Summary:

- Rocket Lab is positioned as the second-leading commercial space company behind SpaceX, with a solid backlog and positive developments with big new government contracts.

- The company offers end-to-end space services, including launch services and space systems design and manufacturing.

- Despite risks inherent in the rocket business, Rocket Lab has demonstrated launch consistency and has improved its gross margins over time as introductory prices phase out.

- Its valuation looks modest vs. the opportunity set. We rate the stock a “Strong Buy”.

Alexyz3d

The rocket business is often a turbulent one, and few companies know this better than Rocket Lab (NASDAQ:RKLB), the rocket launch and space systems company that’s been around since 2006. Originally founded in New Zealand by current CEO Peter Beck, the company has overcome a number of hurdles to get to where it sits now – in our view, in a solid second place position in the commercial space market behind Elon Musk’s SpaceX (SPACE).

While Rocket Lab has a number of challenges to overcome in bringing its Neutron rocket to market, and recently suffered an anomaly with an Electron launch that sent the stock price tumbling, improving strength in the company’s launch backlog, positive developments with America’s defense industry, and a solid runway for growth lead us to believe that RKLB is the public company to bet on for the future.

With a growing space systems business that’s also gaining traction – which recently supplied NASA with the solar array for the Gateway lunar space station – RKLB’s growing lines of business and cross-discipline expertise only buttress our thesis.

Today, we’ll break down RKLB’s recent developments, explore the company’s prospects, and explain why we’re willing to pay the stock’s current multiple for exposure to the firm’s future potential.

Sound good? Let’s jump in.

The Business

Rocket Lab is currently made up of two separate businesses – Launch Services and Space Systems.

Here’s top-down overview of the company in its own words:

Rocket Lab is an end-to-end space company with an established track record of mission success. We deliver reliable launch services, spacecraft design services, spacecraft components, spacecraft manufacturing and other spacecraft and on-orbit management solutions that make it faster, easier and more affordable to access space.

While our business has historically been centered on the development of small-class launch vehicles and the related sale of launch services, we are currently innovating in the areas of medium-class launch vehicles and launch services, spacecraft components, space systems design and manufacturing, and on-orbit management solutions:

- Launch Services is the design, manufacture, and launch of orbital rockets to deploy payloads to various Earth orbits and interplanetary destinations.

- Space Systems is the design and manufacture of spacecraft, spacecraft components and software solutions and on-orbit mission operations.

In other words, Rocket Lab is a one stop shop for getting to space. With them, clients can design and manufacture satellites, book launches, and monitor mission state post launch.

On the launch side, RKLB offers Electron, a non-reusable rocket focused on smaller payloads, and HASTE, a sub-orbital, hypersonic rocket platform with potential governmental defense applications. It’s also working to launch Neutron, a bigger reusable rocket system with a larger potential payload capacity.

On the systems side, RKLB offers Photon, a custom family of spacecraft, along with a number of accompanying components & software solutions, including:

reaction wheels, star trackers, radios, separation systems, solar solutions, command and control spacecraft software, [etc…]

As an end-to-end provider, RKLB is well positioned to take advantage of the growth available right now in the space economy.

Risks

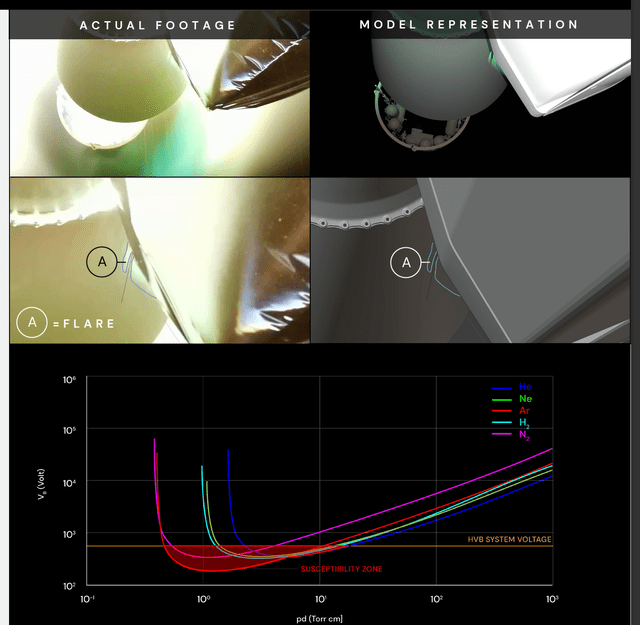

First, the risks. In short, the rocket business is difficult, and things go wrong. This happened recently when an Electron rocket suffered an anomaly and loss of payload, which was the result of an electrical arc damaging circuitry and destroying communication with the vehicle following launch:

After a thorough investigation, the CEO is confident that the issue has been solved, but it’s a sold reminder of just how unpredictable and risky the launch business is in general.

