Summary:

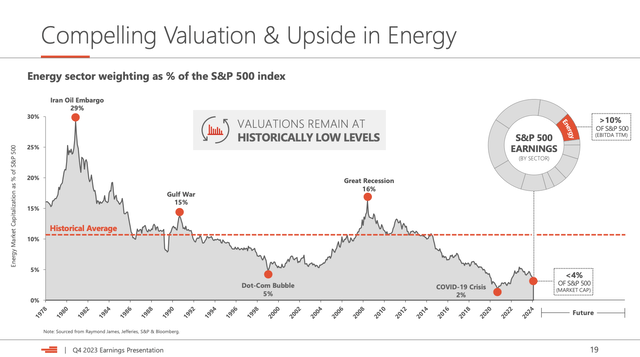

- Energy accounts for more than 10% of the S&P 500’s EBITDA but less than 4% of its market cap.

- Energy stocks are currently undervalued compared to other sectors, with the potential for strong returns.

- Devon Energy stands out thanks to a healthy balance sheet, low breakeven prices, and its ability to reward investors through potentially elevated buybacks and (special) dividends.

Panama7

Introduction

It’s time to talk about Energy – yes, again.

Although I try to keep a fair balance between dividend growth and high yield, energy, and non-energy, and a wide variety of other topics, I have increasingly focused on energy in recent months, as I have started to like the value even more – especially in light of the current AI frenzy.

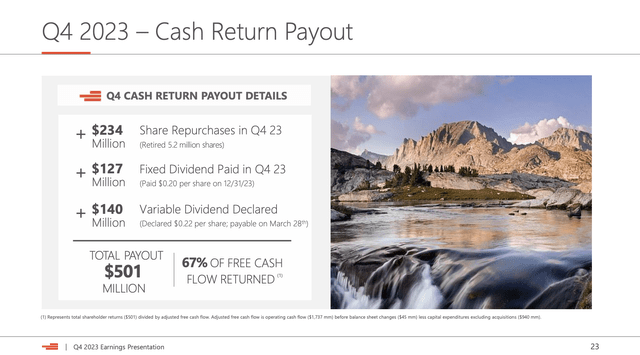

The other day, I worked my way through Devon Energy’s (NYSE:DVN) 4Q23 presentation, which showed the chart below.

As we can see, energy accounts for more than 10% of the S&P 500’s EBITDA. However, it accounts for less than 4% of its market cap.

- During the Great Recession, that number was 16%.

- It was 15% during the Gulf War.

- It was 29% in the 1980s.

Current levels are comparable to the Dot-Com bubble and the pandemic, when front-month WTI contracts briefly traded in negative territory.

My most recent article on Devon Energy was written on September 5, when I went with the title “Devon Energy: The Path To A 10% Yield And 100% Total Return.”

Since then, shares have disappointed, as the market doesn’t care for energy.

I expect that to change, boosted by strong oil fundamentals, a potential rotation, and the related fact that most energy operators are truly “dirt cheap.” And believe me, I’m not using that description lightly. I truly believe energy is unbelievably cheap.

So, let’s dive into the details!

Energy Is Truly Cheap

Earlier this month, I wrote an article on Energy Transfer (ET). ET is a midstream company that focuses on pipelines and infrastructure.

