Summary:

- Adobe is a leader in digital content creation software with exceptional profitability and high returns on invested capital.

- The company’s flagship offering, the Creative Cloud Suite, dominates the graphics software market and offers flexibility for users with different budgets.

- ADBE’s robust financial standing, low leverage, and predictable cash flows position it for sustained growth and innovation.

- My target price is $640.

Bloomberg/Bloomberg via Getty Images

Introduction

Adobe (NASDAQ:ADBE) stands out as an undisputed leader in the realm of digital content creation and editing software, boasting an unparalleled market dominance. This commanding position translates into exceptional profitability, which Adobe consistently channels back into fueling its growth initiatives. With a track record of historically high returns on invested capital, the chances of future investments paying off successfully are very high. The balance sheet is unencumbered with substantial debt amounts, meaning that Adobe has even more options to invest in growth apart from ongoing free cash flows. The stock is traded with an attractive discount, making it a “Strong Buy”.

Fundamental analysis

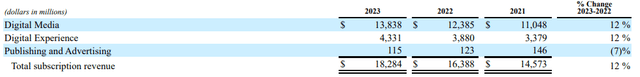

Adobe is a global technology company offering a wide array of products and services that empower customers and users to create and edit digital content. The company divides its offering into three categories: Digital Media, Digital Experience, and publishing & Advertising. Adobe generates 94% of its total sales from the subscription model, which means a higher predictability of future revenue and earnings trajectory.

Adobe’s flagship offering is its Creative Cloud Suite, a cloud-based subscription to a collection of apps, which generated $11.5 billion in sales in FY 2023, i.e., more than half of the company’s total subscription revenue. This offering has been very successful since it provides a vast array of products inside the suite, which can be purchased in a bundle or separately, which provides great flexibility for users with different budgets. The company also invests substantial resources to keep its Creative Cloud at the forefront of the technological edge, since it also offers AI-powered templates and features for content creation.

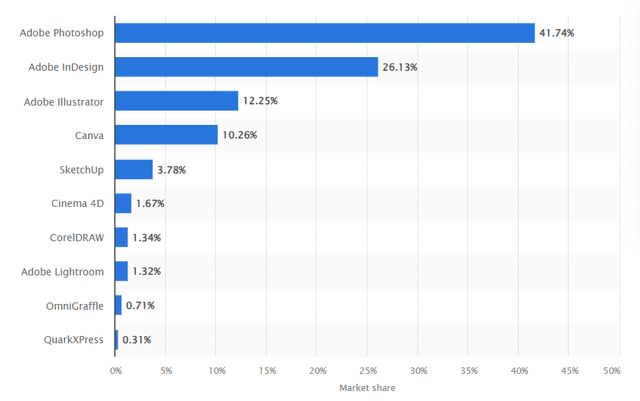

As shown in the chart below by statista.com, Adobe Creative Cloud Suite’s apps dominate the graphics software market by holding three top spots and a massive cumulative market share. This dominance suggests that Adobe’s apps are by far more technologically advanced and attractively priced than competitors. I believe such a dominant position means that Adobe has a strong competitive position and a wide moat. According to the company’s P&L in recent years, the company invests around $3 billion in R&D each year, meaning that the management is committed to retaining its crown, and competitors are unlikely to keep up with the Creative Cloud in terms of the complexity of offerings.

Hence, Adobe is poised to wield formidable pricing power owing to its unmatched products and adaptable offerings. Given the ongoing digital transformation, the demand for graphic design products will unlikely wane anytime soon. Therefore, I am confident that Adobe’s exceptional profitability will endure, enabling the company to balance shareholder value accumulation and capital reinvestment for sustained growth and innovation.

