Summary:

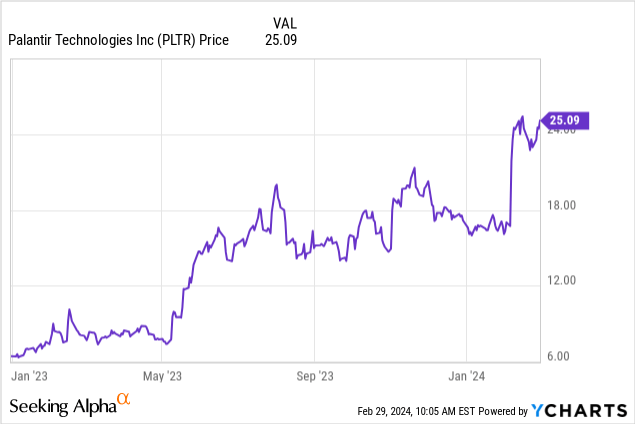

- The market is pricing in very high growth, which is reflected in the rapid rise in the stock.

- However, given the possibility that Palantir could develop one of the strongest competitive advantages, I believe this is justified.

- In fact, I think many still underestimate Palantir’s potential, as it is very likely that profits will rise sharply in the future.

Michael Vi

The Palantir Investment Thesis

Palantir Technologies Inc (NYSE:PLTR) was right on time with the introduction of Palantir AIP last year. And the stock has benefited greatly from that and has done very well so far. And the introduction of bootcamps to help potential customers understand how to apply AI and see the use cases has also been a complete success. In particular, the speed with which an operational system can now be set up in a matter of days instead of months has contributed greatly to the success.

But the market is currently pricing in a very high-growth rate, which I think also indicates that this is a very high-quality company in the eyes of market participants. The key now is to find out if the market is still underestimating Palantir’s chances of having a bright future. So let’s take a closer look at the company.

What Exactly Does Palantir Do And How Do They Aim To Deliver Value To Their Clients?

Palantir was founded in 2003 to compete in the counterterrorism industry. As a result, for years most of its customers were government agencies. But the mix has shifted, with 55% of customers in FY23 being government and 45% being commercial. And the remaining deal value is $2.1 billion for commercial and $1.8 billion for government, so it is very likely that the commercial side will be the larger of the two going forward.

Palantir currently consists of 4 different platforms. And a major turning point was the introduction of AIP in 2023, which uses machine learning and LLMs with data from the other platforms.

Gotham and Foundry, on the other hand, act as an operating system, reflecting the data of the operation and helping the user identify patterns in data sets as quickly and easily as possible. That is because Palantir is committed to ensuring that users can get the most out of the platform, regardless of their level of technical expertise.

And the final platform, Apollo, is a single control layer that is responsible for coordinating that everyone gets the latest updates and features, whether they are in the cloud or working with Palantir elsewhere.

Does PLTR Have Competitive Advantages And Are There Barriers To Entry?

The barriers to entry are extremely high. On the one hand, installation costs are relatively high, and on the other, data environments are very complex. In addition, Palantir has its roots in working with intelligence agencies, which ensures the highest level of data security.

Additionally, Palantir’s virtual tables will make it easier for customers to get started with what is normally a very complex process. And Palantir aims not to replace existing things, but to work with them as a kind of layer that connects the data to the models and the real world, so customers don’t have to make a copy of the data because Palantir is compatible with AWS S3 (AMZN), Snowflake (SNOW), BigQuery (GOOGL), and Azure (MSFT).

In addition to this, Palantir’s clients do not need to know how machine learning or AI works, but can still work with the results. For example, AIP logic allows unit testing and debugging without writing new code, and AIP Scenarios show what effects the actions might have. Furthermore, AIP Automate is able to automate certain processes on this basis.

And Palantir goes to great lengths to make the transition as easy as possible for their customers. With SDDI or Software Defined Data Integration, there is no more costly and time-consuming manual customization of the semantic layer. And no need to write new lines of code.

