Summary:

- Walmart reported better-than-expected Q4 earnings, with adjusted EPS of $1.80 and net sales of $172 billion, driven by its unbrokenly solid value proposition.

- In this update, I take a close look at WMT’s fiscal 2024 results and share my view on the – rather surprising – 9.2% dividend increase.

- I also discuss the recently announced – and equally surprising – acquisition of VIZIO Holding Corp.

- I explain what I would do if I were a holder of VZIO stock and also analyze the proposed transaction from the perspective of a WMT shareholder.

Jeff Greenberg/Universal Images Group via Getty Images

Introduction

Retail behemoth Walmart Inc (NYSE:WMT) reported its fourth-quarter and full-year fiscal 2024 results on Tuesday, resulting in what looks like a temporary spike in its stock price to $180. I have WMT stock on my watch list because I think the company is very well run and one of the few retailers that has a significant moat, largely due to its size and thus cost advantages, as well as its status as a highly-trusted brand. As a result, I cover this company more or less regularly here on Seeking Alpha.

But of course, a great company is not necessarily a great investment. In my last article, I therefore rated the stock as a potential sell, depending on one’s investment goals and horizon.

In this update, I’ll take a look at the retailer’s results for fiscal 2024 and share my view on the – rather surprising – 9.2% dividend increase. I also discuss the recently announced – and equally surprising – acquisition of VIZIO Holding Corp. (NYSE:VZIO) and explain what I would do if I were a holder of VZIO stock.

How Were Walmart’s Fiscal 2024 Earnings?

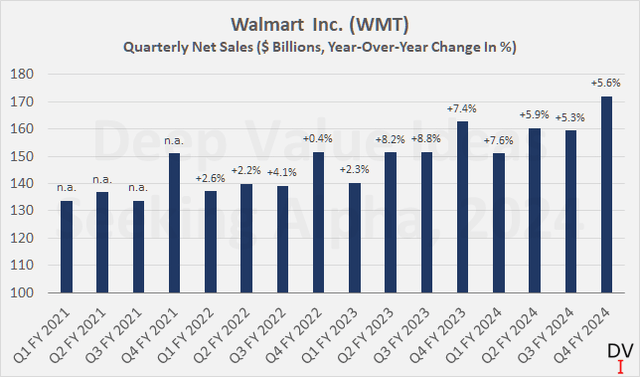

For the fourth quarter, Walmart reported adjusted earnings per share (EPS) of $1.80, beating analysts’ estimates by $0.15 – the seventh positive surprise in a row. Quarterly profit increased by 5.3% year-over-year, broadly in line with net sales, which rose by 5.6% to $172 billion (Figure 1). The continued solid growth despite Walmart’s already large market share is due to the company’s renowned value proposition, which is particularly important in the current environment. This is underscored by the increase in transactions alongside a slight decline in average ticket size. In my view, customers who have only learned to trust Walmart as a brand in recent years are particularly sticky, so it’s only fair to applaud management once again for navigating this challenging environment very well.

Figure 1: Walmart Inc. (WMT): Quarterly net sales and year-over-year change in percent (own work, based on company filings)

Critical investors might now argue that Walmart may have prioritized sales growth over operating income and cash flow growth and boosted EPS growth through share buybacks.

While it is definitely true that Walmart’s management is currently buying back shares at a valuation that represent a poor return on investment, the impact on earnings per share has not been significant enough to impute financial engineering. Walmart repurchased 1.46% of fiscal 2023 fully diluted shares outstanding over the course of fiscal 2024, resulting in a 1.48% boost to fiscal 2024 EPS.

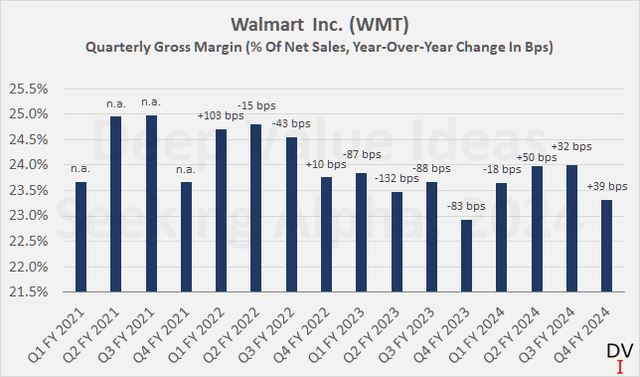

In addition, a look at Walmart’s margins shows that gross profitability is generally very stable – note the y-axis scale in Figure 2 – and even shows signs of improvement year-over-year (+39 basis points). For the full year, Walmart’s gross margin has improved slightly (+24 basis points), albeit after a significant decline in fiscal 2023 (-98 basis points).

