Summary:

- Nvidia Corporation reported fiscal Q4 2024 earnings and shared its outlook for fiscal Q1 2025.

- Nvidia’s Q1 guidance implies that it will achieve run-rate earnings per share of about $22 in Q1.

- Nvidia’s valuation remains realistic given the strong continuing growth in AI accelerators, along with significant long-term opportunities in software, automotive, and CPUs.

- My price target for the end of the year is $930, and I see material upside beyond $1000.

- Overall, Nvidia stock remains a strong buy for me.

NurPhoto/NurPhoto via Getty Images

After much anticipation, Nvidia Corporation (NASDAQ:NASDAQ:NVDA) reported fiscal Q4 earnings, along with its outlook for fiscal Q1, after the close yesterday (February 21, 2024). Nvidia shares climbed 9% and reached $735 at the end of post-market trading. Nvidia reported solid beats on both top and bottom lines. Additionally, Nvidia’s guidance for Q1 is also very positive, and this is what I will be taking a closer look at in this article.

My calculations suggest that Nvidia is guiding run-rate earnings per share of about $22 (annualized) in Q1. Moreover, as I will discuss below, there is a good chance that: (i) Nvidia will beat its guidance, since it seems to have been sandbagging guidance the past few quarters; and (ii) Nvidia will keep growing well beyond Q1. As such, in my view Nvidia’s current valuation around 33x run-rate earnings is still realistic given the firm’s continuing strong performance and future growth potential.

Overall, I maintain my strong buy rating for NVDA stock.

The Q1 Guidance And Implied Earnings Per Share

Nvidia provided the following outlook for fiscal Q1 2025:

- Revenue: $24.0 billion, plus or minus 2% (i.e., $23.52b-$24.48b).

- Gross margins: 76.3% (GAAP) and 77.0% (non-GAAP), plus or minus 50 basis points.

- Operating expenses: $3.5 billion (GAAP) and $2.5 billion (non-GAAP).

- Other income: $250 million.

- Tax rate: 17.0%, plus or minus 1%, excluding discrete items.

We can use these figures to determine the earnings per share implied by Nvidia’s guidance. I will use the same share count as Q4 (2,490m).

Here are the GAAP calculations first:

- Revenue: $23.52-24.48 billion.

- Gross profit: $17.83-18.80 billion.

- Operating profit: $14.33-15.30 billion.

- Net income: $11.96-12.85 billion.

- GAAP EPS: $4.80-$5.16 (run-rate EPS: $19.20-$20.64).

And here are the non-GAAP calculations:

- Revenue: $23.52b-24.48 billion.

- Gross profit: $17.99-18.97 billion.

- Operating profit: $15.49-$16.47 billion.

- Net income: $12.90-14.04 billion.

- Non-GAAP EPS: $5.18-$5.64 (run-rate EPS: $20.72-$22.56).

As readers can see, at the midpoint, Nvidia’s implied non-GAAP EPS for Q1 is $5.41, or a run rate of $21.64/year. I am rounding up to $22, which would require Nvidia to clock in at $5.50 for the quarter, which is only 1.7% higher and still within Nvidia’s implied guidance range. This rounding up is quite conservative, and in my opinion Nvidia is quite likely to meet or exceed it, given that Nvidia seems to have been sandbagging revenue guidance for a few quarters now (presumably in order to avoid overpromising as the company makes all-out efforts to ramp capacity).