Other risks here include delays and other issues in developing RKLB’s Neutron rocket, the program which is responsible for a good portion of the company’s future earning potential.

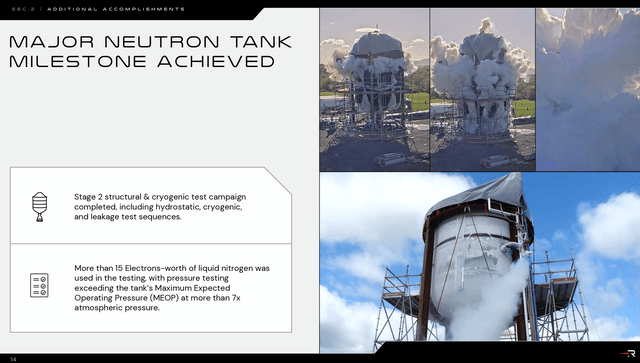

From what we can tell, progress is being made on the system, and towards the end of 2023 the team completed an important material grading test, which was a big milestone for a lot of the underlying engineering in the project:

Here’s what the CEO had to say on the last earnings call about this, when asked about the key milestones to look for in Neutron development:

We achieved – probably it’s understated, but the second stage tank test was a huge milestone, because although it just kind of looks like a big black thing that we fill and made frosty and then blew it up. The reality is that, that validated like so many material properties, so many manufacturing processes. So, much of the kind of core underlying materials and technology and designs were all validated by that test, and by that milestone.

While all signs point to Neutron being ready by Q4 2024 / Q1 2025, it’s impossible to know with any amount of certainty as to where things will end up, due to the inherently capital intensive and difficult nature of the underlying execution required.

The Upside

On the positive side, the company has begun to separate itself from the pack when it comes to launch consistency, quality, and experience overall.

On a recent webcast from the Deutsche Bank Space Summit event, many industry execs agreed that the gap was beginning to widen between the winners and the losers in the market, with there only being space for a handful of domestic launch companies, each servicing different areas and demands in the launch segment.

Obviously, SpaceX is out to an early lead, but in our mind, RKLB is looking like the clear number two, simply due to the amount of experience the company has.

While some of this experience comes from building functional spacecraft, a much larger chunk has to do with productizing the manufacturing process needed to build the spacecraft, which RKLB has now done over 40 times.

On that same webcast, CFO Adam Spice mentioned that he used to work in the semiconductor industry and thought that it was the hardest business to be in from a logistics perspective – until he went to work at RKLB.

Rockets require more than 60,000 different components that all have different lead times. Management, designers, and engineers all need to collaborate in building out an ERP system & production line, and launchpad logistics and infrastructure construction is also of paramount importance. From top to bottom, there’s no substitute for experience in this execution driven market.

For its part, the company has begun to collect some dividends from this level of XP.

The U.S. Space Development agency recently awarded the company a $515 million dollar contract to design, manufacture, deliver, and operate 18 transport-layer data satellites over the coming years, which represents a huge deal for the company in terms of finances, as well as market perception. The U.S. government clearly wouldn’t pick RKLB if it wasn’t certain that they could deliver the goods, which further underscores the company’s runway and lack of any immediate cash pressures.

It also underscores the government’s trust that RKLB will be able to execute on the design and manufacture of the space systems, in addition to the delivery of that payload into space. As we mentioned before, the end-to-end nature of RKLB’s business should allow the company to capitalize on interest in the space economy over the long term, no matter what vector that ends up coming from.

Finally, RKLB also recently was able to move away from the introductory pricing scheme it had to use upon first launching Electron, and so the company’s ostensibly ‘full’ 2024 backlog is now operating with very healthy gross margins of more than 22% on a GAAP basis:

GAAP gross margin for the third quarter was 22.1% above the high-end of our prior revised guidance range of 18% to 20%. Non-GAAP gross margin for the third quarter was 29.5%, which was also above our prior revised guidance range of 26% to 28%. GAAP and non-GAAP gross margin improvements relative to our revised Q3 2023 guidance reflect continued efficiencies in both our launch and satellite manufacturing businesses.

This represents a change from historical pricing, which the company had to suffer through in the past:

So, look, on the order side, until a vehicle is kind of proven and flying, any launch contract that you can sign is basically worthless … We saw this with Electron, right, an unproven vehicle. You just take a massive haircut. So, you have to do really low introductory pricing. And with Electron, we carried some of that introductory pricing on 3 years and we managed to flush it out this year. But for years, we had some really bad missions. So, I just don’t want to go down that road again … So, I would much rather arrive to the market [with Neutron] with something that works.

