Summary:

- General Motors is recovering from the consequences of the crisis better than expected, leading to positive stock performance.

- US auto sales are on an uptrend, but there has been a decline in demand due to macroeconomic uncertainty.

- General Motors’ market share in North America decreased in Q4 2023 due to the impact of strikes, but it is expected to recover in the near future.

Scott Olson

Investment thesis

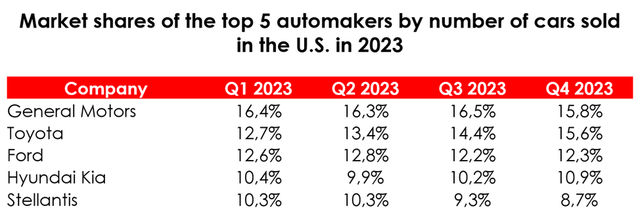

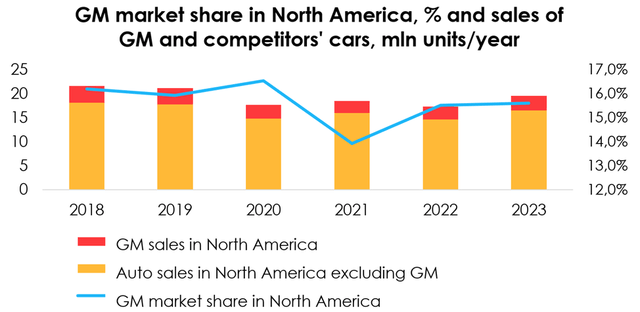

General Motors is getting over the consequences of the crisis of the last quarter better than the market expected, and therefore stock prices are doing well. As a result of the prolonged strikes, the company itself estimates the damage from the production downtime at 95k unproduced vehicles, which as a one-off effect led to a partial loss of market share in North America (from 16.3%-16.5% in Q1-Q3 2023 to 15.8% in Q4 2023), which we expect the company to be able to recover in the near future – the market is strong and GM production is all set.

We have covered the stock before and we expected the impact of the strikes on costs to be smoother, but now we see that the company has likely made most of the one-off payments in Q4 and the impact will be weaker in future periods. The rating is BUY.

Automotive market performance

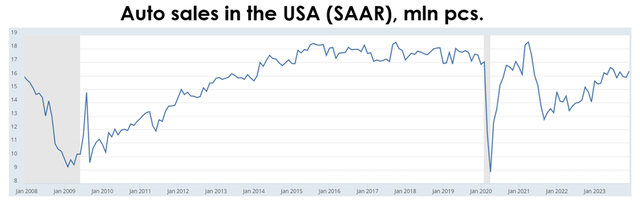

US auto sales continue to be globally in an uptrend and averaged 16.1 mln units in Q4 2023, up from 14.7 mln units a year earlier (+9% YoY). However, after Q1 2023, US auto demand declined quarterly by 100-150k autos due to consumer and market worries about a possible US recession, high Fed Funds rate, inflation above target, i.e. a result of macroeconomic uncertainty.

The consumer sentiment index calculated by the University of Michigan in the US has been rising steadily over the past two months after a prolonged decline in July-November 2023. According to a Bloomberg, survey conducted ahead of 2024, consumer plans for major purchases have improved, which is also a good sign for the automotive industry.

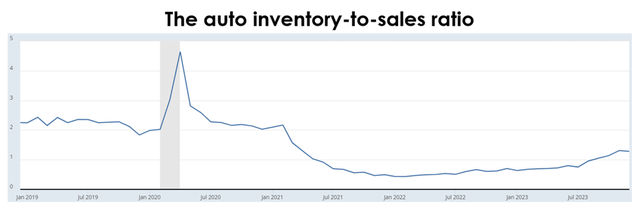

The inventory-to-sales ratio for cars at the end of December 2023 is 1.28x vs. a value of 1.31x at the end of November and a historical average of 2.5x, indicating that auto supply is exceeding demand and contributing to dealer inventory accumulation.

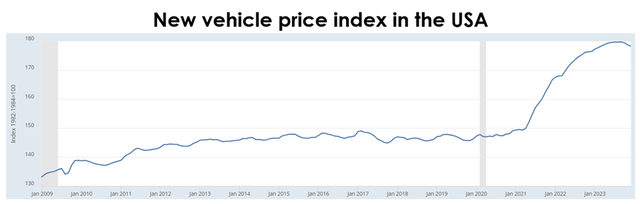

The U.S. New Auto Price Index continues to reach highs amid the ongoing supply-demand imbalance, but the index declined slightly for all three months in Q4 2023 (the first time in the last 10 quarters).

