Summary:

- Microsoft reported strong financial performance in FQ2, with revenue growth and improved operating leverage, powered by strong momentum in cloud business.

- The strategic partnership with OpenAI positions Microsoft at the forefront of the generative AI revolution, providing long-term growth potential.

- The big indicator of strength is that Azure has gained two percentage points in infrastructure market share at the expense of the undisputed leader, Amazon’s AWS.

- My valuation analysis suggests that the stock is attractively valued.

FinkAvenue

Investment thesis

My previous bullish thesis about Microsoft’s (NASDAQ:MSFT) stock aged well, with the stock rallying by 11% since then. My analysis of recent developments suggests that the company’s fundamentals are still intact as the company continues delivering stellar financial performance and fortifying its balance sheet. The huge indicator of MSFT’s strategic strength is its Q4 2023 expanding market share in the emerging cloud technologies domain. I think that gaining market share at the expense of the long-term market leader, AWS, is not a randomness, but was achieved by the technological advantage powered by the partnership with OpenAI. The stock is very attractively valued, despite my discounted cash flow simulation showing only a mere 3% upside potential under the base-case scenario. I believe that a company dominating across different IT domains, like MSFT, deserves a substantial premium to its fair value. It is also crucial to understand that in the current environment of AI capabilities rapidly evolving, it is highly likely that MSFT’s long-term consensus revenue estimates might be substantially upgraded, which will, in turn, boost the fair value of the stock. All in all, I assign Microsoft with a “Strong Buy” rating.

Recent developments

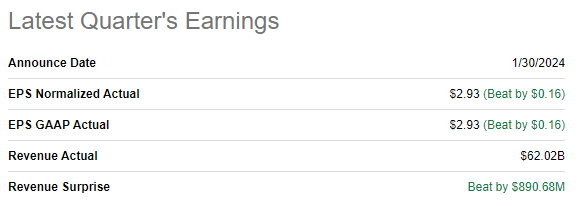

Microsoft reported its FQ2 earnings on January 30, topping consensus estimates. Revenue growth accelerated notably in FQ2 with a 17% YoY increase. The adjusted EPS also expanded notably, from $2.32 to $2.93.

Seeking Alpha

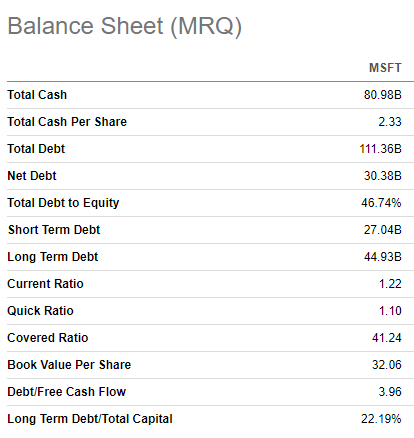

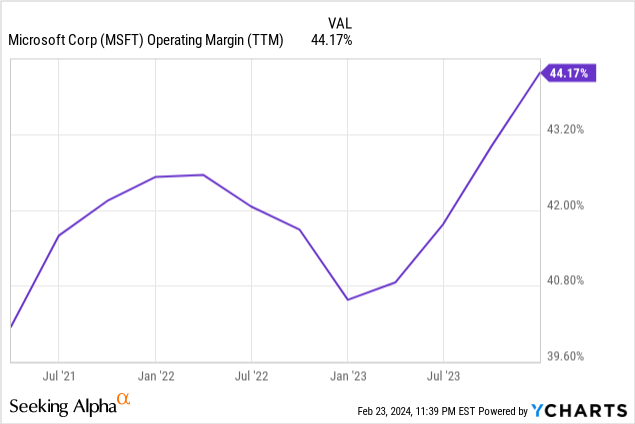

The increase in EPS was due to a notable improvement in operating leverage. The operating margin expanded from 38.7% to 43.6% on a YoY basis. Strong profitability improvement allowed to boost operating cash flow from $11.2 billion to $18.9 billion. This allowed MSFT to continue fortifying the balance sheet, which now has $81 billion in total cash. The outstanding cash amount is around three times higher than the short-term debt, meaning ample liquidity to continue investing in growth and innovation.

