Summary:

- Tesla, Inc.’s stock has been volatile due to macro headwinds, but the company continues executing its long-term growth strategy.

- Tesla’s strategic positioning is intact, given weak competition in the developed world and geopolitical constraints for the major Chinese player.

- My target price for Tesla stock is $262.

jetcityimage

Introduction

Tesla, Inc. (NASDAQ:TSLA) stock has been very volatile within the last 52 weeks and had a tough 2024 start after a disappointing Q4 earnings release. The pessimism was caused by the expected deceleration in 2024 revenue growth and profitability metrics compression. But both these factors are due to temporary challenges in the macro environment, which are factors outside Tesla’s management’s control.

From the business perspective, where the management has full control, the picture looks much better. Model Y’s good value for money together with unparalleled technologies made it the world’s bestselling car in 2023. The company has ample resources to continue investing in its strategic priorities and I am optimistic about the plans to build new gigafactory in Mexico, which will highly likely unlock the affordable electric vehicle (“EV”) niche for Tesla. My valuation analysis suggests that the stock is almost 30% undervalued, which makes it an apparent “Strong Buy.”

Fundamental analysis

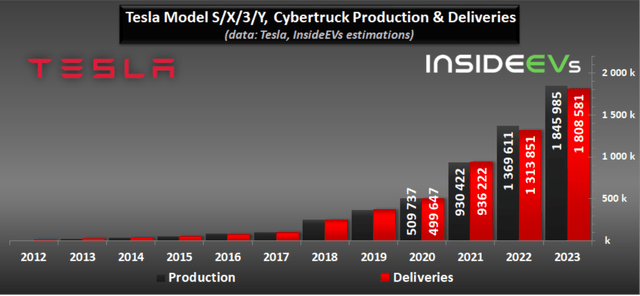

Tesla is by far the world’s largest automotive company in terms of market capitalization. The big optimism around TSLA is due to the pace with which the company ramped up production in recent years and the company’s commitment to delivering unique software to Tesla car owners. As shown below, the company’s deliveries grew exponentially between 2012 and 2023.

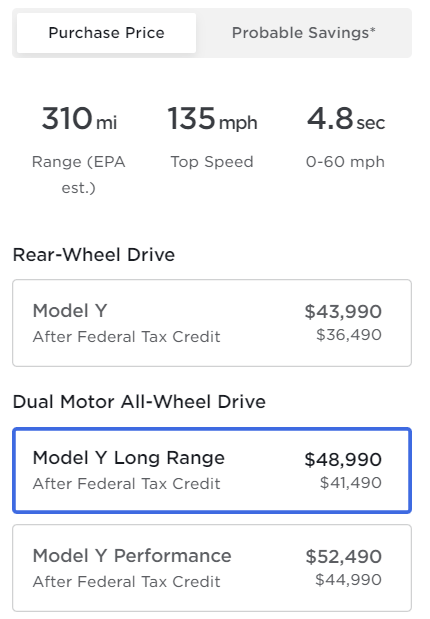

Tesla’s Model Y became an absolute bestseller in recent years, and moved to number one spot in the global ranking in 2023. The fascinating fact is that Model Y became a leader in the overall ranking, which also includes internal combustion engine (“ICE”) models. I think that Model Y became a global bestseller because it offers great value for money. Purchase price below $42k after Federal Tax Credit for a fast, all-wheel drive, long-range, and up to seven-seat SUV looks like a real bargain for American and European households.

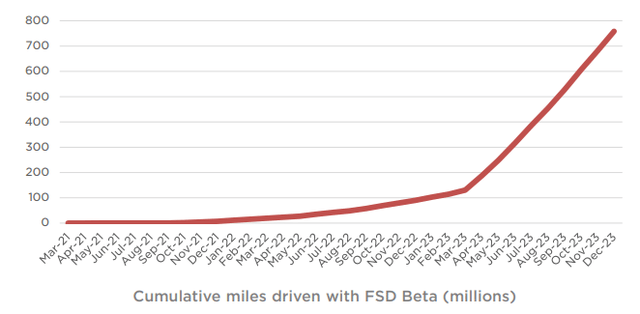

Tesla’s website

Besides the good value for money, Tesla differentiates itself with unparalleled technologies. The company has been investing heavily in its Full Self-Driving (“FSD”) technology for years, and it is currently sold for Tesla vehicle owners for $12,000. Tesla’s FSD is an AI for the real world, and the algorithm’s learning curve is impressive. Tesla owners share tons of remarkable videos on YouTube and other social media about their experience with FSD, and it indeed looks like a real disruptor. And Tesla’s management is unwilling to stop there as the company continues investing hundreds of millions USD in R&D every quarter. With almost 5 million Tesla cars cumulatively sold over the last five years, I think that there is a great potential customer base for the FSD.

