Summary:

- Intel is expanding its capacity and aiming for dominance in the foundry sector with its IDM 2.0 strategy.

- Despite a setback in an Ohio project, Intel’s strategic launches and strong market confidence from $10 billion worth of lifetime deals support its resilience.

- Intel is well-positioned to capitalize on emerging opportunities in the semiconductor landscape and bridge the AI chip shortage gap.

NurPhoto/NurPhoto via Getty Images

Investment Thesis

Through the noise of semiconductor manufacturing, Intel (NASDAQ:INTC) gets at its big push with IDM 2.0 strategy, expanding its capacity to gain dominion in the foundry sector. While just being handed a short-term setback in the form of an Ohio project delay, there’s no denying the strong market confidence emanating from $10 billion worth of lifetime deals Intel has under its Intel Foundry Services (IFS).

Strategic launches like Sierra Forest and Granite Rapids are on the horizon and support Intel’s resilience and readiness to act fast to cash in on every opportunity. Intel’s bull run since October has faced a pullback before reaching new highs.

Intel aims to bridge the AI chip shortage gap by leveraging its comprehensive AI-centric chip and platform lineup, including Xeon and Core Ultra/Meteor Lake, backed by significant investments in advanced semiconductor packaging technologies like Foveros. We remain confident in the company’s long-term prospects, reaffirming the buy rating.

Intel’s $10B Leap: Foundry Finesse and Future Frontiers Unveiled

Intel is pursuing capacity expansion and dominance in the foundry sector with its IDM 2.0 initiative. Recent updates highlight IFS’s achievements, securing significant design wins with major High-Performance Computing clients and broadening its portfolio through advanced packaging victories. Notably, the lifetime deal value for IFS exceeding $10 billion underscores growing confidence and solidifying long-term commitments from clients.

While the delay in the Ohio project introduces a temporary hiccup, Intel’s overarching roadmap execution, with imminent launches like Sierra Forest and Granite Rapids, projects a bullish outlook. Despite the setback, Intel’s dedication to technological advancement and its ability to secure substantial design wins position the company favorably in a competitive market.

The delay’s impact on capacity expansion needs to be closely monitored, but Intel’s track record and strategic initiatives point towards a resilient and forward-thinking approach. We consider the delay as a temporary challenge rather than a fundamental setback. Overall, we expect Intel to capitalize on emerging opportunities in the semiconductor landscape with its IDM 2.0 capacity expansion strategy and growing foundry business.

Intel’s Mixed Q4: AI Resilience, Mobileye’s Rise, and Foundry Services’ Promise

Intel’s Q4 2023 performance reflects a mixed result across its business segments. In the Data Center and AI (DCAI) sector, despite a 10% year-over-year (YoY) decline, the sequential 5% growth and a strong performance in core server CPU shipments indicate resilience.

With record Xeon ASPs (average selling price) and an expectation of returning CPU compute core growth, Intel anticipates a recovery in the traditional server market, particularly with the proliferation of smaller LLMs and on-premise inferencing needs.

In the Network and Edge (NEX) segment, a reported YoY decline of 24%, aligning with expectations, is accompanied by ongoing challenges related to elevated customer inventory. Nevertheless, Intel maintains an optimistic outlook for the data center market in the quarters ahead, anticipating increased spending on general-purpose computing.

Author

Mobileye, with a revenue increase of 13.0% YoY, is expected to contribute more than $7 billion of future revenue, or more than 3.5 times of 2023 revenue, leveraging its advanced driver-assistance systems (ADAS).

