Summary:

- Palantir achieved its fifth straight quarter of GAAP profitability, unlike other software companies, Snowflake and C3.AI, who continue to not generate profits.

- Institutional interest in Palantir reaches an all-time high, with ownership soaring to nearly 40%. Over the last 3 years, institutions have added to PLTR by 400%.

- Palantir’s newest business model with AIP Bootcamps is accelerating customer adoption and expansion in the sales motion.

- Palantir continues to win industries like healthcare, energy, and others by solving complex industry-specific problems.

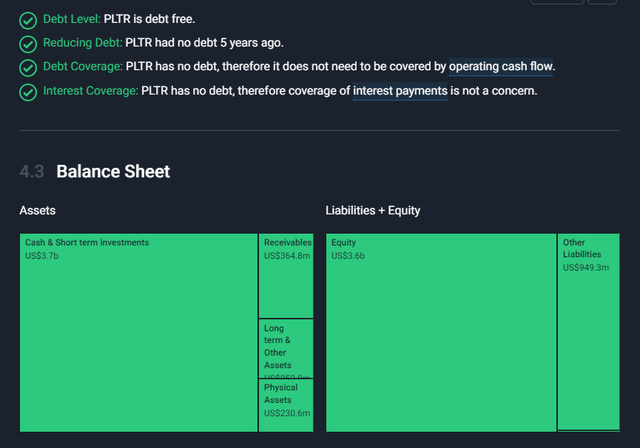

- Palantir is financially strong with $3.7B in cash and $0 in debt, and growing margins with their new business model.

Michael Vi/iStock Editorial via Getty Images

Institutions Wake Up after Q4, Full Year Results, & AI Excitement:

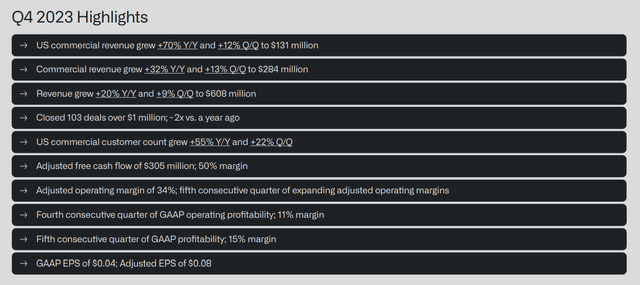

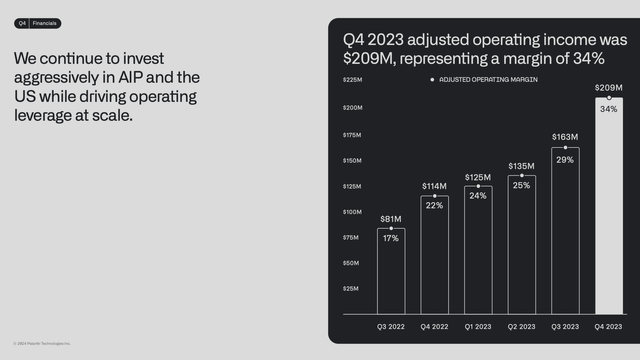

In the heart of Denver, Palantir Technologies Inc. (NYSE:PLTR) wrapped up its year with a bang, showcasing its fifth straight quarter of GAAP profitability that has left both Wall Street and Main Street buzzing with excitement. Palantir delivered a GAAP EPS of $0.04 for Q4, which resulted in $93.4M in GAAP Net Income. It’s not just the numbers that are talking; it’s the story they’re telling about a company on the rise. Amidst a backdrop of growing investor enthusiasm for AI technologies, Palantir stands out, not just for its impressive 20% year-over-year revenue growth but for the consistency in profitability, excellent financial stewardship, and delivering real-world outcomes for its customers.

