Summary:

- Meta Platforms reports strong Q4’23 earnings, beating consensus expectations in revenues, operating income, and GAAP EPS.

- Meta Platforms announces a $50 billion increase in its stock repurchase authorization and initiates a quarterly dividend.

- The year of efficiency has led to a leaner cost structure for Meta Platforms and higher margins.

- Engagement across the Family of Apps reached an all-time high as Reels and the discovery engine continued to improve engagement.

grinvalds

Meta Platforms (NASDAQ:META) recently published its Q4’23 earnings report and made a significant announcement surrounding capital return to shareholders.

I have covered Meta Platforms extensively on Seeking Alpha. Since the last article, the stock has gone up 53%, more than the S&P 500’s 16%. In my last article, I shared how the company was positioning well for 2024, with many new products launching in the next year, with a huge focus on AI.

In this article, I will provide an update to the company after its Q4’23 earnings call and share more insights into the improving fundamentals of the company.

The fundamentals of the company have never been better after it was sold off in the last few years. This marks a new beginning for Meta Platforms and things are looking great for the company.

Q4’23 results

Meta Platforms showed the market that the business is not only thriving, but well positioned in 2024.

The beat in the Q4’23 results was broad based and across the top and bottom line.

Revenues beat consensus by 3%, growing 22% on a constant currency basis, while operating income beat consensus by 7%, and translated to 40.8% operating margins.

Consequently, the beat in GAAP EPS was even greater than that of revenues and operating income, beating consensus by 11%.

The magnitude of beat here is very encouraging as it suggests that the company’s business fundamentals are faring better than expected, and that the company’s efficiency efforts are yielding better results than expected.

While the company has become a more lean and efficient organization, it continued to invest in future growth opportunities. Meta Platforms capital expenditure for Q4’23 was $7.9 billion, as the company continued to invest in servers, data centers and network infrastructure.

The balance sheet strength is a differentiator for Meta Platforms, generating strong free cash flows and having a strong cash balance on its balance sheet. For Q4’23, the company generated $11.5 billion in free cash flow and at the end of the quarter, had $65.4 billion in cash and marketable securities and $18.4 billion in debt.

In addition, the company continues to improve its shareholder return policy. Meta Platforms also repurchased $6.3 billion of the company’s stock, with the full year 2023 share repurchases amounting to $20 billion. The company still has $30.9 billion remaining in its prior share repurchases authorization as of the end of the quarter. On top of that, Meta Platforms also announced another $50 billion increase in its stock repurchase authorization.

As suggested earlier, the strength was across the board, across segments and geographies.

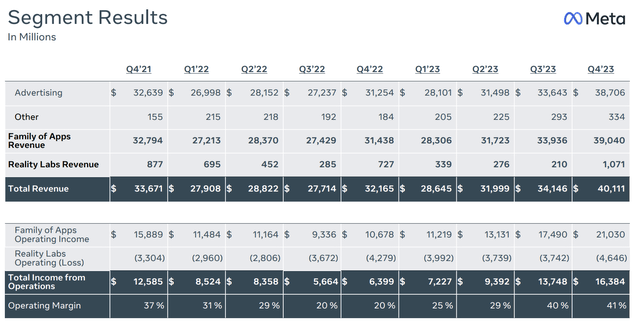

Family of Apps revenue came in at $39 billion, growing 24% from the prior year and Family of Apps operating income came in at $21.0 billion, translating to 53.9% operating margin. Both marginally beat consensus expectations.

Advertising revenue came in at $38.7 billion, up 21% from the prior year on a constant currency basis.

By geography, US & Canada grew 19% year-on-year, Europe grew 33% year-on-year, APAC grew 23% year-on-year, and RoW grew 32% year-on-year.

For the Reality Labs segment, revenue came in at $1.1 billion, growing 47% from the prior year. Reality Labs revenue beat consensus expectations by a huge 47%. Reality Labs operating losses came in at $4.6 billion, largely in-line with consensus.

Segment results (Meta Platforms)

In my opinion, this means that the underlying business fundamentals of Meta Platforms proves to not only be more resilient than market expects, but also continuing to improve.

The beat also was in the bottom line, meaning Meta Platforms has continued to execute really well in being a more efficient and lean organization.

Huge success from year of efficiency

The larger operating income beat came from multiple sources, and in my opinion, this really shows the flexibility in the business model of Meta Platforms.