Figure 2: Walmart Inc. (WMT): Quarterly gross margin and year-over-year change in basis points (own work, based on company filings)

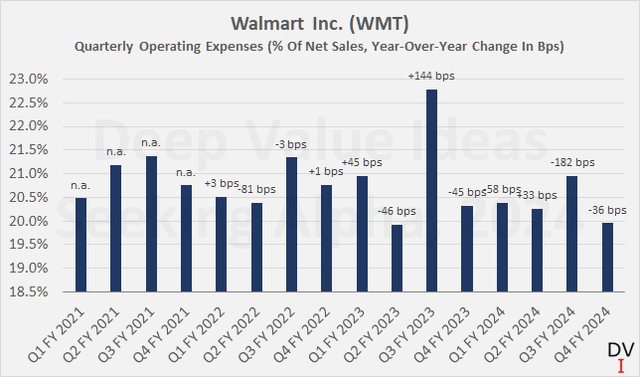

Operating expenses are looking good with a decrease of 36 basis points compared to the previous year’s fourth quarter (Figure 3). For the full year, operating expenses have declined by 60 basis points, after an increase by 23 basis points last year. This is definitely a very strong performance in a rather difficult environment and puts the decline in gross profitability in fiscal 2023 in a different light. At 3.35%, operating profitability is now back to fiscal 2021 levels and almost back to fiscal 2022 levels of 3.69% after having fallen to just 2.48% in fiscal 2023. Clearly, Walmart was able to absorb most of the input cost inflation that it could not (or did not want to) pass on to consumers by further improving its operating cost structure.

Figure 3: Walmart Inc. (WMT): Quarterly operating expenses in percent of net sales and year-over-year change in basis points (own work, based on company filings)

However, even if this is only a small contribution, Walmart’s advertising division should not be overlooked. In fiscal 2024, the advertising business reached a size of $3.4 billion, or 0.5% of total revenues. The segment grew by a very strong 33%, and Walmart Connect (U.S.) grew by 22%. However, it should be noted that Walmart recognizes its advertising business partly through net sales or a reduction in cost of sales. Therefore, the advertising business can be seen as another factor influencing the gross margin, i.e., giving management another lever to stabilize profitability.

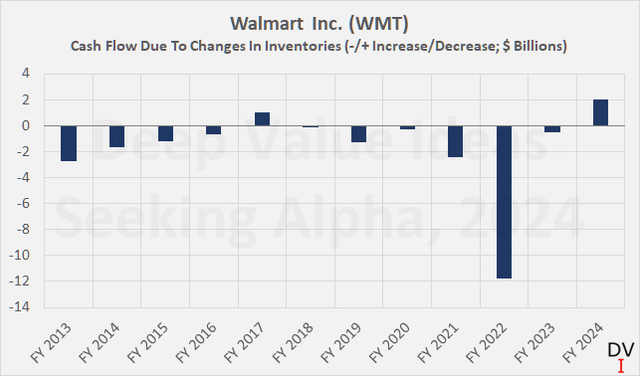

Finally, free cash flow also improved significantly compared to the previous year, but this was not really a surprise, as I explained in my previous articles. In fiscal 2024, Walmart was able to significantly reduce its working capital by increasing trade payables more than trade receivables and reducing its inventories. During the year, the company recorded a cash inflow of $2.0 billion due to the reduction of inventories:

Figure 4: Walmart Inc. (WMT): Cashflows due to changes in inventories (own work, based on company filings)

