Summary:

- Amazon’s stock has rallied by 88% in 2023, leading to high market expectations that may be difficult to meet.

- Current stock price assumes 16% sales growth and 10% operating margin for the next 10 years, which may be overly optimistic.

- Intense competition in e-commerce and cloud services adds additional constraints, potentially limiting multiple expansions.

- Risks include a potentially adverse macroeconomic environment, rising competition from new entrants, and the challenge for Amazon to balance pricing for operating margins without sacrificing volume growth.

DIMITAR DILKOFF/AFP via Getty Images

Investment Thesis

Shares of Amazon.com, Inc. (NASDAQ:NASDAQ:AMZN) have rallied by 88% in the year 2023. The recent rally has led to higher embedded expectations in the stock price. My reverse DCF valuation indicates, in order to justify the current stock price of $168, Amazon would need to achieve 16% sales growth coupled with a 10% operating margin for the next ten years. In my view, these assumptions are too high at current levels, as further margin improvements will come at the cost of volume growth. Moreover, Amazon still faces fierce competition, in both the e-commerce and cloud business, which could put further limits on multiple expansions. I therefore assign Amazon a Hold rating at current levels, as I believe market expectations have become overly optimistic.

Solid Fundamentals, But Worrying Macro Trends

Amazon reported strong growth in sales and profits last quarter, mainly supported by robust holiday spending. Moreover, Amazon gave a solid outlook for the current quarter, as the company benefits from the increased interest in AI. The company reported profits of $10.6 billion for the three months through December, paired with ~14% revenue growth YoY. I think the company needed to show increasing profits, as market participants put more weight on profitability in a high interest-rate environment. Notwithstanding the good news, strong consumer demand seems to be decelerating. The recent retail sales report has shown signs of weaknesses in the economy, which might directly affect Amazon’s growth trajectory. I believe this is an important trend to monitor, as it directly impacts Amazon’s sales momentum. As I show in my reverse DCF model, investors expect top-line growth of ~16% for the next years. If consumer spending declines further, this could significantly affect Amazon’s valuation, leading to compressing multiples.

Shareholder Value Drivers

During the pandemic, Amazon invested heavily in its logistic network in order to deal with increased demand. However, as growth started to slow, the company was confronted with a situation of overinvestment in its distribution and logistics network. This led to a subsequent decline in its share price. However, shares have recovered sharply in the year 2023, appreciating by 88%. As growth started to rebound, the company could effectively leverage its excess capacity and thus drive sales and operating margins. I believe the key question for Amazon lies in the profitability of its overall business. I can see the company making further progress in managing costs and leveraging capacity, thus driving margins higher in the long term.

Amazon’s e-commerce business exhibited a retail share of ~38% in 2023. I believe the company will continue to capture market share due to its durable moat. Customers tend to highly value fast and free delivery, which requires a large distribution and logistics network. To put it briefly, competitors will face difficulties in providing the same value proposition as Amazon’s, due to the high capex requirements and a protracted learning curve, needed to set up a dominant e-commerce business. I see this business generating margins in the high single-digits and thus not significantly contributing to operating margins. However, I see a strong upside as Amazon’s ad business continues to unfold. In my view, the company can achieve 30-35% margins on its ad business, similar to those of Google and Meta. Moreover, increasing Prime membership monetization and a 3P mix shift can lead to profitability upside.

The key value driver for shareholders, in my view, will be AWS. Gartner expects that by 2025, more than half of IT spending in the enterprise segment will shift to the cloud. According to other estimates, the current adoption of public cloud workloads lies between 15% and 25%. Even though expansions of workloads will probably lead to further price decreases, the increased volume will most likely offset pricing pressure. IoT Analytics expects the TAM for Amazon to expand in the upcoming years, reaching a $2 trillion market opportunity. If Amazon can continue to maintain its dominant market position, this could lead to significant multiple expansion, due to the high profitability of its cloud segment. I believe margins can rebound to 30% if the company continues to execute well. Amazon’s dominant market position should be bolstered by its strong competitive position, predominantly high capex requirements, and significant switching costs from changing providers. This underscores the thesis that AWS will benefit from a strong secular trend, which should drive sales and profitability for many years to come.

However, this is largely embedded in the stock price. As my reverse DCF valuation analysis shows, markets expect strong top-line growth coupled with double-digit operating margins for a long period. In my view, these high expectations leave little room for error and put a limit on multiple expansions.

Valuation: Revealing Market Expectations

Rather than sticking with vague assumptions, I believe it is more sensible for investors to quantify current market expectations in order to see what is embedded in the stock price. Only in this way, investors can compare their assumptions to those of the market.

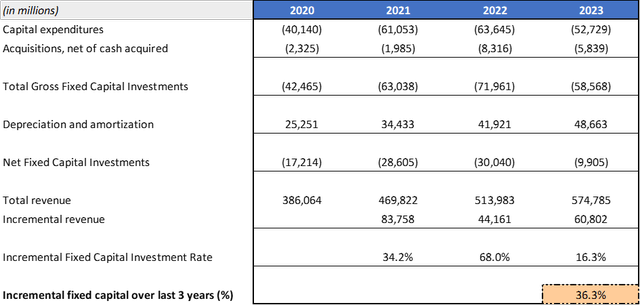

In my reverse DCF model, I first computed incremental fixed capital, where I considered capital expenditures and acquisitions net of cash acquired. As my model shows, Amazon has incurred significant capital expenditures throughout the last three years, in order to deal with increased demand during the pandemic. Incremental fixed capital has averaged 36.3% over the last three years. I believe capex will remain high in the distant future, however slightly subdued on a relative basis, as the company is still leveraging excess capacity. I therefore assumed a 25% incremental fixed capital rate for my model.