Palantir Q4 2023 Highlights (Palantir Earnings Presentation)

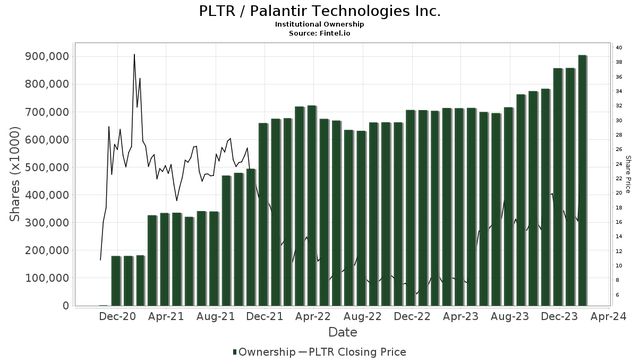

The company has finally captured institutional interest, with ownership soaring to an all-time high of nearly 40%. This isn’t just a number—it’s a validation of institutional investors understanding this is not a black box company that doesn’t produce actual outcomes. After Q4 earnings, institutions who have never been fans of Palantir, such as Citigroup and Jeffries, even had to raise their price targets over $20. The negativity by institutions publicly on Palantir doesn’t match up with the staggering 400% increase in institutional buying over the past three years.

After the recent AIPCON3 conference, Institutions that have been supporters of Palantir such as Bank of America raised their price target to $28 and Wedbush Securities raised their price target of Palantir to $35 a share.

Now as my readers know I like to outline up front what the purpose on my articles are, so here it goes. I want to share with you why I believe Palantir will still go up from here and provide market beating returns in the next two years and beyond. I will discuss what trends we are seeing in their financials and how they compare to their peers, and my forward-looking expectations for the company, which leads me to keep my buy rating.

There are many changes that have happened at Palantir in the last 12 months that have helped contribute to their 181% total return for shareholders in this time. We will cover most of these, but also discuss the catalysts that can continue to push the stock higher over time.

Palantir Institutional Ownership (Fintel.IO)

Proof over Proof of Concept

As we peel back the layers of Palantir’s success, it’s impossible to ignore the many approvals the company has received from third-party analysts. Giants in the industry like Gartner, Forrester, and Dresner Advisory Services have not been shy in their praise, bestowing leadership positions and awards on Palantir across a spectrum of categories. From AI, Data Science, and Machine Learning to Cloud Business Intelligence and beyond, Palantir’s trophy case is expanding almost as rapidly as its market share. In the most recent Dresner 2023 Technology Innovation Awards, Palantir was named Top-Tier performer in 8 of their 16 thematic studies.

2023 Dresner Tech Innovation Awards (Palantir Website)

These accolades are not just shiny ornaments; they’re powerful indicators of Palantir’s central role in the modern digital enterprise and battlefield. Foundry isn’t just a product; it’s being utilized as the potential backbone of organizations’ operational ecosystems, capable of powering everything from supply chain analytics to self-service BI and model ops.

But it’s not just about what Palantir can do; it’s about how it’s doing it better than anyone else out there. The combination of third-party endorsements and stellar financial outcomes paints a picture of a company that’s not just participating in the AI and data analytics race—it’s leading the pack, leaving competitors in its wake. As we look to the future, it’s clear: Palantir’s journey is one of innovation, investor confidence, and most importantly a firm commitment to creating meaningful outcomes for every customer.

Risks that Other Institutions are Concerned About with Palantir

There is still 50% retail investor share ownership vs. the 40% that institutions hold. What does this tell us? Well, there is still a large portion of institutions who haven’t invested in the company for one reason or another. Some institutions cannot invest in the stock until it is included in the S&P 500 which Palantir is eligible to join, it just hasn’t been selected yet. Another hesitation is current valuation as Palantir trades with an extremely high valuation at a P/E GAAP (TTM) of 294 with just $209M in earnings this past year. However, this is the shortsighted approach to viewing the company’s operations and progress. In just 12 months, it is estimated to go from a P/E GAAP of 294 to 183 and with earnings growth of 32% y/y.

Now I am not insinuating that Palantir will not be a volatile stock, by no means am I saying this. The stock trades with a wild 2.7 Beta, so whatever response the market takes, typically Palantir will take an impact of nearly 3x that. Now, who does that hurt if caught in a volatile price swing in a stock? It is the trader or institution that is moving in and out of positions often.

