during the last earnings call:

Our own research as well as external studies show as much as 70% improvement in productivity, using generative AI for specific work tasks. And overall early Copilot for Microsoft 365 users were 29% faster in a series of tasks like searching, writing, and summarizing.

His claims were backed by Melanie Kalmar, the CIO for Dow, Inc. Following a trial period, she stated use of Copilot resulted in , “… tremendous efficiency gains.”

According to Mark Moerdler, an analyst at Bernstein, Microsoft’s AI products are “significantly more advanced than what is available from their competitors. It’s not a marketing pitch; it’s proof points.”

Nonetheless, ChatGPT has serious limitations. For one, the bot is absolutely miserable at answering simple math questions. This leads some to question whether investors are getting ahead of themselves by boosting the valuations of AI stocks.

I wouldn’t say we’re ready to spend $30 per user for every user in the company.

Sharon Mandell, CIO, Juniper Networks.

Furthermore, not all of Microsoft’s AI tools have been hits. The company’s much-hyped first release, an AI-powered chatbot for its Bing search engine, failed to make any inroads in challenging Google’s (GOOG, GOOGL) search dominance.

A Recovery In The PC Market

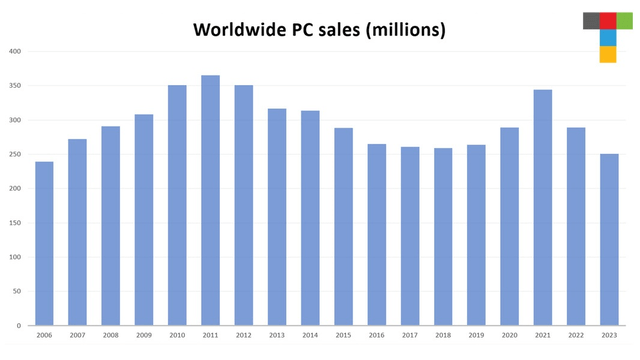

Following a marked drop in global PC sales in 2022, followed by a 14% YoY shipment decline in PC shipments in 2023, it appears as if the market is set for a rebound. Once again, AI can be credited for much of the renewed demand.

This year, Dell (DELL) and HP (HPQ) are set to launch AI capable PCs with Neural Processing Units (NPUs). Many in the industry believe this will begin a supercycle in PC sales.

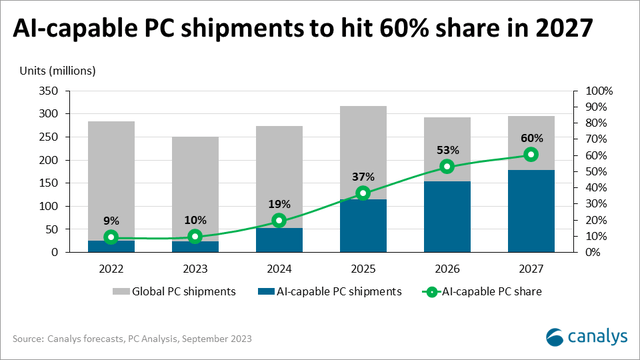

Canalys projects AI-enabled computers will constitute a quarter of the market in 2024.

Growth in sales of AI capable PCs should remain strong throughout 2025 and 2026, and in 2027, shipments are estimated to exceed 175 million units, equal to 60% of all PC sales.

Also, Windows will include AI-enhanced by late 2024.

Along with the evolution to AI capable PCs, Microsoft is ending support for Windows 10 towards the end of 2025. The following is from a report by IDC.

The vast and aging installed base of commercial PCs surpassing the four-year mark by 2024 is expected to necessitate a refresh, coinciding with the pressing demand to migrate toward Windows 11.

Debt, Dividend, And Valuation.

Microsoft’s debt is rated AAA/ stable. Microsoft is one of only two publicly traded companies with an AAA credit rating from S&P. At the end of Q2, the company had $79.2 billion in debt and $81 billion in cash and equivalents.

MSFT yields 0.74%. The payout ratio is 25.86%, and the 5-year dividend growth rate is 10.20%.

The forward P/E of 34.94x is above the 5-year average P/E for the stock of 32.60x. The 5-year PEG of 2.37x is also greater than MSFT’s average PEG ratio over the last 5 years of 2.29x.

Microsoft currently trades for $406.02 per share. The 55 analysts that follow the stock have an average price target of $465.47. Thirty-nine rate the stock a strong buy, and thirteen rate MSFT as a buy.

Is MSFT A Buy, Sell, Or Hold?

Microsoft is the very definition of Warren Buffett’s “wonderful company.”

MSFT has a wide moat, exceptional leadership, and arguably the world’s best balance sheet. There is but one potential problem investors must navigate when considering the stock as a potential investment: do the shares trade with a margin of safety?

I would argue that the answer to that question lies solely in the company’s growth prospects.

For Microsoft stock to grow at a double-digit rate, the company must generate tens of billions of dollars in new revenue every year.

Microsoft has roughly 80 million subscribers for its 365 platform. While that provides a robust source of recurring revenue, large scale revenue growth from that business is unlikely.

The gaming platform is growing at a rapid pace, but it contributes a relatively small percentage of overall revenues.

It is reasonable to argue that Cloud will generate strong growth for the foreseeable future.

However, there is no doubt that MSFT is betting big on Copilot and AI to drive growth: Copilot was mentioned 52 times during the last earnings call.

Copilot has to be a success for the stock to work.

Rishi Jaluria, analyst, RBC Capital.

However, management also has an ace up its sleeve. Since Nadella took the company’s reins, he has struck well over 300 deals, collectively valued at over $170 billion. The company acquired LinkedIn for $26 billion, Nuance Communications for $16 billion, ZeniMax Media for $7.5 billion, and now Activision for nearly $69 billion, and the list goes on.

Nonetheless, the stock now trades at the upper end of its historic valuation metrics.

If an investor has a one-year perspective, it doesn’t make a ton of sense to buy Microsoft here, because the expectations have risen. This is not going to be a good year for Microsoft when it comes to AI. The breakout years are three, five years down the road.

Gene Munster of Deepwater Asset Management.

I rate MSFT as a HOLD based on the current valuation.

I have a small investment in Microsoft Corporation, and I do not intend to add to my position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For A FREE 2-Week Trial

Join iREIT® on Alpha today… for more in-depth research on REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, Builders, and Asset Managers. You’ll get more articles throughout the week, and access to our Ratings Tracker with buy/sell recommendations on all the stocks we cover. Plus unlimited access to our multi-year Archive of articles.

Here are more of the features available to you. And there’s nothing to lose with our FREE 2-week trial. Just click this link.

And this offer includes a FREE copy of my new book, REITs for Dummies!