Summary:

- Nvidia Corporation shares surged over 16% after reporting better-than-expected FQ4 earnings.

- The chipmaker continued to generate impressive top line growth and demand for AI chips remained extremely strong, leading to record results in the Data Center segment.

- Nvidia’s Data Center segment has been responsible for a massive expansion in the company’s FCF margin.

- Nvidia’s FCF grew twice as fast as its revenues in FQ4 ’24.

- I will discuss the lessons learned from my previous strong sell recommendation.

BlackJack3D

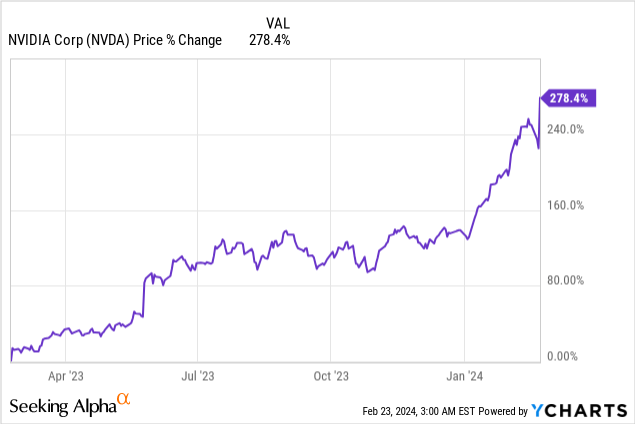

Shares of Nvidia Corporation (NASDAQ:NVDA) soared more than 16% after the chipmaker reported a much better than expected earnings sheet for FQ4’24 on Wednesday. The chipmaker added more than $270B to its market cap on Thursday after Nvidia revealed that it saw a massive increase in its revenue base, stronger than expected free cash flow (“FCF”) growth, and much higher gross margins due to soaring demand for artificial intelligence chips. I especially underestimated Nvidia’s potential for free cash flow growth, which soared in FY 2024 and showed a 7-fold increase relative to the previous year. Although I am still worried about Nvidia’s valuation multiplier, I acknowledge my mistake here and upgrade Nvidia to hold!

Previous rating

I rated Nvidia a strong sell in November — Nvidia: Running Out Of Enthusiasm — when shares of the chip maker traded at $478. This caused me to miss out on a massive 65% increase in Nvidia’s share price, as the company proved, against my expectations, that it can continue to generate impressive top line growth and that demand for its AI chips is not waning. Although I still have concerns about Nvidia’s valuation, I believe a rating upgrade is in order, and I will discuss why I believe the investment thesis has considerably improved.

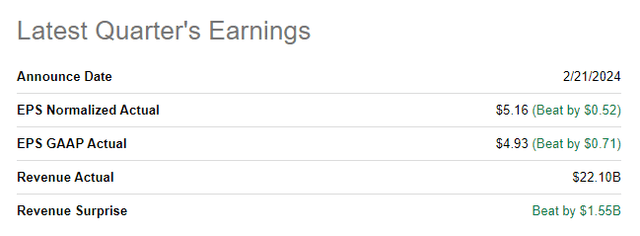

Nvidia crushes earnings results

It was an overall very strong earnings report from Nvidia, which reported total revenues of $22.1B for its FQ4, beating the consensus prediction by a massive $1.6B. On an adjusted EPS basis, Nvidia crushed expectations as well: $5.16 in actual EPS compared against $4.64 in consensus expectations, resulting in a $0.52 per-share beat.

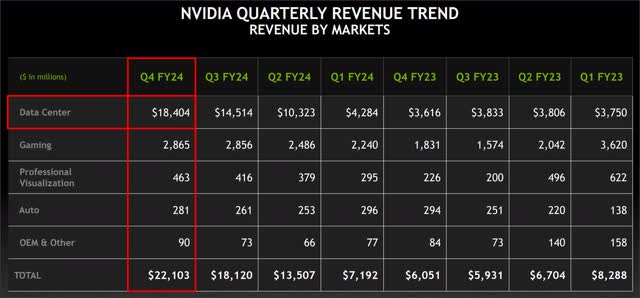

My biggest mistake: Nvidia’s top line growth is still soaring

The biggest mistake I made in my last call was to expect moderating top line growth for Nvidia’s core business, Data Centers, which played out only partially. The demand for AI chips — which are used for power large language models/LLMs, as an example — is stronger than I expected. Although Nvidia’s Q/Q revenue growth slowed from 41% in FQ3 to 27% in FQ4, this growth was more than enough to generate massive free cash flow gains.