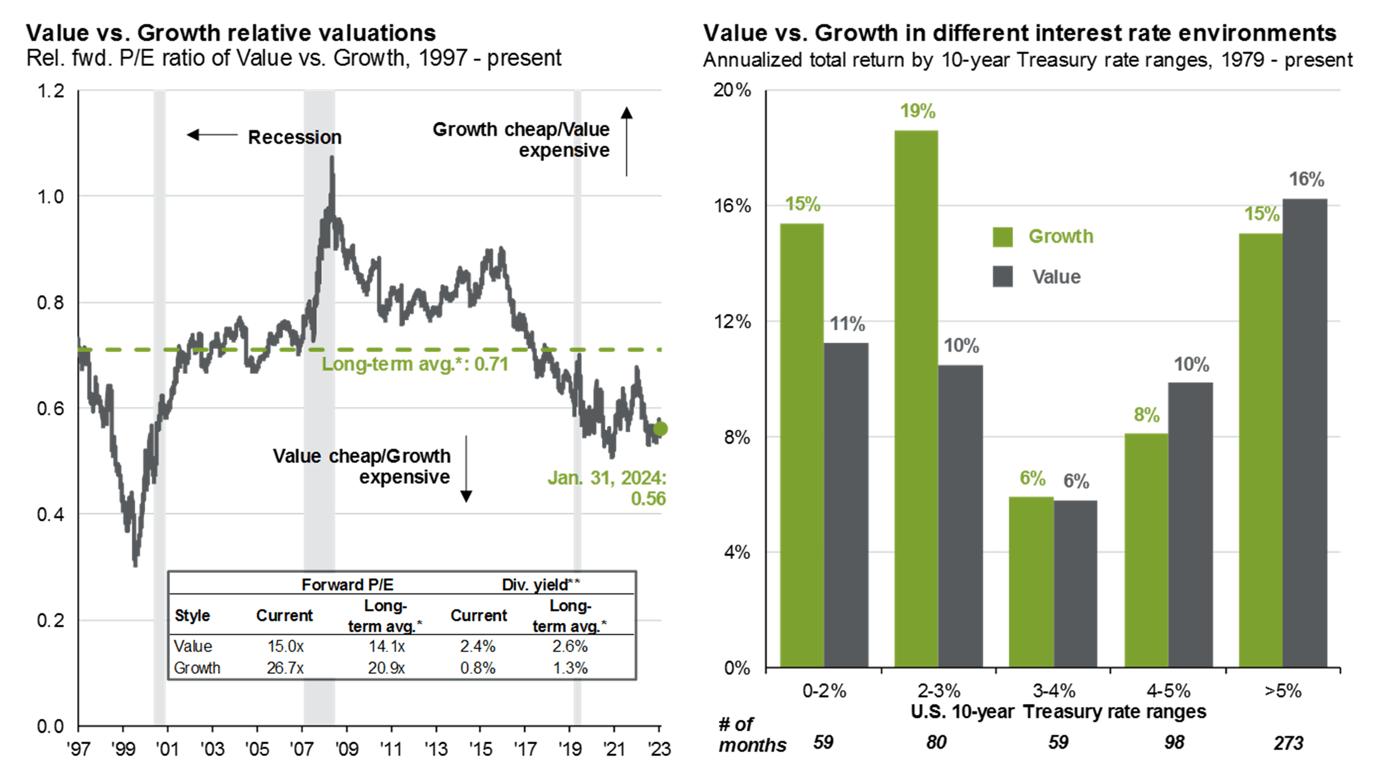

In that article, I made the case that “value” stocks are too cheap, using the chart below.

This chart shows that value stocks haven’t been this attractive on a relative basis since the lows of the pandemic and the tech bubble in 1999/2000. This chart is very similar to the one I showed in the intro of this article.

JPMorgan

This is fueled by a number of things, including the market’s belief that inflation is on its way to 2%, allowing the Fed to quickly cut rates without hurting the economy.

It also helps that the market has found out that it can build an incredible bull case on AI, as it’s truly the technology that will reshape our modern economies.

The problem is that this hasn’t helped valuations.