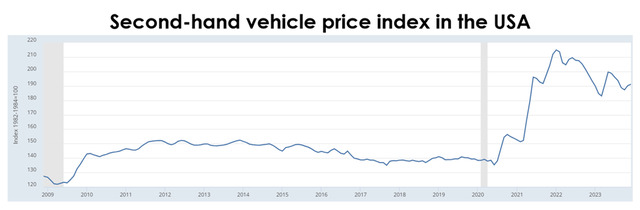

In 2023, used vehicle prices in the U.S. declined by an average of 7% YoY. Due to the reasons for consumer unrest described above, used car prices behaved quite volatile during 2023, which is not expected to happen in the coming months as the automotive market situation is improving.

Due to the still high shortage of new autos on the market, automakers are still passing costs on to the consumer, albeit at a more moderate rate.

Impact of strikes on auto production

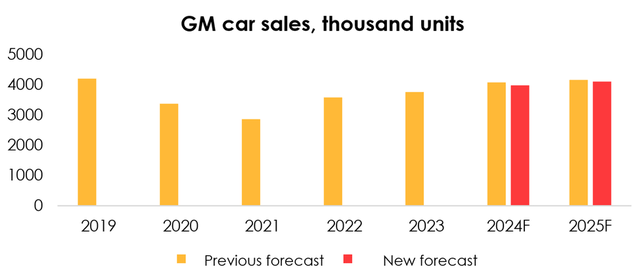

GM sold 943k vehicles in Q4 2023, which was below our forecast of 1 006k vehicles and was the result of the prolonged strikes. The company itself estimates the damage from the production downtime at 95k unproduced vehicles, and due to the supply shock GM used accumulated inventories to meet the existing demand, which resulted in inventory reduction from $17.7 bn to $16.5 bn.

Due to a similar, presumably one-off, effect of lower production volumes in the US in Q4 2023, General Motors lost part of its share in the North American market, where it sells more than 80% of cars produced. Thus, GM’s share in the U.S. fell from 16.3%-16.5% in Q1-Q3 2023 to 15.8% in Q4 2023, benefiting Toyota Motor, whose share in Q4 increased sharply.

North American sales thus declined from 15.6%-15.8% in Q1-Q3 2023 to 15.2% in Q4 2023, resulting in an average annualized rate of 15.6% in 2023 (+10 b.p. YoY). We expect the company to continue to gain market share at a faster pace over the next two years compared to 2023, driven by a strong sales portfolio based on internal combustion engine autos and as the post-strike slowdown period ends and its aftermath is addressed.

GM auto sales forecast

North American auto sales

We keep our forecast for North American sales of internal combustion engine vehicles unchanged at 3.2-3.25 million vehicles in 2024-2025.

On the electric vehicle side, General Motors’ 2023 EV sales totaled 74.6k units (+141% YoY), in line with our expectations of 77.2k units. For Q4 2023 results, General Motors recognized a previously unseen decline in EV demand. Electric vehicle sales are a very small part of the company’s total sales (within 2-3% of GM’s North American sales), and, as management claims, the company is ready to be flexible in choosing between production of internal combustion engine vehicles and e-vehicles as demand changes, so the decline in EV sales in GM’s portfolio is not so significant at the moment and gives the company additional time to build and upgrade battery plants, which will allow the company to enter the positive profitability zone of EV production faster in the future.

Due to the slower expected pace of GM’s electric vehicle sales, we have revised downwards General Motors’ EV sales forecast for 2024 from 112.8k units (+51% y/y) to 99.4k units (+33% Y/Y), and for 2025 from 165.2k units (+46% Y/Y) to 145.5k units (+46% Y/Y).

Auto sales outside North America

As for GM’s presence in Asia, we expect a slower pace of sales recovery in these regions due to growing penetration in electric car sales and the emergence of a serious competitor, BYD. As such, we cut GM International’s sales forecast from 719k units (+16% YoY) to 669k units (+8% YoY) for 2024 and from 759k units (+6% YoY) to 709k units (+6% YoY) for 2025.

Thus, we have revised our GM auto sales forecast from 4.1 million units (+8.2% YoY) to 4 million units (+5.9% YoY) for 2024 and from 4.2 million units (+2.3% YoY) to 4.1 million units (+2.8% YoY) for 2025.