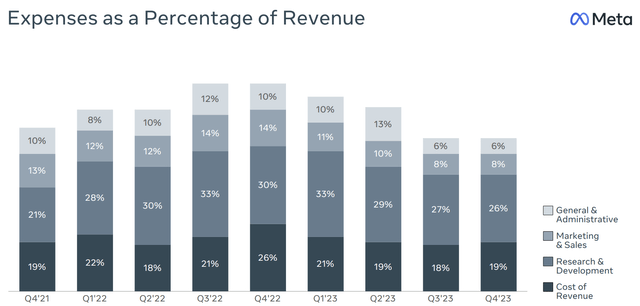

Cost of revenue fell by 8% in Q4’23, and cost of revenue as a percentage of revenues fell from 26% one year ago to 19% today. This was mainly contributed by lower restructuring costs, that was offset by higher infrastructure related costs.

Marketing & sales spend fell by 29% in Q4’23, and marketing & sales as a percentage of revenues fell from 30% one year ago to 26% today. This was a result of lower marketing spend and lower restructuring costs.

G&A fell by 26% in Q4’23, and marketing and sales as a percentage of revenues fell from 10% one year ago to 6% today. This was again due to lower restructuring expenses.

R&D was the only one to increase in Q4’23, by 8%, which was driven by higher headcount costs from both Family of Apps and Reality Labs, along with higher non-head count related Reality Labs operating expenses. That said, we still saw R&D as a percentage of revenue decline in Q4’23. R&D as a percentage of revenues fell from 30% one year ago to 26% today.

Expenses as a percentage of revenue (Meta Platforms)

Guidance for Q1’24 revenues came in 6% above consensus at the midpoint, and it implies revenue growth between 20% and 29% on a year-on-year basis.

The FY2024 expense guide remained unchanged, between $94 billion and $99 billion.

Lastly, on capital expenditures, Meta Platforms increased its 2024 outlook by 3% at the midpoint, from the earlier range of $30 billion to $35 billion to the new range of $30-$37 billion.

In my opinion, the company is executing really well here by balancing the spending on capital expenditures to grow its business, while at the same time, being more efficient in its operating expenses, whether it is in marketing and sales or G&A.

As a result, I continue to see the management strategy favorably, as it has a focus on improving profitability and margins, while still investing in the future growth potential of the business.

Engagement

The Family of Apps segment continued to see strong engagement.

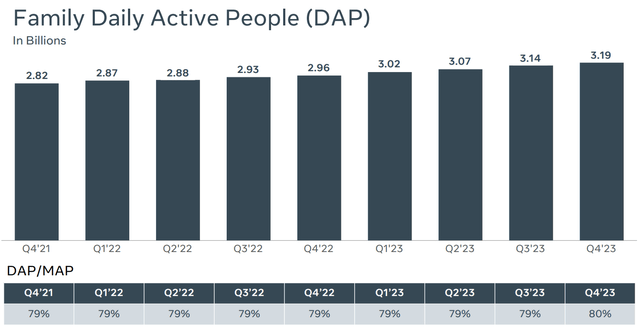

Meta Platforms will be transitioning away from reporting Facebook-specific metrics after introducing Family metrics for some time now, and will now report year-over-year changes in ad impressions and the average price per ad at the regional level while continuing to report family daily active people.

Family of Apps Monthly Active People and Daily Active People for Q4’23 came in at 3.98 billion, up 6% from the prior year, and 3.19 billion, up 8% from the prior year. Both metrics were higher than expected.

The DAP/MAP ratio came in at 80.2%, which is up 95 bps sequentially and the company’s highest ratio ever. This shows that engagement at the whole Family of Apps level is at an all-time high.

Even the last of the Facebook-specific metrics were great.

Facebook Monthly Active Users came in at 3.07 billion, up 3% from the prior year, and Daily Active Users cane in at 2.11 billion, up 6% from the prior year.

This resulted in Facebook’s DAU/MAU ratio of 68.8%, which is also an all-time high.

Family Daily Active People (Meta Platforms)

The key to the growing and high engagement rate across the Family of Apps segment is both Reels and the discovery engine.

Both remains a priority for Meta Platforms and a driver for engagement.

Reels continued to do very well in Q4’23, with users re-sharing Reels 3.5 billion times daily. Management also shared that Reels is now contributing to the company’s net revenue across its apps.

The near-term focus for Reels is to unify Reels and other types of video to enable users to discover the best content across the Family of Apps.

Meta Platforms has also seen sustained growth in Reels and Video as the daily watch time across all video types grew more than 25% in Q4’23, driven by ongoing ranking improvements.

In addition, the recommendations made in user’s feeds of posts from accounts they are not connected to also continued to drive incremental engagement, as the company look to make these recommendations more personalized.

Messaging continues to be another long-term revenue pillar for Meta Platforms. In particular, management also highlighted that WhatsApp is also doing very well. For WhatsApp, one of the positive trend is that it is succeeding more broadly in the United States. This is important because the US is a very important market for the company given its outsized revenue contribution. The Channels product has also quickly scaled up to more than 500 million monthly active users since it was rolled out globally in September of 2023.

