Summary:

- BYD Company Limited is and will remain the dominant electric vehicle player in 2024. That’s not my focus.

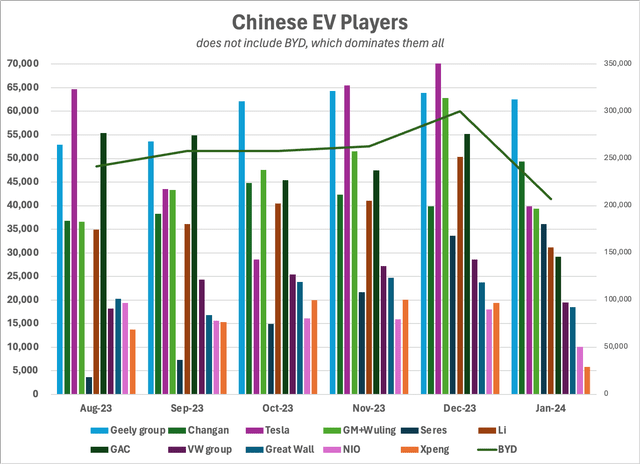

- Another battle is between Tesla, Inc. and other EV producers. Overall January sales were down, as were Tesla’s (-47%) and BYD’s (-31%). In contrast, sales rose for Volvo, Changan, and Seres.

- The Model Y is aging and faces greater competition in the Chinese B SUV segment. Letting Giga Shanghai capacity utilization fall will impair margins. Discounting will likewise impair margins.

- Will the A segment Model 2 “Redwood” help? There are already strong-selling EVs below its $25,000 target. Above that price, potential customers upgrade to a “B” segment SUV. So, likely NO.

- In the background is a red flag, poor January sales: BYD -31%, Tesla -47%, NIO -44%, XPeng -58%. Only Changan, Geely and Seres rose. February will likely be worse, March weak.

BAY ISMOYO/AFP via Getty Images

Preface

We’re coming out of the Lunar New Year holidays, which began February 10th, including 8 days of official holidays. This year, there are 240 million people traveling across regions to their natal towns and villages, and many more traveling within a region, for over 470 million trips – China is, after all, a country of migrants. The FT reports that 80% of these trips were by private car. But back to long holidays: on February 18th, one web site hadn’t updated since the 8th, and another since the 6th.

Car shopping websites didn’t update because, sales-wise, nothing happens over the holidays. Dealerships are closed. Registration and insurance offices are closed. Now that sites are refreshing, you can find lots of videos of the car trips home. One theme is getting stuck in snow and (for EVs) running out of juice when neither roads nor chargers have been plowed. And smooth trips, too, which provide the fodder for lots of car reviews.

One (Chinese-language text and videos) is of a trip from Guangzhou to Pingxiang, a city in Guangxi, a 1300 km round trip. Three A-segment PHEV sedans are compared in features, and to see if any could make the trip without refueling/recharging. The winner: the Geely Galaxy L6, which also was rated the best of the three in handling, comfort, amenities and interior and exterior styling.

I will return to that comparative review later. My focus here is to use the analytic framework of my previous article to examine Tesla’s sales potential in China. For that framework, see my February 4th SA article, “Disruption and EVs: Tesla, GM and BYD in China.” In it I argue for the strength of the “full court press” strategy that BYD Company (OTCPK:BYDDY) and the Geely Automobile Holdings (OTCPK:GELYF) group employ.