The biggest segment, Data Center, added a massive $3.9B in incremental revenue volume to Nvidia’s revenue base in FQ4 (Q/Q) while Gaming revenues didn’t grow much at all (+$9M Q/Q). Nvidia’s business, and especially its free cash flow growth/margin expansion, is almost exclusively driven by Nvidia’s Data Center business.

However, Nvidia’s top line growth in Data Centers declined for the second quarter in a row: this segment generated a mind-blowing revenue growth rate of 141% in FQ2’24 as adoption of AI products soared in the corporate sector. Nvidia benefits from this growth through the sale of its dedicated AI chips that allow the support of artificial intelligence applications.

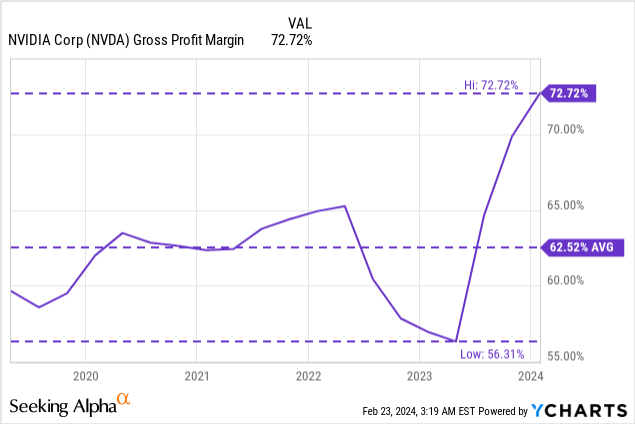

Nvidia’s gross margins continued to expand as artificial intelligence applications are going mainstream. In FY 2024, Nvidia’s GAAP gross margin hit a record 72.7% which is a solid 10 PP above the company’s 5-year average gross margin.

Nvidia’s free cash flow margins are exploding

Nvidia’s free cash flow margins exploded in FY 2024, proving that the chip maker has been quite capable to convert surging Data Center top line momentum into incremental free cash flow margin expansion.

The expansion of free cash flow margins, for me, was actually the biggest take-away from Nvidia’s fourth quarter earnings release: while Nvidia’s revenues soared 265% year over year in FQ4’24, Nvidia’s free cash flow grew twice as fast (+546% Y/Y) which resulted in a massive improvement in the company’s free cash flow margin. The firm’s FCF margin expanded to a massive 51%, showing 22 PP growth year over year. This take-away is significant because Nvidia has managed to become more profitable and now retains a much larger share of its revenues as free cash flow than last year.

Going forward, FCF margins, FCF growth rates and gross margins are primary KPIs for me that I believe are worth tracking.

|

in $M |

FQ4’23 |

FQ1’24 |

FQ2’24 |

FQ3’24 |

FQ4’24 |

Growth Y/Y |

|

Net Revenue |

$6,051 |

$7,192 |

$13,507 |

$18,120 |

$22,103 |

265% |

|

Operating Cash Flow |

$2,249 |

$2,911 |

$6,348 |

$7,333 |

$11,499 |

411% |

|

Capital Expenditures |

($513) |

($268) |

($300) |

($291) |

($282) |

-45% |

|

Free Cash Flow |

$1,736 |

$2,643 |

$6,048 |

$7,042 |

$11,217 |

546% |

|

FCF Margin |

29% |

37% |

45% |

39% |

51% |

77% |

(Source: Author.)

In FQ4 ’24, Nvidia generated $11.2B in free cash flow, a more than 6-fold increase over the year-earlier period. This growth is almost exclusively due to Nvidia seeing surging AI adoption across the corporate sector, where companies such as Meta Platforms (META), Alphabet (GOOG) or Microsoft (MSFT) are using Nvidia’s AI chips to power their large language models in order to generate their own AI-specific product offerings.

Google is also using Nvidia’s AI products to power its new open language model called Gemma. The mainstreaming of AI applications in technology, Internet search and healthcare, as examples, presents an opportunity for Nvidia to grow revenues going forward. Amgen has decided to use Nvidia’s data center platform NVIDIA DGX SuperPOD to build its own AI models.

Nvidia’s outlook for FQ1 ’25

Nvidia projects $24.0B in revenues, +/- 2% for the first fiscal quarter of FY 2025 which implies 334% Y/Y top line growth. Nvidia’s non-GAAP gross margin is expected to come in at 77% (+/- 50 bps) which implies a stable gross margin relative to FQ4’24.

