Summary:

- Ailing zero-emission transportation start-up Nikola Corporation reported abysmal third-quarter results and provided a disappointing near-term outlook.

- The recent Nikola Tre BEV truck recall resulted in the company recognizing aggregate losses of more than $100 million.

- During the quarter, dilution continued unabatedly. Since the beginning of the year, outstanding shares have almost doubled.

- Ongoing management turnover remains a major issue. So far this year, the company has seen its CEO and two CFOs resign.

- Given ongoing, massive funding needs, outsized dilution for common shareholders is likely to continue for the time being. With further disappointment likely ahead next year, investors should sell existing positions and move on.

Tramino

Note:

I have covered Nikola Corporation (NASDAQ:NKLA) previously, so investors should view this as an update to my earlier articles on the company.

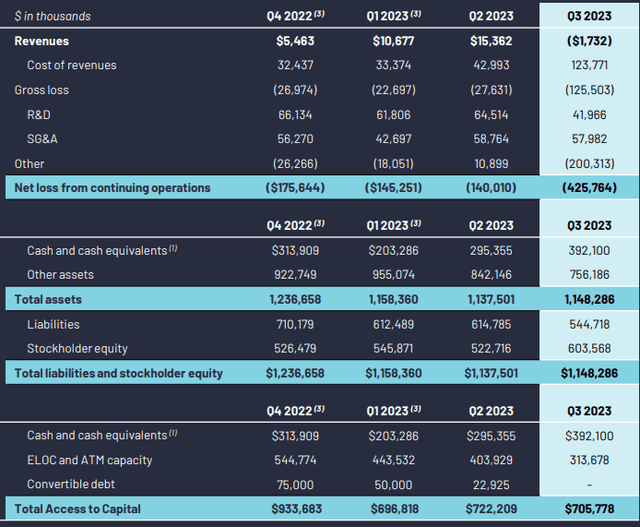

Four weeks ago, ailing zero-emission transportation start-up Nikola Corporation (“Nikola”) reported abysmal third-quarter results and provided a disappointing near-term outlook.

Reported revenues for the quarter turned negative as the company was required to repurchase several Nikola Tre BEV trucks from dealerships after canceling the respective dealer agreements.

According to management’s prepared remarks on the conference call, the move was a result of the company focusing its sales efforts on California but later in the questions-and-answers session, CFO Stasy Pasterick admitted to other issues (emphasis added by author):

Yes, I think that the current the buyback the two dealers from which we bought back trucks were contractually required to and we choose to terminate the dealership relationship to buy back those trucks.

Those decisions are made by Nikola a lot of times they are made in combination with the dealer depending on demand depending on how much time and resources the dealer has to dedicate to Nikola business. So it’s not necessarily just because his dealers happened to be outside of California.

We are focusing primarily on California so expecting if we do sign up future dealers, they’re most likely going to be more likely than not they will be in California and going forward.

But we don’t necessarily have any active plans to cancel any other dealership relationships at this point.

Even worse, in contrast to management’s previous expectations, the recent recall of 209 Nikola Tre BEV trucks will require retrofitting all vehicles with entirely new battery packs from another supplier.

As a result, the company had to accrue an eye-catching $61.8 million, or almost $300,000 per truck for the recall campaign. Please note that the average sales price for the Nikola Tre BEV truck in H1/2023 amounted to approximately $324,000.

Adding insult to injury, Nikola incurred another $45.7 million in costs to reserve for now obsolete inventory of legacy BEV battery packs and components.

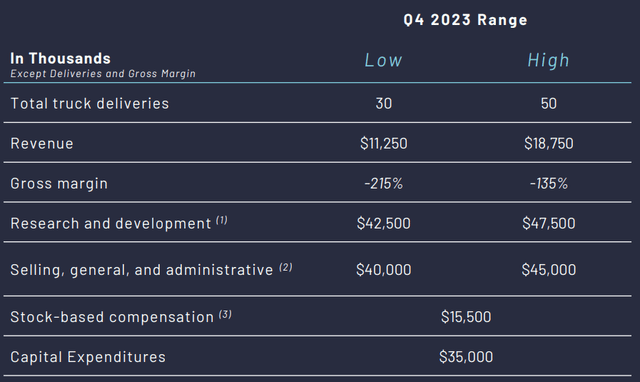

But the bad news doesn’t stop here. On the conference call, the company reduced projections for Q4 fuel cell truck volumes from 120 to a range of 30 to 50 with supply chain issues stated as the primary reason.