So Palantir has analytics, workflow, integration, data, and AI/modeling all in one place. Combined with easy, secure synchronization with existing ERPs, MES, SCMs.

If, in the future, the models prove to be more accurate and faster at predicting trends than current solutions, there will be a huge competitive advantage. At that point, I believe Palantir will become mission-critical to its customers, and the longer they use the platform, the more dependent they will become on it. So the cost of switching would be incalculable.

Real-life Examples Of How Organizations Have Benefited From Palantir’s Software

Corporate marketing departments often throw around buzzwords, so I think it’s better to look at real use cases and see if Palantir has really delivered value to its customers.

For example, Palantir’s hospital solution improved nurse staffing ratios by 30% and reduced patient length of stay in the anesthesia unit by 28%. Clearly, two examples that have created value for customers and the business.

Ferrari (RACE), a Palantir partner since 2017, has benefited from being able to find anomalies faster and more effectively, allowing them to spend more time analyzing data rather than collecting, organizing, and cleaning it. And anyone who has worked with Python or other languages knows how much time it takes to clean up and organize data. In the past, as much as 80% of the time was spent on these tasks, and the actual analysis time was much less than most people think.

Palantir helped Swiss RE (OTCPK:SSREY), one of the world’s largest reinsurance companies, to significantly reduce the time it takes to produce reports. And reinsurance is a very complex business, with data that ideally is analyzed in real time, while respecting the strict regulatory privacy guidelines.

Fujitsu (OTCPK:FJTSF) selected Palantir to optimize its supply chain and modernize its technology infrastructure. And this partnership came about because Takahito Tokita, CEO of Fujitsu, said that Palantir’s track record in solving complex problems was important.

And I think it is good to see that some of the big companies see Palantir as one of the best partners to solve complex problems because their models are probably ahead of the competition in terms of identifying trends or predicting them a little bit more accurately. And something else that Palantir does very well is they manage to get a lot of different users using different systems to work together perfectly to save time. And every time you save time, you save money.

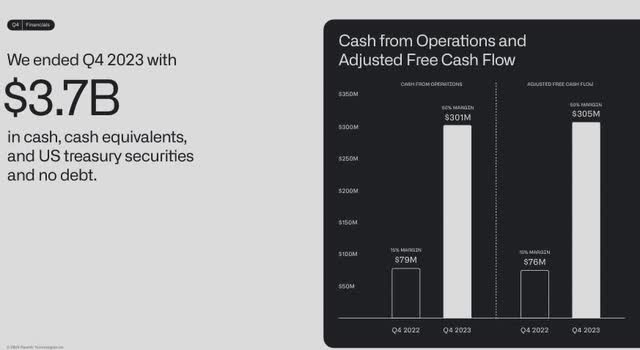

PLTR’s Balance Sheet And Metrics

With $3.7 billion in cash and no debt, Palantir is in a fantastic position financially. Furthermore, because the company has positive FCF and positive net income, there will be enough money in the future to invest in growth opportunities or to return money to shareholders at some point.