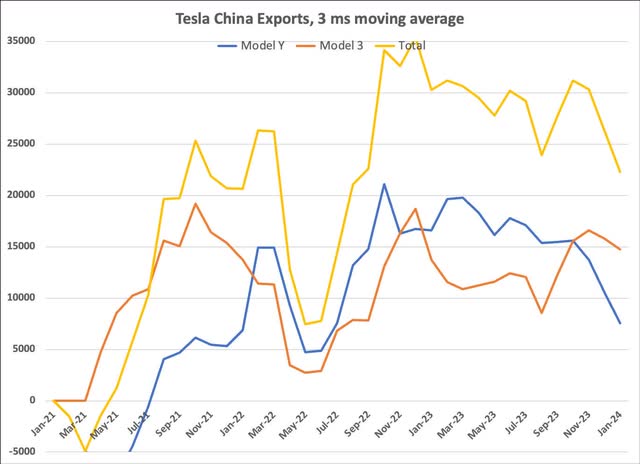

But before diving into Tesla’s prospects, what of the overall market for NEVs (EVs + PHEVs) in China in the coming year? The Shanghai plant is Tesla’s biggest production facility, with a run rate of 1 million units a year. With sales of 604,000 units in CY2023, China was by far the Tesla’s biggest market after the U.S.’s 670,000 units. (Europe trailed with 364,000 units.) Keeping Giga Shanghai operating close to capacity is critical for keeping unit production costs low. Moving that much metal in 2024 will be a steep challenge.

January 2024: Sales Down Sharply – Yellow Flags, Not Red Flags

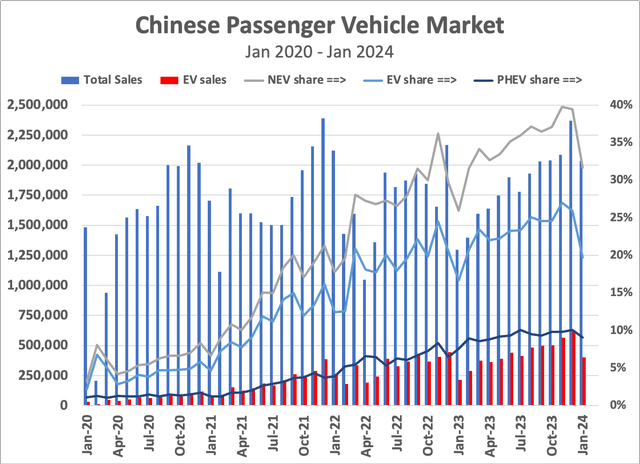

January 2024 sales were terrible compared to December 2023; EVs were worse. A lot of companies pushed end-of-year sales with discounts. On top of those, in late 2023 local governments provided consumption vouchers to households hard-hit by China’s macroeconomic troubles. Some offered temporary car purchase incentives.

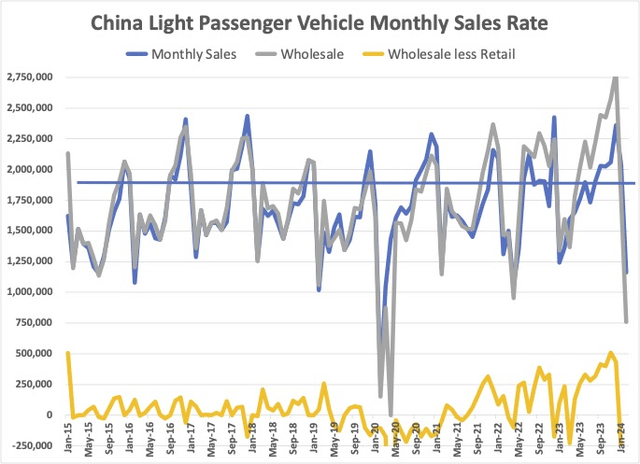

Well, that was December. In January, car companies pared back discounts, government consumption vouchers were used up, and buy-local car incentives are mostly gone. Sales remain close to a 24.4 million annual sales rate, so January began the year at a good pace, but that’s below the 25.0 mil of November and 14% below the 28.5 mil of December.

As per the following chart, EVs took a bigger hit. PHEVs were down 24%, and EVs 35%. In absolute terms, PHEV sales were off by 75K; EV sales fell 215K. Over 12 months, that level of decline would translate into 2.5 million fewer EVs being sold, and 3.5 million fewer NEVs. That would be a gut punch to the industry.

Note that last year, the Lunar New Year holiday fell in January. Sales fell 40% that month, from 2.17 mil in December 2022 to 1.30 million in January. EV sales fell more, by 51%. So what happened in February and March 2023? – critically, there was no bounce back. EV sales didn’t return to previous levels until June 2023, and overall sales didn’t recover until the fall of 2023.