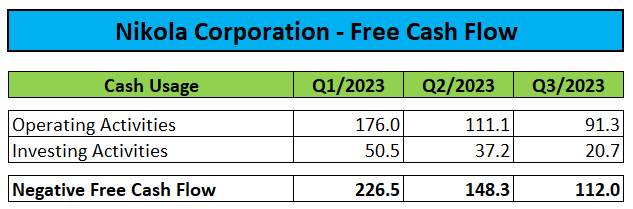

With the recall campaign currently precluding the company from selling BEV trucks, Q4 cash usage is projected to increase to $140 million, up from $112 million in the third quarter.

Regulatory Filings

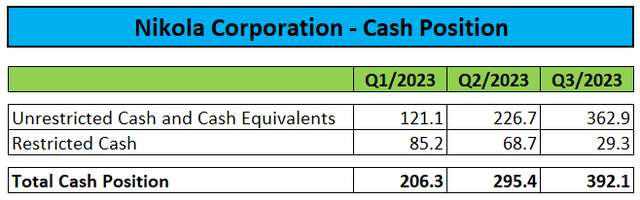

After raising approximately $250 million in additional funds during Q3, Nikola finished the quarter with $363 million in unrestricted cash, up from $227 million at the end of Q2.

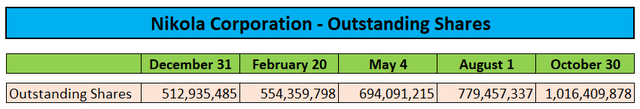

However, the company’s ongoing utilization of open market sales and its equity line of credit with Tumim Stone Capital LLC has resulted in massive dilution for common shareholders.

From the beginning of the year until the end of October, Nikola issued more than 500 million new common shares thus causing outstanding shares to almost double.

On the conference call, management projected additional cash requirements of $400 million to fund the business to EBITDA profitability currently anticipated by the end of 2025.

However, this guidance assumes the majority of hydrogen infrastructure being financed by partners.

As we explore opportunities in the hydrogen production and dispensing ecosystem and continue to develop our energy strategy, we may require additional capital in order to participate in hydrogen production and dispensing economics.

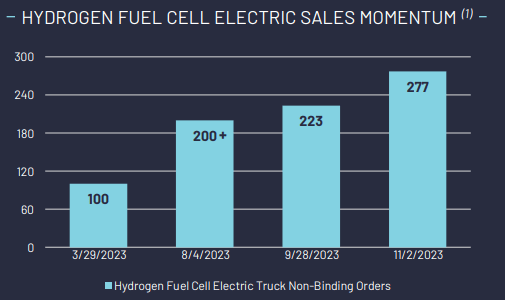

Quite frankly, with up to 300 truck sales per quarter required just to achieve gross margin breakeven and only 277 non-binding orders for the all-important Nikola Tre FCEV truck received so far, I have no idea how the company would be able to achieve EBITDA profitability within two years, particularly given the fact that large customers usually require several months of successful demonstration before placing a binding order, as outlined by management on the call.

Company Presentation

In addition, the availability of hydrogen infrastructure and complex subsidy application proceedings are further issues the company is currently dealing with.

As a result, Nikola has only received 20 firm FCEV truck orders for delivery in Q4 so far, and these are solely with dealers.

Please note that the current analyst consensus implies expectations of approximately 650 truck sales next year, which I consider entirely unrealistic.

At this point, I do not expect BEV truck sales to resume before H2/2024 and given elongated sales cycles for the company’s FCEV offering, I would consider 400 truck sales next year a major success already.

Consequently, investors will likely have to prepare for another year of underperformance ahead.

Lastly, I consider the recent resignation of CFO Stasy Pasterick a major loss for Nikola as she had been with the company since 2019 before being appointed as CFO in March.

Particularly the fact that she decided to leave for a much smaller start-up Universal Hydrogen Inc., a company developing fuel cell conversion kits for conventional aircraft and with a special passion for dogs, isn’t exactly suited to instill confidence in Nikola’s projections.

Bottom Line

Nikola Corporation remains an unmitigated disaster. The company reported abysmal Q3 results and once again reduced expectations for truck sales, revenues, and margins, while dilution for common shareholders continued unabated.

In addition, management turnover remains an issue. So far this year, Nikola has seen its CEO and two CFOs resign.

Considering the dismal state of the business, I have no idea how the company is going to achieve management’s stated EBITDA profitability target within just two years.

Given ongoing, massive funding needs, outsized dilution for common shareholders is likely to continue for the time being.

With further disappointment likely ahead next year, investors should sell existing positions and move on.

Risks

Shares have been subject to a number of violent momentum rallies in recent quarters, with traders apparently using any temporary selling pressure relief to move the stock.

Should the company for some reason pause its open market sales and abstain from issuing additional convertible notes, another momentum run might be in the cards.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.