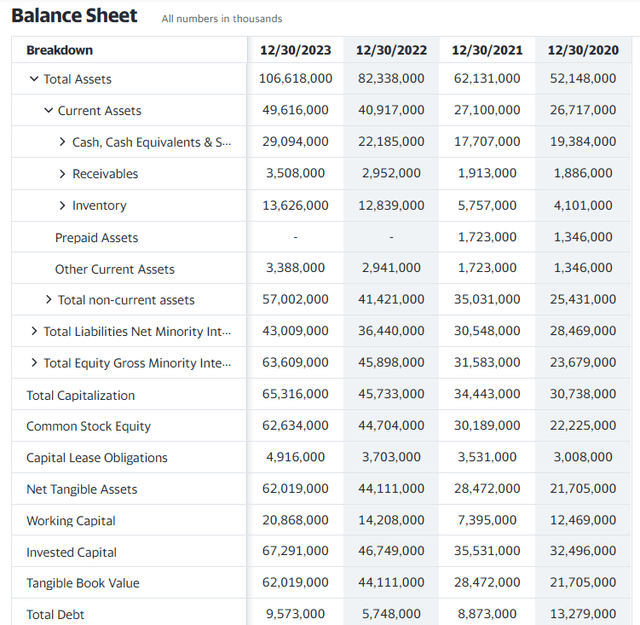

Deliveries growth is expected to decelerate notably in 2024 due to the challenging macro environment. However, shifts in macroeconomic cycles are inevitable, and they affect all players, not only Tesla. The crucial factor here is the ability of the company to weather the storm. With $29 billion in cash and much lower total debt, Tesla’s financial position provides it with the opportunity to continue financing all its strategic plans without the necessity to raise additional finance.

The crucial factor for Tesla to achieve its ambitious long-term goal of delivering 20 million cars per year sometime in the future is introducing a mass-market model, which will be notably cheaper than its current offerings. The company plans to offer the market a new model codenamed “Redwood” that will be sold at $25k, but a new production facility is needed to build this model on a brand-new platform. It is planned that the new gigafactory will be built in Mexico, which is expected to be the major facility for a “$25k Tesla car.”

I think that an emerging economy like Mexico is very interested in attracting Tesla’s manufacturing facilities, as the government already provided the company with land-use permissions in December 2023. Tesla’s gigafactory in China was built within two years, in Berlin it was built within three years (seems like COVID was a headwind). The company has solid experience in rapid construction of new factories, which adds optimism to me about the new gigafactory in Mexico if Tesla starts construction in 2024.

Tesla’s position as an EV provider across the developed world looks unparalleled since the company competes mostly with legacy automakers in North America and Europe. For example, Europe’s largest automotive company, Volkswagen (OTCPK:VWAGY), sold 771 thousand all-electric vehicles (“BEV”) in 2023. This is more than two times less than Tesla did in 2023. American giants like Ford (F) and General Motors (GM) were more than ten times behind Tesla in terms of deliveries in 2023.

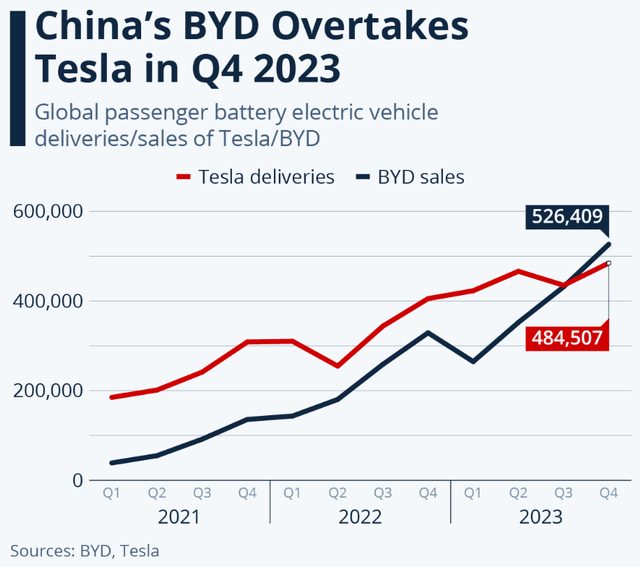

The only real rival for Tesla in the EV field across the world seems to be the Chinese giant BYD Company (OTCPK:BYDDF). This company overtook Tesla as the leading EV manufacturer in 2023, but due to the “Second Cold War,” I do not believe in BYD’s potential to expand into the developed world. Therefore, I think that Tesla’s position across the developed economies is intact.