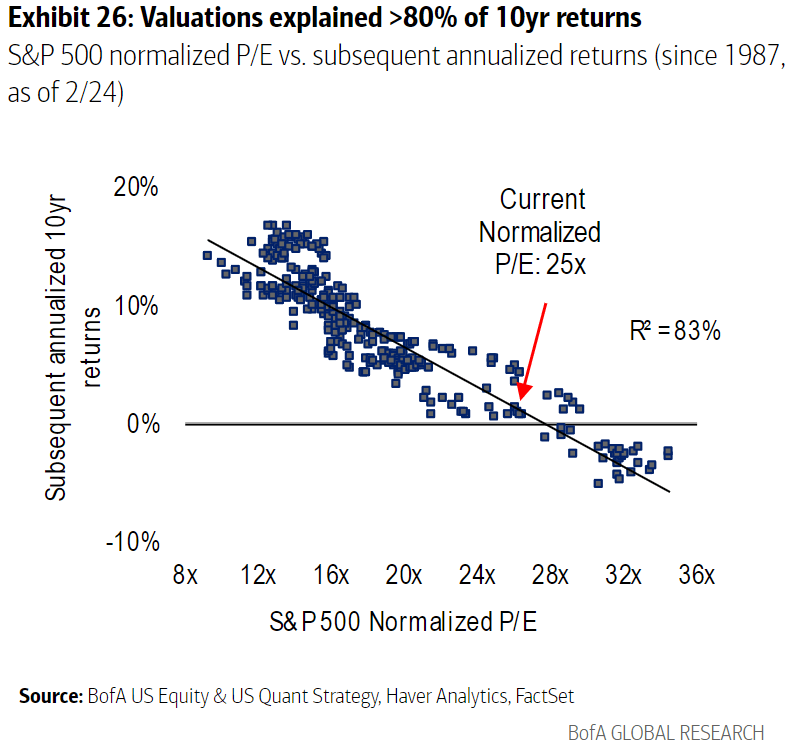

Currently, the S&P 500 valuation suggests very subdued returns for the years ahead, which is based on data collection going back to 1987.

Bank of America

Generally speaking, the higher the valuation, the lower the expected return.

Current valuations suggest low-to-mid single-digit annual returns through 2034.

I also do not believe that inflation has been defeated.

The chart below displays the 5-year breakeven inflation rate, which shows the expected average inflation rate over the next five years.

It appears that we are indeed in a “new normal,” supported by sticky wage inflation, changing energy supply dynamics (beneficial for Devon Energy), geopolitical issues, supply chain re-location, and other factors.

TradingView (5-Year Breakeven Rate)

As such, it seems the Fed isn’t expected to cut rates as quickly as possible, which Powell (more or less) confirmed during his latest comments to the House Financial Services Committee on Capitol Hill.

On the first of his two days of semi-annual testimony to Congress, Powell also suggested that the Fed faces two risks: Cutting rates too soon – which could “result in a reversal of progress” in reducing inflation – or cutting them “too late or too little,” which could weaken the economy and hiring. The effort to balance those two risks marks a shift from early last year, when the Fed was still rapidly raising its benchmark rate to combat high inflation. – AP (Emphasis Added)

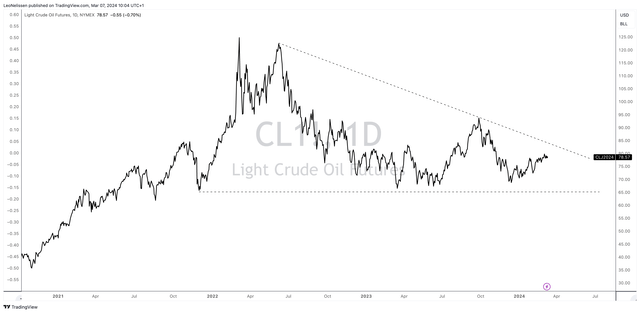

We are also seeing a rebound in oil prices, as WTI is trading at roughly $79.

However, we need to bear a few things in mind.

- Europe is on the brink of a recession, with major economies like Germany suffering from poor demand and energy issues.

- China’s housing market is very weak and working its way through the economy.