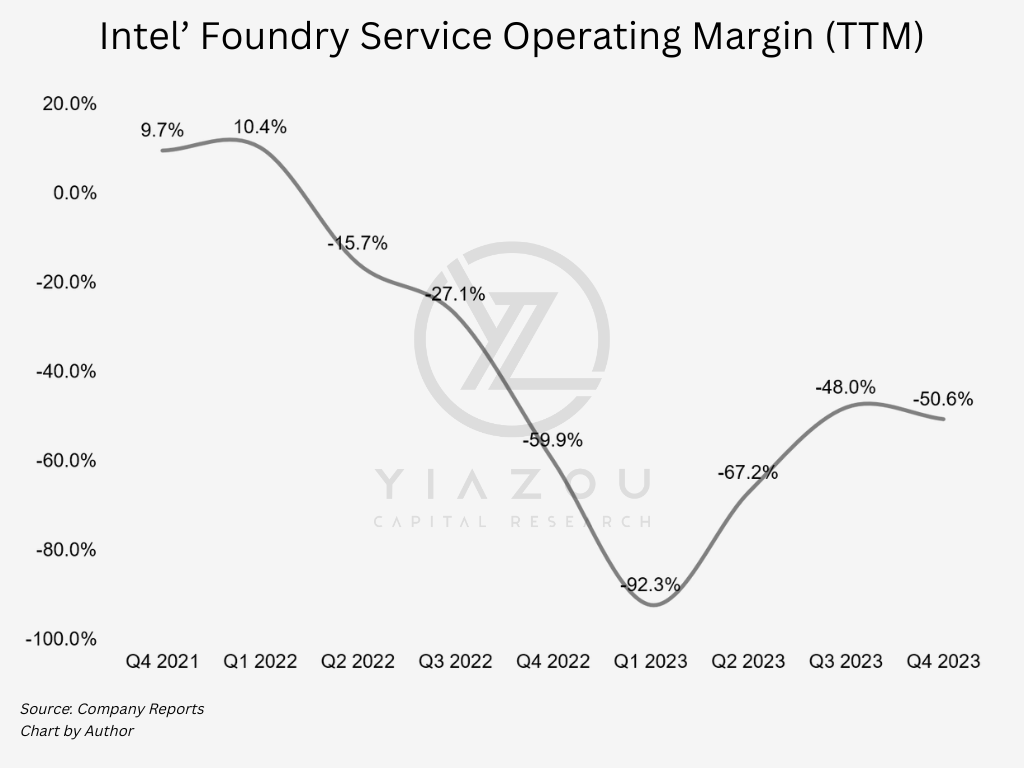

IFS reported revenue of $291 million, a 63% YoY increase. While this figure is below the street estimate, the operating loss of $113 million occurred mainly due to continued investment in system foundry development. The disclosure of three additional advanced packaging design wins in Q4 2023, bringing the total to five in the year, positions Intel well for the future.

Undoubtedly, the delay in the Ohio project may slow capacity expansion. Still, the broader IDM 2.0 strategy appears robust, with diverse foundry customers and a lifetime deal value for IFS exceeding $10 billion.

Author

Intel Eyes Revenue Surge and Tech Leadership Amid Foundry Shake-Up

For Q1 2024, Intel anticipates a revenue range of $12.2 billion to $13.2 billion and forecasts a gross margin of ~44.5% at the midpoint revenue of $12.7 billion. Intel’s Q1 2024 guidance anticipates a sub-seasonal performance in core product businesses, attributing it to inventory corrections in Mobileye and PSG. They expect a significant drop in IFS revenue due to accelerated purchasing in the traditional packaging business and cyclical weakness in wafer equipment buying.

Additionally, the exit from certain businesses in 2023 is estimated to impact revenue by approximately $1 billion sequentially outside of core products. Despite projecting a double-digit percent sequential decline in data center revenue for Q1, Intel is optimistic about improvement throughout the year. The company expects a return to historical growth rates in CPU compute cores and foresees traction in the discrete accelerator portfolio, with a pipeline exceeding $2 billion.

In the NEX segment, solid growth is anticipated from network, FNIC, and edge products, although telco markets may need to be stronger. Overall, Intel expresses confidence in surpassing typical seasonality after a soft Q1, targeting sequential and YoY growth in revenue and EPS each quarter of 2024.