Incremental Fixed Capital (Author’s calculations)

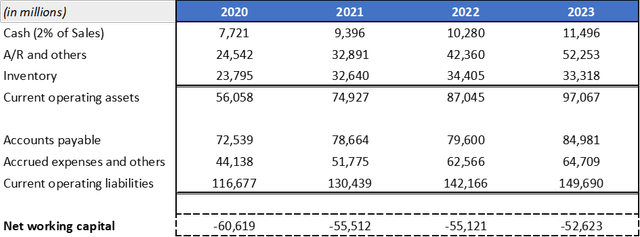

Next, I determined incremental working capital for Amazon, by using data from the previous years. The company has continuously benefited from a negative cash conversion cycle. In my view, Amazon will be able to achieve negative working capital for many years to come. The company can sell its inventory quickly (lower DIO), receives its cash upon sale (lower DSO), and is able to defer payments to its suppliers (higher DPO). I assumed cash tied to operations to be around 2% of sales.

Net Working Capital (Author’s calculations)

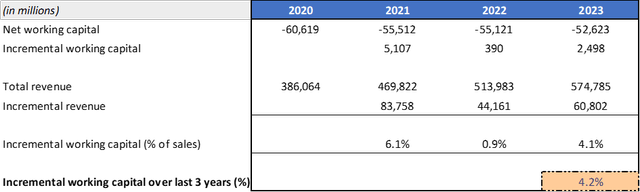

As already mentioned, I see Amazon to continue exhibiting negative working capital in the near future, due to its sheer size and economies of scale. I therefore stuck with my computed value of 4.2% incremental working capital over the last three years.

Incremental Working Capital (Author’s calculations)

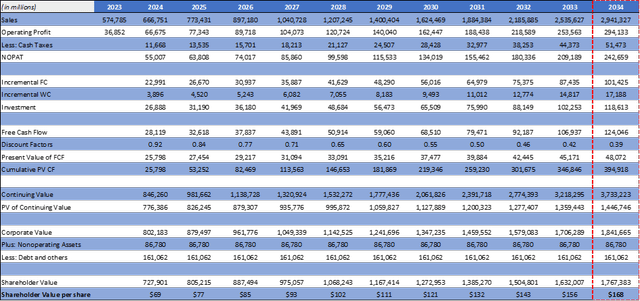

As of February 16, Amazon traded at $168. In order to discern the assumptions leading to this stock price, I used analyst estimates for sales and operating margins and made necessary revisions. As my model implies, at the current share price of $168, markets expect 16% sales growth coupled with a 10% operating margin to continue for 10 years. I note that slightly different results might arise by adapting the projection period. However, I believe a 10-year projection period for Amazon is reasonable, as markets recognize the company’s durable competitive advantage and growth opportunity, leading to a longer period of generating cash flows. In addition, I applied a 9.0% WACC for Amazon and utilized a 2.50% growth factor (reflecting ongoing inflation estimates) for the computation of continuing value. Cash taxes are expected to be at 17.50%.

Reverse DCF Model (Author’s calculations)

I find the current expectations embedded in the stock price too optimistic. I note that revenues have increased by ~14% YoY in the recent quarter. Given the law of large numbers, the implied top-line growth seems too high at current levels. Moreover, operating margins need to stay at 10% in order to justify the current stock price. I believe the combination of achieving both together is difficult because price increases aimed at driving operating margins may come at the cost of volume growth. The projections for operating margins are also above current levels, as operating margins have been at 6.4% in the last quarter. In my view, rapid advancements in top-line growth might come at a cost of margin compression for Amazon. Even though I can see a significant margin upside for the company (ad business and AWS), this seems to be largely priced into the stock. For instance, if one assumes operating margins of 7%, this will require 22% revenue growth for Amazon to justify the current stock price.

Risks

My main concern lies in the current state of US consumers and retail. Retail sales have slowed according to the most recent report, and it remains crucial to see if weaker consumer confidence levels will stay elevated. Higher interest rates, diminishing excess savings, and the return of student loan payments are all factors that could adversely affect Amazon’s valuation.

Moreover, increased competition from newer entrants (e.g., TikTok Shop, Temu & SHEIN) might put pressure on margins. As newer entrants try to capture market share by offering lower prices to consumers, I expect Amazon to follow suit. Over the long term, I believe Amazon will sustain its dominant market position, due to its strong moat, wide range of products and consumers, and unassailable Prime value proposition.

Summary: Amazon – A Great Company, but Expectations are too High

Amazon should continue to benefit from strong secular trends, especially the increasing transition to the cloud. In my view, AWS and advertising have the potential to enhance margins and deliver upside potential. However, at the current share price, lots of optimism seems to be embedded in the stock price. My reverse DCF implies that the current share price of $168 is justified by 16% top-line growth and a 10% operating margin for the next years. I believe that these assumptions are too ambitious, given the persistent competition in the cloud and e-commerce business. I therefore assign Amazon a Hold rating at current levels. The main risks I see for the company are increased competition, in both cloud and e-commerce and a worsening macro environment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.