Summary:

- Q1 earnings showed improved profitability and earnings, with a 49% increase in EPS, the return of share buybacks and a 50% dividend increase.

- Management acknowledged recent missteps and promised improved content production in the future.

- Despite the rally, shares are still trading at a 14% undervaluation, making Disney a real GARP opportunity.

- The firm still faces risks from the standoff with Ron DeSantis and potential for failed execution of content releases.

- Buy rating issued.

Kim Kulish/The Image Bank Unreleased via Getty Images

Investment Thesis

The Walt Disney Company (NYSE:DIS) produced what I view as solid Q1 earnings data with an improvement in their operating efficiency and streaming successes resulting in improved profitability and net income for the firm.

A massive 49% increase in EPS, the return of share buybacks along with a 50% bump in the firm’s dividend shows how confident management is about 2024 being a solid year for the entertainment giant in my view.

These quantitative improvements were accompanied by a refreshingly accountable attitude by the management team for recent missteps along with the promise of improved content production in the future.

Current valuations have seen a solid rally since late 2023 which has left shares trading at around a 14% undervaluation given a base case.

I rate Disney stock a Buy at present time given the validity their Q1 earnings have given to the thesis that DIS stock is once again a real GARP opportunity.

Company Background

DIS FY23 10K

Walt Disney is perhaps the most well-known American entertainment company with the firm having spent the last 100 years growing to become the leading provider of films, news and shows to consumers across the globe.

Disney continues to grow their portfolio of content with the firm having a huge portfolio of original movies, TV shows, music and content available for consumers to enjoy.

Through multiple acquisitions of smaller studios and media firms, Disney has become a juggernaut with their entertainment empire stretching from global news outlets to a portfolio of world class theme parks, and award-winning film releases.

Nevertheless, recent challenges to their lucrative Reidy Creek Improvement District (RCID) tax structure, boycotts against what some consider “woke” movies and some notable missteps in the execution of projects have soured the firm’s image in the eyes of some members of the public.

Earnings Analysis – Q4 & Full Year 2023

I conducted an in-depth analysis of Disney’s economic moat and fiscal profile back in late-2023. The core topics in that article still ring true today in my opinion and I urge you to read that article: “Disney: The Deep-Value Play of 2023” to gain a better understanding of the firm.

In this update, I would like to unpack the rather information-laden Q1 FY24 report which delivered a mostly positive set of earnings data to kick-off the new year for Disney.

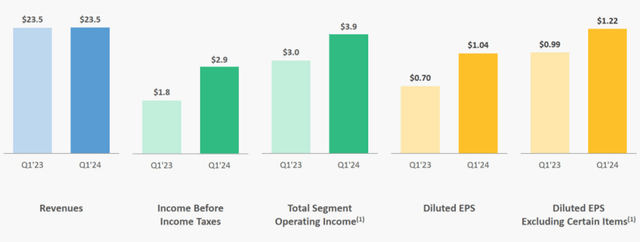

In Q1 the Walt Disney Company posted revenues of $23.5 billion, which were flatline YoY, and diluted GAAP EPS of $1.04, which increased a massive 49% QoQ.

The company attributed this wonderful earnings growth to the progress it has made in its strategic transformation, as it continues to develop its DTC business and enhance the profitability of its parks.

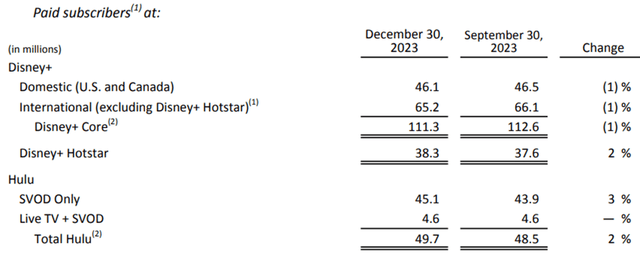

Disney’s streaming services generated mixed results in the first quarter. Hulu subscribers increased by 1.2 million QoQ while Disney+ Core subscribers decreased by 1.3 million QoQ.

