Summary:

- Lucid Motors slashes production forecast for 2023 and 2024, indicating little growth in production and deliveries.

- Weak demand and high operating expenditures contribute to the company’s ongoing losses and lack of profitability.

- The market for EVs is becoming less hospitable, with slowing demand and potential buyers holding out for lower prices. Multiple compression and downside sales estimates are expected.

hapabapa

Lucid Motors (NASDAQ:LCID) kept disappointing investors in 2023 when the electric-vehicle company slashed its production forecast to 8,000-8,500 EVs amid faltering demand.

But if this disappointed you, you haven’t seen the forecast for 2024 yet which implies a total production of only 9,000 EVs which would make 2024 the second consecutive year of very little growth in production and deliveries.

Taking into account the EV company’s disappointing growth outlook, the stock’s premium multiple is getting harder to justify. Sell.

My Rating History

I soured on my investment in Lucid Motors quite substantially in the third quarter after the company’s production results disappointed, resulting in me throwing in the towel completely.

The forecast for car production in 2024 production sort of reaffirms my decision and Sell stock classification, and investors better anticipate softer sales growth in 2024 as well. As a consequence, Lucid Motors sales multiple looks poised for ongoing contraction.

Sales Drop, Guidance Disappoints

Lucid Motors started to lose production momentum in 3Q-23 which is when early signs of demand weakness came to light that resulted in a steep drop in production.

In 3Q-23, Lucid Motors produced 1,550 EVs in Arizona, down from 2,173 EVs during 2Q-23. In 4Q-23, the production accelerated again to 2,391 EVs, but the company did overall not do well at all.

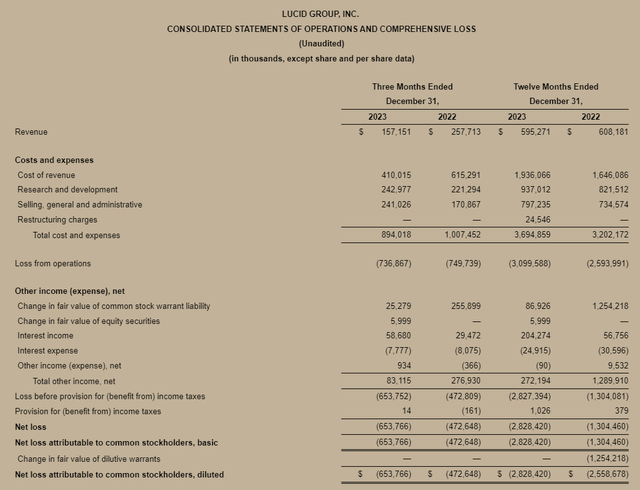

Headwinds to demand left a nasty imprint on Lucid Motors’ results for the fourth quarter with sales crashing 39% YoY to $157.1 million.

Due to the EV company slashing operating expenditures (and reducing its headcount), Lucid Motors reported a similar level of operating losses compared to 4Q-22, but the profit situation is unlikely to improve this year.

Lucid Motors racked up $653.8 million in net losses in 4Q-23 and $2.8 billion in 2023. I don’t see any path for Lucid Motors to drive its business to profitability in the near term as demand weakness and high operating expenditures should be a drag on the company’s valuation multiple.

Consolidated Statements Of Operations (Lucid Motors)

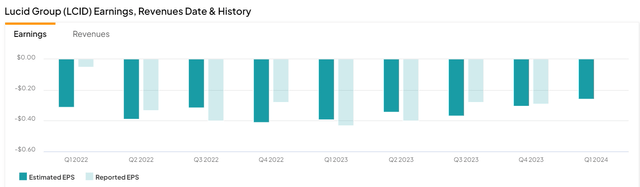

Lucid Motors’ quarterly results broadly met expectations, however, with the EV company reporting a loss of $0.29 vs. a consensus of a $0.30 per share loss. It was the second profit beat in a row for the EV company.

Earnings And Revenue (Yahoo Finance)

Headwinds To Demand And Why The Guidance For 2024 Is Disappointing

The market for EV producers is a little less hospitable in 2023, for a series of reasons.

First, EV demand is slowing as consumers are not yet willing to ditch ICE vehicles. Lucid Motors’ EVs, though positioned in the luxury market, are quite expensive with the base model, the Lucid Air Pure, now having a starting price of $71,900. This is expensive for a lot of folks and with EV turnaround times on dealers’ lots increasing, the buyer of a new EV seems to be a lot more hesitant to make a purchase decision compared to 2022.