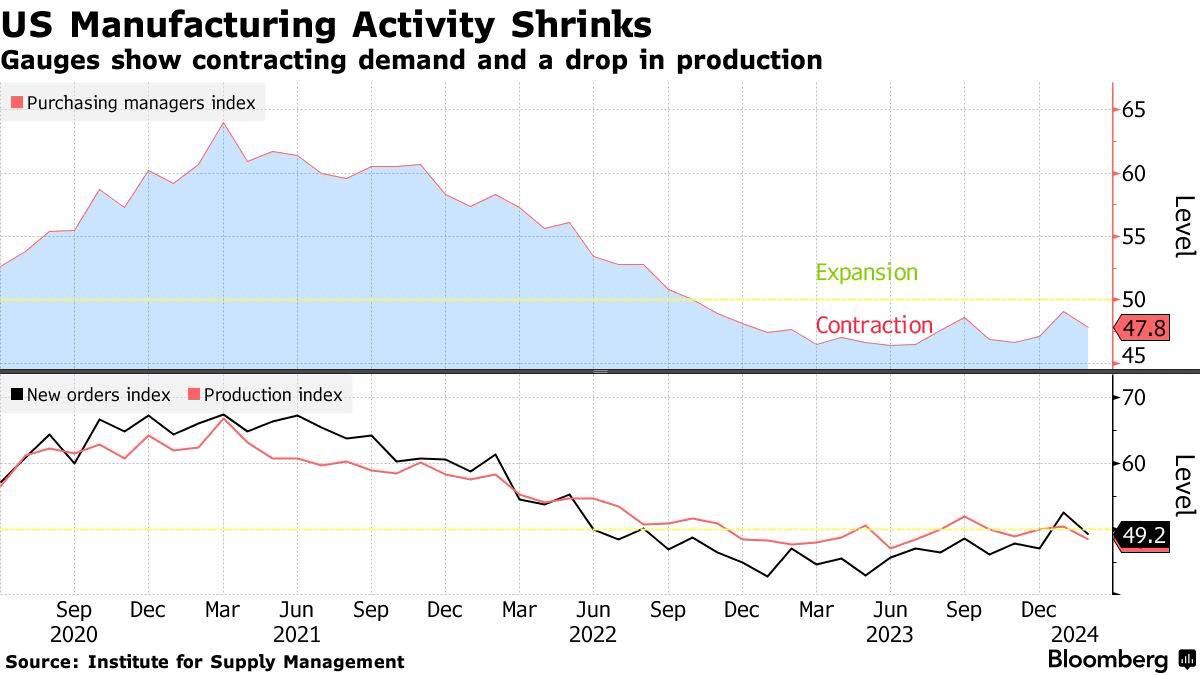

- Even cyclical demand in the U.S. is weak, as proven by the fact that the leading ISM Manufacturing Index continues to hover below the neutral 50 level.

Bloomberg

I believe if oil supply growth were higher, oil would trade at least $15 to $20 lower.

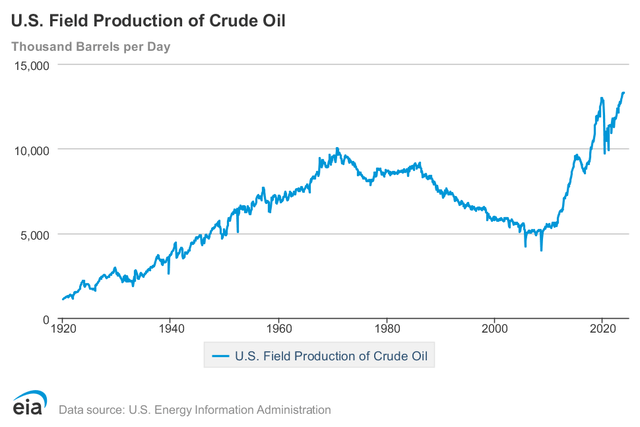

However, OPEC is sticking to production costs, and the shale revolution in the U.S. is slowly running out of steam.

In the past, the shale revolution was the main reason why oil prices couldn’t start a sustainable rally.

While oil production in the U.S. hit a new all-time high last year, the rate of change has come down significantly, as production is barely above pre-pandemic levels.

Energy Information Administration

Before the pandemic, output quickly rallied after price declines, fueled by rapid shale production growth.

Now, this party is slowly ending, handing back pricing power to OPEC.

That’s the short version of why I expect oil prices to remain a long-term tailwind and potentially reach triple-digit dollar territory the moment cyclical economic growth rebounds!

Once that happens, the market may be forced to buy energy equities, as value stocks are highly attractive, with energy being the cheapest value segment on the market.

That’s where Devon Energy comes in.

