Summary:

- Lucid Group’s stock has dropped by over 60% in the past year due to weak business performance.

- The company has strong technology and well-designed vehicles, but struggles with scaling up operations and high selling prices.

- Potential factors that could turn around Lucid’s stock include a buyout by Saudi Arabia, success with the upcoming Gravity SUV, and operational improvements.

ROBYN BECK/AFP via Getty Images

Article Thesis

Lucid Group, Inc. (NASDAQ:LCID) is an electric vehicle company with potential, but also with a weak business performance. Over the last year, the company’s shares have cratered, dropping by more than 60%. Let’s take a look at what could help the stock turn around.

Past Coverage

Lucid Group is an EV company I have covered in the past, most recently in May 2023. In that article, I argued that the company had major problems, such as its hefty cash burn rate and its weak production growth. I concluded that Lucid was a stock I was staying away from at the time — so far, this has been the right decision, as Lucid Group has dropped by around 50% since that article was published last May.

Lucid’s Problems Have Made The Stock Drop Lower And Lower

The last two years have not been easy for electric vehicle stocks — euphoria around the technology has waned, and with rising interest rates, investors’ interest in unprofitable companies has diminished. Many EV players, even profitable ones like Tesla (TSLA) have seen their shares fall considerably from the bubble highs during the cheap-money days during the pandemic. Lucid Group definitely belongs to that group as well — shares peaked at more than $50 in early 2021 but have fallen by more than 90% from the top. Still, Lucid Group is valued at close to $10 billion, thus Lucid Group is not a micro-cap at all — unlike some other EV players that have fallen from grace.

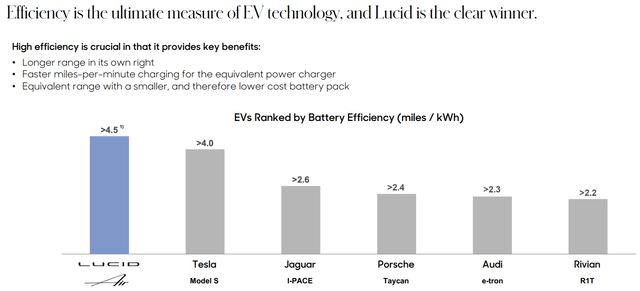

Lucid Group has strong tech and the vehicles the company produces are well-designed. This is, for example, shown by the following chart from a Lucid presentation (on Lucid’s investor relations website):

Lucid tech versus peers (Lucid investor presentation)

We see that the company has a superior battery efficiency in terms of miles per kWh compared to competitors such as Tesla, Porsche (OTCPK:DRPRF), Rivian, and so on. Motortrend.com reports that Lucid’s Air Grand Touring has the longest range of all EVs on the market in the US.

Lucid also is a supplier of electric motors for Formula E — this likely wouldn’t be the case if its technology was weak, as Formula E would have opted for a different supplier in that case.

Lucid’s first vehicle, the Air, has gotten great reviews and has even won major prizes such as the MotorTrend Car of the Year in 2022 and the World Luxury Car of the Year in 2023. Designing vehicles with appealing tech that are well-received is thus not Lucid’s problem — the company is doing well on that front.

Unfortunately, the company has some other major problems. One of these is that the company is having a hard time scaling up its operations. Lucid Group has started producing vehicles at more or less the same time as Rivian (RIVN), another EV player that was very hyped during the peak of the EV bubble. But Rivian has done a much better job scaling up its operations, as Rivian produced 57,000 vehicles last year, versus just 8,000 for Lucid. Lucid’s vehicles are pricy, but so are Rivian’s vehicles, which is why the big gap in production numbers, despite a relatively comparable “starting time” is concerning.

Lucid also seems to have somewhat of a demand problem. Last year, CEO Peter Rawlison hinted at the fact that demand issues play a role in the sub-par production growth. Lucid’s demand issue is not due to the vehicles being badly designed or featuring weak tech. Instead, one of the likely reasons is a pretty high selling price for Lucid’s vehicles. Many consumers can’t purchase highly expensive vehicles, and even those who can do not necessarily want to buy a pricy vehicle from a company they don’t really know. Also, Lucid’s decision to enter the sedan market can be seen as a mistake — the sedan market is not especially large, and the luxury sedan market is even smaller. Rivian’s decision to go for the much larger pick-up and SUV markets was a good one, but Lucid’s decision to go for the luxury sedan market was arguably a bad one.