Robotaxi Cruise

Since Cruise provided insufficient information to regulators regarding the accident that occurred on October 2, 2023, the California Department of Motor Vehicles suspended Cruise’s license.

On October 2, 2023, a pedestrian who was the victim of an accident with another vehicle was hit by a robotaxi, causing Cruise to misclassify the accident (as a side collision), turn around and drag the person about 6 meters further, resulting in serious injuries to the victim.

Federal authorities have been investigating the incident for more than three months and it is not yet known when the Cruise robotaxi will resume service.

Since the fatal accident, the company has undergone global changes:

- The CEO voluntarily resigned in November.

- In December, nine top Cruise executives were fired, including the company’s chief operating officer. The head and vice president for government relations and general counsel also left voluntarily. Collectively, the company has reduced the number of employees by 24% by the end of 2023.

According to GM officials, the personnel decisions made during Q4 2023 were necessary as “the company focuses on accountability, trust and transparency.” According to information provided on GM’s conference call following the release of its Q4 2023 financial results, the company is currently developing new financial goals and a new roadmap that will reflect a more deliberate go-to-market strategy following the Cruise license renewal. As a result, GM’s spending on its subsidiary could be reduced by $1 bn.

It’s certainly important for General Motors to relaunch Cruise, as autopilot and robotaxis would allow for a meaningful share of these emerging markets, and at the moment there is far more than one major company competing for supremacy in their final development and authorization of autopilot operations.

Cruise is known to show show 74% fewer crashes with a significant risk of injury and 94% fewer crashes where Cruise is the culprit. In comparison, Google’s autopilot, Waymo, causes 76% fewer crashes involving property damage compared to human-driven cars.

GM financial results

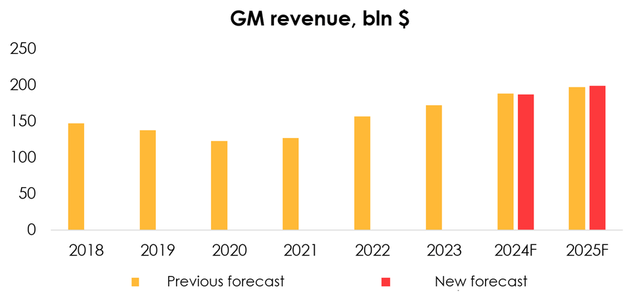

We have revised our 2024 GM revenue forecast downwards from $188.1 bn (+9% YoY) to $187.1 bn (+9% YoY) and upwards from $197.3 bn (+5% YoY) to $198.9 bn (+6% YoY) in 2025 due to an increase in the average selling price of autos in 2024 from $42.5k to $43k and in 2025 from $43.6k to $44.3k, which was more than offset by a decrease in the forecast for 2024 from 4.1 mln units (+6.2% YoY) to 4 mln units (+5.9% YoY) and partially offset by a decrease in the forecast for 2025 from 4.2 mln units (+2.3% YoY) to 4.1 mln units (+2.8% YoY).

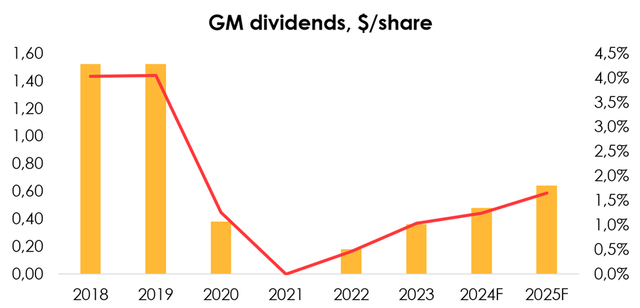

In November 2023, in order to restore investor confidence, General Motors launched a $10 bn accelerated share repurchase program and increased its quarterly dividend in 2024 by 33%, from $0.09/share to $0.12/share. Assuming that the company will increase its quarterly dividend again by one-third to $0.16/share in 2024 due to growing earnings and strong automotive sales, the forward dividend yield in 2024 and 2025 will be 1.2% and 1.6%, respectively.