Why I Like Devon So Much

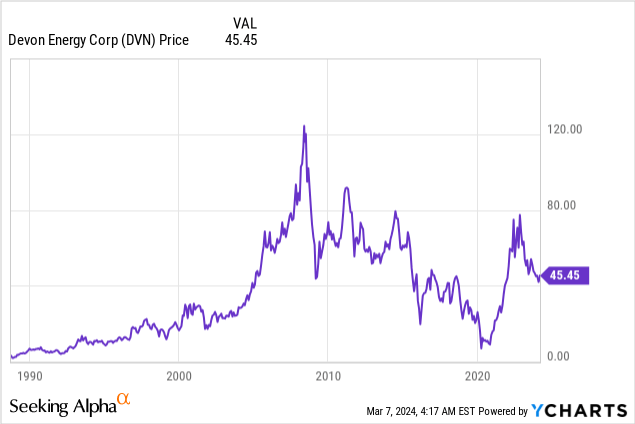

Devon Energy used to be a company with little to no value.

For example, between the Great Financial Crisis and 2021, when shale production was exploding higher, DVN had little to no value for shareholders. Its stock price was in a free fall, as American shale producers were their own biggest enemy.

Although the sector helped America to become energy independent and pave the road for subdued inflation, they simply could not catch a break, as higher production pressured oil prices, making it close to impossible to reward shareholders.

That’s over now – I think.

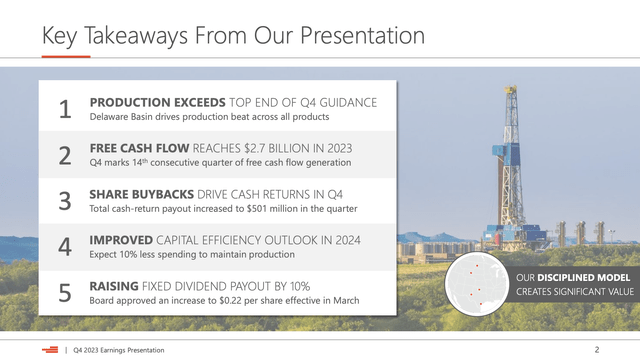

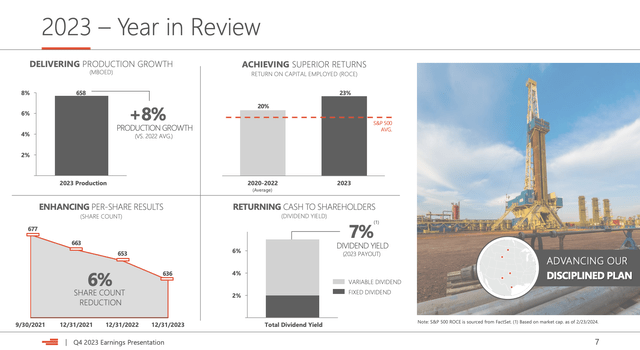

Now, Devon is different, recording its 14th consecutive quarter of positive free cash flow in 4Q23, allowing it to raise its fixed dividend by 10%.

Moreover, on a full-year basis, the company achieved an impressive production growth rate of 8%, allowing it to reach a new all-time high.

This growth was accompanied by returns on capital employed that beat the S&P 500 for the third consecutive year.

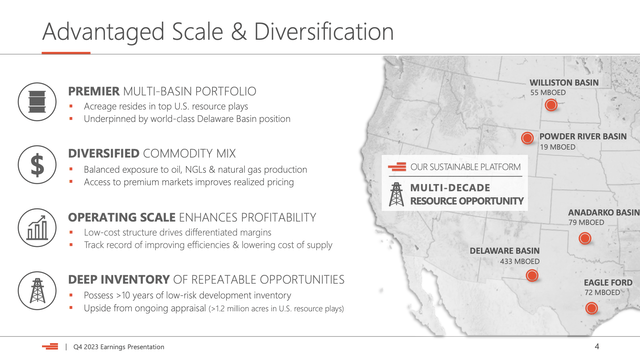

Speaking of production, note that after a series of acquisitions, Devon is a Permian-focused producer, as it produces more than 430 thousand barrels of oil equivalent (“OE”) per day in the Delaware Basin, which is located in the west section of the Permian.