If similar patterns hold this year – slow sales until summer, then rising into the fall – then it will not be possible to distinguish a slowing economy from seasonal effects. So far, 2024 fits the pattern of a poor winter-spring. Preliminary sales for February 1-25 are down 43% from January, and the Chinese Passenger Car Association predicts that sales will be down 43% for the month as a whole to 1.15 million units. EV sales are pegged to decline to 400,000 vehicles. That’s down over a quarter million vehicles from December’s 652,000 units. All NEV producers were down sharply, except for two small players, Chery and General Motors (GM). Finally, wholesale shipments were off 49%, so dealerships cut inventories a bit, rather than building up for a strong March.

In the meantime, the industry is seeing a renewed price war, with major NEV brands cutting prices at the start of March by 10% or more. Tesla is not the only one challenged to “move the metal.”

Tesla

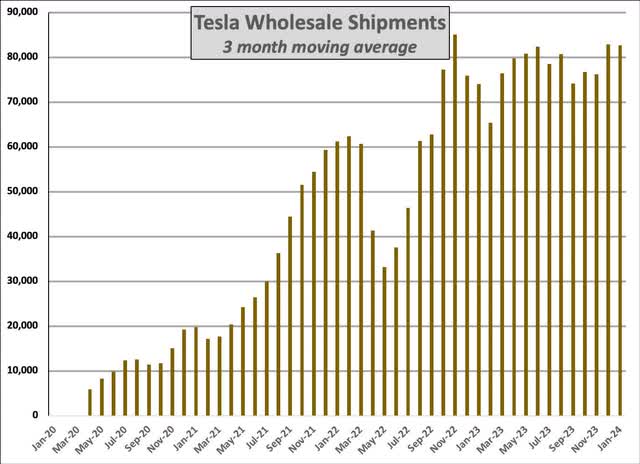

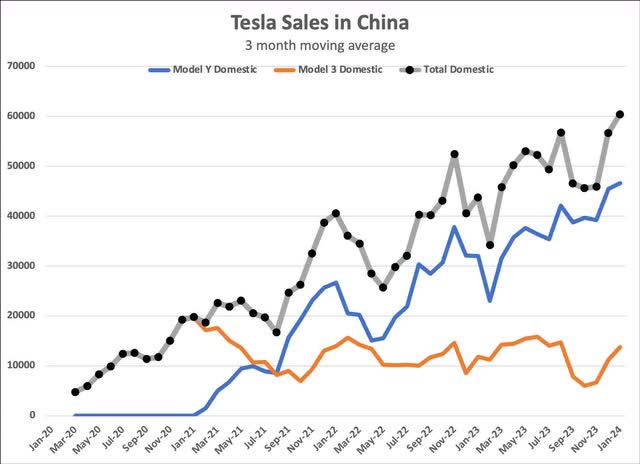

Tesla, Inc.’s (NASDAQ:TSLA) sales were down sharply in January, but it continues its pattern of producing for export early in a quarter, and then emphasizing domestic sales towards the end of a quarter. That complicates analysis prior to mid-April, when detailed 2024Q1 data become available. Nevertheless, January provides one takeaway: the continued decline of Model 3 sales, despite the “Model 3+” refresh launched in China in fall 2023.

1. At capacity

Tesla Shanghai has a capacity of roughly 1 million units a year, or 80,000 units a month. It’s been running at or near capacity since fall 2022. That’s been an important contributor to Shanghai’s and hence Tesla’s profitability. The flip side is that it’s a lot of metal to move.