Seeking Alpha

The strength in Microsoft’s financial performance was demonstrated across all streams, but the major driver was the Intelligent Cloud business. Microsoft Intelligent Cloud business delivered a 20% YoY growth and generated $25.9 billion in FQ2 revenue. Industry tailwinds undoubtedly played a role, but it’s crucial to highlight that Azure’s growth was also fueled by capturing a significant 2 percentage points of market share from Amazon’s (AMZN) AWS. Let me remind you that AWS has been an undisputed market leader for a long time, and it looks like Microsoft is able to try to close the gap between the two leaders. The strength of the cloud is crucial for Microsoft because this business already represents more than 40% of the company’s total sales.

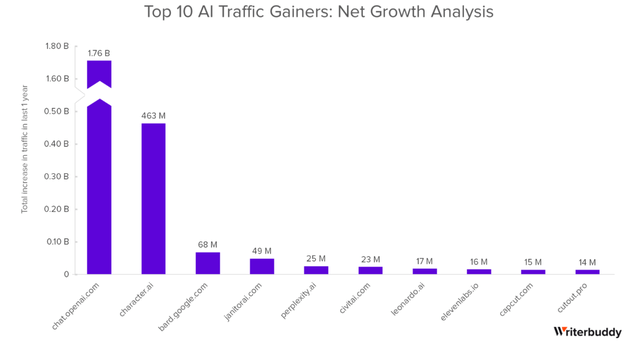

It looks like Microsoft’s strategic partnership with OpenAI, an emerging generative AI company, provides real benefits and helps in delivering appealing value to the cloud users. I am definitely not a generative AI expert, but an industry report from WriterBuddy suggests that OpenAI’s ChatGPT holds a massive 60% share of all the global traffic generated by AI chatbot/writer websites. To me, this is a massive indication of ChatGPT’s technological strength compared to that of its peers. The recent sensational release of a text-to-video Sora tool also suggests that OpenAI is at the forefront of the generative AI revolution. Being the big strategic partner and investor of OpenAI, Microsoft has the advantage of incorporating cutting-edge capabilities into its products, which will likely help the company to capitalize on it over the long term.

I also see another highly probable growth driver for Microsoft from the $69 billion Activision Blizzard (ATVI) acquisition, which closed closer to the 2023 year-end after big regulatory scrutiny. I see the potential here to diversify Microsoft’s strength in the cloud for business applications and an emerging cloud gaming industry. According to Statista, the cloud gaming industry is expected to compound at a massive 30% CAGR within the next five years. I see this factor as a crucial potential further growth catalyst for Microsoft. The recent massive round of layoffs in ATVI and Xbox is a clear indication that the company’s management is taking this revenue stream seriously and aims to maximize profitability here.

To sum up, I believe that synergies for the cloud from leveraging OpenAI’s capabilities together with a promising gaming business continue to help the company sustain its stellar operating margin trajectory. In Personal Computing, it is an apparent market leader, with its staggering 70% market share. Despite Microsoft 365 facing fierce competition in the productivity tools market, it is still an undisputed number-one choice for the largest corporations. According to ZipDo, more than 80% of Fortune 500 companies use Microsoft 365, which is a clear indication of trust and loyalty from the wealthiest corporate customers in the U.S. It is also crucial that for its Microsoft 365 applications, Microsoft also leverages artificial intelligence capabilities with its recent introduction of a tool called Copilot.

Therefore, I think that strong market positioning will likely ensure consistent revenue growth from these segments accompanied by steady profitability expansion.

Valuation update

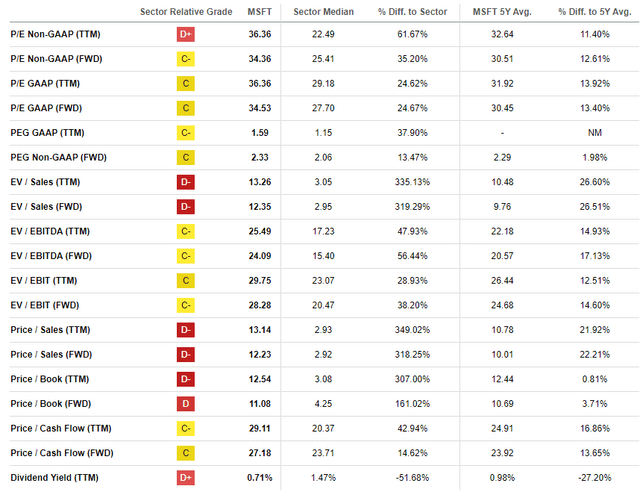

MSFT substantially outperformed the broader U.S. stock market over the last 12 months, with a 64% rally. The start of 2024 has also been solid, with a 10% YTD stock price increase. Current valuation ratios are moderately above the last five years’ averages across the board, which might mean overvaluation.

