Summary:

- Lucid again failed to meet quarterly revenue expectations.

- The company continues to lose large sums of money and burn through tremendous amounts of cash.

- Production guidance for 2024 implied little growth, which doesn’t support this premium valuation.

Kseniya Ovchinnikova/Moment via Getty Images

After the bell on Wednesday, we received fourth quarter results from Lucid (NASDAQ:LCID). The struggling electric vehicle maker has consistently failed to meet production and delivery targets, sending shares significantly lower over time. Unfortunately for investors, the latest report showed many of the same trends, meaning shares could easily see new lows this year.

Why I was bearish to start:

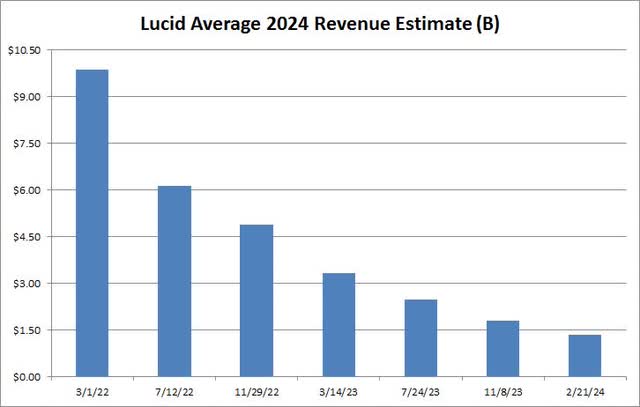

When I last covered the name at its Q3 2023 report, the company had just announced a large revenue miss and cut full year production guidance. At that time, I rated the stock a sell because demand troubles and large losses were leading to tremendous cash burn. Since then, shares have lost about 8%, badly underperforming the overall market that’s rallied double digits to new highs recently. The only thing that’s been worse than Lucid stock lately has been analyst revenue estimates, which continue to drop as seen below.

Lucid Revenue Estimates (Seeking Alpha)

For Q4, Lucid had already announced production of almost 2,400 units and deliveries of 1,734 vehicles. This was the sixth straight quarter where the company built more than it sold, with an average of 800 extra units per quarter in that time. When I previously covered the stock in November, it was selling at nearly the same price to sales multiple as EV giant Tesla (TSLA). That didn’t make sense, given Lucid was having trouble selling a few thousand vehicles each quarter, and was reporting large losses and cash burn.

Last week’s quarterly report:

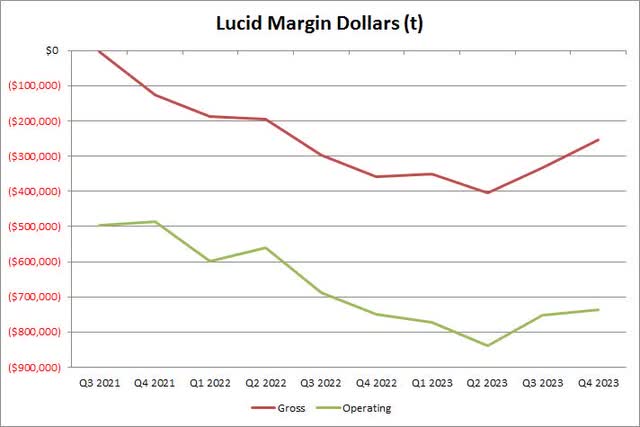

Lucid ended up with Q4 revenue of $157 million. Not only was this number down more than $100 million over the prior year period, but it badly missed heavily reduced street estimates for over $181 million. Revenue per vehicle delivered dropped nearly $4,000 sequentially. As the chart below shows, margins remain heavily in the red, with the company running at a nearly $3 billion per year operating loss in Q4.

Lucid Margins (Company Earnings Releases)

With Lucid’s losses being quite dramatic in recent years, the company has been burning through tons of cash. In the latest quarter, cash burn was more than $747 million, putting the total for last year at more than $3.4 million. Management previously said it has enough liquidity to get through the Gravity launch and into 2025. However, it would not shock me if we see another capital raise to fortify the balance sheet. Cash and investments finished Q4 at more than $4.3 billion, while Lucid had about $2 billion of debt on the balance sheet as well.

Why 2024 won’t be much better:

Perhaps the most disappointing item in Wednesday’s report was guidance. Management is calling for 2024 production of 9,000 vehicles, including the new Gravity starting late this year, which implies single digit percentage overall growth from the 8,428 production figure seen in 2023. Analysts went into the Q4 report expecting revenues to more than double to $1.32 billion this year, and have since started cutting their numbers on this disappointment.

Not even two months into the year, Lucid has already announced price cuts on multiple variants of the Air Sedan. The Pure rear-wheel drive version was cut by $7,500 to under $70,000. The Touring model is now under $78,000, down $8,000 this time. That version, along with the Grand Touring, have seen their prices slashed by almost $30,000 from where they were just about 10 months earlier. Lucid clearly has a demand problem, and management doesn’t exactly have a ton of credibility here. When Lucid went public via SPAC, it guided for 20,000 Air sedans to be produced in 2022 and for total production this year to be 90,000 vehicles. Guidance now implies 10% of that original forecast.

My current view on the stock:

Given another terrible quarter on the record, I am continuing to rate Lucid shares as a sell even after last week’s fall. The valuation angle here continues to be a problem, as Lucid finished Friday trading at about 7.7 times this year’s expected sales, well above the 5.5 that Tesla goes for. Many other smaller volume electric vehicle players trade at even lower price to sales multiples in the low single digits. The average analyst price target for Lucid is now down to $4, down double digits percentage wise in less than a week, and this was a stock that analysts saw worth more than $40 just two years ago.

For me to upgrade Lucid to hold, I need to see deliveries ramp up to more material levels. The Gravity launch could be a positive catalyst if Lucid shows it can drive more demand for an electric SUV, but that’s really a 2025 story. To become a worthwhile investment, investors need to see a major reduction in net losses and cash burn, to show that this business has any hope of a long term future. I’d also like to see another capital raise here, because even though management says it has a cash runway into next year, launching another vehicle is going to be quite expensive. It’s possible that we’ll see the Saudi Investment fund, already a huge Lucid investor, contribute more capital to help get the Gravity launch going. If Lucid shares continue to fall, it’s even possible that the Saudis eventually buyout the rest of Lucid that they don’t already own and just take the company private.

In the end, Lucid’s Q4 results last week showed that the company remains in big trouble. Revenues missed expectations yet again, with large losses and cash burn continuing. Guidance for this year implies almost no production growth, despite the upcoming Gravity launch, which has analysts cutting their revenue estimates further. With shares still trading at a premium valuation and Lucid probably needing more capital, I will continue to rate this name a sell until we see some major progress here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I own 1207 shares of Lucid Motors

@ $14 / share. I guess my strategy at this point would be to hold and short options against it.

Do you have any suggestions?

Thanks,

PAUL