(Emphasis ours)

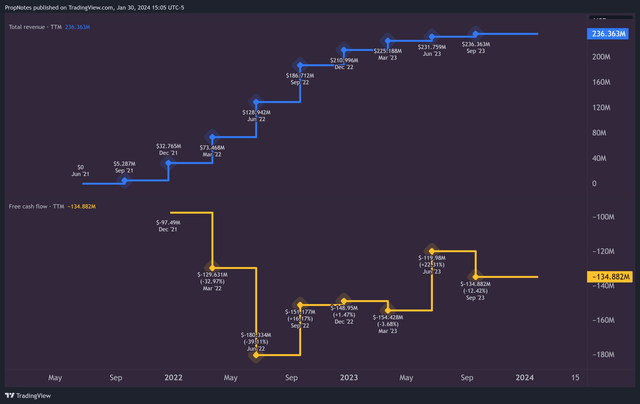

Here’s the thing; RKLB does remain unprofitable on a TTM basis:

However, with sufficient cash stores, a backlog of over $580 million, and positive GAAP unit economics, it’s only a matter of continuing to execute over time until the company first cranks out a profit, likely in 2025 or 2026.

Once you factor in the potential impact of Neutron, the full picture begins to emerge as to what RKLB might be able to do in revenue, with a healthy level of margin, towards the second half of this decade.

Valuation

Thus, what is the company worth?

Right now: $2.5 billion.

To us, this seems modest. While the figure is about 10x TTM sales, with the improvements RKLB management expects to achieve in the coming quarters, on both the revenue front as well as the profit front, it seems a bit ‘cheap’.

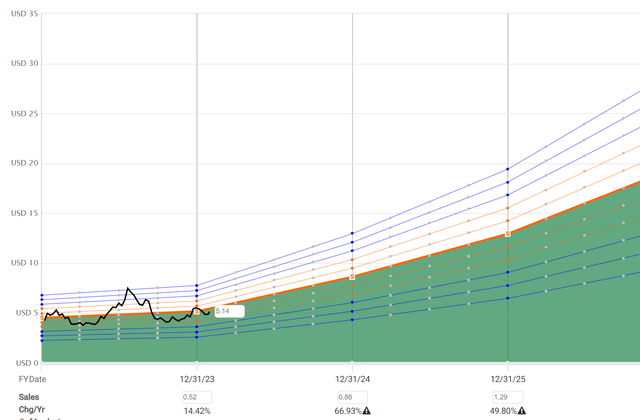

Assuming the company achieves the average estimated level of sales growth between now and 2025 and the multiple remains stable, RKLB could see a share price of more than double the current figure in only 2 years’ time:

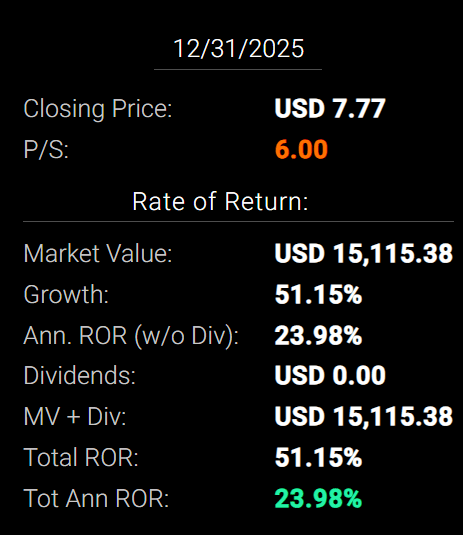

Even if the multiple collapses to 6x between now and 2026, the company is still poised to return more than 24% annualized to shareholders:

FAST Graphs

This seems highly attractive, even when baking in the potential for future execution issues and other mishaps which may harm the growth trajectory.

Summary

All in all, Rocket Lab is an incredibly attractive looking opportunity in the market right now. With government contract momentum, improving GAAP margins and pricing for the more than half-a-billion-dollar backlog, and the experience and diversification needed to tackle a wide range of opportunities, RKLB is very well positioned for growth into the remainder of the decade. Priced at 10x, we view RKLB shares as a steal, currently.

While there are risks inherent to building a commercial launch company due to the extreme engineering challenges and high capital requirements involved, we believe that RKLB is the clear number two in the space, which makes it the number one stock to invest in when it comes to the growth of this industry over the interim.

We rate RKLB a “Strong Buy”.

Cheers!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RKLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.