2. Model 3 is about exports, Model Y relies on domestic sales

The “Model 3+” refresh that launched in China in fall 2023 has not increased sales. But realistically, that’s not what a refresh accomplishes. Instead, it’s designed to stem the sales decline as a model ages. From that perspective, the Model 3+ has been a success. To reiterate, I have low expectations for what a refresh does, and Tesla met those low expectations. [click charts to expand]

Author’s database |

Author’s database |

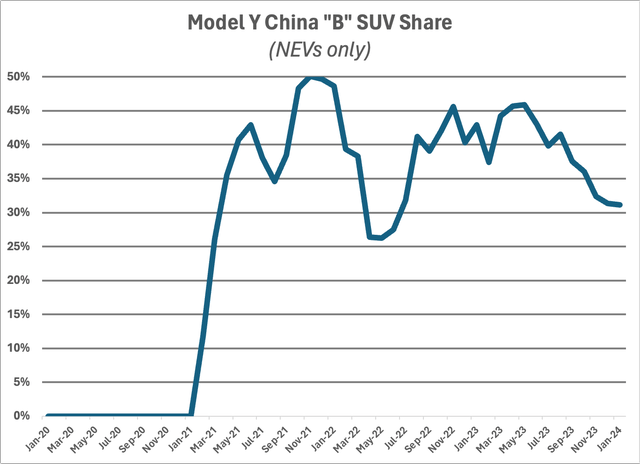

3. Model Y: The NEV Competition

Can the Model Y continue its recent torrid sales pace? Likely NO.

There are a lot of options for someone whose starting point is a compact “B” SUV. Tesla continues to have a strong brand, conveys “performance,” and is dropping prices. But in January, the Aito Wenjie M7 outsold the Model Y, at only a $1,000 lower base price. Of the 16 B SUVs that sold over 1,000 units, 5 are priced above the Model Y; another 6 lower-volume models are also priced higher. Some 11 however come in lower.

The Model Y faces competition both up- and down-market.

[The Wenjie M7 is from Huawei’s collaboration with Seres (not publicly traded). Baidu has also launched its first vehicle with Geely. In contrast, there are no Apple, Samsung, Google or Facebook cars.]

In addition, the Model Y is an old design. In January 2024, sales of the 12 newer models listed below accounted for 60% of the segment. On top of those, Chinese companies launched 5 additional models in the past 3 months that have yet to break 1,000 a month in sales. [For reference, these are the Geely-Volvo Polestar 4, the Leap C10, the Kia EV5, the Toyota bZ4X, and the SAIC Maxus 大家 Dajia 6.]

|

Jan ’24 Sales |

Launch |

Model |

Base Price |

|

7,374 |

2023.12 |

BYD 宋L |

19.0 |

|

4,586 |

2023.10 |

Great Wall Haval 坦克400新能源 |

28.5 |

|

8,816 |

2023.09 |

Geely Lynk 领克08 |

21.8 |

|

1,337 |

2023.09 |

GAC 传祺ES9 |

23.0 |

|

1,803 |

2023.06 |

XPeng 小鹏G6 |

21.0 |

|

3,944 |

2023.05 |

NIO 蔚来ES6 refresh |

35.8 |

|

9,109 |

2023.05 |

Changan Shenlan 深蓝S7 |

17.0 |

|

5,289 |

2023.04 |

Seres Langdian 蓝电E5 |

14.0 |

|

1,847 |

2022.12 |

BYD 护卫舰07 |

21.6 |

|

1,503 |

2022.12 |

Changan Avatr 阿维塔11 |

35.0 |

|

29,997 |

2022.07 |

Seres Aito 问界M7 |

25.8 |

|

2,127 |

2022.03 |

Toyota 威飒 |

22.0 |

|

29,912 |

2021.02 |

Tesla Model Y |

26.4 |

|

3,769 |

2020.12 |

BMW-i 宝马iX3 |

40.0 |

|

1,528 |

2020.10 |

NIO 蔚来EC6 |

36.8 |

|

8,892 |

2018.04 |

BYD 唐新能源 refresh |

21.0 |

|

6,276 |

plus… |

…20 other models |

|

|

128,109 |

Total, 36 Models |

None of these will be a “Tesla Killer.” That’s not how competition works in the auto market. Cars vary in style, interior, and many other characteristics besides segment and price. Consumers have a set of desiderata when they shop for a car. The more choices they have, the greater the likelihood that they will find one closer to their liking than the Model Y. Most “B SUV” models have fresher styling than the Model Y, and can claim more luxurious interiors. Some have fancier infotainment systems, and many have more robust driver assist software than Tesla. However, beloved full self-drive, or FSD, may be in the U.S., Tesla is not viewed as a driver assist technology leader in China.

