Summary:

- Dell currently trades undervalued based on a DCF calculation. There is a potential 20% upside assuming 3% growth.

- Dell is well-positioned to capitalize on the growing demand for AI-driven tools, such as generative AI chatbots. The AI market size is estimated to grow by 6x through 2030.

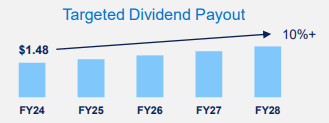

- Management confirmed a targeted dividend growth of 10% annually through 2028.

SOPA Images/LightRocket via Getty Images

Overview

Dell Technologies (NYSE:DELL) offers a wide range of solutions globally, primarily through its ISG (Infrastructure Solutions Group) and CSG (Client Solutions Group) segments. The ISG segment focuses on storage, servers, networking, and associated services for business transformation. Meanwhile, the CSG segment it PC related with including items such as desktops, workstations, notebooks, and more. Additionally, Dell provides cybersecurity solutions, customer financing, and infrastructure-as-a-service.

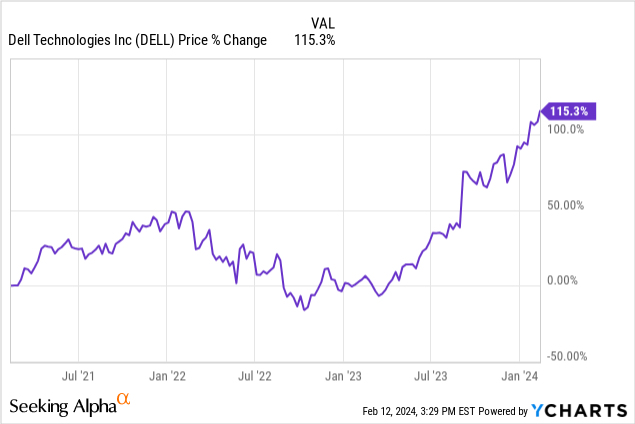

Dell had a price run and is has returned over 100% throughout the last year. With a short interest of 3.42%, there is a lot of optimism around the future of this company. Also, the small starting dividend yield of 1.7% isn’t anything to get excited about. However, the projected dividend growth of 10% annually through 2028 sparks my interest. If the business is able to sustain this kind of dividend growth, DELL might deserve a spot in my portfolio.

So the question arises: Is DELL still a buy after the run up over 100%? The stock has gain over 115% over a 3-year period and currently has a Strong Buy rating from Seeking Alpha’s Quant. If you’re anything like me, you’re afraid that as soon as you buy in, the price will reverse from the upward momentum and fall of a cliff. So let’s dig in and see why DELL has become such an attractive prospect.

Financials

DELL operates within two main segments: CSG (Client Solutions Group) and ISG (Infrastructure Solutions Growth). It has directed its efforts strategically by focusing on targeting the most profitable and rapidly growing segments throughout the PC ecosystem.

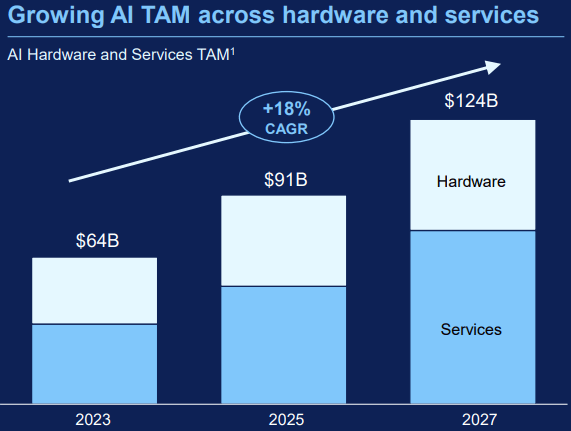

Within the ISG segment, they are focused on servers and storage. Dell has maintained its dominance as the number one provider in mainstream servers for an impressive 21 consecutive quarters. With a diverse portfolio tailored to support various levels of AI applications, the company is well-positioned to capitalize on the growing demand for AI-driven progression. While we are still in the early stages of the AI growth, I think Dell is positioned to capture a sizeable amount of marketshare growth.

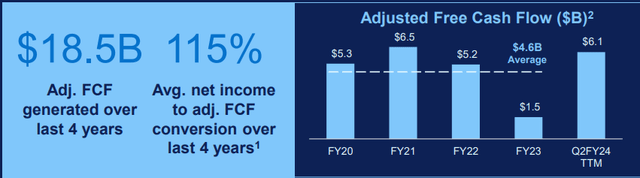

Combining these two segments, revenues are expected to grow at a 3-4% CAGR. Accumulating an impressive track record, the organization has achieved nearly $0.5 trillion in revenue, along with $36 billion in adjusted FCF (Free Cash Flow) and $30 in non-GAAP diluted EPS. Following the spin-off of VMware, shareholders have benefitted from the return of $5.5 billion since 2021.

In the most recent earnings report from November of 2023, the company reported solid financial performance with revenue totaling $22.3 billion. Operating income amounted to $1.5 billion, accompanied by a non-GAAP operating income of $2 billion. Additionally, the company demonstrated strong cash flow from operations, generating $2.2 billion in the third quarter alone and accumulating $9.9 billion throughout the past 12 months.