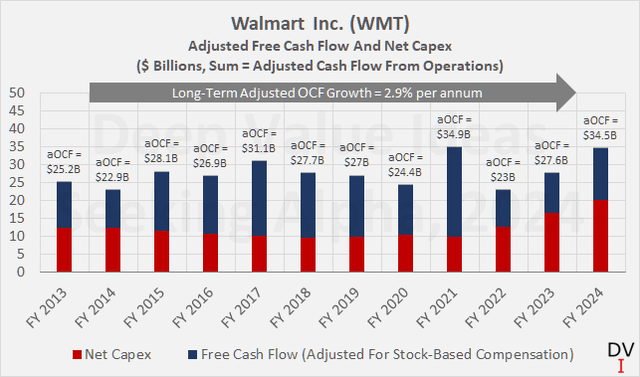

Free cash flow (FCF), adjusted for stock-based compensation but excluding normalization of working capital movements, increased nearly 30% year-over-year, but is still well below the all-time high of $24.9 billion in fiscal 2021. The primary reason for the largely stagnant FCF over the long-term (e.g., WMT generated an average FCF of $14.4 billion between fiscal 2014 and fiscal 2016) is high capital spending. Walmart continues to invest aggressively in e-commerce, advertising, pickup and delivery presence – not only through Walmart+, but also through Walmart Fulfillment Services and Walmart Go Local. During fiscal 2024, Walmart invested $20.4 billion (net capex, red bars in Figure 5), up 22% year-over-year – no wonder long-term FCF growth remains almost absent (blue bars in Figure 5).

In my view, operating cash flow adjusted for stock-based payments (aOCF) is a better indicator of performance than FCF, at least in the current environment. Long-term aOCF growth of around 3% is quite acceptable given the generally slow growth of the sector and also the size of Walmart.

Figure 5: Walmart Inc. (WMT): Adjusted free cash flow and capital expenditures, net of divested property and equipment (own work, based on company filings)

With online retail giant Amazon.com, Inc. (AMZN), one could argue that these investments are certainly necessary to keep pace, suggesting that Walmart’s FCF will likely continue to tread water. However, given that e-commerce grew by 23% globally in the fourth quarter, a significant improvement on both the previous quarter and the previous year, one can conclude that the investments are not just to keep up with the competition. In the U.S., e-commerce grew by 17%, which had a positive impact of 2.4 percentage points on comparable sales growth (4.0% year-over-year). So I think it’s reasonable to expect Walmart’s FCF to return to meaningful long-term growth as currently above-average capital expenditures decline eventually. It is also worth remembering that the company’s working capital is still high and further normalization will provide a tailwind to FCF.

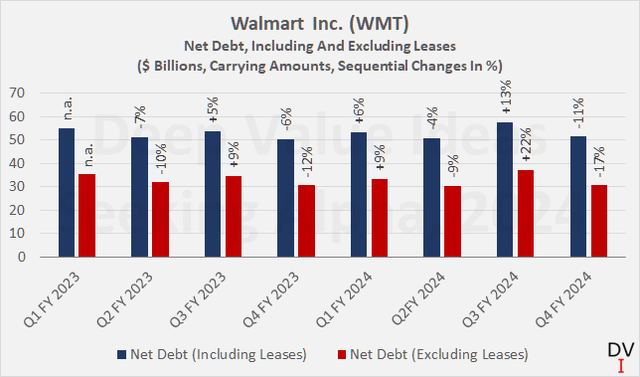

From a balance sheet perspective, there is nothing particularly noteworthy to report. Net debt, both with and without operating and finance lease obligations, is down from the previous quarter but largely unchanged from a year ago (Figure 6). Putting debt and free cash flow in perspective, Walmart could theoretically pay off all of its debt (excluding lease obligations) in two to three years if it suspended its dividend. But of course, this is just a thought experiment to illustrate Walmart’s comfortable situation. Including lease obligations, the company’s leverage ratio rises to still very acceptable 3.6 to 5 times adjusted FCF (depending on the years taken into account FCF-wise).

Hence, and also considering the solid interest coverage ratio of 8.5 times fiscal 2024 FCF before interest (which doesn’t even include interest income), it’s no wonder that rating agency Moody’s saw no reason to change the stable outlook on Walmart’s reassuring Aa2 long-term credit rating.

Figure 6: Walmart Inc. (WMT): Net debt, including and excluding operating and finance lease obligations (own work, based on company filings)

What To Make Of Walmart’s 9.2% Dividend Hike?