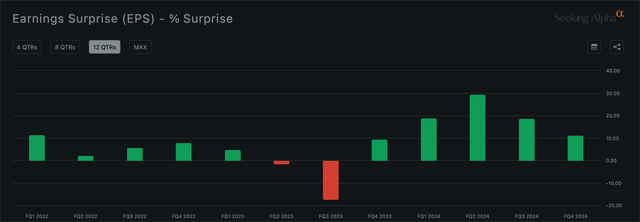

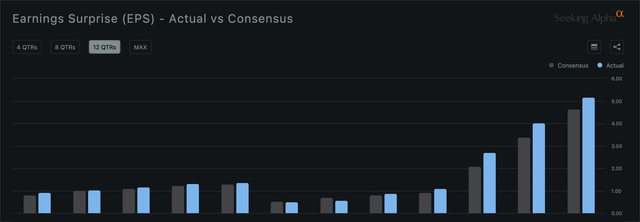

As readers can see in the figures below, since the start of the post-ChatGPT AI boom, Nvidia has solidly beat consensus analyst estimates each quarter (analyst estimates have tended to track guidance pretty closely). In fact, for the last three quarters, Nvidia has beaten by more than 50 cents each quarter. Hence, I think that my rounding up from the midpoint of $5.41 to $5.50 does not stretch credulity, and Nvidia could very well exceed the $5.50 figure. I, therefore, feel quite confident in saying that Nvidia is guiding run-rate annual EPS of $22 for Q1.

Expect More Growth Through Fiscal 2025 (And Perhaps Beyond)

In addition to the strong guidance for Q1, Nvidia’s growth also seems likely to continue for some time, for a few reasons.

First, there continues to be very high demand for AI accelerators, where Nvidia continues to enjoy a leadership position. Per management on the earnings call, Nvidia’s updated H200 accelerators are on track to ramp production in fiscal Q2, and next-generation B200 AI accelerators are scheduled to launch this year. Management noted that (emphasis added):

Supply of Hopper architecture products is improving. Demand for Hopper remains very strong. We expect our next-generation products to be supply constrained as demand far exceeds supply.

Later, management added that:

There is no way we can reasonably keep up on demand [for new accelerators] in the short term as we ramp.

In addition, I expect that prices for Nvidia’s upgraded AI accelerators (especially the B200) will likely be higher than for H100 accelerators (which, in turn, were more expensive than previous-generation A100 accelerators). At least Advanced Micro Devices (AMD) CEO Lisa Su has already endorsed the expectation that each subsequent generation of AI accelerators will sell for a higher price, driven by increases in silicon content and memory capacity (leading to more performant chips). It is difficult to say exactly how much the price boost may be, especially since Nvidia doesn’t directly disclose prices for AI accelerators, but I think we can reasonably assume that there will be some increase in AI accelerator prices (especially if Nvidia is supply constrained), and that this will help Nvidia grow further.

Of course, competition for the AI accelerator market is heating up, with AMD the most significant challenger in my view (there are others, including chip startups like Groq, but given industry-wide capacity constraints and the time it takes for production to ramp, I do not expect them to take much market share this year). My current forecast is that AMD will capture 8-10% of the AI accelerator market by Q4 2024 (readers can see my analysis in the article “AMD: The 2024 AI Outlook Is Very Positive”). This is significant progress for AMD, but I still expect Nvidia to continue to command the lion’s share of the market this year. And if Nvidia’s upcoming accelerators remain supply-constrained for another few quarters, then it does not seem like AMD will slow down Nvidia’s growth much, as the overall market for AI accelerators continues to grow very rapidly. It is worth noting here that AMD is forecasting 70% annual growth in AI accelerator total addressable market, or TAM, through 2027, so it would seem that Nvidia can keep growing quickly this year despite share losses to AMD, and perhaps for multiple years down the line if AMD (and Nvidia’s) forecasts of strong secular growth for multiple years turn out to be accurate.

On the long-term growth front, investors should be further pleased with some of the new commentary from management. Management estimated that “in the past year approximately 40% of data center revenue was for AI inference,” with CEO Jensen Huang later adding that “the estimate is probably understated.” Hence, it seems that inference workloads are taking off. In addition, it seems that recent investments toward AI by customers are now beginning to bear fruit. Nvidia listed a slew of firms, including Microsoft (MSFT) and Meta Platforms (META), that are seeing improved revenues and profits as AI drives gains in productivity and introduces efficiencies to recommendation systems such as those underpinning “e-commerce, social media, news and video services, and entertainment.” Customers seeing good returns on their AI investments is critical for the sustainability of demand for Nvidia AI accelerators and the company’s long-term growth, and it seems that the initial signs are very positive.