Dell has a healthy level of cash from operations totaling $9.8B and a net income margin of 2.92%, which is healthier than the median net income margin of 2.2%. While the latest reported revenue came in -10% than the year prior and reported revenue missed expectations by $646M, the 5-year average revenue growth is roughly 5.3%.

Upcoming Earnings

Dell is set to report their next earnings on February 27th. The EPS normalized estimate is $1.72 and the revenue estimate is about $22.1B. For reference, Dell beat prior Q4 2023 expectations by $0.16/share as well as beat revenue estimates by $1.5B. I expect the results for this upcoming earnings to meet expectations based on their increased revenues and higher demand for generative AI tools.

However, there may be a chance of a lower reported EPS due to funds being invested for further growth in the network cloud and AI spaces. When a company allocates resources towards investments like research and development, acquisitions, or expansion into new markets, it incurs expenses that may temporarily depress its earnings in the short term. So if Dell were to report under expectations, I don’t necessarily think this is a bad thing in the short term. This is because their investments would be aimed at driving long term growth and profitability. The only caveat is that these investments may not immediately translate into increased revenue or earnings.

For example, Dell announced a partnership with Nokia (NOK) on Feb 15th to advance 5G and cloud transformation. Nokia designates Dell as its preferred infrastructure partner for AirFrame customers, while Dell adopts Nokia’s Digital Automation Cloud for enterprise edge solutions. This collaboration aims to simplify network scaling and address evolving customer needs through joint research and workload certification.

Forward Looking

Dell’s strategy moving forward will be to focus on the growth of their AI-related products as well as implementation into businesses across the globe. Management sees the potential and hype around AI and wants to capitalize on this. We received confirmation of this from their last earnings call:

Our AI-optimized server backlog nearly doubled versus the end of Q2 with a multibillion-dollar sales pipeline, including increasing interest, across all regions. That all said, AI hype is everywhere, and we need to be measured in our expectations. We are still in the early innings with AI as customers continue to work through their AI strategies. Experience over multiple technology cycles tells us that progress won’t always be linear, but we are excited about the opportunity in front of us. We believe Dell is uniquely positioned with our broad portfolio to help customers size, characterize and build GenAI solutions that meet their performance, cost and security requirements. Our AI strategy, AI in our products, AI built on our solutions, AI for our business and AI for our ecosystem partners is the foundation for our actions, priorities, roadmaps and partnerships. And in Q3, we continue to build our capabilities. – Jeff Clarke – Vice Chairman and Chief Operating Officer

They are also aligning with strategic partners to help this vision of AI growth become a reality. Dell is currently in collaborations with Meta (META) and Hugging Face, an Ai-based company, to further integrate themselves in the space. I believe that Dell will continue leveraging strengths to extend reach on new opportunities like multi-cloud, edge computing, and AI as a priority. Optimism from my end is high because of expectations of returning to growth this year 2024, driven by anticipated tailwinds across various businesses, particularly AI. Regardless of economic cycles, it’s clear to me that their focus remains on growing and extending core businesses in profitable areas.

Strong AI Demand

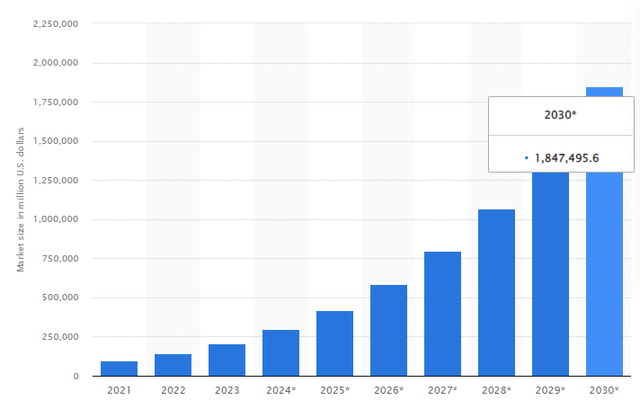

The projected market size of artificial intelligence is expected to grow 6x by 2030. Reaching nearly two trillion U.S. dollars by 2030, the expansion is set to encompass a wide array of industries, from supply chains and marketing to product development, research, analysis, and more, as businesses integrate artificial intelligence into their operational frameworks. The most common segment of this would be “Generative AI” with chat boxes such as ChatGPT.

The demand for Gen AI is substantial and continues to grow exponentially, evidenced by the potential addition of $4.4 trillion to the global GDP due to increased productivity. Access to generative AI tools and utilization of Large Language Models (LLM) are expected to drive a remarkable 20% increase in productivity. So naturally, I think it’s very likely that more and more companies will start to embrace this kind of technology. I am a consultant within the tech industry and I have now worked with multiple clients that are developing their own form of generative AI to help with productivity.

So speaking from experience, I think within the next 5 years, generative AI assistance will be very common and there will be lots of money spent on development and refining the efficiency of these tools. Imagine eliminating the need for spend on wages on financial analysts with a Gen AI tool that can instantaneously give you the answers you are looking for. For example, there are tools being developed that can instantly give you total spend by department per quarter and breakdown where the inefficiencies are.