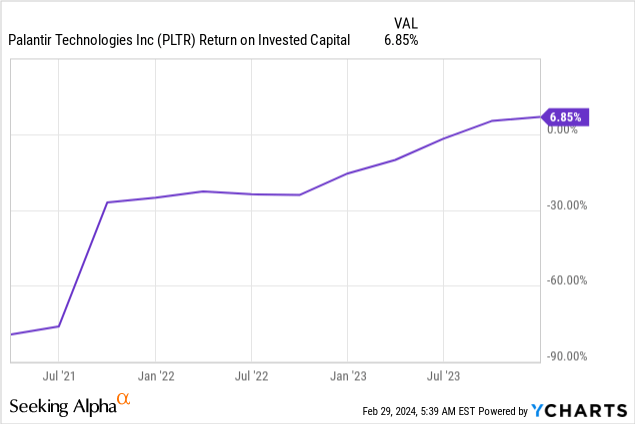

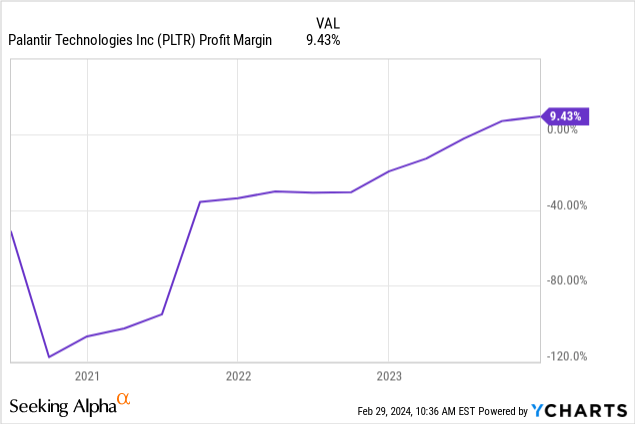

And right now, ROIC is below average, but it is increasing, and Professor Mauboussin’s research has shown that companies that increase their ROIC are among the best performers. And since Palantir has not been profitable for a long time, I think we will see a big increase in that over the next few quarters.

Palantir Earnings Report Q4 23

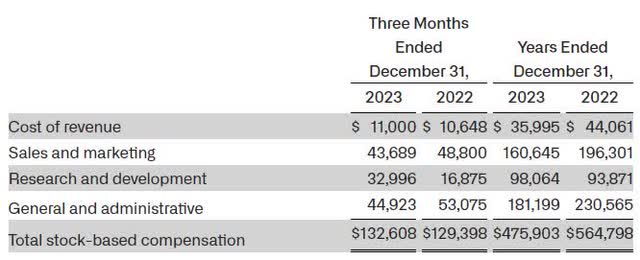

Fortunately, the number for SBC at Palantir is also decreasing. In FY22 SBC costs were $564 million and in FY23 they were only $475 million.

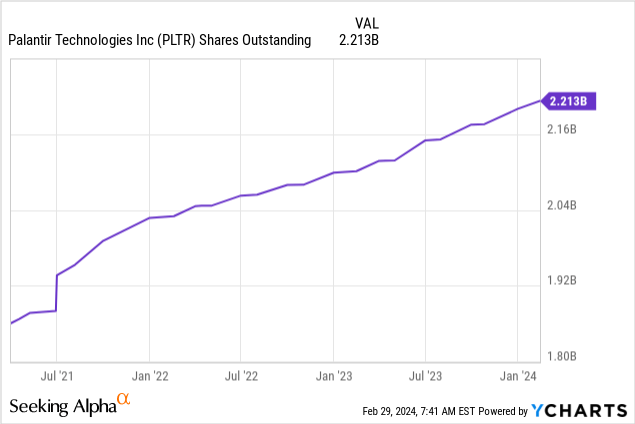

Nevertheless, the issue of new shares has resulted in a relatively high degree of dilution, but if EPS continues to rise over the next few years, that will be fine. Still, flat or declining shares outstanding in the future would be preferable.

Are There Too Many Insider Sales At Palantir?

I think most people who are interested in Palantir right now are following the discussions about insider selling, especially CEO Alexander Karp’s stock selling. And the stock situation is a little more complicated at Palantir than it is at other companies. It’s relatively common for companies to have A and B shares with different voting rights, but Palantir also has F shares, which effectively give the founders at least 49.99% of the votes.

So no matter how many shares they sell, they will probably make sure that together with the F shares they always have a majority of the voting rights. However, Thiel’s share of Class A shares, about 7%, is lower than that of most other founders of well-known companies. For example, Zuckerberg owns 13% of Class A Meta shares and Musk owns 20.5% of Tesla. So we can definitely say that other founders have a bigger slice of their own company’s pie, but that Thiel and Karp’s interests are still aligned with those of shareholders because their stakes are still in the billions.