For the long-term investor who has done his or her research, their thesis is intact, and is continuing to dollar cost average or even double down in downward swings from all-time highs will be rewarded. So, it is important to really understand the company’s you invest in, what is the risk for you, not what is the risk for everyone else. The other risk that has prevented others to invest in Palantir is the high amount of stock-based compensation (SBC) and dilution of shareholders. This risk as well, in my opinion, is a short-sighted decision if you don’t know why Palantir must utilize stock-based compensation to keep premier talent.

Palantir Balance Sheet (Simply Wall St. App)

The other caveat every investor should pay attention to is the decline in stock-based compensation, as it is 22% of revenue today but used to be nearly 70%. There is a good amount of uproar about the 110 million shares that got released this month but that was set back to be released in a plan designed in 2020. The stock is not to raise capital as they have $3.7B in cash, but to pay their employees in SBC. Palantir is also going to be implementing what are called P-RSUs where in order to receive the stock-based compensation you have to hit certain performance metrics. This is just another way the company is aligning employees to their customers and shareholders. It is extremely difficult to compete with the big tech organizations for retaining talent, when they have endless amounts of cash, perks, and employees, whereas Palantir has their culture, mission, leadership, and SBC. In my opinion, this says a lot, when you look at all that Palantir has accomplished since being public in 2020.

So, there is risk in investing in any stock, but when you look at Palantir’s balance sheet, customer base, retention, and understand their business model, then the risk is much lower if you are a long-term investor.

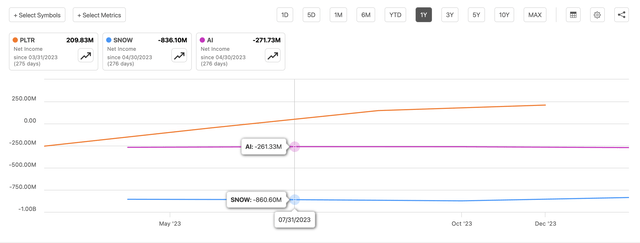

Palantir’s Growth into Valuation vs. Others

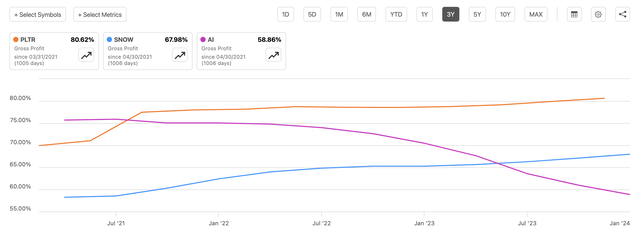

Some may ask, “How can I say that Palantir is a buy after such a run-up in performance? It has a higher price to sales at nearly 26 vs. (SNOW) at 19 and (AI) at 13.” But I would challenge those statements with the profitability that Palantir has already delivered consistently compared to these two. In fact, Palantir is projected to grow earnings 27% annually for the next 3 years and neither Snowflake or C3.AI or projected to be profitable in the next 3 years.

PLTR Annual Net Income vs. SNOW & AI (Seeking Alpha Net Income Chart)

Snowflake had 9,437 customers at the end of 2023 and an average customer spend of $297K, while C3 AI had 445 customers with an average spend of $1.9M, and then Palantir had 497 customers with an average spend of $4.48M. Palantir is winning bigger contracts and with a more profitable business model that is designed to compound earnings over the long haul. Palantir has maintained gross margins over 80% for the last 3 years vs. its competition in the market, Snowflake at 68% and C3 AI at 59%. Palantir is also forecast to grow revenues over 19% in 2024 while Snowflake dropped to 18.5% revenue growth and C3 AI at 11%. I also believe Palantir will surpass the 19% growth expectations with them hitting their stride with their new GTM business model, AIP Bootcamps.