Lastly, Threads has been strong coming out of the gates and today, has grown to more than 130 million monthly active users. Management remains optimistic about the improvements they will see going forward.

Based on Apptopia, an app intelligence firm, Threads is actually outpacing competitor, X, at least in terms of new downloads. Since September 2023, Threads daily downloads have grown from 350k in early September to 620k in November

In my opinion, this supports management commentary that Threads continued to grow and could be a real threat to competitors like X in the longer term, although it still remains early days for the company.

All in all, I think the engagement trends for Meta Platforms is trending in the right direction. It shows that the company is doing the right things to ensure that its audience remains engaged and stay on the platform for a longer period of time. It has done well for Facebook, Instagram, and now it is doing really well in Reels and starting its Threads journey. I think one of the advantages of Meta Platforms as a social media company is that it has a strong social media playbook and is able to adapt well to changing times and trends to emerge as a stronger social media company.

Paying dividends

In my view, one of the more significant announcements in the Q4’23 quarter was the $0.50 quarterly dividend that was initiated.

Meta Platforms believes that it is in a strong financial position to not just invest in the business and return capital to investors over time. While this has been traditionally done so in the form of share repurchases, the company is modestly changing its approach by returning some capital to investors through a regular dividend subject to quarterly Board approval.

This may only yield less than 1% on the current stock price, but it does bring in a wide and more diverse shareholder based in the form of dividend and income funds.

In addition, the dividend should be seen as a complement to the existing share repurchase program, and it does not change how much capital the company will return. Share repurchases will remain the primary way capital is returned to shareholders, but dividend provide a more balanced capital return strategy.

Valuation

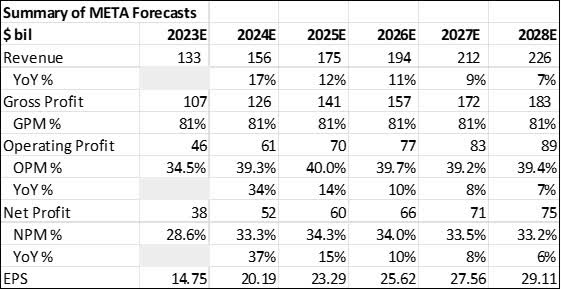

There are material upward revisions to the Meta Platforms’ financial forecasts and valuation after the Q4’23 results.

Recall that my intrinsic value calculation is based on the discounted cash flow model, discounting the free cash flows to equity of Meta Platforms for the five-year period until 2028. I assumed a terminal multiple of 25x and cost of equity of 12% for the discounted cash flow model, both of which are fair for a company like Meta Platforms.

Summary of 5-year financial forecasts for Meta Platforms (Author generated)

As a result of the financial forecast revisions post the Q4’23 results, the intrinsic value is revised upwards by 21% to $440. All the underlying assumptions remain the same.

Likewise, my 1-year and 3-year price targets are also revised upwards.

To elaborate more on my 1-year and 3-year price targets, these price targets are based on applying 2024 and 2026 P/E to the 2024 and 2026 P/E multiple.

I applied the same 25x 2024 P/E and 25x 2026 P/E multiples that I used in the earlier article.

As a result of the financial forecasts being revised higher after the Q4’23 results, the 1-year and 3-year price targets also go up to $505 and $640 respectively.

Risks

Macroeconomic environment

If the macroeconomic environment were to weaken, global advertising spend would be reduced. Consequently, Meta Platforms and other players in the industry would see slower growth.

Competition

The social media landscape can change very quickly. If emerging and popular players like TikTok decide to grow more aggressively, this could be a headwind to Meta Platforms as TikTok could win over more user time spent.

Conclusion

Meta Platforms has emerged from the darkness and proved to be one of the best turnaround stories in the Magnificent seven.

As mentioned earlier, with engagement at an all-time high for Family of Apps and Facebook, driven by Reels and improvements in the discovery engine.

Meta Platforms made 2023 its year of efficiency, and in all areas of its cost structure, it became more lean and cost efficient in the past year, resulting in cost reductions and margin improvements.

To be clear, the company also looks well positioned to be a top share gainer in the digital ad market in 2024, given the 4 percentage points acceleration to 29% growth from the prior year is at the high-end of the Q1’24 revenue guide. This strength in the results we have seen should also lower the market fears that advertiser demand is softening, or at least that Meta Platforms is able to mitigate this softness better than others.

The company has shown that it will likely be a key player in the AI space, given its investments made to leverage AI across its ad systems and product suite.

And, of course, the biggest surprise no one was expecting is the initiation of its first ever quarterly dividend.

I think the company has proven its worth to be in the Magnificent seven, and its business fundamentals have been strong enough to even warrant Meta Platforms outperforming the Magnificent seven.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 50% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!