Moreover, by 2025, Gen AI is projected to be responsible for generating 10% of the global data. The “GenAI” initiative represents a significant growth opportunity for Dell, focusing on the integration of artificial intelligence technologies into various aspects of the company’s operations.

DELL Investor Presentation

Dividend

As of the latest declared quarterly dividend of $0.37/share, the current dividend yield is about 1.7%. While this is a low upfront yield that isn’t capable of providing a sizeable amount of income without a huge starting investment, the yield itself is not the focus here. The anticipated dividend growth is the focus here as management has announced that they are targeting a dividend growth of 10% annually all the way through 2028.

In terms of cash, I don’t think this targeted dividend growth would be too difficult to achieve. At the moment, the current dividend payout ratio sits at a healthy 21.4%. For reference, the sector median dividend payout ratio is closer to 30%. The only ratio that I would like to see a bit healthier is the interest coverage ratio. The interest coverage ratio represents how easily a company can pay the interest on the outstanding debt. The current interest coverage of 3.24 severely sits below the sector median interest coverage ratio of 11.49.

DELL Investor Presentation

Management seems dedicated to delivering significant value to shareholders by prioritizing the return of over 80% of their adjusted FCF (Free Cash Flow). Their approach to returning value encompasses both share repurchases and dividends. I expect the share repurchases to contribute to a continued boost in price since reducing the number of outstanding shares increases the ownership stake of existing shareholders.

This can lead to an increase in EPS and potentially boost the stock price over time as Dell simultaneously continues to capture AI-related growth. DELL has the opportunity to provide a sense of balance by making shareholders happy while maintaining the flexibility to reinvest in growth initiatives.

Valuation

Wall St. seems to think that DELL is currently trading at a premium to fair value. This is based on the range of price targets as high as $95/share and as low as $46/share. The current average price target sits at $80.89/share which means the price currently trades at a slight premium of about 7%.

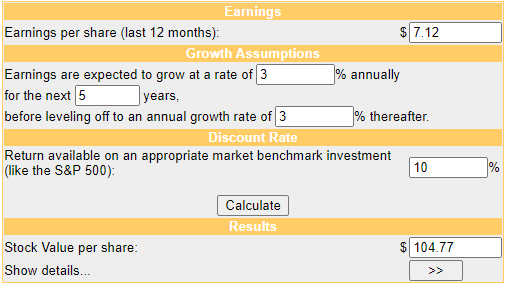

The estimated EPS for the full year of 2025 is about $7.12. With the expected growth of 3-4%, we can use a conservative estimate and use 3% for our input. If management can achieve this 3% growth, we can determine a fair stock value of $104/share. From the current price level, this would represent a potential upside of 20%. I think this is reasonable due to the projected growth in the AI space especially. Dell already has the meaningful connections and collaborations that should help propel them to success.

Money Chimp

Even from other valuation metrics, DELL seems to be undervalued. For example, the current P/E (price-to-earnings) ratio sits at 12.95x compared to the sector median of 26.31x. It’s also worth mentioning that DELL beat EPS estimates consistently since Q1 of 2023. I would like to revisit Dell’s progress two quarters from now to see how well they’ve grown in the AI-space. I think they are setup for success and my expectation is that we will cross the $100/share mark as growth continues.

If for whatever reason this upcoming earnings doesn’t meet expectations, I would revisit my thesis as to why. My assumption would be investments into the profitable areas of their business may affect metrics in the short-term, but if there are any potential headwinds, I would revisit to assess and update my thesis.

Risk

Dell faces the possibility of encountering slowing consumer and commercial PC market demand. There is a lot of competition in this space and to no surprise, many others are fighting to develop and refine their AI tools. With strong competitors like HP (HPQ), Seagate (STX), or even Microsoft (MSFT), there are a lot of companies making active strides to capture more of the market share.

Although unlikely, it’s worth mentioning the possibility that the Federal Reserve could raise interest rates rather than cutting rates as anticipated. Raising ruts would cause there to be less cash available to allocate towards growth and development initiatives. As previously mentioned, the interest coverage is also behind the sector median so a rise in rates may also widen this gap.

Takeaway

In conclusion, Dell presents a unique opportunity because of its dynamic growth trajectory and the growth of the AI market. With a diverse portfolio including both the Infrastructure Solutions Group and Client Solutions Group, Dell is strategically positioned to capitalize on emerging trends in technology within the AI landscape. The company’s robust financial performance, underscored by impressive revenue and strong cash flow, reflects its resilience and ability to navigate any potential market headwinds effectively.

Lastly, Dell’s management has done a great job showing that they care about returning value to shareholders through dividends and share repurchases. While uncertainties such as PC market demand and potential interest rate hikes pose risks, Dell’s strategic focus and competitive positioning position it well for continued success. With an attractive valuation and growth prospects, Dell remains an intriguing prospect. We are likely to experience large dividend growth as management has targeted a dividend growth of 10% per year through 2028.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DELL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.