PLTR Gross Margin History vs. SNOW & AI (Seeking Alpha Gross Margin Charts)

How the New Business Model & Execution Combat the Risk

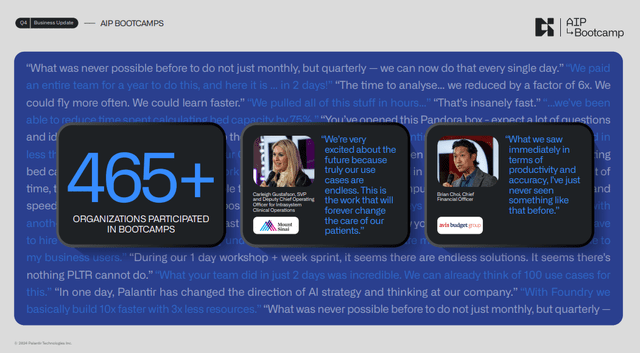

The Transformation of AIP Bootcamps – Creating Speed to Value

Now onto the business model that has transformed Palantir’s Go-To-Market (GTM) and really the company. Palantir’s AIP Bootcamp events were the perfect pivot for the company during this AI excitement phase the market has been in for the last 12 months. This was a seismic shift in how organizations can rapidly innovate and solve critical operational challenges using Palantir Foundry, and its ontology, and their AIP platform. This transformative approach is not just about showcasing Palantir’s capabilities; it’s a hands-on, results-driven experience that dramatically shortens the pilot phase from months to just five days.

Palantir AIP Bootcamp Recap (Palantir Q4 Earnings Deck)

In 2023, Palantir skyrocketed its engagement through this method, completing 560 bootcamps with over 465 organizations, in addition to running another 130 traditional pilots. And the number of bootcamps total increased through February of 2024 is 850! This leap from fewer than 100 pilots in 2022 underscores the effectiveness and appeal of the bootcamp model. I don’t see Palantir changing this model any time soon, as this has proven to accelerate the sales motion for new prospects and expansion of current customers.

Adjusted Operating Income Growth Trends (Q4 Earnings Presentation)

The essence of the AIP Bootcamp Sales Motion is its practicality and immediacy. Organizations come with a problem and data, and within a week, they leave not just with a deeper understanding of how AI can transform their operations but with a minimum viable product ready for deployment. This direct approach to problem-solving and education on Palantir’s platform has proven to be a compelling method to get organizations “hooked” on the potential of AI and driving to business outcomes.

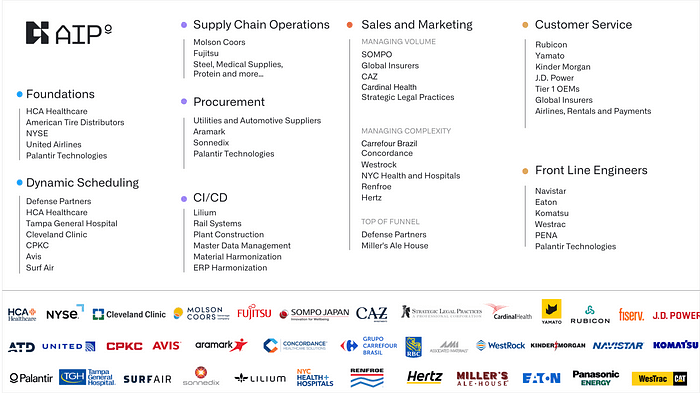

Palantir AIP Use Cases (Palantir Blog)

The diversity of use cases solved at these bootcamps is a testament to the versatility and power of Palantir’s AIP. Over 200 unique use cases have been identified, and will continue to drive new product creation for customers and allow Palantir to rinse and repeat in delivery. They reviewed some of these use cases at their AIPCON3 conference which had over 60 unique customer stories shared, and they had so many companies sign up, they couldn’t support the entire capacity.

Palantir’s AIP Bootcamp Sales Motion is more than an innovative sales strategy; it’s a paradigm shift in operational problem-solving and AI adoption. It is getting customers hands on keyboards and seeing value immediately. By enabling organizations to directly experience the impact of their AI platform, Palantir is not just selling a product but empowering industries to envision and implement future-ready solutions. I believe this puts a lot of pressure on other software companies that try to compete with Palantir.