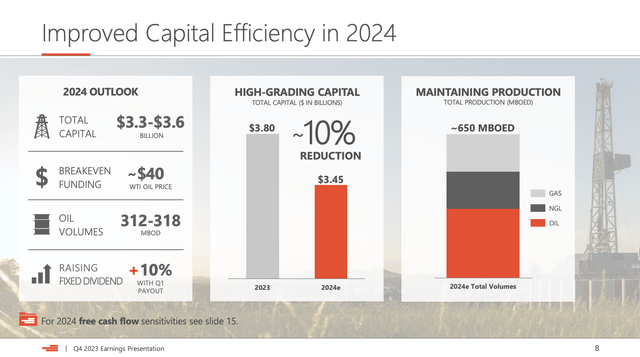

Looking ahead to 2024, Devon expects to further improve its capital efficiency while maintaining production levels comparable to 2023.

The company plans to optimize its capital program to achieve higher returns, with a focus on reducing capital expenditures by 10%.

Even better, Devon aims to achieve this while sustaining production at breakeven prices of around $40 per barrel of WTI crude oil, which is extremely low, especially in light of almost three years of elevated inflation!

Roughly half of its 650 thousand BOE in 2024 is expected to come from oil.

It has more than ten years’ worth of reserves in the low-cost segment.

Attractive Shareholder Value

One of the most important things oil companies have done since 2020/2021 is reducing their debt.

Even if we were to enter a severe oil price decline in the next few years, many oil companies would be much better off, as they do not have the risks that come with unhealthy balance sheets.

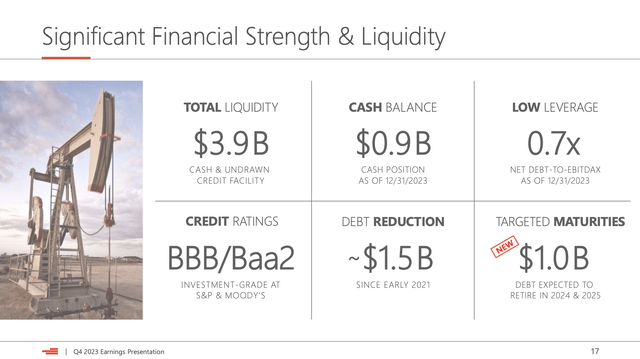

The star of this article, Devon Energy, ended the fourth quarter with cash balances of $875 million and a net debt-to-EBITDA ratio of only 0.7x.

Looking ahead, Devon plans to utilize excess free cash flow to boost liquidity and retire maturing debt, with upcoming debt maturities providing opportunities for further debt reduction.

The good thing is that a healthy balance sheet not only reduces risks but also opens up opportunities for higher shareholder distributions!

Essentially, Devon Energy has a 70-30% strategy.

The company aims to achieve a cash payout ratio of 70%, with the remaining funds being used to improve the balance sheet.

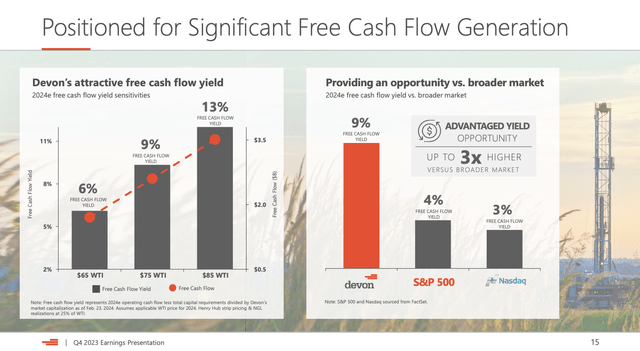

This can be highly lucrative, as the company – thanks to efficient operations and low breakeven prices – has an implied free cash flow yield of roughly 9% at $75 WTI. That number is 13% at $85 WTI.

In other words, the company should be able to return more than 6% of its market cap to shareholders at $75 WTI. That’s 70% of 9%.

The company currently has a fixed quarterly dividend of $0.22 per share, which translates to a yield of 1.9%.

In the fourth quarter, the company declared dividends worth $0.44 per share, which is an annualized yield of 3.8%.