Valuation analysis

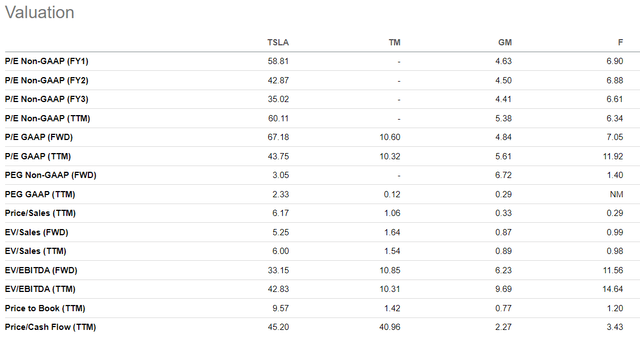

The stock had a bumpy start in 2024 with an 18% YTD price decline. Over the last twelve months, the stock demonstrated around zero change in price, but the range within the previous 52 weeks was very wide, from $152 to almost $300. Tesla’s market cap is $645 billion, nearly two times higher than the world’s largest car manufacturer in volume production, Toyota Motor (TM). Indeed, Tesla’s valuation ratios are sky-high compared to major legacy automakers.

However, it is important to understand that there is a secular shift from ICE to EVs, and all these legacy automakers lag behind Tesla substantially in terms of electric vehicles sold, which I highlighted in my fundamental analysis. Please also do not forget that Tesla is not a purely automotive company but strives to become a clean energy ecosystem, which includes charging infrastructure (which will highly likely be ultimately adopted by all prominent automotive players), energy storage business, and cutting-edge software. Therefore, Tesla is a unique mix of an automotive, clean energy, and software company, and I am not surprised that it has multiples like a SaaS company.

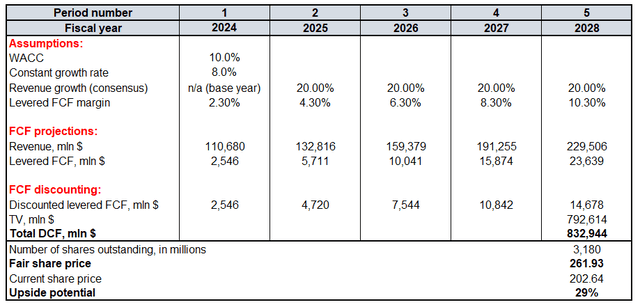

Therefore, I prefer to ignore valuation ratios here because assessing the valuation of a growth company is all about the present value of future cash flows the company can generate. Therefore, I want to run the discounted cash flow (“DCF”) model with a 10% WACC to assess the fairness of Tesla’s current market cap. I rely on the FY 2024 revenue consensus estimate and project a flat 20% CAGR for 2025-2028. I use an 8% constant growth rate for the terminal value (“TV”) calculation.

These assumptions might seem too aggressive for someone, but I think they are more conservative than a 23% long-term CAGR projected by Precedence Research. I use a TTM 2.3% levered FCF margin for FY 2024 and expect a rapid 200 basis points yearly expansion, which aligns with the aggressive revenue growth. According to Seeking Alpha, around 3.2 billion TSLA shares are currently outstanding.

According to my DCF model, the fair price of TSLA shares is $262. This represents almost 30% upside potential. This price level looks quite realistic considering that the market saw this level relatively recently, in October 2023.

Mitigating factors

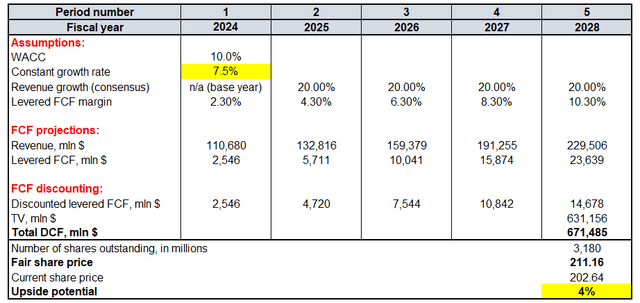

As usual, for a growth stock, I want to emphasize the high sensitivity of the terminal value to the constant growth rate. Adjusting the constant growth rate by 50 basis points diminishes the upside potential to only 4%, which does not look as attractive as 29% in the valuation section above. Therefore, any adverse changes in the management’s guidance during the next earnings call, or new more cautious long-term projections for the global EV industry growth might lead to an unfavorable change in underlying assumptions for the DCF.