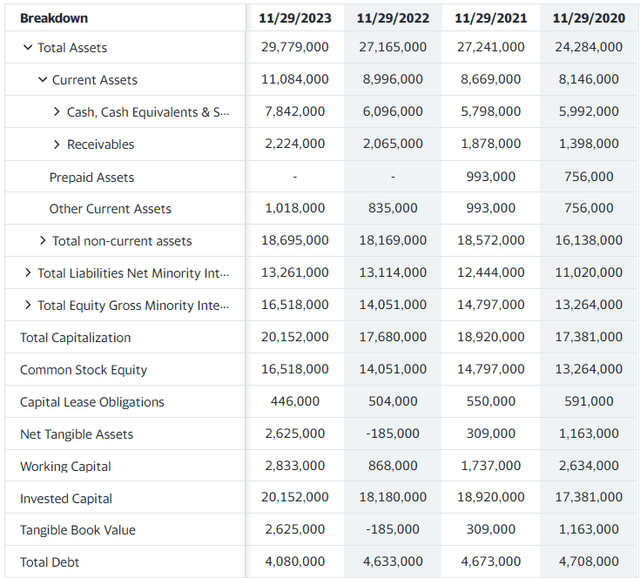

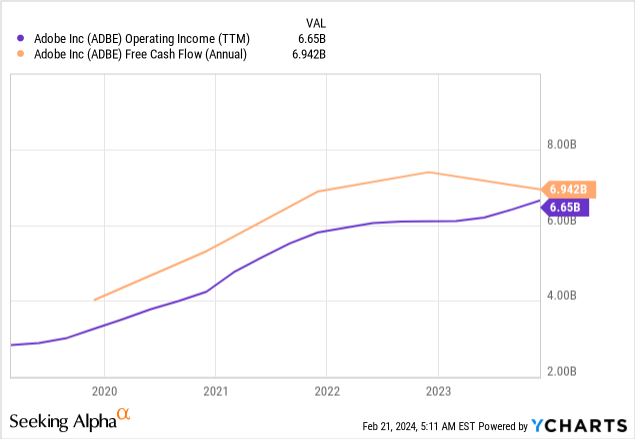

It is important that Adobe does not need to allocate its massive free cash flows (“FCF”) to substantial debt repayments, since the company’s leverage is low and the outstanding cash position is higher than the total debt amount. That said, all the cash generated from the business will likely be reinvested in new ventures. Since Adobe has a robust history of delivering high returns on invested capital, it is very likely that the benefits from new potential ventures will significantly outweigh the costs. Hence, the company’s robust financial standing, coupled with the steady and predictable cash flows from subscriptions, forms a potent combination. This affords the management the resources needed to drive sustainable enhancements in revenue and profitability.

Valuation analysis

Despite Adobe’s offerings also being powered with artificial intelligence capabilities, the stock’s performance was not as impressive as other AI trends’ beneficiaries demonstrated in recent months. Still, a 56% rally over the last twelve months is a robust dynamic, and the stock is currently not far from all-time highs achieved during the pandemic-driven stock market mania.

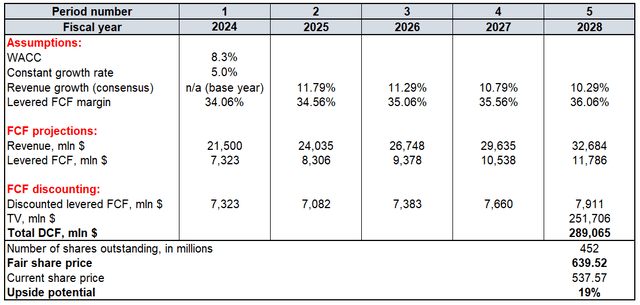

The current market cap is close to $250 billion, and I will check whether it is fair with the help of the discounted cash flow (“DCF”) model. I use a low 8.3% discount rate considering Adobe’s wide moat, predictable free cash flows, and clean balance sheet. As usual, I rely on consensus estimates for FY 2024 and 2025 when project revenue trajectory, and for the years after 2025, I expect a steady 50 basis points per year deceleration as the industry naturally matures. I incorporate a 34.06% TTM levered FCF margin and forecast that it will expand by 50 basis points per year as the business scale expands. According to Seeking Alpha, there are currently 452 million ADBE shares outstanding.

My DCF model figured out ADBE’s fair share price at $640. This is 19% higher than the current market levels, meaning a solid discount. When considering the attractiveness of the investment opportunity, it is also important to understand that a high-quality wide-moat business is currently traded below the fair value. That said, I believe that current share price levels are compelling.

Mitigating factors

Despite its status as a wide-moat profitability powerhouse, ADBE is not immune to fluctuations in overall market sentiment. In the bear market of 2022, Adobe’s stock plummeted by more than half in just nine months, despite ongoing revenue growth and profitability gains. Hence, investors should brace themselves for the potential of significant unrealized losses in the event of a broader downturn in the stock market, a scenario that cannot be ruled out.

Given ADBE’s industry dominance, regulatory considerations could challenge its future growth trajectory. An illustrative instance is Adobe’s decision to call off its ambitious $20 billion acquisition of Figma in December 2023 following concerns raised by European antitrust authorities. Consequently, the company’s capacity to drive growth through acquisitions may face constraints imposed not only by U.S. regulatory bodies but also by those in Europe.

Conclusion

I view the current 19% discount on a company of Adobe’s industry dominance as a rare opportunity, particularly for long-term investors willing to weather short-term volatility. Adobe’s unwavering market leadership suggests that it will persist in generating significant free cash flows, which can then be channeled into continued growth and innovation. Hence, I firmly believe that Adobe warrants a “Strong Buy” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.