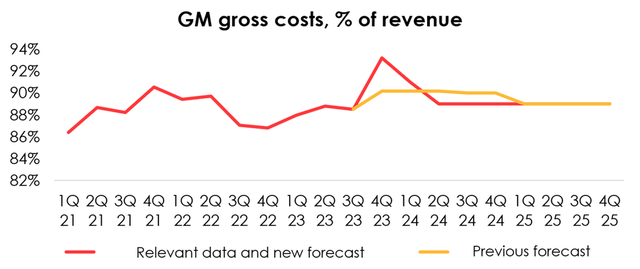

In Q4 2023, due to sharply higher gross costs, GM’s dollar margin per auto was $2810 vs. $4750 in Q3 2023, $5450 in Q4 2022 and the historical average of $2500.

The impact of the strikes on costs is sharper than we expected. We believe that the company made most of the one-off payments in Q4, which means that the impact will be weaker in future periods. Therefore, we lower our 2024 gross cost forecast from ~90.2% to ~89.5% and keep it at ~89% in 2025. Given the lower revenue forecast in 2024 in absolute terms, our 2024 gross cost forecast is lowered from $156.1 bn (+10% YoY) to $153.4 bn (+9% YoY).

Due to slower than we expected decline in SG&A expenses, we raise our forecast for SG&A expenses in 2024 from ~5% to ~5.3% of revenue and in 2025 from ~4.6% to ~4.9% of revenue. The forecast for operating costs as % of revenue remains unchanged.

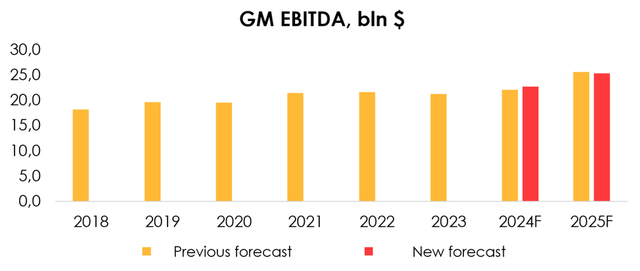

Thus, we have revised our 2024 EBITDA forecast from $22.1bn (+4% YoY) to $22.7bn (+7% YoY) and lowered it in 2025 from $25.5bn (+16% YoY) to $25.3bn (+11% YoY) due to a cumulative decrease in GM’s costs in 2024 from $177. 5 bn (+9% YoY) to $176 bn (+8% YoY) and increase in 2025 from $183.2 bn (+3% YoY) to $185.2 bn (+5% YoY), partially offset by lowering the revenue forecast in 2024 and raising it in 2025.

Valuation

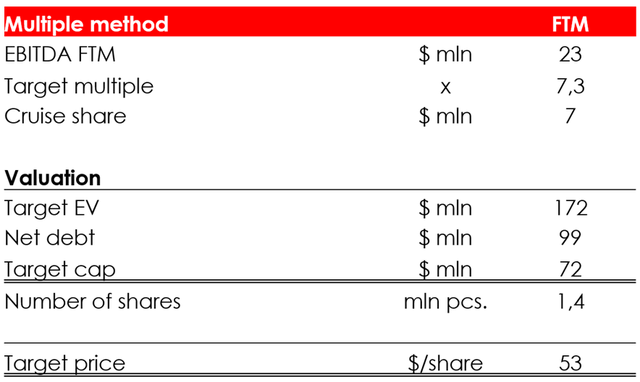

We maintain a $53 target price on the stock due to:

- upward revision of EBITDA guidance for 2024 and an increase in EV/EBITDA multiple from 7.1x to 7.3x, offset by an increase in net debt from $88 bn to $99 bn;

- shift in FTM estimate.

Based on the new assumptions, we maintain BUY status.

Risks

- Slower return of market share previously held by GM in the U.S.

- Continued downward trend in new car prices in the U.S.

- Regulatory issues related to the Cruise license that would have shifted the timing of reaching positive cash flows from this business

- Faster decline in sales in Asia due to market capture by electric cars from local manufacturers

Conclusion

GM continues to develop the electric car segment and is committed to its plans to capture this market by launching new models in various auto categories. Despite the crisis, GM will continue to invest heavily in EVs, both through the opening of new plants and through the development of new product lines: the largest portion of capex is spent on the development of electric vehicles and batteries for them.

We expect the company to continue to gain market share at a higher rate than in 2023, driven by a strong sales portfolio based on internal combustion engine vehicles and the end of the post-strike slowdown period. We consider the decline in GM’s market share of U.S. and North American auto sales in Q4 2023 to be a non-recurring event related to the effect of the strikes.

We believe the company has strong underlying fundamental strength and is now trading well below fair value. The rating is BUY.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.