Summary:

- The Walt Disney Company’s Q1-Fiscal 2024 results were good and margin expansion was a welcome plus.

- Disney’s cost-cutting measures and free cash flow forecast of $8 billion set the tone for the rally.

- We update our return forecast as the two opposing trends fight it out in the house of mouse.

popovaphoto/iStock Editorial via Getty Images

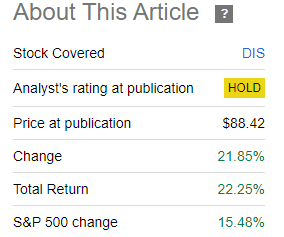

On our last coverage of The Walt Disney Company (NYSE:DIS) we had a slightly more optimistic bent and were forecasting positive 10 year forward returns. This was in contrast to our earlier takes, where we felt investors would likely have negative outcomes even under the best-case scenarios. We still stayed with a “hold” as there was not much relative juice.

There is certainly nothing wrong with a 12X-14X multiple in such an environment. We remain optimistic of the longer term strength in the franchise and believe you could manage 6-7% annual returns from here. But do you want to? You could get the same in investment grade bonds yielding 7.0%-7.5% to maturity with a fraction of the risk. So while we can swear that investors will have a happy 10 year outcome from here, relatively, we are hard pressed to slap a buy at almost 20X 2024 earnings. We reiterate a hold and would wait some more time for Bob Iger to work his magic.

Source: Eye Of The Iger

Well, Bob Iger came out swinging and the results this quarter were good. We break down what we like and how that influences our fair value of the stock.

Q1-Fiscal 2024

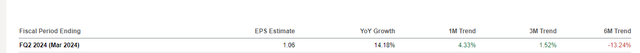

For the quarter ending December 30, 2023, Disney missed revenue expectations by about 1% but came in ahead via non-GAAP estimates to the tune of 18 cents per share. This part was set up by a lot of help from analysts who worked tirelessly to lower the bar enough, so it would appear that Disney accomplished something magnificent. It is hard for investors to keep track of this game, but the earnings revisions on Seeking Alpha are incredibly helpful for those interested. Here are the numbers for the next quarter, and here is where you can see exactly what we are referring to. Those estimates are down 13.2% over the last 6 months.

That is despite them rising 4.33% in the last 1 month. So lots of estimate cutting prior to earnings for the next few quarters and then revisions upwards which allowed everyone to say “they did so well”. But Disney still do a lot of things right this quarter, and most notable amongst them was the free cash flow forecast.

We are achieving significant cost reductions across our businesses, as evidenced by the realization of over $500 million in selling, general and administrative and other operating expense savings across the enterprise in the first quarter. We are on track to meet or exceed our $7.5 billion annualized savings target by the end of fiscal 2024, while we continue to look for further efficiency opportunities. Based on the strength of first quarter results as well as our expectations for the balance of the year, we expect full year fiscal 2024 earnings per share excluding certain items to increase by at least 20% versus 2023, to approximately $4.60. Further, we continue to expect free cash flow generation in fiscal 2024 to total roughly $8 billion.