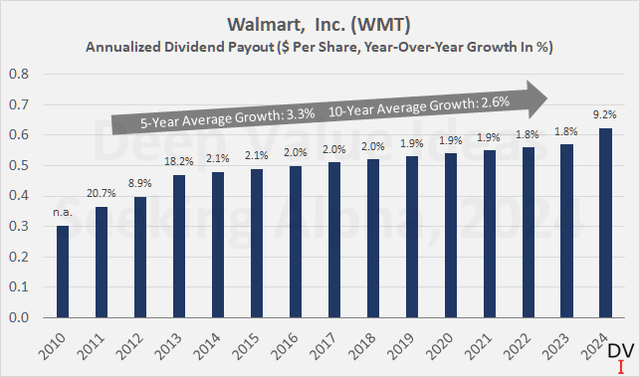

Against this definitely solid backdrop, I was pleased to see the Board of Directors finally approve a significantly higher dividend growth than shareholders became used to over the last decade. A 9.2% increase is certainly good news for long-term investors in WMT who rely on the dividend income. In recent years, the purchasing power of dividends paid by the company has declined in the face of rising inflation (Figure 7). It has now been ten years since Walmart last increased its dividend by more than a penny on a quarterly basis, or around 2% year-over-year.

Figure 7: Walmart Inc. (WMT): Annualized dividends per share and year-over-year growth in percent (own work, based on company filings)

At the same time, Walmart’s longer-term dividend growth of 3.3% per year (5-year average) and 2.6% (10-year average) remains relatively low from an income-oriented investor’s perspective. However, long-term investors with substantial yields-on-cost are likely to appreciate that the purchasing power of the WMT dividend remained largely intact over long periods of time. However, for a potential new investor, the combination of a starting yield of just 1.44% and long-term growth in the low single digits is not really compelling. And even if Walmart increases its dividend by 5% annually from now on – which I consider manageable given the company’s strong position, expected further improvement in free cash flow and solid balance sheet – it would still take 23 years for the yield-on-cost to exceed the current yield on 30-year Treasuries of 4.5%.

However, while I may appear to be a proponent of long-term government bonds, I would like to make it clear that one of the central pillars of my investment strategy is to emphasize high-quality companies that have staying- and pricing power and are therefore able to increase their dividends to a rate that at least preserves purchasing power. In the case of fixed coupon bonds and assuming that the coupon is identical to the long-term inflation rate, only the purchasing power of the invested capital is preserved. As an aside, those interested in a deep dive on why I believe it is important to stick with dividend stocks despite comparatively attractive bond yields should take a look at my article published in November 2023.

With regard to Walmart, I maintain that the combination of the low starting yield and slow long-term dividend growth is not attractive to me as a dividend growth investor. Instead, I prefer companies with low yields such as The Cigna Group (CI, current starting yield 1.6%) and sustainable double-digit dividend growth (see my coverage).

What I Would Do As A VZIO Shareholder And What To Make Of The Acquisition As A WMT Shareholder

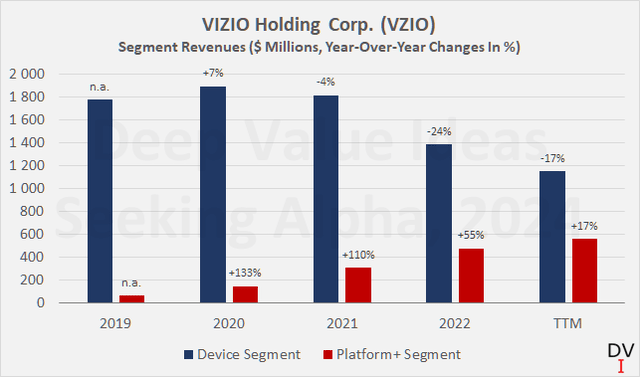

Finally, I would like to share my views on the Vizio acquisition, which was announced along with the fourth quarter and full year 2024 earnings report. Walmart has agreed to pay $11.50 per VZIO share, which equates to a value of $2.30 billion based on the diluted weighted-average number of Vizio shares outstanding in the third quarter of 2023. However, with cash, cash equivalents and short-term investments of $335 and no debt, Walmart is essentially paying an enterprise value (EV) of only $1.97 billion – hardly a significant price for the retail giant and a very reasonable valuation multiple even for me as a value investor (1.15 times trailing twelve-month EV/revenue). For example, close peer Roku, Inc. (ROKU) is currently trading at an enterprise value to revenue ratio of 2.4.

From the perspective of a VZIO shareholder, this naturally sounds like a suboptimal deal. However, I think it’s worth bearing in mind that device sales peaked in 2020 and have only gone in one direction since then (Figure 8). It looks like Vizio’s marketing is unacceptably weak and the company’s management has not been able to stabilize the business, let alone get it back on track for growth.