The loss in Disney + subscribers came most likely due to a price hike for the service.

While the leveling-off in Disney+ core subscribers is disappointing, I believe it comes as no surprise given how tied the segment is to the firm’s overall studio businesses successes.

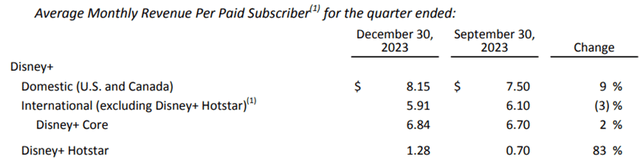

Disney+ Core ARPU increased by $0.14 QoQ which again was most likely due to the increase in subscription prices.

The firm’s entire DTC business also approaches profitability at a great rate with Q1 seeing the segment’s operating loss down 86% YoY to just $138M.

I really like the prospects of Disney+ becoming profitable near Q3 with increasing ARPU and growth in ESPN+ presenting a real pathway to solid profitability for the segment.

The entertainment business as a whole achieved over 150% operating income growth in Q1 which was truly superb to see.

Still, Disney+ fundamentally needs excellent content to retain customers amid massive competition from the likes of Netflix (NFLX), Amazon’s Prime (AMZN) and even Paramount+ (PARA).

The entertainment giant expects to see around 6 million net subscriber additions for their Disney+ service in FY24 which could come as a result of password sharing crackdowns.

On the topic of Disney’s film studio content, the segment saw real underperformance at the box office. New releases such as “The Marvels” simply failed to meet total sales estimates and critical expectations.

Interestingly, CEO Bob Iger actually acknowledged the theatrical release woes and vowed that moving forwards, Disney will rely less on sequels and focus more on films centered around novel storylines.

I really do like how transparent Iger is about the firm’s recent struggles. Gone is the boiler-room talk about how some of the firm’s flops are actually winners and instead we get what I believe is a refreshing honesty from the management team.

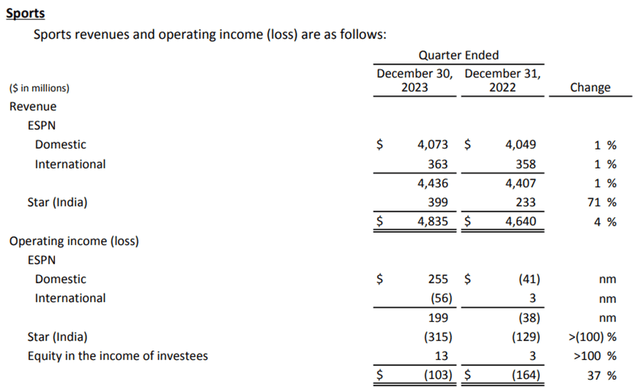

The company’s sports division consisting of ESPN and Star, generated okay results in Q1. Both revenue and operating income grew by 1% YoY in the first quarter.

Given how universally adopted ESPN already is within the U.S. as the leading source of sports content, any growth within this segment is encouraging.

The company’s experiences division generated record revenues of $9.2B (up 7% YoY), while operating income grew 8%. This leaves the segment with an excellent operating margin of 35%.

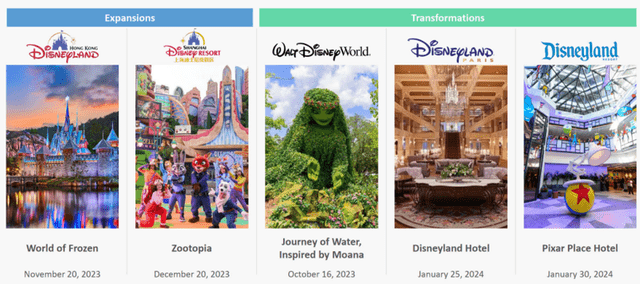

These great quantitative results were accompanied by the reportedly well-received openings of the new “World of Frozen” at Hong Kong Disneyland and a Zootopia themed land at their Shanghai park.

Disneyland Paris is also set to open their “World of Frozen” land at the park in 2024 which should draw customers into the theme-park in the coming quarters.