Car shopping sites carry reviews of new models, and the better sites make sure they list weaknesses and not just strengths. No one will look at all 20+ models, and Tesla’s brand strength gets them automatic consideration. So, sales of the Model Y won’t crash.

To reiterate, none of the cars list above will be Tesla killers, even if they consistently outsell the Model Y. On the plus side, the “B” SUV segment accounted for 1 in 5 NEVs in January 2024, reflecting a gradual shift away from sedans. But I expect the overall passenger vehicle market to remain below last year’s level, and the B SUV segment to be lower in absolute volume.

The implication is that Model Y sales will trend lower, a little bit at a time.

That presents a big challenge for Tesla Shanghai: maintaining margins requires keeping capacity utilization high, but Model 3 domestic + export sales, and Model Y exports do not look like they can take up the slack. (Remember Berlin and Austin.)

Of course, Tesla can discount, and is discounting in China. That, however, does not support a growth story for either the top or the bottom line, and TSLA share valuations require both. The upcoming Model Y refresh represents a holding action. As with the Model 3+, the refresh will be a success if it slows the sales slide. It is not realistic to think it will reverse the slide.

4. The Model 2 “Redwood”

Tesla expects to launch the “Redwood” with production commencing in summer 2025, though launch timing and ramp remain unknown. Since in China, the Model 3 is fading, the Model Y will be the company’s only high-volume vehicle for 2 more years. That’s a long hiatus for a company where shares are priced for top- and bottom-line growth.

We can’t predict 2026. Still, we can analyze the prospects in China for a $25,000 “A” segment SUV.

First. as the auto industry has known almost since its inception, small cars mean small profits. The main reason is that a $25,000 car can only gross so much – even a 20% margin equates to only $5,000 in gross profit. Furthermore, manufacturing costs for a smaller vehicle are close to those for a larger vehicle. EVs change that calculation a bit, because battery packs are so costly and heavy. However, the electronics, aluminum castings, sheet metal, frame, paint and seats change little in cost, and the assembly process requires roughly the same number of workers. Nor do up-front engineering costs and factory tooling costs vary with size. (This is not true at luxury level, and the cost structure diverges even more for the Ferrari’s of this world.)

Quite simply, Tesla likely won’t be able to realize higher margins. They are touting their “unboxed” process, but much of vehicle assembly is already “unboxed.” Vehicle corners (which for some vehicles are shipped to the assembly line as entire front ends), drivetrains, doors, rear assemblies, instrument panels, and seats are all completed off site. New paint shop technologies mean there will be no efficiency gains from an “unboxed” body-in-white. Unboxed is an increment to received practice, not a revolution, and the Tesla version is untested.

Now Tesla can and will use smaller batteries for the Redwood. However, so does everyone else in the “A” segment. Smaller batteries won’t give Tesla any advantage.

Second, there’s already a lot of competition. Some 91 models in the “A” compact SUV segment generated positive sales in China in January 2024, not including imports. No table!! When I eliminate low-selling models and ICEs, there are still 27 EV models. (I include recent launches, as they may take time to hit their stride.) Of those 27, 8 are priced above Tesla’s target of 元175,000 [US$25,000 at US$7/元]. The remaining 19 are less expensive (plus those 64 weak sellers and ICEs).

The two top-selling A SUVs, the BYD Song Pro NEV and the GAC Aion Y – each selling over 200,000 units in 2024Q4 – list for 元136,000 and 元120,000, respectively. In contrast, none of those above the Model 2 target price are strong sellers; the best is the VW ID.4 CROZZ at 3,622 units (add the ID.4 and sales hit 5,247). A big factor is that Chinese consumers willing to spend 元175,000 can upgrade to a “B” segment SUV, where 12 different models would be within the budget required to purchase a Redwood.