Palantir is Winning Industries

I feel Palantir has always been one step ahead with the problems they are trying to solve and their approach to how they take care of customers. We live in a world where SaaS-based companies try to sale their specific product, talk speeds and feeds, but never actually take the time to learn what the business problem really is. The other caveat is if the real problem doesn’t get solved then come renewal time the customer is just going to replace the product with another one that is different or cheaper. This is why you see most companies purchase a one-year software agreement, sometimes a three year, but rarely a five year, because they don’t want to be tied down to a solution that may not work.

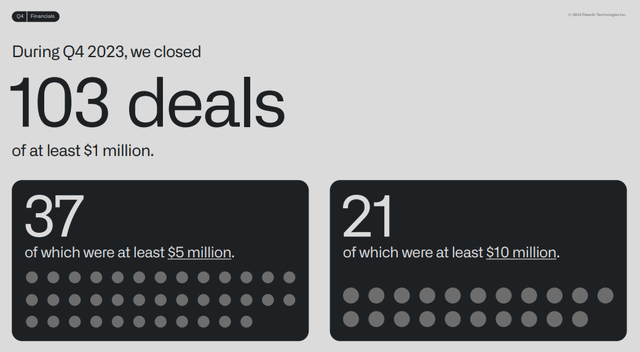

Palantir Large Deals in Q4 (Palantir Q4 Earnings)

However, this is not the case for Palantir has they have held customers for decades and often on renewal deals close three- or five-year expansions, because of the value they have already delivered. In Q4 of 2023 Palantir closed 103 $1M+ deals, 37 $5M+ deals, and 21 $10M+ deals. They understood years ago the importance of solving industry-centric problems with their ontology in Foundry and Gotham, and how over time it could be the standard for specific industries. Let’s just take Healthcare for example and how Palantir has captured this market in such a short amount of time and is now even hosting specific Healthcare AIP bootcamps and now modularizing parts of Foundry for customers to try.

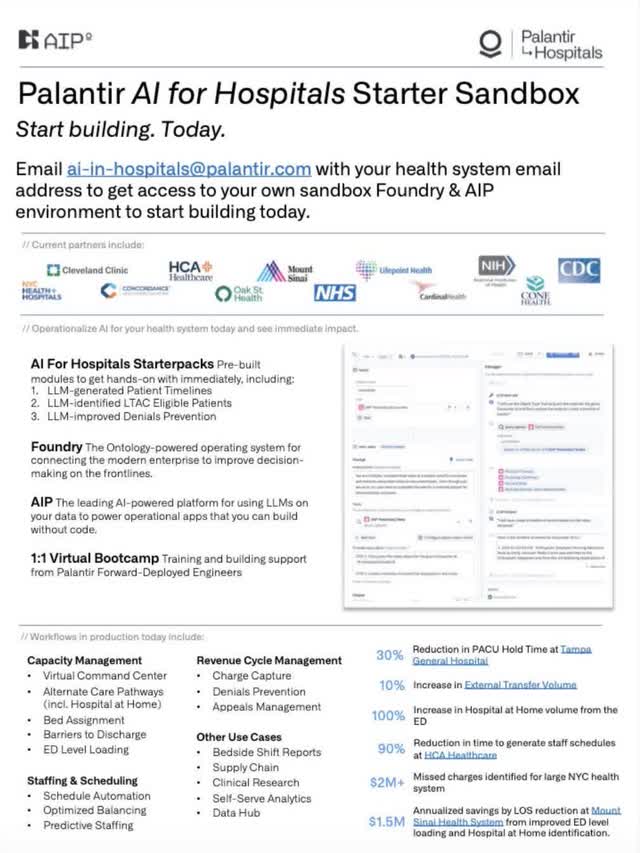

Palantir for Hospitals Starter Pack (Palantir Webinar)