Any solid box office releases and content output should further boost park attendance with Disney being a master of translating successful media into further earnings in their experiences division.

Given that the firm has pledged to invest $60B into the updating and renewal of their parks, cruise lines and hotels, I really like that Disney has simultaneously chosen not to ignore efficiency.

The firm appears to remain focused on profitability and margin expansion within the experiences business segment despite significant growth objectives.

Overall, the company achieved massive cost reductions across its businesses, with over $500 million in savings being achieved in Q1 alone.

Disney’s management is confident the firm will at the very least meet its $7.5 billion annualized cost savings target figure by the end of FY24 which I view to be a superb achievement so long as it materializes.

I want to reiterate my appreciation of Disney’s focus on efficiency and believe the leaning of their operations is a critical step to ensuring future profitability.

Net income grew by a huge 48% YoY which ultimately illustrates just how well the firm was able to extract profits from their operations in Q1.

Disney also announced that it expects FY24 EPS to increase by at least 20% YoY. The firm also expects FY24 FCF to be around the $8 billion mark which would be very healthy indeed.

For the first time in a long time, The Walt Disney Company also announced a new share repurchase program. Disney plans to target $3 billion in total repurchases in FY24.

This solid buyback scheme was combined with a dividend of $0.45 per share which came as a great surprise to many investors. This significantly boosted dividend represents a massive increase of 50% compared to the last one paid.

I think management’s decision to increase the dividend and repurchase a huge number of shares over the coming year acts as a vote of confidence from the firm itself regarding their 2024 and beyond outlook.

Overall, the Q1 2024 earnings report showed that Disney is successfully executing its strategic transformation through leveraging its strong brands, to drive growth in its streaming, sports and experiences businesses, while reduced expenses helped improve profitability through margin expansion.

Valuation – Q4 & Full Year 2023

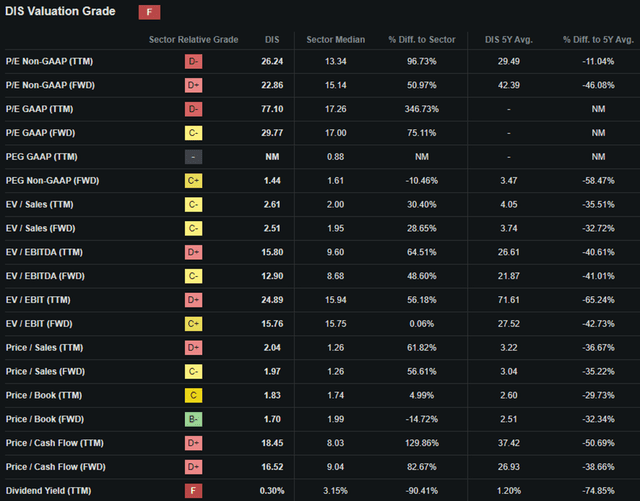

Seeking Alpha | DIS | Valuation

Seeking Alpha’s Quant assigns Walt Disney with an “F” Valuation rating. I find this pessimistic letter grade truly surprising given the stock’s valuation multiples are at significantly lower ratios, especially compared to their running 5Y averages.

Disney currently trades with a P/E GAAP FWD ratio of 29.77x. While such an elevated P/E ratio places The Walt Disney Company at a much higher multiple compared to other stocks in the sector, I do believe the solid progress in their turnaround warrants a slightly more elevated ratio.

Currently, shares trade at a P/CF ratio TTM of 18.45x and an EV/Sales TTM of 2.61x. Both of these ratios are over 51% and 36% down from the firm’s 5Y averages respectively.

Furthermore, the firm’s Price/Sales TTM is just 1.97x. To emphasize this, the entire company’s stock price implies just a 2x appreciation relative to their sales during the TTM.

I find this ratio in particular to imply investors are very cautious about pricing-in any real growth potential into Disney’s stock valuation.

While none of these metrics scream deep-value, I believe Disney is positioned as a GARP stock. Accordingly, I find most of these metrics to be more than acceptable given the firm’s approximately 10% YoY revenue growth estimates.