In China, the “Redwood” Model 2 will thus be at the top of its segment price-wise. That will limit sales, unless Tesla includes “premium” features. Doing so, however, would be stupid, as it would cannibalize higher-grossing Model Y sales. The strength of the Tesla brand will help, but I see no potential for it to approach the volume of the Model 3, much less the Model Y.

5. The CyberTruck

We have yet to see how the market will receive the CT, as so few have been produced to date. However, it is a quintessential California/Texas product, and unsuited for other markets.

The CT is so massive that in Europe a driver will require a commercial vehicle license. Despite China being a far larger passenger vehicle market than the U.S., pickups are a niche market. Overall sales peaked in 2021 at 546,000 units, whereas Ford alone sold 750,000 F-series pickups. (Sales were down to 513,000 in CY2023, plus exports of another 132,000.) Furthermore, in China pickups are very much work vehicles. Only 4% were sold in China’s largest cities, and another 13% in second-tier cities. In contrast, 40% of pickups were sold in rural markets (县乡) and 23% in small fourth-tier cities. Neither of those are significant markets for NEVs, nor are they wealthy enough to be a target for higher-end brands. Since there’s been no mention of assembling the CT outside of Texas, it would be an import, and subject to China’s standard 25% tariff (Chinese vehicles in the U.S. face a 27.5% tariff). That would put the CT out of reach for most urban Chinese consumers. [Source: CPCA 2024年1月皮卡市场分析]

Even in the U.S., however, EV pickups have flopped. Ford (F) has cut output of the F-150 Lightning to one shift, so less than half of the targeted level. I live in a rural area; I’ve spoken to one local contractor and farmer who has one as his daily drive. He loves it, but when he needs to tow sheep to market, or haul materials from a supplier to a building site, he turns to one of his diesel-guzzling pickups. He needs greater towing range than an EV can provide on a single charge, and he can’t afford to take the time to use a public charger en route. I’ve explored purchasing one, but I bought my last two pickups used for well under $10,000, and so far, I can’t bring myself to spend over $50K to buy a new truck. Given my needs, an F-150 is really too big to use as my daily drive.

Ford isn’t the only EV pickup firm, but Rivian Automotive (RIVN) has fared no better. I like their design inside and out, but it’s even more expensive. I’m not alone in that perception, as it has sold far below its business plan. In 2023 Q4, Rivian lost $1.5 billion on revenue of $1.3 billion, and it forecast flat sales in 2024. (See the many articles on SA following its Feb 21 earnings report.) With just under 14,000 units in Q4, it’s operating far below scale, and announced a 10% cut to its salaried workforce and small cuts to its production staff (see Automotive News coverage). Unlike Ford, however, Rivian lacks the profit cushion that comes from selling ICE trucks. I do not see how they can survive.

Tesla has the brand name, and may pick up some sales in suburbia. But it’s expensive, and EV pickups simply have gotten no traction in the U.S. market. There is no significant market for the CT in China, and no market whatsoever in Europe. CEO Elon Musk himself notes that it will not make much of a dent to Tesla’s top or bottom line in 2024.

6. Summary

My focus is on the Chinese market. Between aging models and greater competition, Tesla likely will not be able to maintain its CY2023 sales pace of 600,000 units in CY2024, and CY2025 will be worse. The Model 2 Redwood likely won’t be available in volume until 2026, but it is already poorly positioned for the Chinese market, and won’t be able to replace the Model Y’s contribution to Tesla’s top and bottom lines.

Time is not on Tesla’s side.

Other EV Brands

Of the 300+ Chinese auto firms to enter the post-2000 period, and additional new entrants, a few will succeed through a combination of pluck, luck and superior management. The star here is BYD, but several other domestic firms fit the bill: Geely/Volvo (GELYF, PSNY, OTCPK:VLVCY), Great Wall (OTCPK:GWLLF), Changan (not publicly traded) and GAC (OTCPK:GNZUF). There are also the global OEM joint ventures. Of this list of firms, the NEV sales of Geely and Changan stood out in January 2024.