Leading-Edge Semiconductor Technologies and Advanced Packaging Ahead

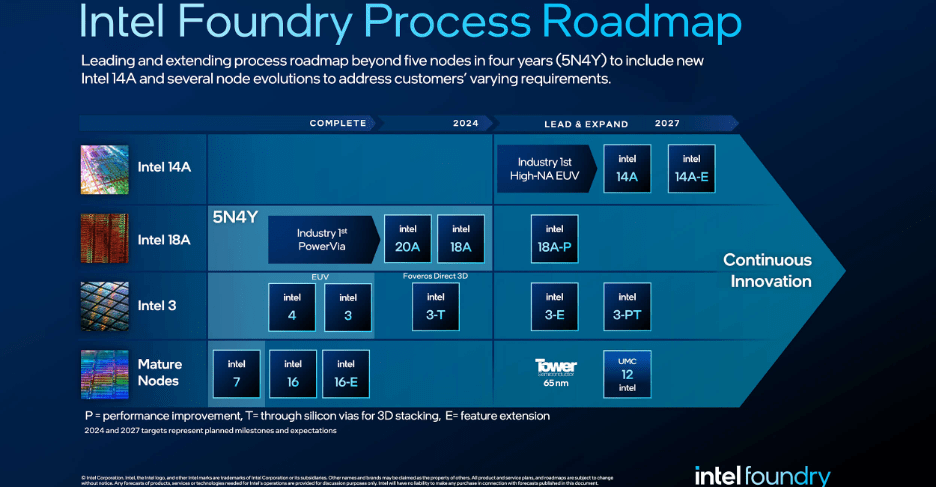

As revealed on February 2024 Investor Day, Intel’s roadmap outlines its semiconductor process nodes and packaging technologies plans. Intel’s extended process technology roadmap adds Intel 14A to the company’s leading-edge node plan, several specialized node evolutions, and new Intel Foundry Advanced System Assembly and Test capabilities.

Additionally, Intel affirmed that its ambitious five-nodes-in-four-years process roadmap remains on track and will deliver the industry’s first backside power solution. The roadmap also includes transitioning from Intel 7 to Intel 4, followed by 20A and 18A. Intel also announced the addition of Intel Foundry FCBGA 2D+ to its comprehensive suite of ASAT offerings, including FCBGA 2D, EMIB, Foveros, and Foveros Direct. By 2025, Intel aims for process leadership, ensuring competitiveness in the industry.

EMIB (Embedded Multi-Die Interconnect Bridge) enables chip-to-chip connections on a 2D plane, allowing efficient data transfer between chips. On the other hand, Foveros is a 3D stacking technology that allows multiple smaller chiplets or tiles to be packaged together. It optimizes silicon for specific purposes, improving performance, power, and product design.

While uncertainties exist, such as potential delays in roadmap execution and competition from rivals like AMD (AMD), we are optimistic about the strategic initiatives with a clear roadmap ahead, positioning Intel favorably for the evolving semiconductor landscape.

Intel Press Release on February 21, 2024

Intel set to benefit from tailwinds in industry dynamics

The rapid advancement of AI, with unique use in machine learning and deep neural networks, has triggered an accelerated demand for specialized AI-centric chips. With their series of AI-centric chips and platforms – Xeon (used in data centers and cloud environments), Core Ultra/Meteor Lake (for AI Everywhere strategy), 5th Gen Xeon Server (AI processing needs in server environments), Intel is at the forefront of this surge in demand.

The integration of AI technologies is growing across various industries, including autonomous vehicles, healthcare, finance, and edge computing, which propels this surge. The sudden surge in demand resulted in insufficient advanced packaging capacity for the supply of AI-centric chips globally. In May 2021, Intel announced a $3.5 billion investment in its New Mexico operations specifically for advanced semiconductor packaging technology to enhance chip performance and integration. One notable technology is Foveros, which enables vertical stacking of compute tiles within a package.

Intel is actively collaborating with government initiatives to develop reliable and secure domestic sources of state-of-the-art semiconductors. Projects like the U.S. Department of Defense State-of-the-Art Heterogeneous Integration Prototype (SHIP) and partnerships with the U.S. Defense Advanced Research Projects Agency (DARPA) leverage Intel’s industry-leading packaging capabilities to advance Application Specific Integrated Circuit (ASIC) platforms.

Reportedly, Nvidia (NVDA) will add Intel as a provider of advanced packaging services to help ease the constraints, taking 5,000 units per month starting as early as Q2 2024. The previous shortage of AI chips stemmed from three main factors: insufficient capacity in advanced packaging, tight supply of high-bandwidth memory (HBM3), and some cloud service providers placing duplicate orders. However, these bottlenecks have gradually resolved, and the improvement rate is better than expected.