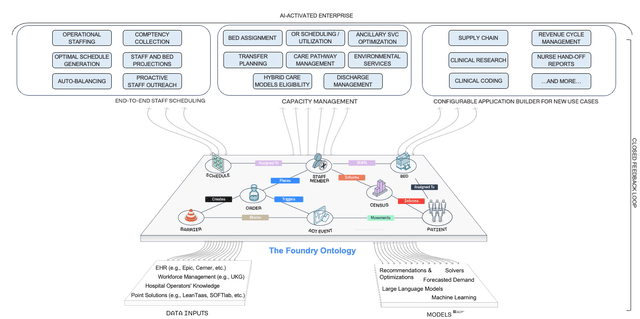

Palantir has won enough healthcare customers and solved plenty of use cases, which now has led to Palantir for Hospitals on Foundry. This platform now powers nearly 20% of all U.S. hospital beds and solves organizational problems like patient demand forecasts, staff & scheduling, capacity management, and creating a digital twin of a hospital. With how AI continues to excite C-Levels and organizations on how they can optimize performance, what they want is quantifiable results. This is where Palantir shines with AIP bootcamps, and their newest addition now offering AI for Hospitals Starter Sandbox environments. They have started having industry specific AIP bootcamps virtually.

Palantir for Hospitals (Palantir Website)

Palantir has a customer in that industry, so for this case, it was Tampa Bay General Hospital, and they speak on all the different problems they were able to solve with AIP and Foundry. Customers get to ask questions and then get offered to get access to their own sandbox version of Foundry and AIP to start using right away. I could see this becoming a way that Palantir can eventually modularize Foundry for specific problems to service the mid-market segment, but for now, I believe it will just be a way to accelerate sales motion with Enterprises.

Why Long Term Investors Can Buy Palantir

So, I have covered the excellent results that Palantir had for Q4 and full year 2023. We have talked about how more institutions are buying into Palantir and seeing enterprise customers generating meaningful returns with Foundry and AIP. We also talked about what risk some retail and institutional investors see in the company’s valuation, but I do not believe they are closely observing the consist improvement in customer count, their earnings, and top line. Palantir is also growing profits faster than its peers, generating much higher gross margins, and their customers spend way more on average.

This is important to pay attention to because the design of the software they sell gets more entrenched with customer users and environments over time. So even though they had 860 AIP bootcamps in the last 12 months, we won’t see that revenue for a bit of time, but when we do, it will be an exponential uplift. This is just another reason why dollar cost averaging now could yield big returns in the long term.

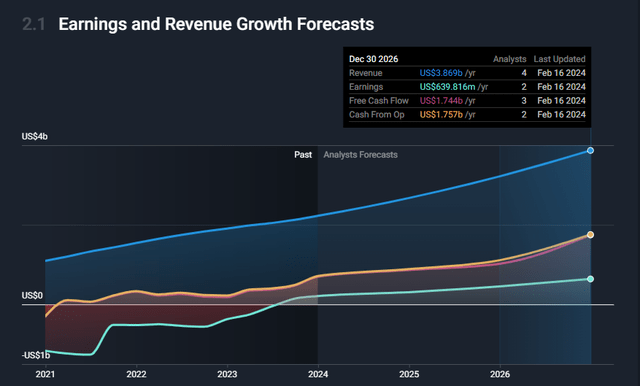

The S&P 500 on average goes up 10% a year, and with the dramatic increase in profits, customers, AIP bootcamps, and new products I believe Palantir will generate more than a 20% return by the beginning of 2026. However, I am invested in this stock for a decade or more, so I am focused on how the return compounds.

Palantir Future Earning and Revenue Forecasts (Simply Wall St.)

I believe Palantir is focused on the right things with customer growth, new use cases, new products, and continuing to improve scale with profits. What I will close with is, remember when investors thought the stock was expensive at $10 or $15, and were waiting for a retracement. Trying to time the market is extremely difficult, and if the stock retraces eventually, then just add more, but it could just go up from here. Palantir continues to provide steady growth and is in no rush to overstretch themselves, as they know what they are doing is working. This means this gives investors the chance to continue dollar cost averaging over longer, consistent periods of time, because Palantir’s business model compounds gradually. Don’t expect Palantir to conform to Wall Street, CEO Alex Karp even stated in the last earnings call, “We are doing this our way!”.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.