In the graph below, BYD has its own scale on the right. Of those on the main left-hand scale, Geely is first, and Changan second. While Changan is not a major player outside China, Geely has owned Volvo since 2010, and has launched a series of EV-only brands. Including ICEs, Geely sold 1.6 million cars in China, and 400,000 cars in the U.S. and Europe, plus exports to third countries, so sells more vehicles than Tesla. Companies in the Geely group already have plants in South Carolina, Sweden and Belgium, and not just China. The various companies share new, EV-specific platforms. It’s wrong to think of EV players as BYD and Tesla. Geely, in particular, is a strong player inside China, and in addition has a global sales and production footprint.

The second thing apparent is how poorly new entrants are faring. There were standouts: in a down market, Changan saw EV sales rise 24%, Seres 8% and the Geely group 5%. In contrast, BYD was down 31%, GAC and Tesla were both down 47%, Li (OTCPK:LAAOF) was down 38% and, on a downward spiral towards failure, NIO (NIO) was down 44% and XPeng (XPEV) 58%. Given the timing of the Chinese New Year this year, February is, of course, worse. That this was expected, however, is no help to companies that are burning cash.

Summary

Back to the beginning: why look at those three cars? The answer is because Chinese with range anxiety opt for a PHEV, not an EV. They’re also “A” segment compact sedans, not SUVs or the “B” segment occupied by Tesla. The Geely Galaxy L6 has been out only 3 months, while the Shenlan SL03 came out in August 2022 with additional variants released last year. The BYD Qin Plus went on sale in February 2021 but was updated last year. The Qin Plus was the segment leader, with 41,000 units in December (but only 29,000 in January), the L6 sold 14,000 in December (and 6,000 last month), while the SL03 sold 6,000 both in December and January. The Qin Plus tops the segment, while the others are in the top 6 NEVs in a highly competitive field. All list for well under the target price of the Model 2 Redwood. Compared to Americans, Chinese aren’t averse to small cars, but they expect them to be inexpensive. The Model 2, when it comes out, won’t be.

The Chinese EV market isn’t just Tesla and BYD. The Geely group, Li, GAC Aion, Seres and Changan also stand out. They and others in the aggregate provide stiff competition to Tesla in China, which faces pressure to discount to maintain Giga Shanghai capacity utilization.

I analyzed GAC in “China 2023 Q2 NEV Update: Focus On Guangzhou Automobile,” and covered BYD in my previous article, Disruption and EVs. My next article will focus on the Geely group (drafted, but not included as a comparison here as SA editors counseled me to make Geely a separate article). I have yet to analyze Li, and neither Seres nor Changan are publicly traded, so covering them is a low priority.

Investors interested in electric vehicle producers should follow all these firms, but we ought not discount incumbents in China. VW has the strongest sales and service network in China, and strong premium brands in Audi and Porsche. GM has good distribution, as does Toyota (Toyota’s premium Lexus brand tops the China import charts). Great Wall has a strong brand, Haval. All are launching EVs.

The prospects for the Chinese economy in 2024 remain uncertain. Does the January sales decline simply reflect seasonal factors, and the end of provincial incentives, so that CY2024 will be OK? Or is the real estate and construction downturn spilling over into the wider consumer economy, including local government? In fall 2023, I believed that those troubles would bypass the new car purchasing income brackets. Now I’m not so sure, but given the seasonal pattern of slow sales from now through late summer, the data is likely to be ambiguous. I do not, however, expect CY2024 to match the record sales rate of CY2023.

In closing, please also see Paulo Santos’ recent article, “The $25,000 EV has arrived, but not from Tesla.” He looks at the lessons to be learned from a single model, whereas with my economist’s training I “count the competition.” Paulo is diligent in responding to comments, so there is much to be learned in the subsequent discussion.

Oh, and I clearly believe Tesla is a car company with a set of other businesses that are distractions to management and will not contribute to Tesla’s bottom line. As a car company, the prospects for CY2024 and CY2025 are not good, given the challenges I trace in the crucial Chinese market. Without continued top- and bottom-line growth, there is no way to justify the current TSLA price. If you are “long” TSLA, plan your exit strategy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.