Summary:

- Devon Energy Corporation produced at the top end of guidance for FY23 and anticipates remaining disciplined in their 5% production growth rate.

- Devon will continue to focus production in their core Delaware assets paired with frac and refracs in the Eagle Ford.

- Despite expectations for a flat oil market in 2024, Devon remains a strong investment opportunity with 70% of free cash flow being paid out to shareholders.

jzabloski/iStock via Getty Images

Devon Energy Corporation (NYSE:DVN) reported a strong end to FY23, with production exceeding the top end of guidance at 662Mboe/d, an 8% increase in total production for the year. 6% of the production increase resulted from improved performance in the Delaware Basin alone. Management guided significant strength going into 2024 across their core Delaware Basin as well as their differentiated fracking techniques in their Eagle Ford properties and anticipates flat-to-slightly increased volumes going into q1’24 on a y/y basis.

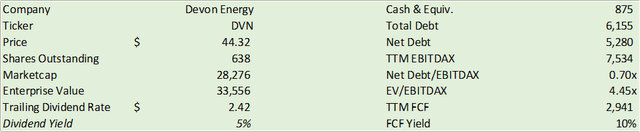

Management remains committed to capital discipline, moderating production growth by upwards of 5% annually, and returning cash to shareholders in the form of a dividend or share buybacks with upwards of 70% of free cash flow funneling to these shareholder values. Despite the expectations for a moderately flat oil market in 2024 that may result in little-to-no growth, Devon remains a superb investment opportunity in terms of shareholder value and return of capital. I provide DVN shares with a BUY recommendation with a price target of $54.19/share at 4.50x eFY25 EV/EBITDAX.

Operations

Production grew by 4% in q4’23, reaching 662Mboe/d with oil accounting for 48% of production. These tailwinds in volumes offset some of the pricing headwinds Devon faced throughout FY23 following a year of exceptionally strong and volatile oil and natural gas prices as a result of the Russia/Ukraine war. This has led to a -20% y/y decline in top-line revenue; however, Devon maintained their 49% EBITDAX margin through operational excellence.

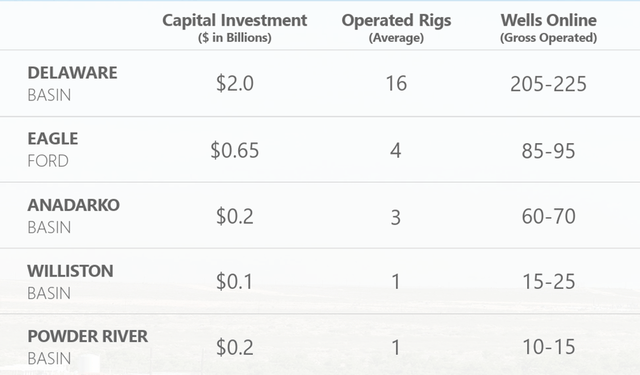

Looking to eFY24, management is targeting flat production at 650Mboe/d with a capital reinvestment rate between $3.3-3.6b. Liquids production should remain around 73-74% of total volumes with gas taking up the remaining 26-27%. Management mentioned on the Q4 ’23 earnings call that significant improvements have been made to the infrastructure in the Delaware Basin, including an additional 2Bcf/d of gas processing capacity, expansion to the downstream gas takeaway, enhancements to water handling capabilities, and an investment in self-generating power and microgrids in-basin. Given the significant investments in FY23, management anticipates a 10% reduction in capital spending in eFY24 that should enhance free cash flow.

Looking to the Delaware Basin, Devon added a 4th frac crew to the basin to enhance production within their core asset and expects to allocate over 60% of the $3.3-3.6b capital outlay to the basin in eFY24. The firm’s primary focus in the basin will be in developing their New Mexico assets to bolster their infrastructure in support of their optimization plan.

Management will be curtailing investments in the Williston Basin and only focusing on high-confidence developments. Overall, this will free up capital to allocate to the Delaware Basin while maintaining that -10% investment outlay. Management also expects to develop their Eagle Ford assets and leverage their refrac and well enhancement program. I believe that this capital allocation plan will play to the firm’s advantage in the anticipated flat oil market as management anticipates a 10% improvement on resource production, resulting in a breakeven price of $40/bbl WTI. Guidance suggests that at $75/bbl WTI, Devon should generate a 9% free cash flow yield and 13% at $85/bbl WTI.