Both General Motors Company (GM) and Ford Motor Company (F) have prepared investors for a slower pace of growth in the EV market.

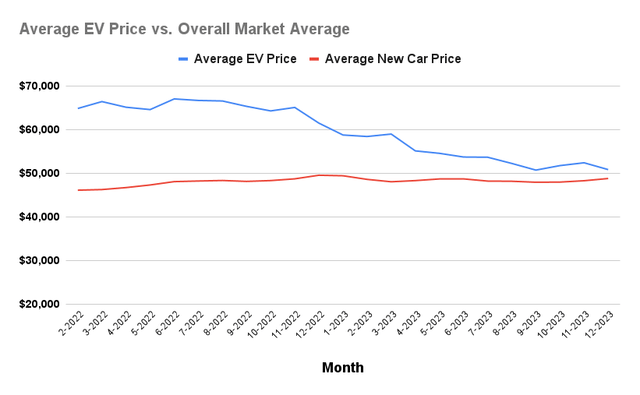

As EV prices are trending down, potential EV buyers may be holding out for even lower prices, or decide to buy ICE vehicles instead. The price trend for the average EV price according to CarEdge | Buy, Sell, and Protect New & Used Cars has dropped to about $50K in the last year, reflecting an almost $12K drop in price per EV since June 2022.

With that being said, buyers still pay about a 17% premium for the average EV compared to the average new car price.

Average EV Price Versus Overall Market Average (Caredge.com)

Weakness in demand has unfortunately translated into real weakness as far as Lucid Motors’ production is concerned. For the present year, Lucid Motors only anticipates to produce 9,000 EVs which is only 572 more EVs than it produced in 2023.

In 2022, actual car production totaled 7,180 EVs which reflected a 2023 YoY production increase of 1,248 EVs. The takeaway here is that the projected present year production increase is set to drop drastically compared to 2023 which is ultimately revealing of waning customer demand.

Multiple Compression

The most likely outcome in this situation is ongoing pressure on Lucid Motors’ sales multiple as well as sales estimate corrections to the downside.

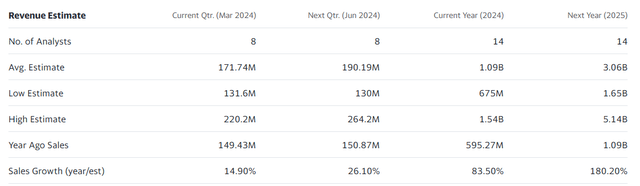

According to Yahoo Finance, the sales estimate trend is concerning as the market has started to come to terms with the notion that the EV company is not going to grow as quickly as once assumed. This, unfortunately, is probably going to continue to affect Lucid Motors’ valuation multiple this year.

Lucid Motors, since November, has lost about 22% of its estimated sales volume as the market is anticipating slower-than-expected sales growth in response to the EV company’s disappointing production results.

For 2024, the market models now only $1.09 billion in sales, compared against $1.40 billion in sales back in November. The implied 2024 sales multiple at a present stock price of $3.02, is 6.4x which is a proud multiple for an EV maker that barely manages to grow its production.

The present near-term production outlook, waning EV demand, weakening EV price trend, disappointing sales and high operating costs don’t make Lucid Motors a compelling buy here.

Revenue Estimate (Yahoo Finance)

Upside Potential And Risk Clarification

Lucid Motors might do a lot better when it launches its next project, the Gravity SUV which primed to go into production later this year (likely 4Q-24).

Passenger sedans presently don’t seem to be what the market wants and a broadening of the portfolio may attract a new segment of buyers which have passed on the Lucid Air Pure. If the Gravity SUV has a good market reception, then Lucid Motors’ stock could also have re-rating potential.

My Conclusion

Lucid Motors crushed all remaining hopes that the situation in the EV market is going to improve in the near-term which seriously imperils the original growth story about Lucid Motors’ EV market potential.

The 9,000 production forecast was extremely disappointing, particularly because investors have pinned their hopes on a potential recovery in production for 2024.

This obviously is not going to materialize as the EV price trend reflects what big auto companies have said as well: The EV market is going to grow slower moving forward.

Sales estimates are therefore poised to fall further in 2024 which may continue to put pressure on Lucid Motors’ valuation pressure. Sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.