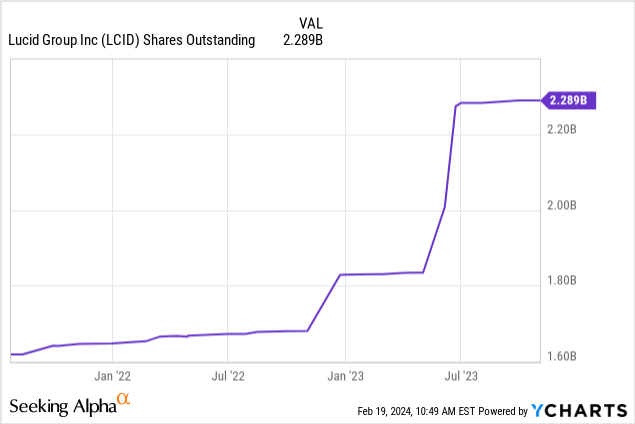

The third major is partially caused by the other issues Lucid has. The company is burning large amounts of cash, which means that it has to dilute shareholders again and again in order to not run out of cash — the dilution is well-documented in the following chart:

A rising share count means that each share’s portion of the overall company declines, and with the share count growing by around 40% in less than three years, that is a considerable headwind.

What Could Make Lucid’s Stock Turn Around?

But while Lucid Group has major issues, Lucid is not a lost cause. Instead, the company also has some major opportunities. While I am staying on the sidelines for now and do not consider Lucid a great buy here, there are things that could make Lucid’s stock rise considerably in the foreseeable future. Let’s take a look.

First, Lucid is a major buyout candidate. One of Saudi Arabia’s wealth funds already owns a huge stake in Lucid and cooperates with the company when it comes to bringing EV tech and production to Saudi Arabia. It would not be outrageous at all if this fund, Public Investment Fund of Saudi Arabia, decided to buy out the remainder of the company as well. Considering the scale of PIF, which has hundreds of billions of dollars in assets, acquiring the remainder of Lucid would not be very costly and would give Saudi Arabia even more control over questions such as where future plants are being built. Saudi Arabia wants to become a major player in EV production in the future as the kingdom seeks to diversify its economy, thus a Lucid takeover could make sense. In that case, the takeover premium that would (likely) be required to seal the deal could result in a nice jump in Lucid’s share price.

The second opportunity for Lucid is its upcoming new model. While Lucid’s decision to go for luxury sedans with its first model can be seen as a mistake, the company could be more successful with its second model, the Gravity. The Lucid Gravity is a sports utility vehicle that was presented late last year and that will likely be available late this year. The SUV market is large and keeps growing, thus exposure to this market segment is a positive thing for Lucid. If the Gravity has strong tech, like the Air, then the Gravity could be a major success. In the recent past, investors were very unhappy with Lucid’s lack of growth, but momentum and sentiment could improve substantially if Lucid is successful with the Gravity SUV. That is, of course, not guaranteed, but the next model release is an opportunity for the company for sure.

A third factor that could help Lucid’s shares climb again is operational improvement. Again, this is far from guaranteed — maybe not even very likely — but there’s an opportunity for Lucid for sure. If the company is able to improve its production more meaningfully, more smoothly, and at lower costs in the coming quarters, that could ease investor concerns and could result in increased demand for Lucid’s shares. Lucid will report its quarterly earnings for the fourth quarter soon, and the company will likely update its production and delivery expectations for the current year. If things look better than expected by many investors today, then that would be a positive sign. If Lucid can reduce the cash burn, become more efficient and faster at producing vehicles, and if Lucid can market and sell its vehicles better, then the value of the business would improve a lot and that would likely be reflected in the share price, too.

Earnings Expectations

Lucid will report its earnings results on Wednesday afternoon. Right now, analysts are expecting sales of $182 million — which would mean that sales would be lower compared to the previous year’s quarter. That’s not a great thing in general, and especially not for a company that is/should be a growth investment. Lucid’s Air comes in different versions, and those have different prices — the ones Lucid sold initially were the costlier ones, thus a shift in the product mix is a headwind for sales. Unfortunately, Lucid is expected to report a major net loss once again, forecasted at $0.32 per share, or around $700 million on a company-wide basis.

In the last couple of quarters, Lucid has missed revenue estimates repeatedly, and the track record versus expectations on the bottom line isn’t great, either. The good news is that many investors are likely expecting another disappointment already — and if sales are stronger than expected, or if the net loss is smaller than expected, that could be a major positive for Lucid’s stock.

The cash burn number will be important as well, both in absolute terms and relative to Lucid’s cash balance at the end of the quarter, as this gives an indication of when Lucid will have to access equity markets again. A stronger-than-expected cash flow performance would reduce the chance for a secondary offering in the near term and could thus result in share price appreciation, but the opposite holds true as well: If cash burn was heftier than expected, the chance of a near-term secondary offering increases, which could result in selling pressure for LCID’s shares.

Takeaway

Lucid Group has major problems, but not everything is looking bleak. While I do not own shares and remain on the sidelines, there are several scenarios that could result in substantial near-term and/or long-term upside for LCID’s shares. A takeover by Saudi Arabia, success with the upcoming Gravity, or even improvements in cash burn, production, and sales momentum could lift Lucid’s shares that have been sold relentlessly over the last year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!