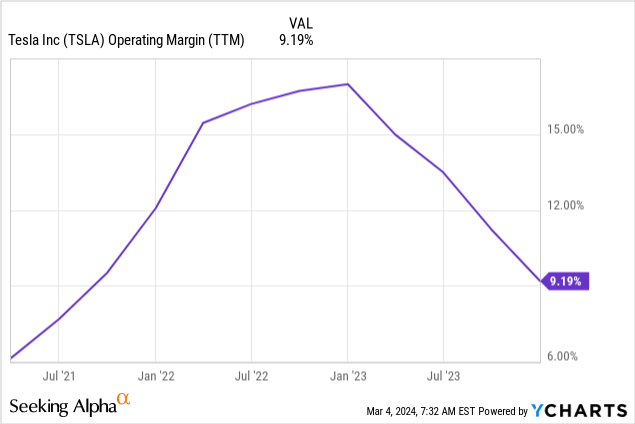

As an automotive company, Tesla is vulnerable to swings in the broader environment. As most new cars are sold on credit in the developed world, Tesla suffers from high interest rates across the world’s major economies. To offset the effect of elevated interest rates on monthly car loan payments for consumers, Tesla was forced to introduce solid discounts on its models in 2023. This has led to significant profitability deterioration, but I expect it to recover once interest rates go down in North America and the EU. The problem apparently looks cyclical; however, there is a great extent of uncertainty about the timing of a profitability recovery.

Tesla’s CEO and founder, Elon Musk, is involved in many other very ambitious projects. It looks to me like the company’s leader is now much less involved in his primary business than just a couple of years ago. Of course, Elon Musk has a team of well-paid and talented managers and engineers, but I believe that his involvement is also crucial. The visionary talent of Mr. Musk increases chances of new sound strategic moves for Tesla, but when his focus is divided among multiple large projects there is the risk that the strategic decision making in Tesla might suffer.

Last but not least, the potential competition risk from BYDDF might emerge in case the geopolitical tension between the East and West subsides. BYDDF looks like a solid competitor if its cars become available for export to the U.S. and Europe in large volumes. The pace with which BYDDF ramped up production to overtake Tesla as the leading global EV maker is impressive.

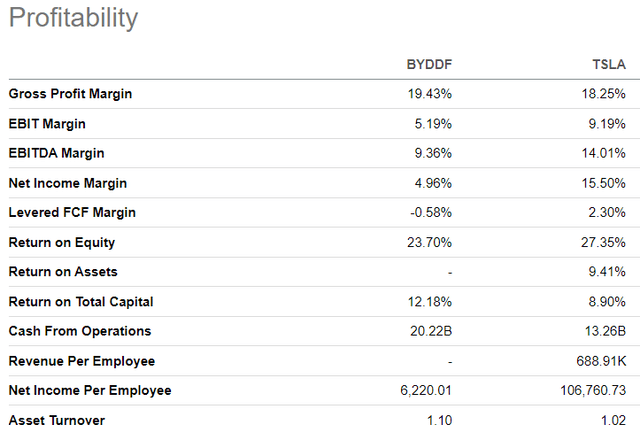

On the other hand, it seems that BYDDF prioritizes growth over profitability since its key metrics lag behind Tesla notably, even considering TSLA’s dip in margins in 2023. I believe that the reason why BYDDF generates lower profitability ratios compared to TSLA is that it has a different target audience for its vehicles. According to CNBC, BYDDF’s top five best-selling models are the ones priced below $30,000. Tesla is not presented in this price segment, with the cheapest rear-wheel drive Model 3 starting from $36,000. Since Tesla differentiates itself with its cutting-edge technologies like FSD, I do not think that these two companies’ offerings overlap at the moment. However, it might be difficult for Tesla’s “Redwood” to compete with BYD’s cheapest models, which start from $10,000.

Conclusion

A 30% upside potential for a stock like Tesla significantly outweighs all the temporary headwinds and makes TSLA a “Strong Buy.” The company’s stellar profitability and solid financial position allow it to continue investing aggressively in innovation and expansion of facilities even in the current uncertain environment. Therefore, I believe that Tesla’s revenue growth and profitability are highly likely to rebound rapidly once the environment improves.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.