Ultimately, a strong device base is a prerequisite for the company’s higher-margin business segment – Platform+ – to perform as expected. The gross margin of Vizio’s Platform+ segment averaged 62% between 2021 and the trailing twelve months period. In my view, Walmart’s tremendous scale can easily bring Vizio’s Device segment back to growth, giving the company great leverage in conjunction with the largely advertising-focused Platform+ segment.

Figure 8: VIZIO Holdings Corp. (VZIO): Annual and trailing twelve months revenues of the Device and Platform+ segment (own work, based on company filings)

For longer-term shareholders, a consideration of $11.50 per share is obviously disappointing, but one can argue that investors had much higher expectations for the company in early 2021, when VZIO shares were still trading above $20. Since Vizio obviously benefited from pandemic-related (but short-term) trends, I argue that these expectations were too optimistic. In contrast, expectations in 2023 were much more muted, and shareholders who bought VZIO shares last year can enjoy a gain of 20% to 140%, depending on the timing of the purchase.

Another aspect of why I would consider selling if I were a VZIO shareholder is the fact that KPMG LLP, the company’s auditor, issued an adverse opinion on the effectiveness of Vizio’s internal controls over financial reporting. In addition, the auditor identified the evaluation of VIZIO’s accrued price protection incentives as a critical audit matter (p. 68 et seq., VZIO 2022 10-K).

Now, don’t get me wrong, this doesn’t indicate that the company has manipulated its financial statements, and indeed KPMG has issued an unqualified opinion thereon, but a critical audit matter relating to a material (but comparatively small, $57.6 million) liability and the finding of potentially inadequate internal controls definitely leaves me feeling uneasy. As a shareholder, I ultimately have to put all my trust in management. Given these issues, I would therefore not mind to be more or less forced out of the stock.

VZIO stock is currently trading at $11.05, a 4% discount to the takeover price. Walmart expects the transaction to close in fiscal 2025, so in less than a year from now. I do not expect the transaction to be blocked by the Federal Trade Commission due to antitrust concerns, and this is likely the reason for the already quite small spread between the price offer and the current stock price. With such a small spread, given the high probability of the transaction going through, and for the reasons stated above, I would sell my VZIO shares if I were a shareholder.

From Walmart’s perspective, the acquisition serves the purpose of improving the breadth of advertising and also strengthening Walmart’s own advertising division. In my view, it is a smart addition to Walmart’s advertising segment.

I’ve already pointed out the strong segment growth, but of course the advertising business is not yet a significant contributor at only $3.4 billion. However, the meaningful organic investments and the acquisition of Vizio underscore management’s unwavering commitment to innovation and diversification. Maintaining growth at such a large retail company is certainly difficult, but I think the focus on e-commerce, delivery presence and definitely also advertising (imagine the addressable market given Walmart has 240 million customers and visitors per day, p. 8, WMT fiscal 2023 10-K) is the right growth strategy. Walmart has already been experimenting with targeted advertising through its partnership with Roku, which was announced in June 2022.

In my view, Walmart will easily be able to ramp up marketing for Vizio devices, and the company has the financial flexibility to operate the Device segment at very low, zero or even negative margin, eyeing the ultimately high potential of the advertising-focused Platform+ segment. However, I believe the Vizio-related advertising expansion will be limited to the U.S. for now, but if successful, I could also see expansion in line with the company’s other international advertising efforts.