Seeking Alpha | DIS | 5Y Advanced Chart

Over the last five years, DIS stock has been outperformed to the tune of over 95% by the highly popular S&P 500 tracking index fund SPY (SPY).

This comes as no surprise to me given the absolute destruction in value that has occurred since 2021 due to DTC losses along with the political challenges in Florida against Senator Ron DeSantis.

Seeking Alpha | DIS | 3M Advanced Chart

However, the last three months have been a completely different story with multiple tailwinds boosting valuations back towards a less over-sold position.

The Value Corner

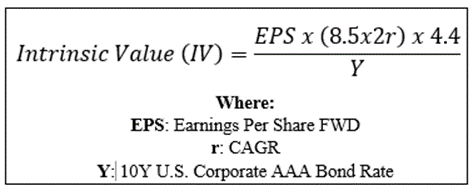

By utilizing The Value Corner’s Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Starting with a base-case valuation using Disney’s current share price of $111.60, an adjusted 2024 EPS estimate of $4.34, a realistic “r” value of 0.12 (12%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.87x, I derive a base-case IV of $128.10.

This represents a reasonable 14% undervaluation in shares given our base-case scenario inputs.

When using a bear-case CAGR “r” value of 0.07 (7%) to reflect a pessimistic outcome where a recessionary environment results in muted revenue growth for Disney, shares are valued at $88.20 representing a 22% overvaluation in shares.

I see this bear-case scenario as a perfect illustration of how sensitive The Walt Disney Company’s valuation is to any underachievement in their future growth prospects.

While such a sensitive valuation is to be expected given the nature of GARP stocks often pricing in future growth, it is important to consider the reduced margin of safety present at current prices.

In the short term (3-12 months), I am hesitant to make predictions on share price direction given that markets act more like a voting machine instead of a quantitatively influenced weighing scale over such compact time periods.

While the growth prospects and expanding profitability generate a positive outlook for Disney, a negative catalyst that results in limited growth for 2024 could send shares down by around 15-20%.

In the long-term (2-10 years), I like the direction The Walt Disney company is taking.

Disney has managed to turn their steamboat around despite a difficult period of lackluster results with solid margin improvements and topline growth suggesting a brighter future for the firm.

Disney’s Risk Profile

Disney still faces real competitive threats within their market environment along with some tangible ESG related impacts.

Despite the progress made by Disney’s DTC business, Disney+ is still facing massive competition from the likes of Apple TV, Prime and Netflix.

I think the key for Disney to generate real profitability from their DTC business lies in first producing great quality content for viewers to enjoy. Disney must regain their ability to produce new, exciting and widely appealing content that attracts consumers to their platform.

On the flip side, any failed execution of movies, shows or attractions could significantly harm Disney’s profitability and image.

Socially, The Walt Disney Company could potentially come under pressure regarding labor relations with staff considering past allegations of racism and alleged sexual misconduct within the firm’s parks division in particular.

For governance factors, Disney is still facing the standoff with Florida Governor Ron DeSantis regarding the RCID. The recent dismissal of Disney’s challenge against the senator is another setback for the firm.

Considering these factors, I believe that the real ESG risks facing the firm would make it unsuitable for an ESG conscious investor.

Of course, opinions may vary and I implore you to conduct your own ESG suitability research should this be of concern to you.

Summary

I think Disney’s Q1 report showed great progress in the firm’s turnaround with the company finally beginning to produce real margin expansion and some solid topline revenue growth.

While the firm continues to struggle to produce content that really engages viewers, Iger has admitted to these missteps and vowed to regain the firm’s previous streak of great quality, original entertainment.

While I still view Disney as materially undervalued in a base-case scenario, the recent rally in stock prices has left shares trading much closer to a fair valuation than before.

Nevertheless, I believe the recent earnings data suggests Disney may once again be a GARP opportunity which may mean the days of the DIS stock being available at a massive 40% discount are over.

I rate Disney a Buy at present time. I think the firm makes for a great long-term GARP opportunity with the potential for significant value generation to shareholders on the horizon for the firm.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.