Summary:

- Nvidia remains the dominant force in the AI industry, with strong growth potential and a cheap valuation.

- The company’s recent earnings report showed impressive results, with significant growth in the data center and gaming segments.

- Nvidia’s outlook for future quarters is positive, and its sales and profitability growth could continue for many years.

da-kuk

NVIDIA Corporation (NASDAQ:NVDA) remains the “King of AI.” The company’s most recent earnings announcement demonstrates its dominant presence in the artificial intelligence, or AI, industry. Moreover, Nvidia’s stellar guidance shows that robust growth should continue, suggesting we’re still in the early stages of the AI ballgame.

As far as its valuation, Nvidia remains cheap relative to its enormous potential in the data center segment and other areas of AI. Furthermore, Nvidia remains the dominant force in the GPU industry, serving as the primary “picks and shovels” company at the base of AI. Therefore, Nvidia’s stock has tremendous potential and should continue moving higher in the long term.

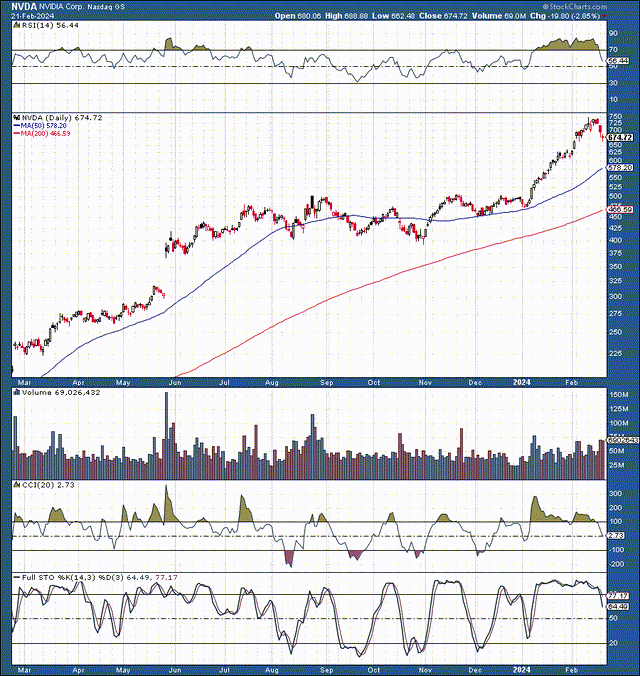

New ATHs Likely Ahead For Nvidia

Nvidia’s stock became tremendously overbought in the near term. I have a considerable stake (by my standards), about 5% of portfolio holdings, and I’ve been long and strong since my latest round of buying around the $400 range. I considered hedging into the report but was confident Nvidia would put up stellar numbers again.

Therefore, the post-earnings profit-taking/sell-the-news pullback may be limited. Also, if we get an opportunity to buy in the $650-600 level again, it is a solid buy-in range, in my view. The stock is still quite overbought technically and, despite the excellent results, could go through a consolidation phase before heading considerably higher again.

Another Home Run Quarter For Nvidia

Nvidia’s Q4 Non-GAAP EPS of $5.16 beat by $0.52. Revenue of $22.1B skyrocketed by 265 YoY, beating by $1.55B. Data Center was the real winner, surging by 409% from a year ago, up 27% sequentially. Gaming revenues illustrated a solid rebound of 56% YoY.

The Stellar Outlook Continues

For fiscal Q1 2025, Nvidia guided to $24B vs. $22.03B consensus. GAAP and non-GAAP gross margins are expected to be 76.3% and 77.0%. Considering that Data Center revenues expanded much faster than expected last quarter ($18.4B vs. $17.21B estimates), we could see another blockbuster quarter for Nvidia in May. Moreover, provided Nvidia’s leading market position, extraordinary momentum, the relatively early stages of the AI revolution, and other favorable tailwinds, its significant sales and profitability growth could continue for many years.

Valuation Perspective – Nvidia Stock Is Still Cheap

People can quote Nvidia’s $1.8T valuation all they like, but it’s just a number, and Nvidia deserves it. Here’s why: Nvidia just reported $22B in revenues and guided it to $24B for this quarter. As Nvidia typically beats guidance, we can expect Nvidia to deliver about $25B in fiscal Q1 2025. This dynamic implies we can expect better-than-expected revenues in future quarters as well.

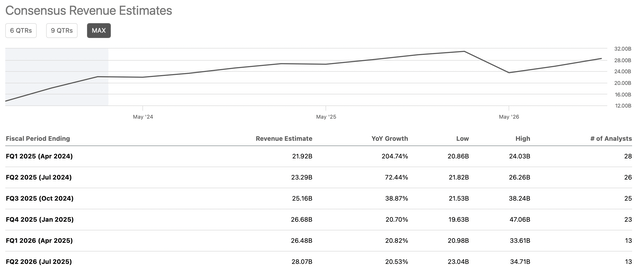

Revenues Likely To Be Better Than Expected

Revenue estimates (SeekingAlpha.com )

As of February 22nd, the highest estimate is only $24.03B for fiscal Q1 2025. This illustrates that the analyst community is still behind the curve on Nvidia, as the company guided to $24B in revenues for Q1 in its recent report. This represents about a 10% increase over the consensus estimates. We can deduce that Nvidia may beat future quarterly estimates by a similar margin. In a more bullish case scenario, Nvidia may beat by a lot.