Second, in addition to potential growth for Nvidia in the AI accelerator market, Nvidia also faces a very large opportunity in software which it has barely tapped for now, and for which it is very well positioned given its leadership in AI software for many years. Nvidia sees a $300 billion opportunity (in terms of TAM) for AI Enterprise and Omniverse Enterprise software, although Nvidia’s currently software sales are only around a $1 billion run rate. However, on the software front, Nvidia CEO Huang provided some new commentary that should please investors:

We are going to do the management, the optimization, the patching, the tuning, the installed-base optimization for all of their [customers’] software stacks…. We call it NVIDIA AI Enterprise…. it’s an operating system for artificial intelligence. And we charge $4,500 per GPU per year. And my guess is that every enterprise in the world, every software enterprise company that are deploying software in all the clouds and private clouds and on-prem [on-premises], will run on NVIDIA AI Enterprise, especially obviously for our GPUs. And so this is going to likely be a very significant business over time.

Given that Nvidia is estimated to have sold 1.5-2.0 million AI accelerators in calendar 2023, with another 3.5 million estimated for calendar 2024, it is easy to see the significant revenue potential here. If attach rate is high (as management claims) and, say, 40% of accelerators sold generate $4,500/year in software revenue, then an installed base of around 5 million exiting the year would imply run-rate AI Enterprise revenues of $9 billion exiting the year – an increase of about $8 billion from now. In addition, of course, the installed base will keep growing each year because it is cumulative, so software revenues could see growth for multiple years. And this growth in software sales still does not include Omniverse or other avenues for software revenue growth.

Investors should, therefore, watch Nvidia’s software revenues very closely in coming quarters since there could potentially be quite a lot of growth here.

Third, Nvidia continues to work on its automotive segment, although revenues are still very small (about $1.1 billion in fiscal 2024). Still, Nvidia sees another $300 billion opportunity in automotive (in terms of TAM). And, of course, not just Nvidia but most players in the industry expect significant growth potential in automotive compute. As such, in coming years, automotive could also potentially drive more growth for Nvidia.

Fourth, Nvidia is trying to break into the data center CPU market with its Grace and Grace Hopper chips. It is also planning to release ARM-based client CPUs down the line, potentially “as soon as 2025.” The CPU market already has some very competitive incumbents, of course, so we will have to wait and see how much success Nvidia sees in this area, but growth in the CPU business could be another potential source of growth for Nvidia over the next few years.

Finally, fifth, I think it is worth noting that Nvidia seems to now have taken the brunt of the headwind from sanctions against AI chip exports to China. These sanctions now seem to be fully in effect, and even include Nvidia’s RTX 4090 cards, which were primarily intended for gaming. Management noted that China only “represented a mid-single digit percentage of our data center revenue in Q4, and we expect it to stay in a similar range in the first-quarter.” This is compared to 20-25% of data center revenues originating in China a couple of quarters ago. It seems to me that there is limited further downside risk to Nvidia’s growth from export sanctions against China since China now represents a very small proportion of data center sales.

Thus, overall, Nvidia’s current financial performance continues to be very good; growth fueled by AI accelerators is likely to continue (perhaps for multiple years if Nvidia and AMD’s forecasts of sustained secular growth are accurate); and Nvidia is well-positioned to profit from long-term growth opportunities in software, and potentially also in automotive and CPUs. Hence, as I see it, all signs suggest that Nvidia’s growth potential is far from tapped, and the firm could very realistically continue to grow at a solid clip for quite some time.

Jensen Huang endorsed this view as well, stating:

We guide one quarter at a time, but fundamentally, the conditions are excellent for continued growth in calendar ’24, to calendar ’25 and beyond.

Nvidia’s Valuation Is Still Realistic

Despite the large increase in Nvidia’s stock price over the last year, and despite the fact that Nvidia is now a stone’s throw from becoming the most valuable firm in the world, Nvidia’s valuation still remains more or less realistic in my view.