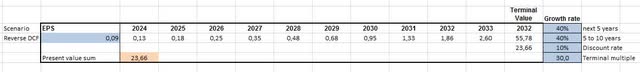

Palantir’s Valuation Via Reverse DCF

The market’s expectations for Palantir are very high. Currently, the market is pricing in a 40% 10Y CAGR for diluted EPS. But that is also because the starting point of $0.09 diluted EPS is very small. So for the stock to be fairly valued, EPS would have to be around $2.6 in 10 years, which I think is quite realistic.

Palantir Earnings Report Q4 23

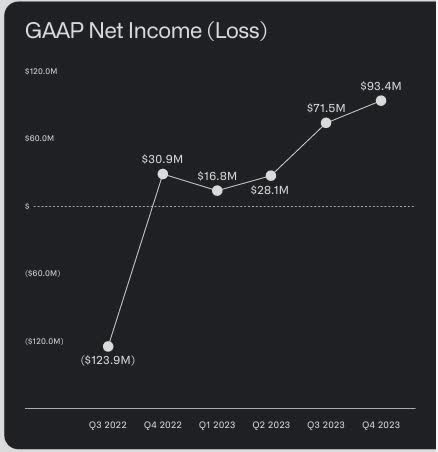

Within one year, Palantir has tripled its net income from $30.9 million to $93.4 million. Therefore, I expect that the increase will continue to be very strong in the coming quarters. If they can achieve growth and profitability at the same time, it would create tremendous shareholder value.

Where Could EPS Be In The Future?

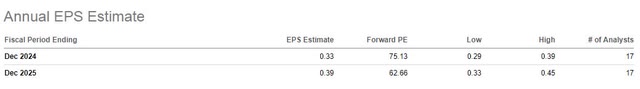

Seeking Alpha Earnings Estimates

The earnings estimate of 17 analysts calls for 3.5x of current EPS by the end of 2024. And then only an 18% increase from 2024 to 2025, which I personally think is too low. I think earnings growth is being underestimated and that Palantir will do better than analysts expect.

I strongly suspect that revenues and net income margins will increase over the next 5 years. And I would not be surprised if we see $1 EPS before the end of 2027. At a 40x to 50x multiple, Palantir would be a $40 to $50 stock if it achieved $1 in EPS.

But Palantir is probably a long-term holding, where the real value will take 5 to 10 years to unfold. In the short term, the stock is likely to be very volatile.

Risks To Palantir’s Business

The most obvious risk is probably that Palantir’s predictions are inaccurate, and since we are likely only in the first inning of the AI era, much can happen and innovation is rapid.

And since we are still in the early stages, laws and regulations can change significantly. It will be interesting to see the impact of the CCPA and CPRA. And ethical issues are also likely to become more important.

In addition, the fact that the three largest customers account for 19% of total revenues is a cluster risk. But I think the biggest risks are probably in the area of cybersecurity. AWS and Azure host some of the platform functions, so a cyberattack could be a big problem. Especially since the data being used is very sensitive and could be of great importance.

Conclusion

Palantir has extremely high barriers to entry, benefits from high switching costs, and is on track to build a huge competitive advantage with its models. In the future, Palantir’s scenarios and models for the best way forward could become standard across industries. And if they succeed, the upside could be huge.

Inclusion in the S&P 500 may help the stock in the short term, but over the long term it is EPS and its performance that matters.

However, with margins and ROIC on an uptrend and revenues also on an uptrend, I expect diluted EPS to surprise the market. And over a 5 to 10 year time horizon, Palantir will likely be in much better shape than it is today.

And if they were to buy back shares at some point to significantly reduce the number of shares outstanding, that would have a very positive impact on EPS. I certainly expect FCF to be strong enough to return money to shareholders over the next few years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.