Nonetheless, in a base case outcome, Nvidia could generate about $25B in Q1, roughly $28B in Q2, $33B in Q3, and $39B in Q4. This implies that Nvidia could generate about $125 billion this year. Due to the company’s incredibly long growth runway, Nvidia’s solid double-digit sales growth could continue for many years as we advance.

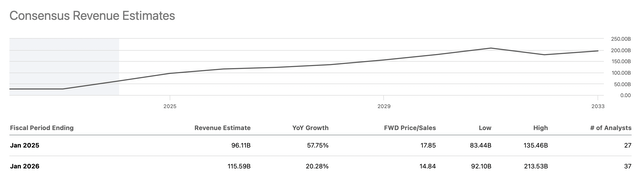

Sales Growth Likely To Be Much Better Than Expected

Annual growth (SeekingAlpha.com )

Some estimates are for more than $200 billion in revenues next year. Moreover, we will likely see considerably higher sales revisions with yesterday’s blockbuster results. Next year’s average annual sales estimate could be closer to $150 billion soon, and the company may report even stronger revenues. Therefore, provided the sales growth potential and Nvidia’s 10-15 times forward sales ratio, its share price appears relatively inexpensive relative to its long-term growth and profitability prospects.

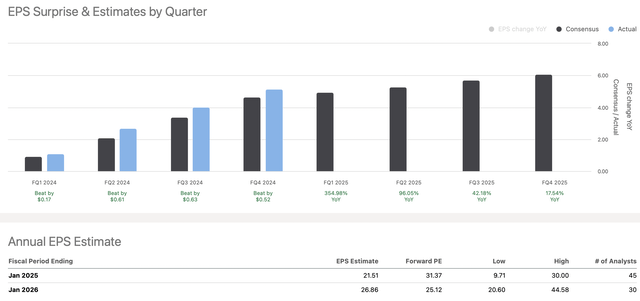

EPS Growth Likely To Continue Much Higher

EPS growth (SeekingAlpha.com )

Many analysts have been extremely far behind the curve on Nvidia. Nvidia’s TTM EPS consensus estimate is only $11.04. In reality, Nvidia smashed the depressed consensus figures, delivering $12.97 in EPS for investors. This is a very impressive 18% beat rate, and we should see this positive trend continue.

For fiscal 2025 (next four quarters), the consensus EPS estimate is just around $21.50. However, given Nvidia’s stellar guidance and past beat rate, it will likely report a much higher EPS. A similar 18% beat rate equates to around $25.38. Yet, higher-end estimates go up to $30. I believe $26-27 in EPS this year is a fair estimate and attainable.

EPS for next year (fiscal 2026) seems extremely low. The consensus figure is only about $27. Higher-end estimates go up to almost $45. My base case fiscal 2026 EPS estimate range is $32-38, so we can use the $35 mid-point estimate to generate a rough valuation for Nvidia now.

With Nvidia’s stock trading around $700, it is only about 20 times forward earnings estimates, which is cheap for a company in Nvidia’s dominant market-leading position with remarkable growth prospects ahead. Therefore, despite the recent run-up, Nvidia’s stock likely has much more upside in the coming years.

Where Nvidia’s stock could be in the future

| Year (fiscal) | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 |

| Revenue Bs | $125 | $160 | $200 | $248 | $303 | $363 | $428 |

| Revenue growth | 105% | 29% | 25% | 24% | 22% | 20% | 18% |

| EPS | $26 | $35 | $45 | $57 | $71 | $87 | $105 |

| EPS growth | 100% | 35% | 28% | 27% | 25% | 22% | 21% |

| Forward P/E | 25 | 27 | 28 | 29 | 28 | 27 | 25 |

| Stock price | $875 | $1215 | $1600 | $2000 | $2400 | $2800 | $3100 |

Source: The Financial Prophet.

Risks to Nvidia

Of course, there will come a time when Nvidia’s AI demand will slow down, and growth will become lower than expected, leading to worsening profits and a lower stock price. However, that time is not here yet, and when it will arrive, only time will tell. Nonetheless, Nvidia is priced for perfection and needs to continue delivering solid results to keep its share price moving higher. There is also the risk of competition from Advanced Micro Devices, Inc. (AMD) and other adversaries on the hardware, software, and services side of AI. A general economic slowdown or a recession would likely hurt Nvidia’s stock substantially if it occurred. These and other risks should be considered before investing in Nvidia Corporation shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!