Nvidia is trading at about 33x run-rate earnings, which is around where the firm has traded for years. While 33x is obviously a fairly high multiple, Nvidia’s growth remains high as well, with Nvidia clocking in at 126% growth in revenue and 288% growth in net profit (non-GAAP) in fiscal 2024. Moreover, as I have discussed, Nvidia seems quite likely to keep growing this year (and perhaps beyond), although of course Nvidia’s growth will likely slow in percentage terms due to the now significantly higher revenues, and given the common sense implausibility of Nvidia doubling revenues each year indefinitely.

Still, Nvidia has been increasing revenues at about $4 billion/quarter since fiscal Q2 2024, primarily on the back of increased AI accelerator sales. This seems to be the rate at which Nvidia is able to ramp capacity, and it seems to me that this rate of growth could realistically continue through the end of year if, as management stated, Nvidia is going to continue to be supply-constrained. With CoWoS (chip-on-wafer-on-substrate) capacity at Taiwan Semiconductor (TSM) slated to double this year, I think this much growth in revenues is realistically possible. But even if we leave a healthy margin of error and say that Nvidia will slow down to $3 billion in incremental AI accelerator sales each quarter, that would take quarterly revenues from the guided $24 billion in Q1 to $33 billion in Q4.

Add in $2 billion/quarter in additional AI Enterprise sales exiting the year, as estimated above, and Nvidia’s quarterly revenues would be $35 billion in Q4. This is what I consider to be the base case for Nvidia exiting this year.

The analyst consensus for fiscal 2026 was $121 billion before the latest earnings, so I understand that my projection is higher than the current Wall Street consensus. But the consensus is likely to increase over the next few days in light of the latest earnings, and Nvidia has been beating consensus estimates all of last year, so I think my estimate of $35 billion/quarter exiting the year is more realistic. I believe it is also supported by the underlying conditions of Nvidia’s business, including continuing capacity expansions at TSMC, increasing AI accelerator prices for the upcoming new releases, and rapid projected AI Enterprise revenue growth. I, therefore, feel confident in this projection even though I understand that I am more bullish than others.

That leaves us with the question of margins. I will use non-GAAP figures here.

In light of the latest earnings and commentary, I now expect no margin compression for Nvidia this year – in fact, if anything, Nvidia’s margins might keep expanding, as they have the last few quarters. There are a few reasons for this:

- If Nvidia remains supply constrained and sells every chip it can make due to excess demand, then its pricing power should persist.

- Nvidia’s operating costs have steadily declined as a percentage of revenue as it has grown over the last year, and this could continue since scale leads to fixed costs being divided over larger revenues.

- AI accelerator prices will likely increase with new releases, which seem likely to be supply-constrained for multiple quarters.

- Growing software sales could further boost margins because software licensing tends to be a very high margin business, due to the very low marginal cost of providing a license to one additional customer (or one additional machine).

Still, let’s be conservative and leave a healthy margin of error and say that Nvidia’s net profit margin will decline to 50% in Q4 from 56% (implied at the midpoint) in Q1. If Nvidia’s revenues are $35 billion in Q4, that would leave it $17.5 billion in quarterly profits (up ~30% compared to Q1). Annual profits would then be at a run-rate of $70 billion (up ~120% compared to fiscal 2024).

At a multiple of 33x, we would then arrive at a market capitalization for Nvidia of $2.31 trillion, which amounts to a share price of about $930. Again, recall that this estimate is still conservatively leaving a healthy margin of error for top line growth and factoring in fairly sizable margin compression despite the margin tailwinds for Nvidia. And so there is a decent chance that Nvidia could very well be trading quite a bit higher, perhaps around $1000-$1200, at the end of the year, depending on how revenues and margins play out. I will update my projections each quarter as we receive more information.

For now, let’s say that officially my price target for Nvidia Corporation shares exiting this year is $930, but I see the potential for material upside beyond $1,000. Given this price target, I still see very good potential for excess returns with Nvidia, and overall Nvidia remains a strong buy for me.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, ARM, META, NVDA, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.