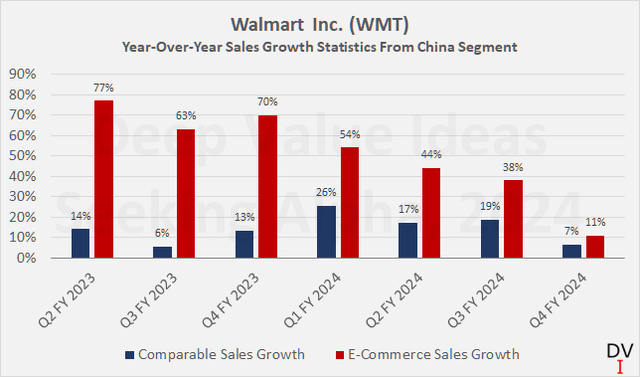

With regards to Walmart’s international expansion, I realize that this is a necessary step as the law of large numbers applies to Walmart’s domestic business, but the development in China in particular has become somewhat sobering. E-commerce growth continues to slow (Figure 9) – which is not surprising given that Walmart is facing fierce competition in China. But even Walmart China’s comparable sales growth – while still double-digit – is pretty weak considering the segment is still an insignificant contributor to sales (2.3% of consolidated net sales in the fourth quarter). In my view, Walmart runs the risk of supporting a potentially unprofitable business that it may eventually have to abandon, which will hurt its consolidated performance. But of course, the company has the flexibility to sustain growth experiments in – culturally very different – regions, but I consider it a high-risk/high-reward undertaking (see, for example, Walmart’s failed expansion into Germany in 2006). Personally, I feel much more comfortable with Walmart’s presence in Canada and Mexico (3.5% and 7.5% of consolidated net sales in the fourth quarter, respectively).

Figure 9: Walmart Inc. (WMT): Comparable sales growth and e-commerce sales growth in the China segment (own work, based on company filings)

To return to Vizio: It is probably no exaggeration that Walmart intends to build an ecosystem similar to what Amazon.com has done with its Alexa franchise in addition to leveraging its advertising business, but of course this is a very long-term expectation that would require significant capital expenditure. However, the potential is certainly huge – creating a virtuous cycle of platform growth and addressable advertising market – and I would argue that building such a platform at this stage of market consolidation is only possible for the few big players, of which Walmart is definitely one. Just imagine the trove of high-value data the retailer collects from its 240 million daily shoppers and visitors.

Concluding Remarks

In a sense, Walmart is doing the impossible. Despite its extremely strong presence in the U.S. and stiff competition from online retail giant Amazon.com, the company continues to grow at a healthy rate. Granted, free cash flow is still in recovery mode, but I think investors should appreciate the well-thought-out growth strategy of the world’s largest retailer. And despite the fact that the law of large numbers should certainly be considered in the context of Walmart’s domestic retail business, the company continues to post good growth, as evidenced by the most recent full-year results. In the current environment, I believe Walmart’s management is doing a particularly good job of communicating the brand values of trust, merchandise variety and value for money.

From a dividend growth investor’s perspective, the 9.2% increase was definitely a positive surprise, and long-term investors will likely appreciate the sizable increase in yield-on-cost after a decade of rather paltry 2% increases. However, as a potential new investor, I maintain that WMT shares are unattractive from an income perspective with a starting yield of 1.44%. Investors should realize that they are paying a current price of 26 times adjusted earnings for a company with a very modest long-term growth rate where the law of large numbers already plays a role – at least in the context of its domestic retail business, which will most likely continue to be its bread-and-butter segment. Therefore, I stand by my earlier conclusion that WMT stock is a sell from the perspective of a relatively new investor who doesn’t have to factor in a sizable capital gains tax.

At the same time, however, I give management credit for relentlessly focusing on new growth opportunities. While I realize that Walmart must successfully penetrate international markets to continue to grow meaningfully, I maintain that the company is taking the (manageable) risk of supporting a potentially unprofitable business in China that it may eventually have to abandon, thereby hurting consolidated performance. In my view, however, the market is already pricing in a successful expansion into China and India at current valuations, while recent trends in the latter segment do not support this expectation.

Walmart’s advertising business is a different story. It is still very small, but I see very strong synergies with the core business. The retailer has an extremely valuable treasure trove of data that it has already started to monetize, albeit on a very small scale. The acquisition of VIZIO, which comes at a very reasonable valuation, fits well into the company’s growth agenda. Vizio has obviously benefited from the pandemic, but its Device segment has suffered from a significant decline in sales since then. I am confident that Walmart can reverse this trend quite quickly, simply because of its enormous scale and the financial flexibility to operate the segment at razor-thin or possibly even negative margins. Long term, the focus will be on building a strong advertising business and possibly even a system similar to Amazon Alexa. The opportunities in this segment should not be underestimated, and Walmart, with its 240 million daily customers and visitors, definitely belongs to a relatively small group of companies that have a high chance of successfully building such a platform.

All in all, I nevertheless think it is too early to upgrade WMT stock, but the growth plan is definitely solid and is already starting to bear fruit. I maintain my sell rating from the perspective of a relatively new shareholder. However, as a long-term shareholder, I would definitely hold on to my position and appreciate the fact that the world’s largest retailer continues to evolve and adapt, growing in a sustainable way without burdening the balance sheet.

Thank you very much for reading my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your own due diligence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.