Intel’s Bold Capex Move: Pioneering the Future with IFS and Leading-edge Technology

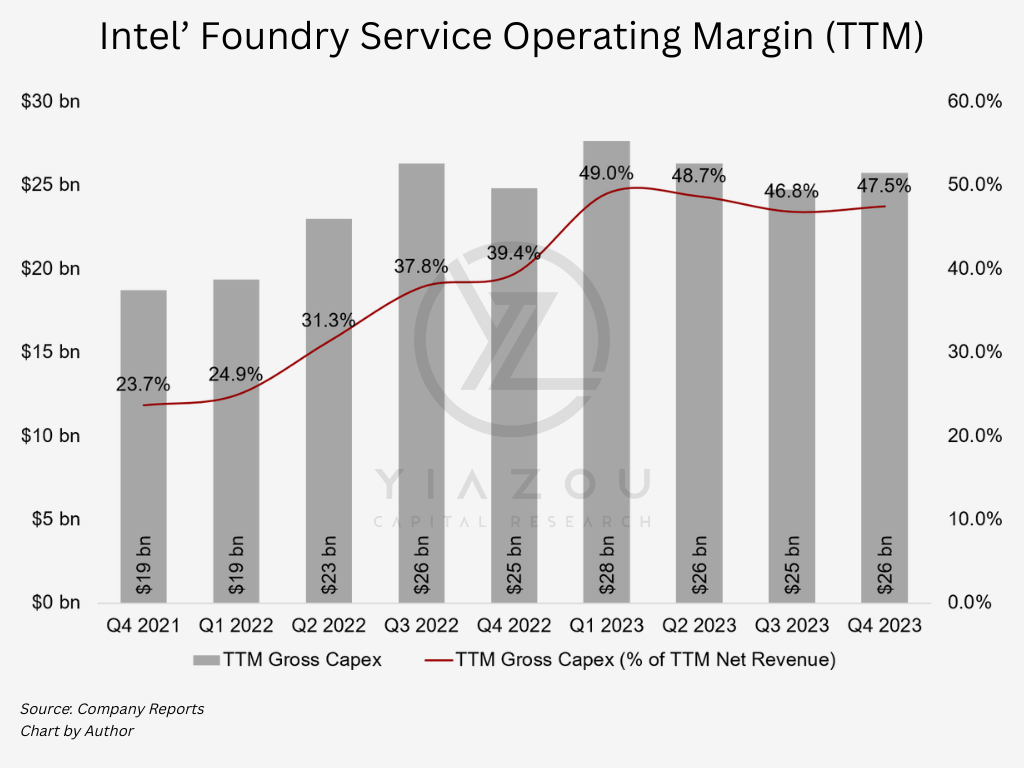

Intel has taken an ambitious capex strategy of capacity expansion to pursue technology leadership. The company’s IFS strategy, targeting five nodes in four years, represents a significant greenfield initiative spanning wafer, packaging, assembly, and testing. This expansion is poised to create a surge in demand for tool suppliers, with key beneficiaries being consistent and repeated award recipients like ASML, the leading EUV tool maker.

The client segment, a focal point in Intel’s roadmap, is expected to lead the transition to leading-edge nodes, with products like the Intel 18A showcasing the company’s commitment to achieving five nodes in four years. The unveiling of full-wafers at Intel Innovation 2023 instills confidence in executing this ambitious goal.

Intel’s accelerated pace in technology advancement, exemplified by the introduction of EUV tools in Intel 4 and advancements in packaging expertise, is anticipated to outpace industry counterparts in both technology and capital spending intensity. This transformation extends beyond technology as Intel shifts from being an integrated device manufacturer to positioning itself as a manufacturing supplier for the fabless chip industry.

Furthermore, the company’s evolving relationships with competitors reflect a more collaborative approach, fostering multifaceted connections where Intel serves as a customer, supplier, and competitor to the same companies.

Intel expects the trajectory of the roadmap to drive high projected capex intensity, aiming for a net capital intensity of about 35%, which would likely stabilize at 25% in the long term. Notably, government incentives, customer prepayments, and strategic capital offsets may keep gross capital intensity around the mid-40s percentage.

Finally, while Intel faces risks, such as those associated with the early success of the 18A nodes accelerating revenue and capex intensity, its transformative approach and ambitious roadmap underscore its commitment to take leadership of the semiconductor landscape in the coming years.

Author

Takeaway

Intel’s Q1 2024 guidance and ambitious process roadmap underscores strategic navigation through short-term challenges toward sustained growth and innovation. Despite expecting a soft start to the year due to inventory adjustments and a forecasted dip in foundry services revenue, Intel is well-positioned to rebound in the following quarters.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.