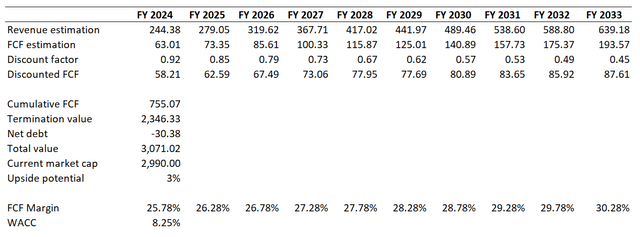

As I always do, I proceed with the discounted cash flow [DCF] simulation. I use a softer 8.25% WACC, compared to 9% last time, because the Fed projects three rate cuts this year. Consensus revenue estimates project an 11% CAGR, which I consider conservative enough for a company like Microsoft. I use a 25.8% TTM FCF margin and expect it to expand by at least 50 basis points yearly.

According to my DCF simulation, the stock is currently very close to its fair value, since the business’s fair value is not far from the current market cap. I believe that a stock like MSFT deserves a substantial premium to the fair value. Therefore, I consider a 3% discount as an attractive valuation.

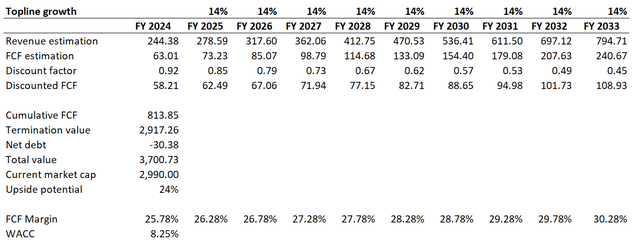

Moreover, it is important to understand that the rapid adoption of artificial intelligence capabilities unlocks new growth drivers for businesses, and it is highly probable that Microsoft will raise guidance multiple times this year. I think that the probability is high here because the AI software market is likely to lag slightly behind hardware in timing. Last year, we saw massive guidance boosts from NVIDIA (NVDA), and I will not be surprised if all the computing capacity from GPUs is converted into new monetizable products from software companies. If we assume that MSFT’s long-term revenue projections upgrade from the current 11% to 14%, the fair value of the business boosts towards $3.7 billion, indicating a 24% upside potential.

Risks update

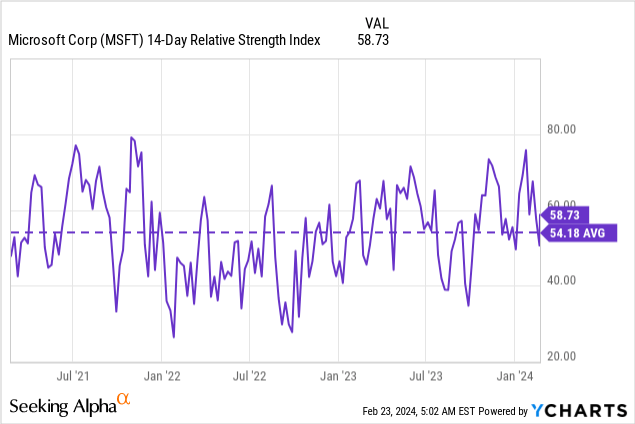

The stock almost doubled in price between autumn 2022 lows and the current levels. Recording such a massive rally within a relatively short timeframe suggests that the FOMO-driven effect persists. That said, there is a chance that even slightly negative headlines, either for Microsoft or other tech giants, might be a red flag for speculative investors, which can cause a temporary stock sell-off. The current relative strength index [RSI] has been above the average for the last three years, but the gap is still not dramatic. The risk of a temporary pullback is likely to increase if the RSI goes closer to 70. Therefore, it is the indicator I would follow in selecting entry points.

In light of the recent cyberattack on Microsoft’s Azure, I believe that security risks are currently in the red zone. In case successful cyberattacks on Azure continue, this might lead to a big hit to Microsoft’s reputation. Security of personal and enterprise data is one of the most important qualities of a cloud platform, and failing to regain users’ confidence in Azure rapidly might lead to very adverse consequences. On the other hand, it is not the first attack on Azure’s platforms, and it does not seem that there were indications of lost trust in the product.

Bottom line

To conclude, MSFT is a “Strong Buy”. I think that the current valuation is very attractive because further long-term earnings upward revisions are quite likely as the company’s cloud business is gaining massive momentum thanks to technological advantage powered by a partnership with OpenAI.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.