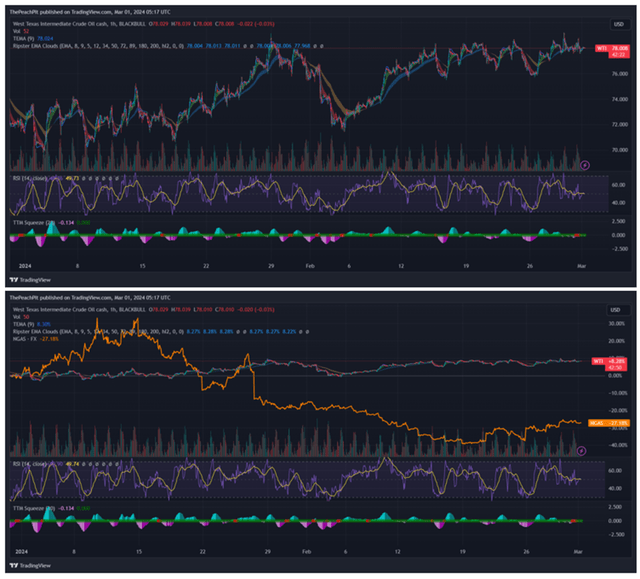

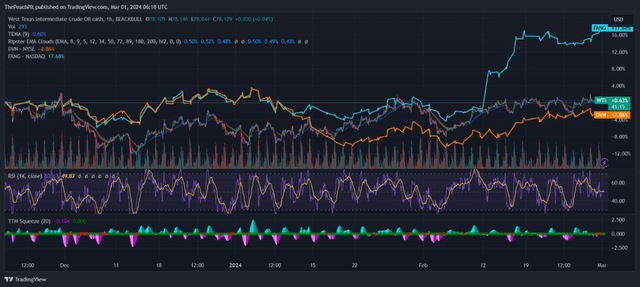

Looking at historical prices for CY24, oil has remained relatively rangebound above $70/bbl WTI while natural gas has experienced significant downward pressure.

Building a model for eFY24, I will be using the CME futures pricing for WTI and Henry Hub natural gas.

Valuation & Shareholder Value

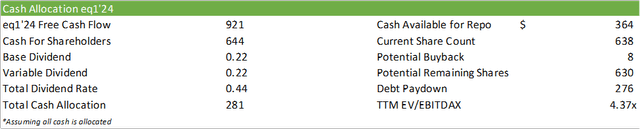

Devon Energy has maintained their disciplined approach to managing operations and returning cash to shareholders. Management is targeting a 70% cash return from free cash flow with the remaining 30% being dedicated to bolstering the balance sheet. As suggested on the Q4 ’23 earnings call, management will be prioritizing share buybacks as they see DVN shares as undervalued and will allocate the remaining excess free cash flow to the variable dividend. To show confidence in their cash return program, management raised the base dividend by 10% to $0.22/share effective March 28, 2024. I anticipate management to maintain this capital allocation approach as they see DVN shares as undervalued.

Management returned a total of $501mm in Q4’23, $234mm of which was allocated to share repurchases. Looking to EQ1’24, management will be paying out $0.44/share in dividends, split 50/50 between base and variable rates.

Running through the potential cash allocation program for EQ1’24, I estimate Devon to generate $921mm in free cash flow for the quarter. With 70% allocated to shareholder returns and 30% to debt repayment, and assuming 100% of the free cash flow is utilized, I estimate that management can repurchase 8mm shares at the current share price and pay down $276mm in debt.

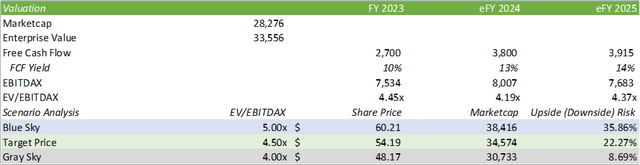

Looking at valuation, I don’t expect DVN shares to trade above 5x EV/EBITDAX in eFY24 given the anticipated flat oil market. If an exogenous macro event were to occur, shares very well could trade above that 5x multiple; however, assuming normal conditions, I anticipate shares to trade around 4.50x for CY24. Using the strip price for future cash flow generation, I value Devon Energy Corporation stock at $54.19/share and recommend DVN as a BUY.

Aside from share appreciation, I believe DVN shares make a great addition for an investor seeking a high-yielding dividend stock. It provides energy exposure without the tax implications of a k-1 filing as seen in midstream names such as Enterprise Products (EPD), Energy Transfer (ET), or MPLX (MPLX).

I believe that owning DVN shares provides an investor with exposure to high-quality, short-cycled energy exposure. Given Devon’s commitment to returning capital to shareholders, this investment will bear much value even without share appreciation.

As discussed in my recent report covering Diamondback Energy (FANG), DVN generally trades with WTI spot prices and will perform exceptionally well in an oil bull market. In terms of trading during a flat-to-down oil market, FANG shares may offer a better hedge position for similar shareholder cash flows.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.