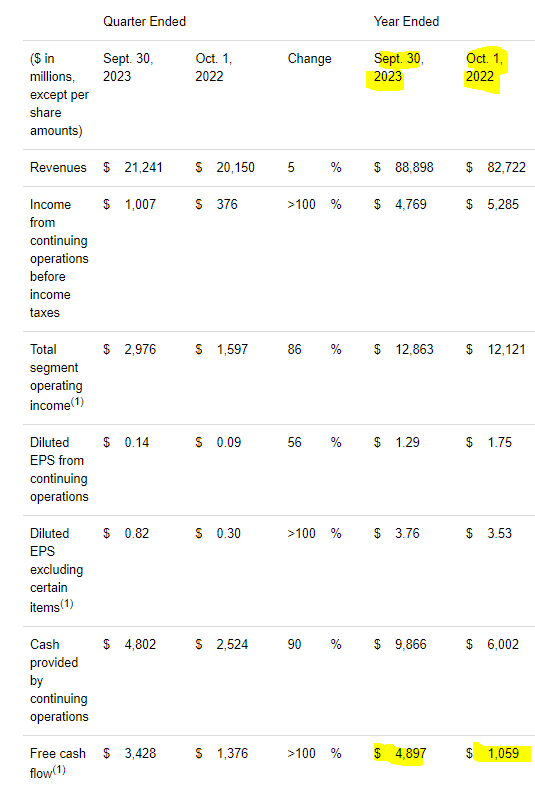

Source: Disney Press Release

$8 billion of free cash flow is what got the bulls excited. For comparison, Disney produced $4.9 billion in the last fiscal and just a little over $1 billion in 2022.

Disney Press Release

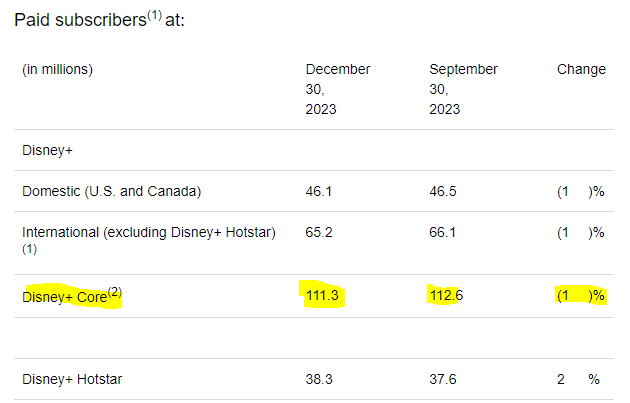

This all is being driven by cost-cutting and a rather pragmatic approach to pricing. Disney’s price push at Disney+ has been so effective that subscribers are actually dropping.

Disney Press Release

We don’t mean that sarcastically. If you recall Disney+ pricing in the “chase growth not profits” era, it was designed just to destroy value. Those numbers look hilarious in hindsight, but analysts ate them up.

Disney didn’t reveal how many subscribers it expects to gain from Star, but it expects its streaming services to hit 300 million to 350 million total subscriptions by 2024, a company spokesperson told Insider.

The Disney Plus video streaming platform, launched in 2019, and has a subscriber base of 94.9 million as of January 2, according to the company.

Source: Business Insider

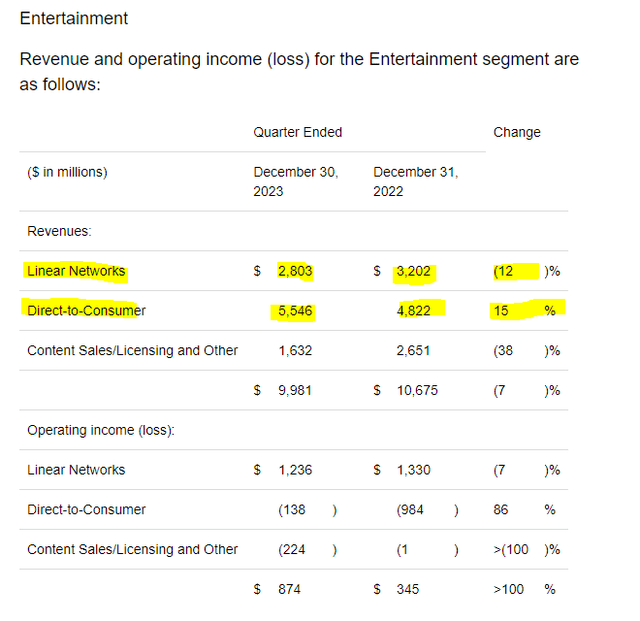

If you spot anything in the ballpark of 300 million by 2030, do drop us a line. But the current strategy is the right one, and it will ultimately produce some value for the company. As the company is moving to make direct to consumer more profitable, its linear channels look like slow bleeding molasses.