Nvidia trades at a 57% premium to its 1-year P/E ratio

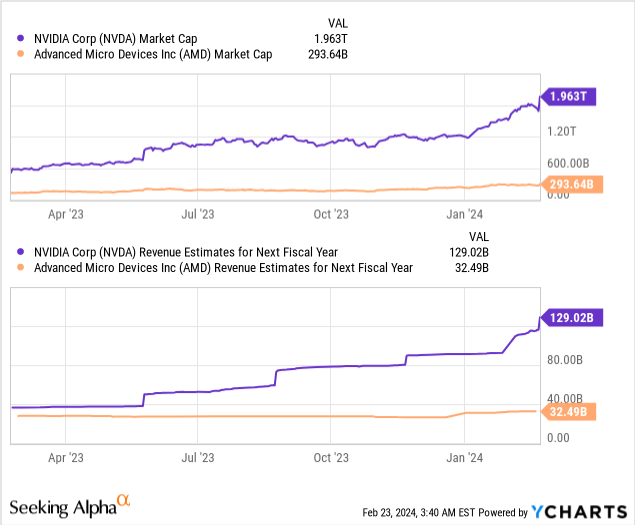

Nvidia is projected to reach $110B in revenues in FY 2025, implying a massive 80% top line growth rate. Based off of this revenue volume, and assuming a stable 44% free cash flow margin, Nvidia could achieve somewhere between $49-50B in free cash flow this year which potentially opens the door to aggressive stock buybacks.

Nvidia currently has a market cap of $1.96T compared against Advanced Micro Devices (AMD)’s $293.6B, but it also a revenue base that is four times larger. Revenue estimates are trending up for Nvidia’s FY 2025, and analysts are likely going to submit more revenue upward revisions following Nvidia’s blowout earnings report this week.

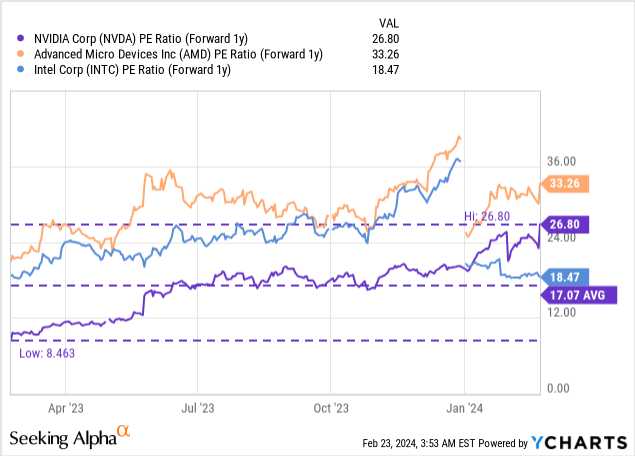

From a valuation perspective, I still have concerns about Nvidia, chiefly because Nvidia’s shares are trading at a material premium to their 1-year average P/E ratio. With Nvidia already generating a ton of profits, using a P/E ratio obviously is a reasonable valuation approach.

Nvidia is currently trading at a P/E ratio of 26.8X which reflects a 57% premium to the 1-year average and it is mainly this high premium that results in my hold rating. I would consider buying Nvidia, assuming it can sustain its top line momentum and defend its FCF margins in FY 2025, at a P/E ratio of 24-25X which I believe is a more reasonable P/E ratio that reflects a higher safety margin. This fair value P/E range implies potential entry points of $703-732.

Risks with Nvidia

The biggest risk for Nvidia, as I see it, is a potential deceleration of growth in the Data Center business because this segment has been entirely responsible for the explosion in Nvidia’s free cash flow growth as well as FCF margin expansion. A slowdown in this specific business would also likely drive a compression of free cash flow margins (and gross margins) which are currently standing at multi-year highs. Should Nvidia see weakening AI product adoption, which I believe is unlikely, the chip maker may see growing valuation pressure and I may change my rating to Nvidia.

Lessons learned

I was very wrong about Nvidia, unfortunately, as I misjudged Nvidia’s ability to convert soaring top line growth into a massive expansion of its FCF margins which I believe was actually the biggest takeaway from Nvidia’s earnings release Wednesday. Nvidia’s free cash flow is growing more than twice as fast as its revenues which makes the chip maker obviously a free cash flow play going forward. Unfortunately, my focus was too narrow and mainly concentrated on the sustainability of revenue growth rats. My Nvidia sell call was the worst call ever for me, and I believe a lesson learned here is that one needs to look beyond mere top line growth.

Nvidia Corporation served up a very impressive earnings release overall this week that resulted in a massive top line beat and more than $270B in additional market cap being added on Thursday. Nvidia’s Data Center growth is driven chiefly by the wholesale adoption of LLMs in the corporate world and a mainstreaming of AI applications… and demand is not waning. I am neutral on Nvidia Corporation shares with regard to valuation, however, due to a high premium to the average P/E ratio. Nvidia is highly valued based off of earnings, and I would wait for a drop towards $732 before engaging!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.