Going forward, the company expects that buybacks will remain a key tool.

I agree with that for one major reason: DVN stock is very cheap!

Valuation

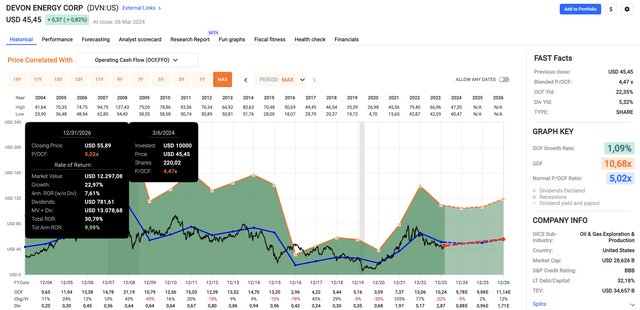

In general, the stock has always been somewhat cheap, as its long-term normalized P/OCF (operating cash flow) ratio is just 5.0x.

Bigger oil majors usually traded at 8-10x OCF.

This has everything to do with its struggles during the shale revolution, the fact that it’s roughly 50/50 oil/gas, and its size (it does not have the scale advantages of majors like Exxon Mobil (XOM)).

Currently, DVN trades at a blended P/OCF ratio of 4.5x, which implies a fair valuation of roughly $56 per share, based on a potential OCF per share rebound to $11.14 in the years ahead – combined with a 5x OCF multiple.

These numbers can all be found in the chart below.

In other words, based on the current energy environment, I think DVN is at least 20-25% undervalued.

In an environment of higher oil prices, the stock could rise significantly higher.

At $85 WTI, it has a 13% free cash flow yield. Applying a 10x free cash flow multiple, the company would have a conservative fair market cap value of roughly $37 billion (10x$3.7 billion in FCF – using the free cash flow generation chart I added to this article).

That’s 30% above its current value.

If oil prices were to remain above $100, I expect that DVN stock would have room to double – especially if a potential stock market rotation occurs.

On top of that, I believe DVN deserves a higher OCF multiple than 5x, as its improved business should not be trading below 6.5-7x OCF, in my honest opinion.

With that said, I recently sold my DVN position, as I restructured the energy exposure in my dividend portfolio. I will elaborate on that in the weeks ahead.

It had nothing to do with me not liking DVN. I just had to free up cash and re-arrange my dividend and trading portfolios.

However, I am looking to buy back into DVN and make it a major part of my trading portfolio, as I really like the new-and-improved DVN and believe it has a lot of hidden value that the market will uncover once it rotates back from tech/AI to value.

Takeaway

As the market fixates on AI and tech, I’ve turned my attention to energy, where undervalued opportunities await.

Despite recent underperformance, companies like Devon Energy show resilience and growth potential, backed by solid fundamentals.

With oil prices rebounding and a strategic focus on reducing debt, DVN emerges as a compelling investment.

meanwhile, its commitment to shareholder value, supported by consistent cash flow and dividend growth, underscores its potential for juicy long-term returns.

While we are dealing with global economic uncertainties, I remain bullish on DVN’s outlook and will likely buy it back very soon.

Pros & Cons

Pros:

- Undervalued: DVN presents an opportunity to invest in an undervalued asset, with a potential upside of 20-25% in the current energy environment. Once oil prices move higher, I expect much more upside.

- Resilience: Despite past struggles, DVN has shown resilience, posting positive free cash flow for 14 consecutive quarters.

- Shareholder value: The company’s commitment to shareholder value is supported by its 70-30% strategy, balancing cash payouts with debt reduction.

- Strategic focus: With a focus on reducing debt and optimizing capital efficiency, DVN is poised to capitalize on improving market conditions and sustaining production levels at low breakeven prices.

Cons:

- Market sentiment: DVN’s performance may continue to be impacted by negative economic headlines and market sentiment favoring growth stocks.

- Sector volatility: The energy sector is very volatile and prone to fluctuations in oil prices, geopolitical tensions, and regulatory changes, which could negatively impact DVN’s stock performance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in DVN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.