In other words, what Disney has been gaining in DTC profits, it is losing on its linear networks.

Valuation & Verdict

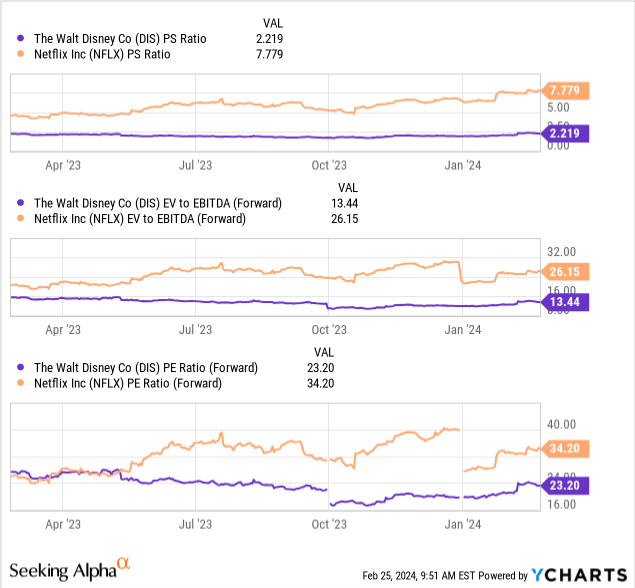

You can argue that Disney is cheap relative to comparative plays. Certainly, the valuation of Netflix Inc. (NFLX) is miles ahead. But if you look at the metrics below, it becomes apparent that Disney’s valuation advantage is a consequence of its poor profitability. That is why the differential between price to sales ratios is so wide but P/E ratios are far closer.

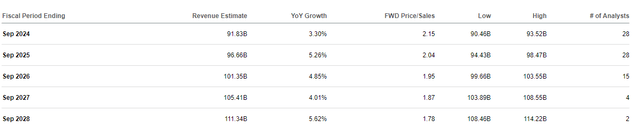

Unlike NFLX, as Disney’s DTC numbers improve they will be offset by some declines of linear channels. The assumption continues to be that this can be done seamlessly. Certainly, analysts collectively believe that revenues will go up at a 5% clip every year.

In addition they think that margins can expand far faster.

That will likely prove to be an incorrect thesis. One of these two can happen. If Disney has to emphasize margin expansion, revenues will suffer and came in below expectations. Total earnings per share will also follow suit. If Disney stresses revenues, then further margin expansion will be missing in action. Total earnings per share will again come in below expectations. None of this is pricing in a recession, which we know is inevitable over this timeframe. So while we think Bob Iger has made progress and Disney is “cheap” relative to some absurdities we see in the market, it is not fundamentally a value play. The free cash flow yield is also tepid at around 4%. In our last article, we were forecasting 6-7% annual returns for the coming decade from that stock price. Obviously, investor enthusiasm has changed things.

Seeking Alpha

We would look for about 3%-4% annual returns from here. While our previous forecast was in excess of investment grade bond yields, the current one is not. Investors would do best to avoid the stock and focus on better risk-adjusted opportunities. We rate the stock a hold and would get more constructive under $80.00.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

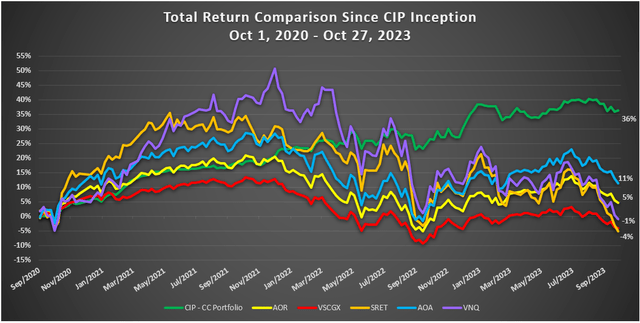

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.